Railroad Service Report Update – May ’22

Weekly service report updates for Class 1 railroads provided by the Surface Transportation Board (STB) were recently updated with values spanning through the end of Apr ’22. Apr 30th week ending total cars online remained near recently experienced two and a half year high levels but finished below pre-pandemic seasonal levels. Grain and ethanol rail transportation speeds each remained below previous year levels while dwell times remained significantly higher on a YOY basis.

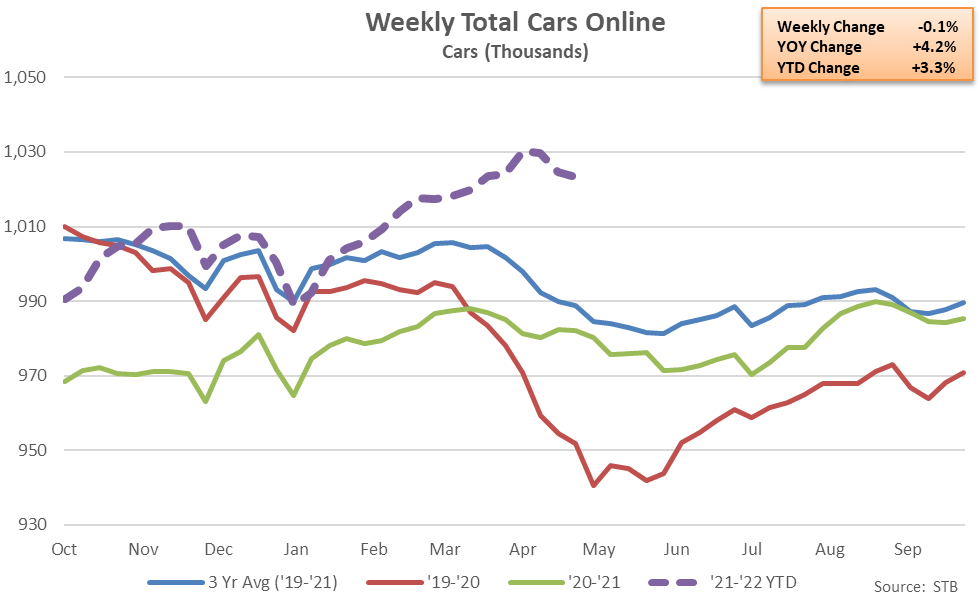

Total Railcars Online:

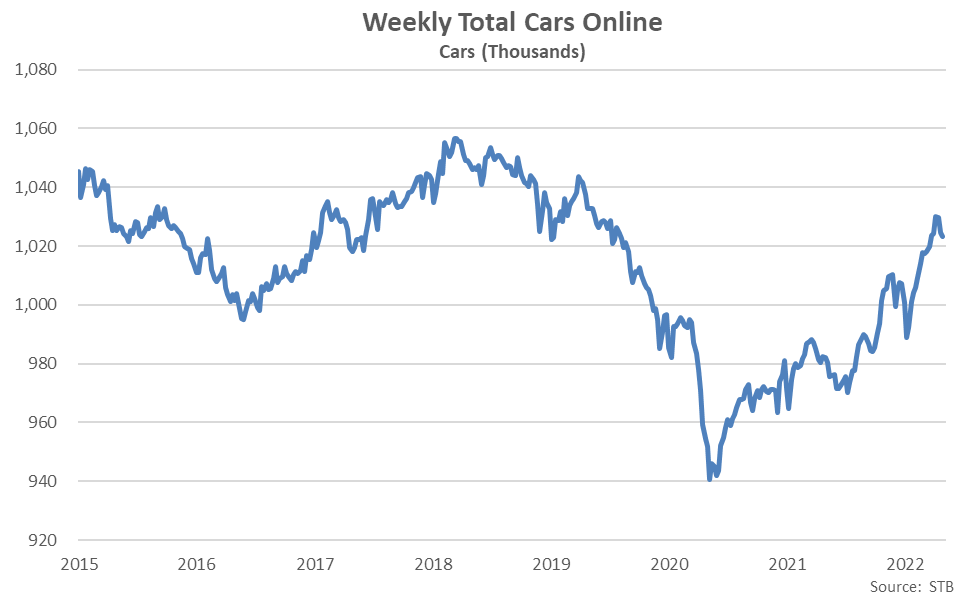

Apr 30th week ending total railcars online totaled 1,023,300, finishing 4.2% above previous year figures but remaining 0.9% below pre-pandemic seasonal levels. Total railcar online figures rebounded to a two and a half year high level throughout the week ending Apr 9th, prior to declining throughout the three most recent weeks of available data.

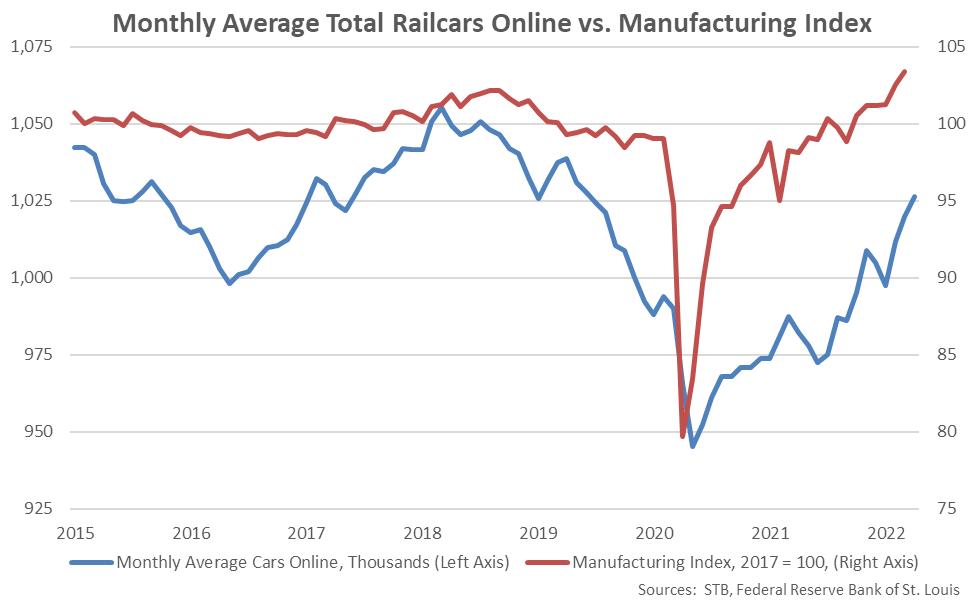

Total railcars online reached record low levels following the significant declines in manufacturing experienced during the early stages of COVID-19. The Federal Reserve Manufacturing Index rebounded to a 13 and a half year high level throughout Mar ’22.

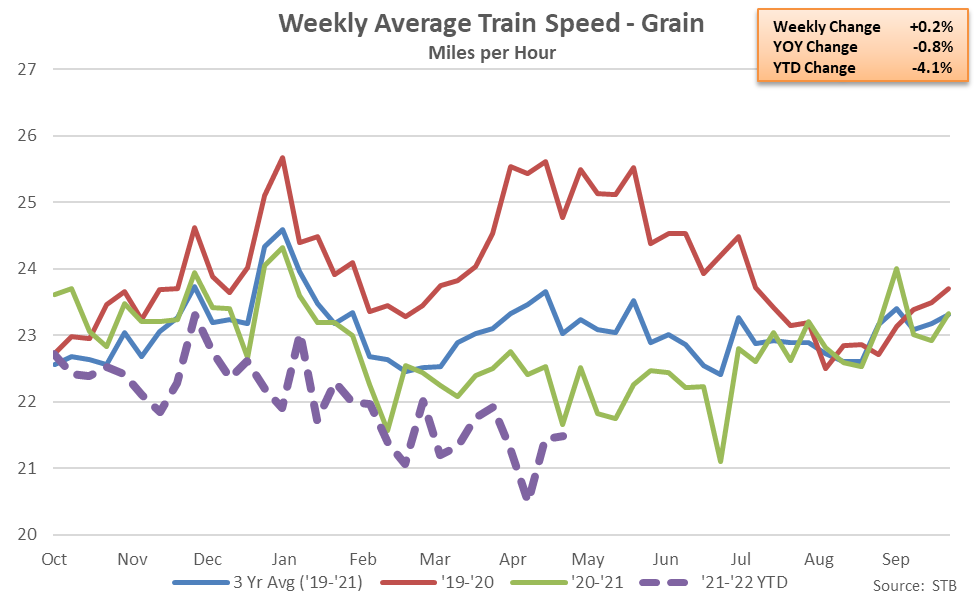

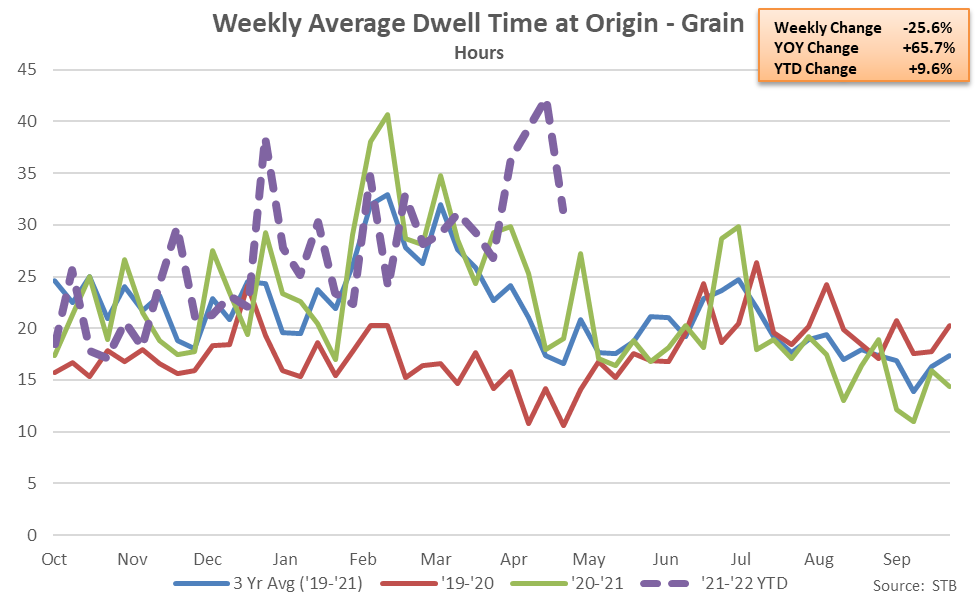

Grain Rail Transportation:

Apr 30th week ending grain train speeds of 21.5 MPH finished 0.8% below previous year levels and 4.1% below historical average grain train speeds. The YOY decline in grain train speeds was the 33rd experienced in a row.

Average dwell times at origin for grain transportation reached a three year high level during the week ending Apr 23rd, prior to declining but remaining significantly above previous year levels throughout the week ending Apr 30th.

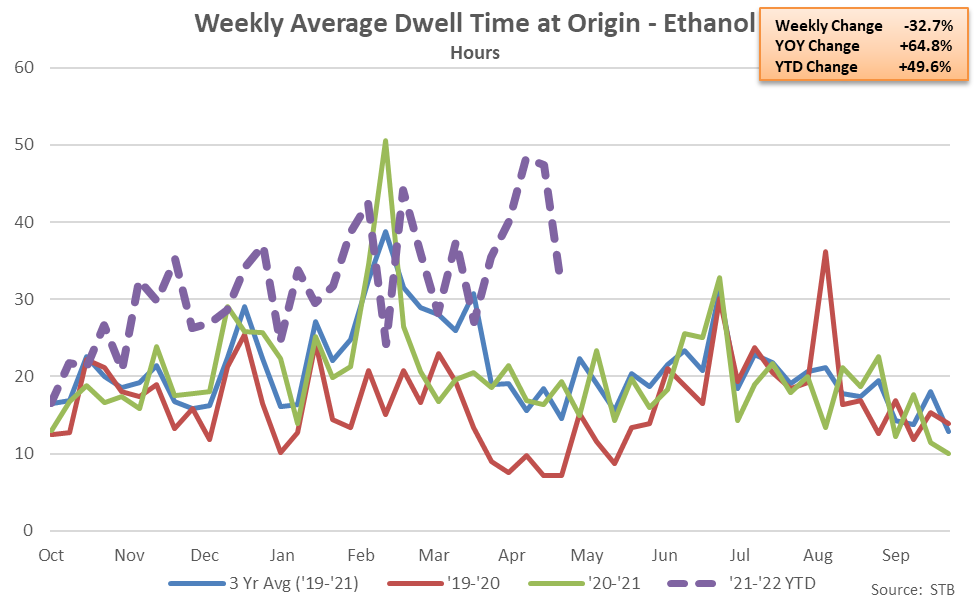

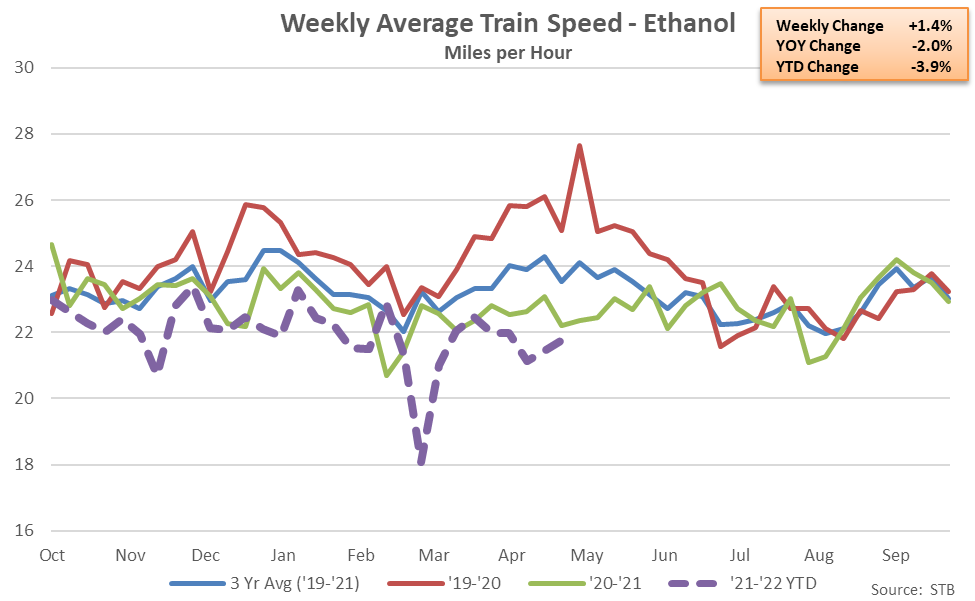

Ethanol Rail Transportation:

Apr 30th week ending ethanol train speeds of 21.8 MPH finished 2.0% below previous year levels and 3.9% below historical average ethanol train speeds. The YOY decline in ethanol train speeds was the 28th experienced throughout the past 32 weeks.

Average dwell times at origin for ethanol transportation reached a 13 month high level during the week ending Apr 16th, prior to declining over the two most recent weeks of available data but remaining significantly above previous year levels throughout the week ending Apr 30th.