U.S. Dairy Cow Slaughter Update – Nov ’19

Executive Summary

U.S. dairy cow slaughter figures provided by USDA were recently updated with values spanning through Oct ’19. Highlights from the updated report include:

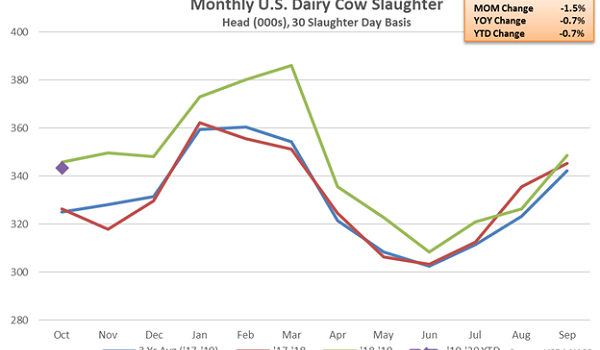

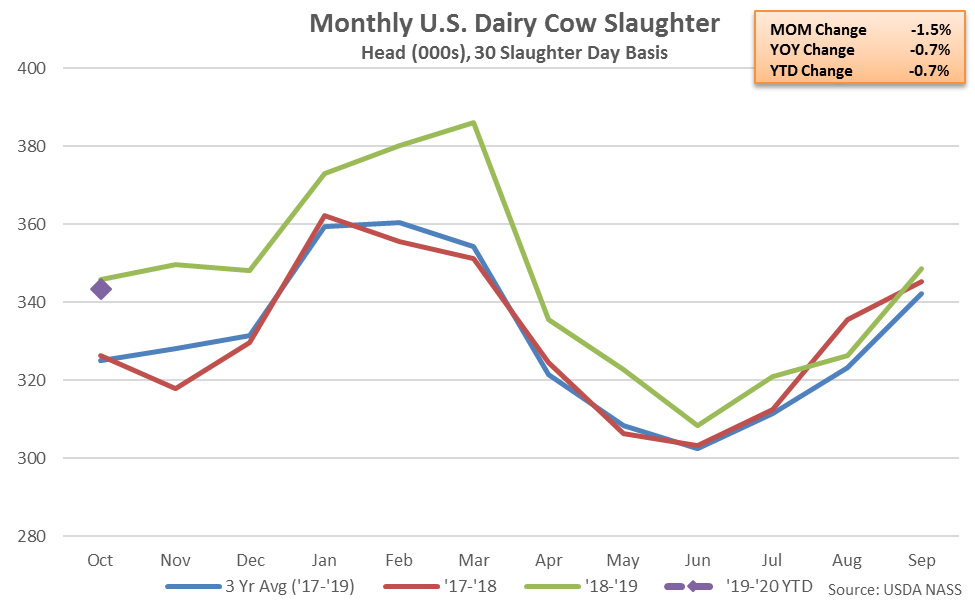

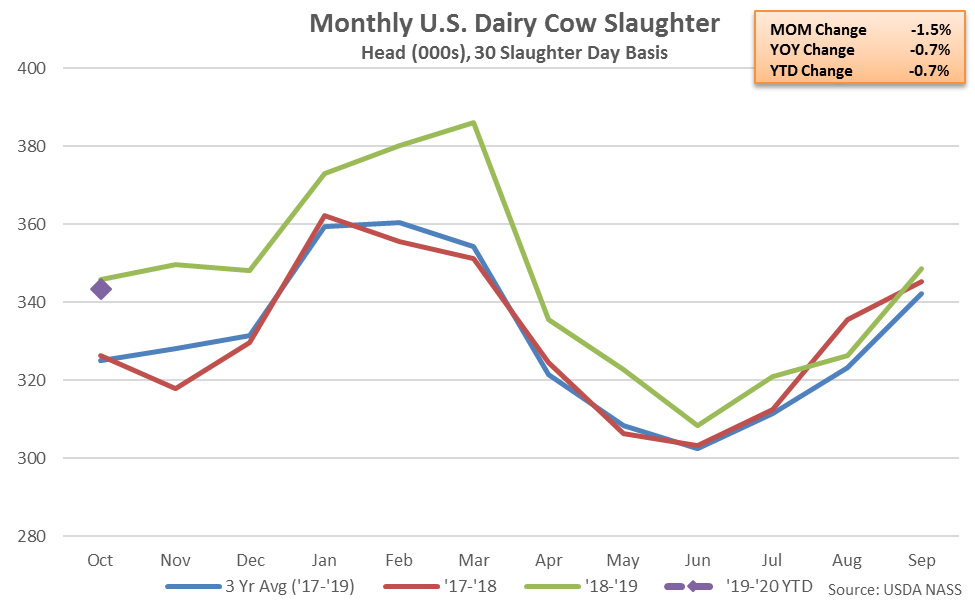

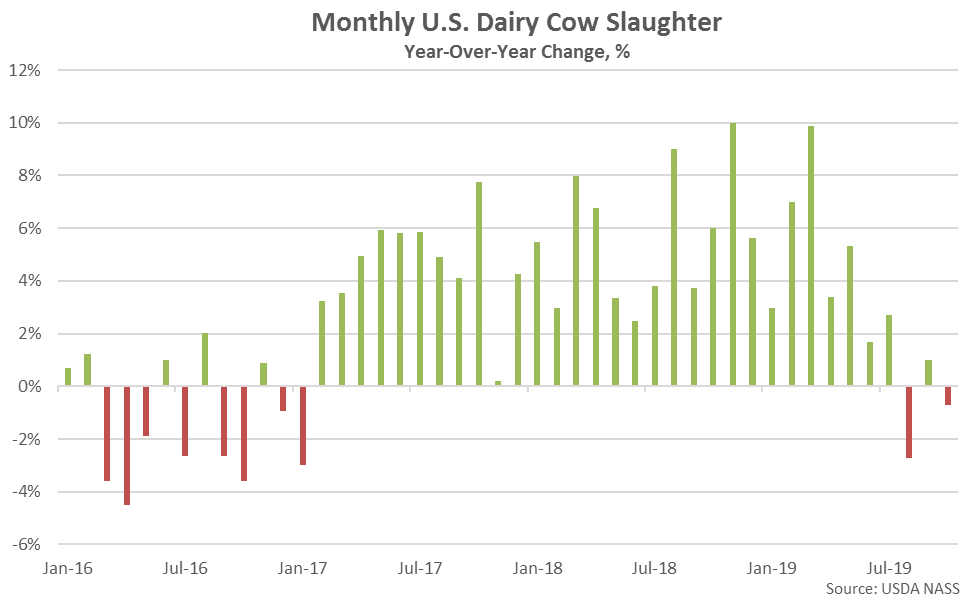

The Oct ’19 YOY decline in U.S. dairy cow slaughter rates was the second experienced throughout the past three months. Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to the recently experienced declines. U.S. dairy cow slaughter rates have declined by a total of 0.8% on a YOY basis over the past three months.

The Oct ’19 YOY decline in U.S. dairy cow slaughter rates was the second experienced throughout the past three months. Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to the recently experienced declines. U.S. dairy cow slaughter rates have declined by a total of 0.8% on a YOY basis over the past three months.

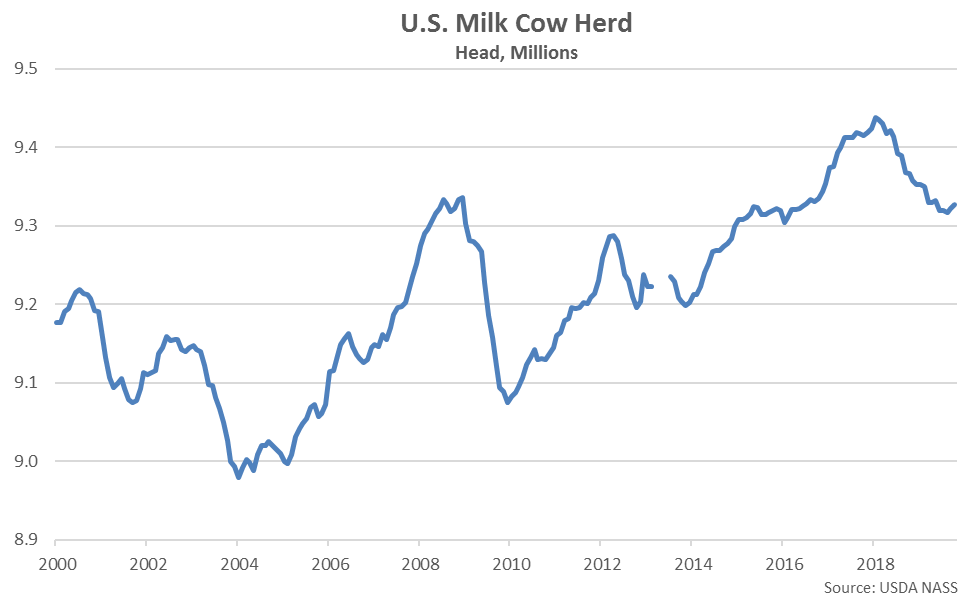

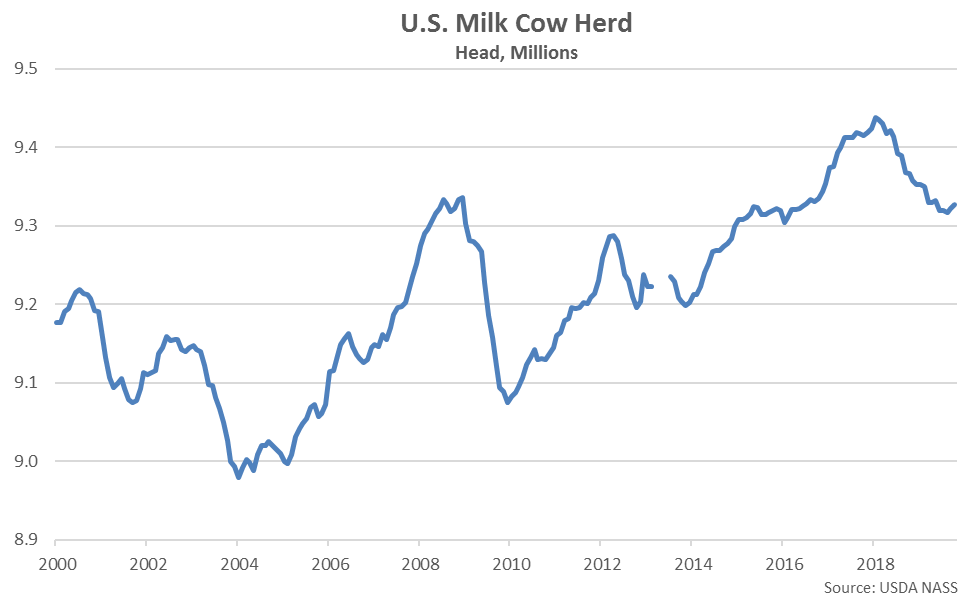

Recent declines in slaughter rates have contributed to the U.S. milk cow herd rebounding from the three and a half year low level experienced during Aug ’19. The U.S. milk cow herd has increased by a total of 12,000 head throughout the months of September and October, rebounding to a five month high level, overall. The U.S. milk cow herd currently stands at 9.327 million head, which remains 40,000 head below previous year figures and 111,000 head below the 23 year high level experienced during Jan ’18, however.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd rebounding from the three and a half year low level experienced during Aug ’19. The U.S. milk cow herd has increased by a total of 12,000 head throughout the months of September and October, rebounding to a five month high level, overall. The U.S. milk cow herd currently stands at 9.327 million head, which remains 40,000 head below previous year figures and 111,000 head below the 23 year high level experienced during Jan ’18, however.

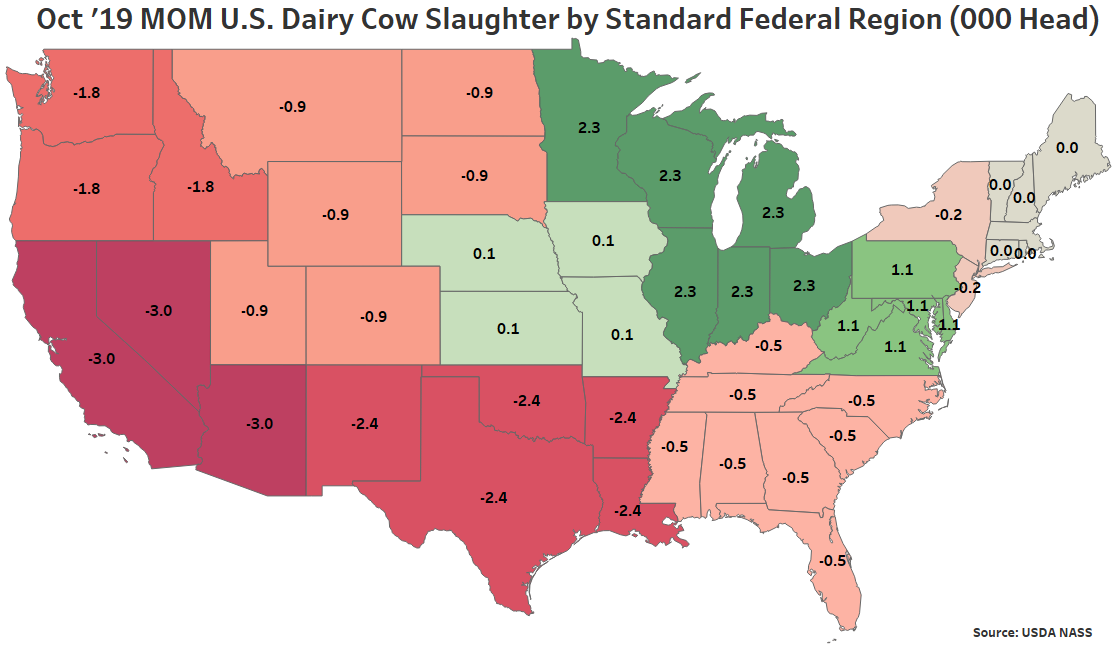

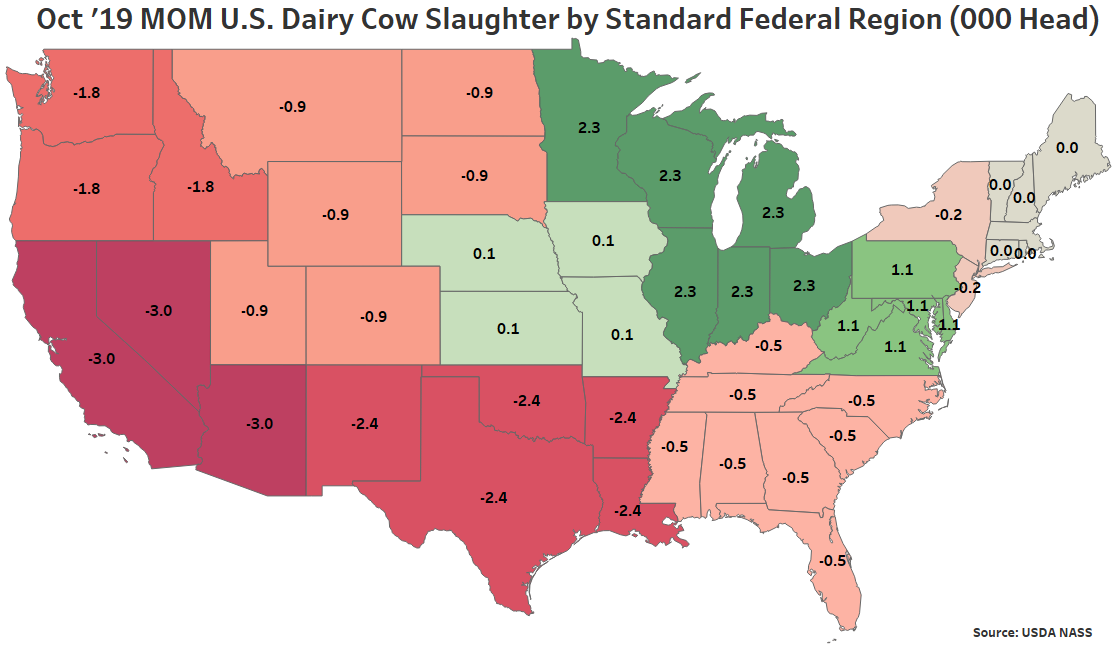

The most significant Oct ’19 MOM decline in dairy cow slaughter was experienced within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). Dairy cow slaughter rates increased most significantly on a MOM basis throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

The most significant Oct ’19 MOM decline in dairy cow slaughter was experienced within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). Dairy cow slaughter rates increased most significantly on a MOM basis throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

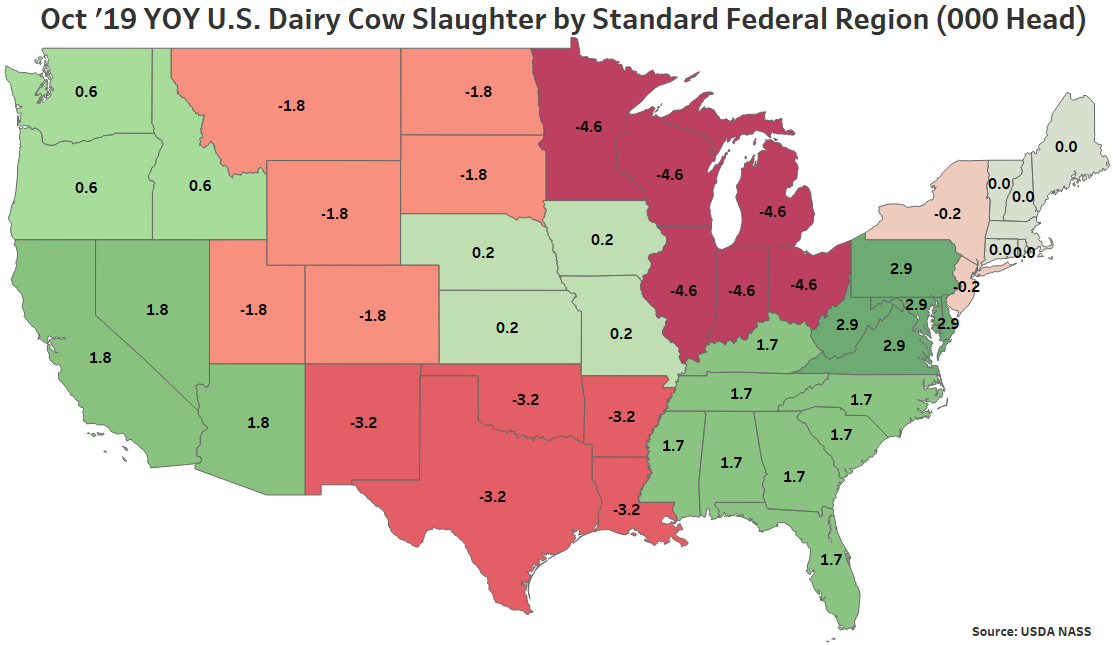

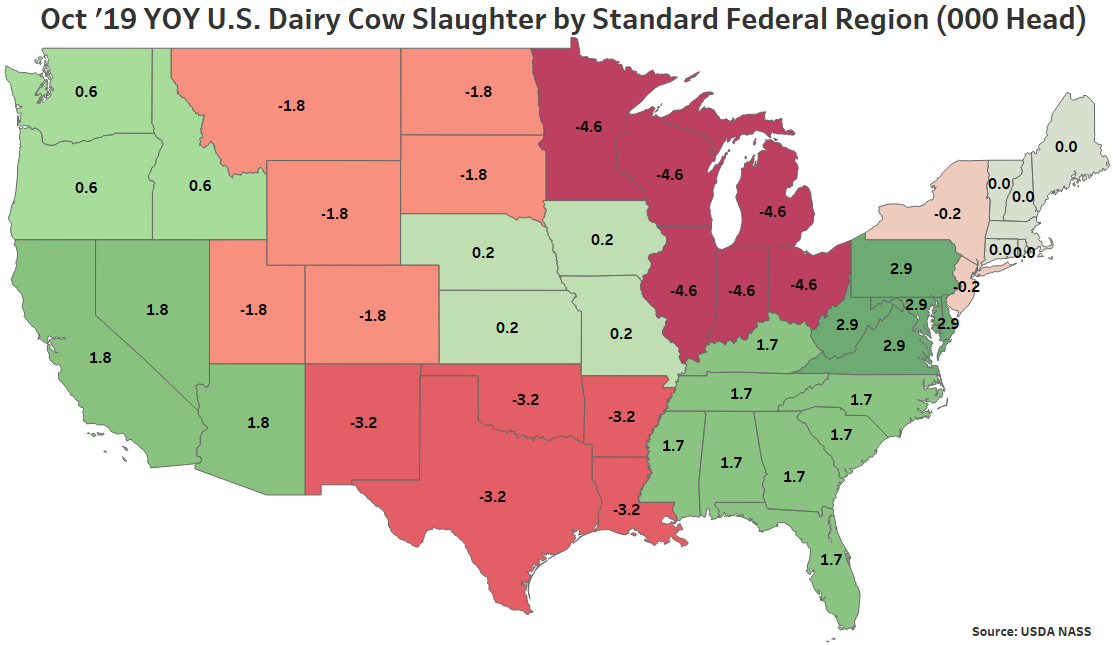

YOY declines in Oct ’19 dairy cow slaughter rates were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while dairy cow slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia).

YOY declines in Oct ’19 dairy cow slaughter rates were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while dairy cow slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia).

- U.S. dairy cow slaughter rates declined contraseasonally while finishing lower on a YOY basis for the second time in the past three months, down 0.7%. Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to declining over two of the past three months through Oct ’19.

- Oct ’19 MOM declines in dairy cow slaughter were led by Standard Federal Region 9 (Arizona, California, Hawaii and Nevada).

- Oct ’19 YOY declines in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

The Oct ’19 YOY decline in U.S. dairy cow slaughter rates was the second experienced throughout the past three months. Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to the recently experienced declines. U.S. dairy cow slaughter rates have declined by a total of 0.8% on a YOY basis over the past three months.

The Oct ’19 YOY decline in U.S. dairy cow slaughter rates was the second experienced throughout the past three months. Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to the recently experienced declines. U.S. dairy cow slaughter rates have declined by a total of 0.8% on a YOY basis over the past three months.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd rebounding from the three and a half year low level experienced during Aug ’19. The U.S. milk cow herd has increased by a total of 12,000 head throughout the months of September and October, rebounding to a five month high level, overall. The U.S. milk cow herd currently stands at 9.327 million head, which remains 40,000 head below previous year figures and 111,000 head below the 23 year high level experienced during Jan ’18, however.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd rebounding from the three and a half year low level experienced during Aug ’19. The U.S. milk cow herd has increased by a total of 12,000 head throughout the months of September and October, rebounding to a five month high level, overall. The U.S. milk cow herd currently stands at 9.327 million head, which remains 40,000 head below previous year figures and 111,000 head below the 23 year high level experienced during Jan ’18, however.

The most significant Oct ’19 MOM decline in dairy cow slaughter was experienced within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). Dairy cow slaughter rates increased most significantly on a MOM basis throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

The most significant Oct ’19 MOM decline in dairy cow slaughter was experienced within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). Dairy cow slaughter rates increased most significantly on a MOM basis throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

YOY declines in Oct ’19 dairy cow slaughter rates were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while dairy cow slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia).

YOY declines in Oct ’19 dairy cow slaughter rates were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while dairy cow slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia).