EU-28 Milk Production Update – Aug ’20

Executive Summary

EU-28 milk production figures provided by Eurostat were recently updated with values spanning through Jun ’20. Highlights from the updated report include:

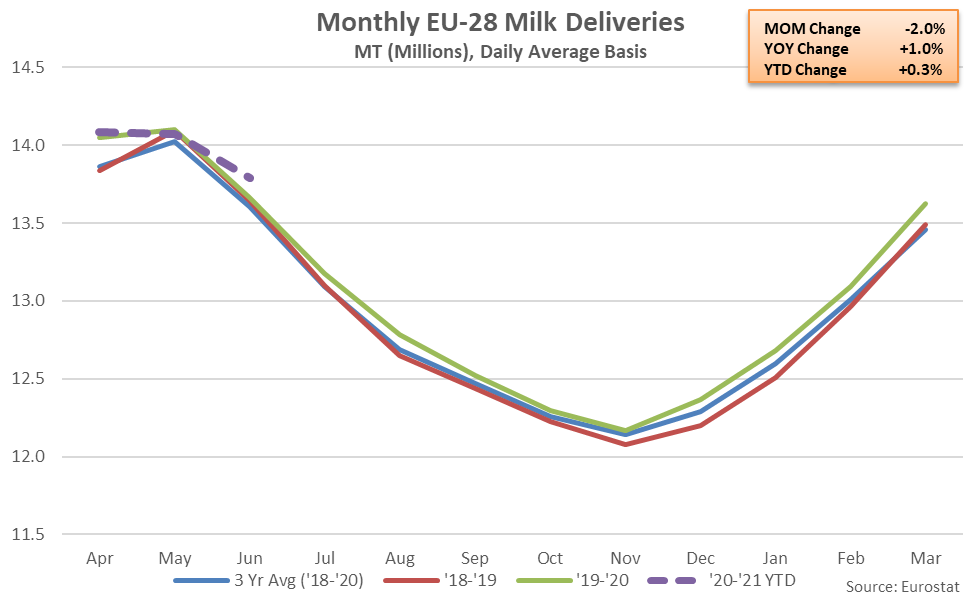

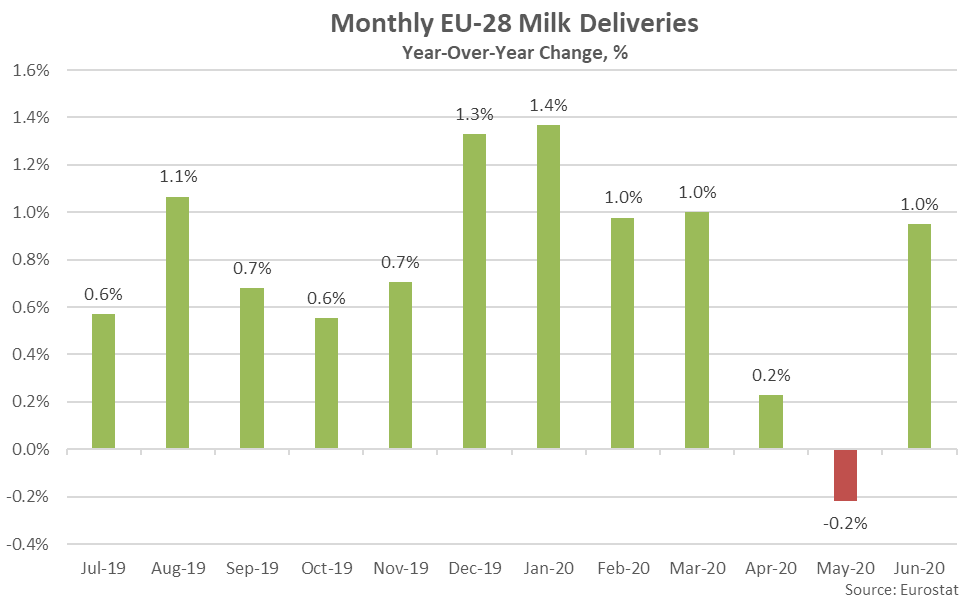

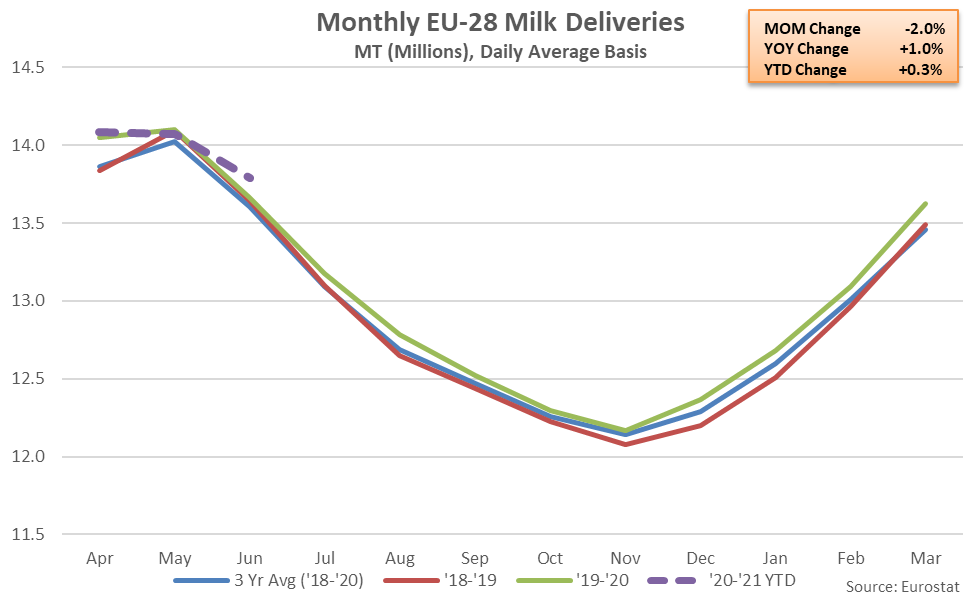

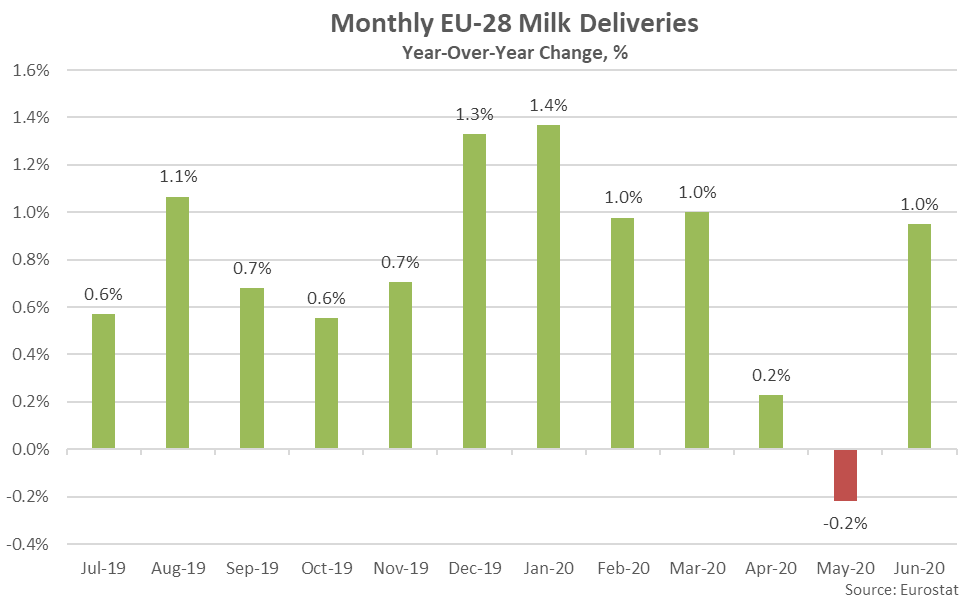

The Jun ’20 YOY increase in EU-28 milk production volumes was the 16th experienced throughout the past 17 months. EU-28 milk production volumes declined on a YOY basis for the first time in 16 months throughout May ’20 as warm and dry conditions adversely impacted pastures, particularly throughout Eastern Europe. Weather conditions have begun to improve throughout the months of June and July, however.

The Jun ’20 YOY increase in EU-28 milk production volumes was the 16th experienced throughout the past 17 months. EU-28 milk production volumes declined on a YOY basis for the first time in 16 months throughout May ’20 as warm and dry conditions adversely impacted pastures, particularly throughout Eastern Europe. Weather conditions have begun to improve throughout the months of June and July, however.

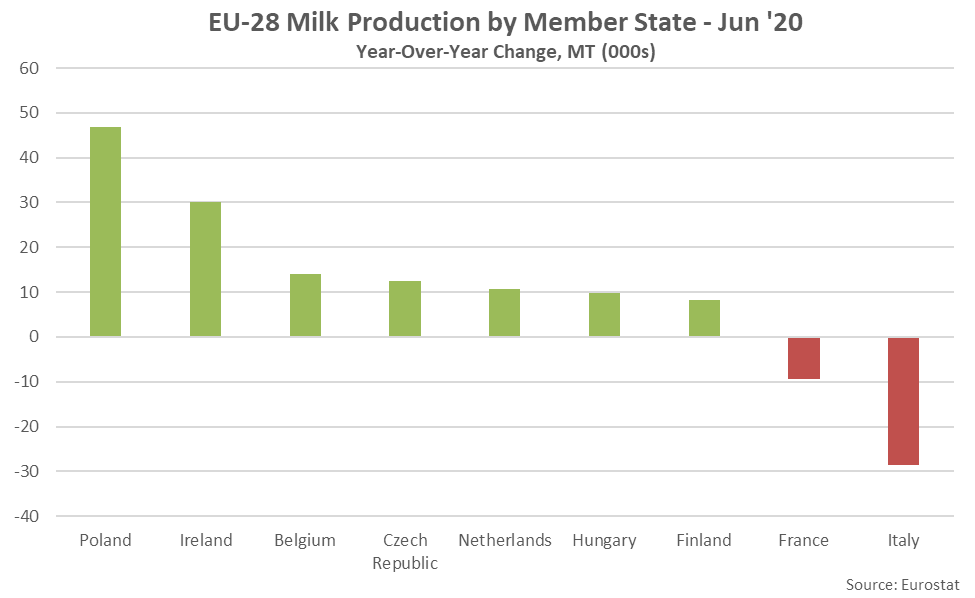

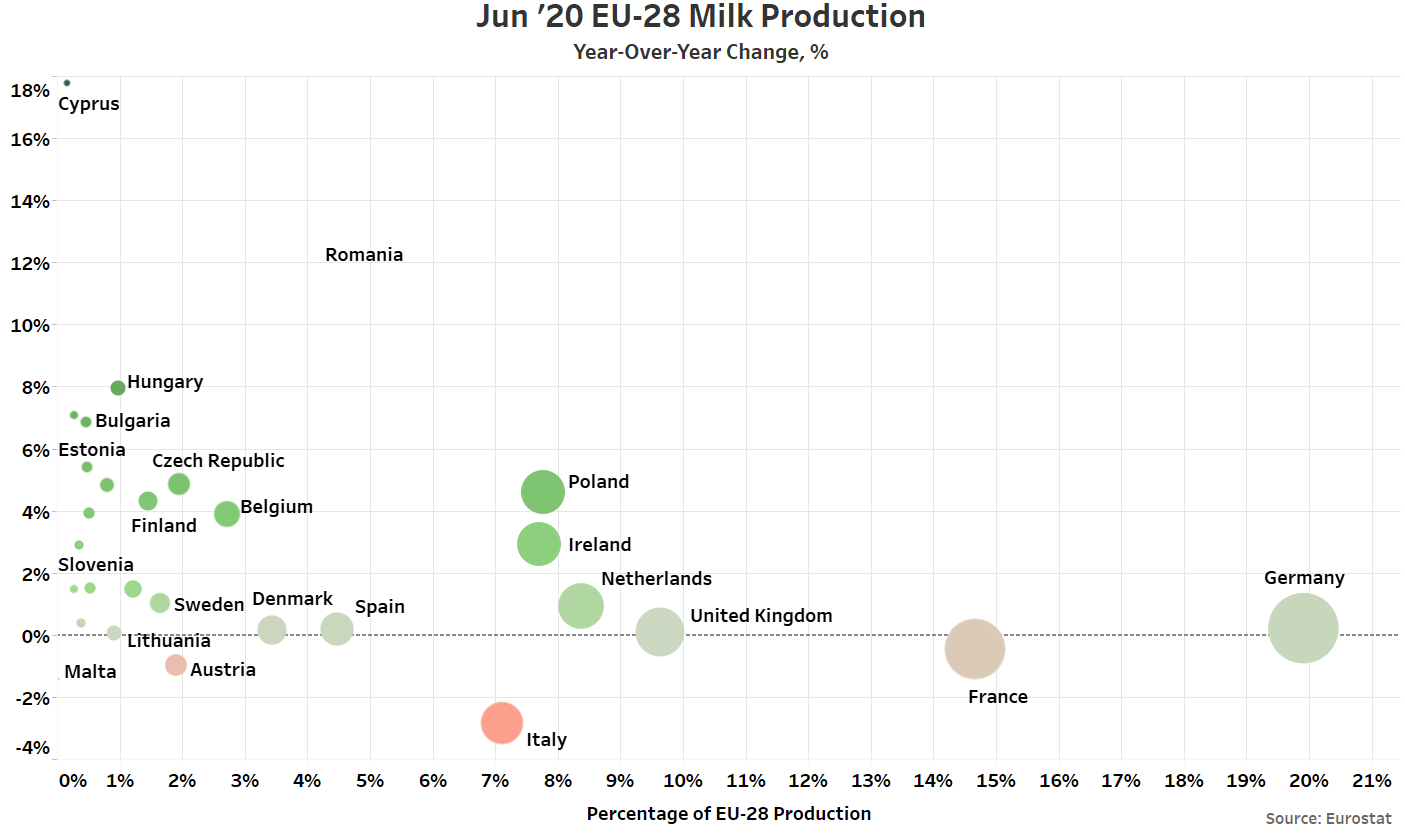

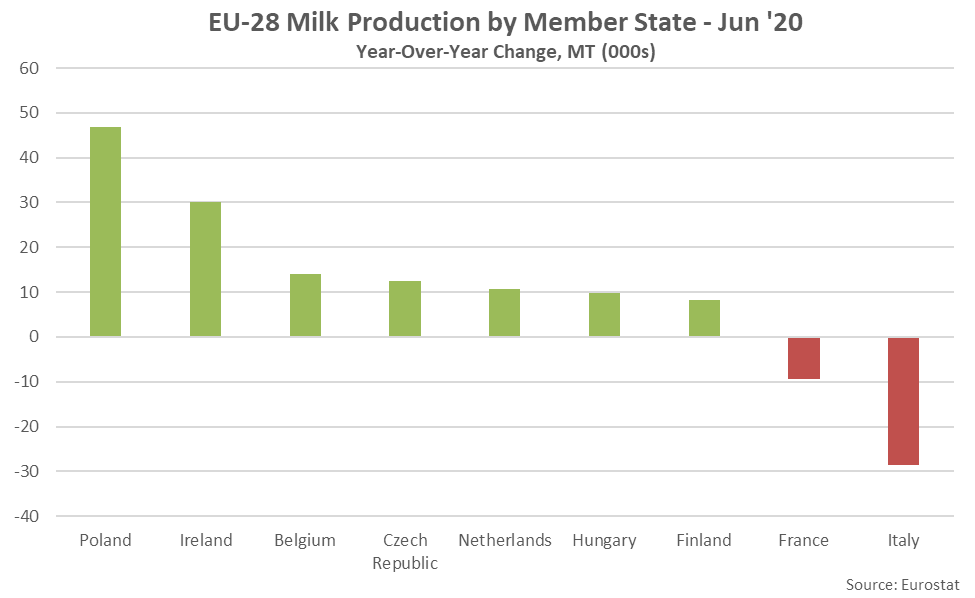

Jun ’20 YOY increases in production on an absolute basis were led by Poland, followed by Ireland, while YOY declines in production on an absolute basis were led by Italy. Western European producers including Poland have experienced more favorable weather conditions than their Eastern counterparts over recent months while Italian borders remained closed through the end of Jun ’20 due to COVID-19.

Jun ’20 YOY increases in production on an absolute basis were led by Poland, followed by Ireland, while YOY declines in production on an absolute basis were led by Italy. Western European producers including Poland have experienced more favorable weather conditions than their Eastern counterparts over recent months while Italian borders remained closed through the end of Jun ’20 due to COVID-19.

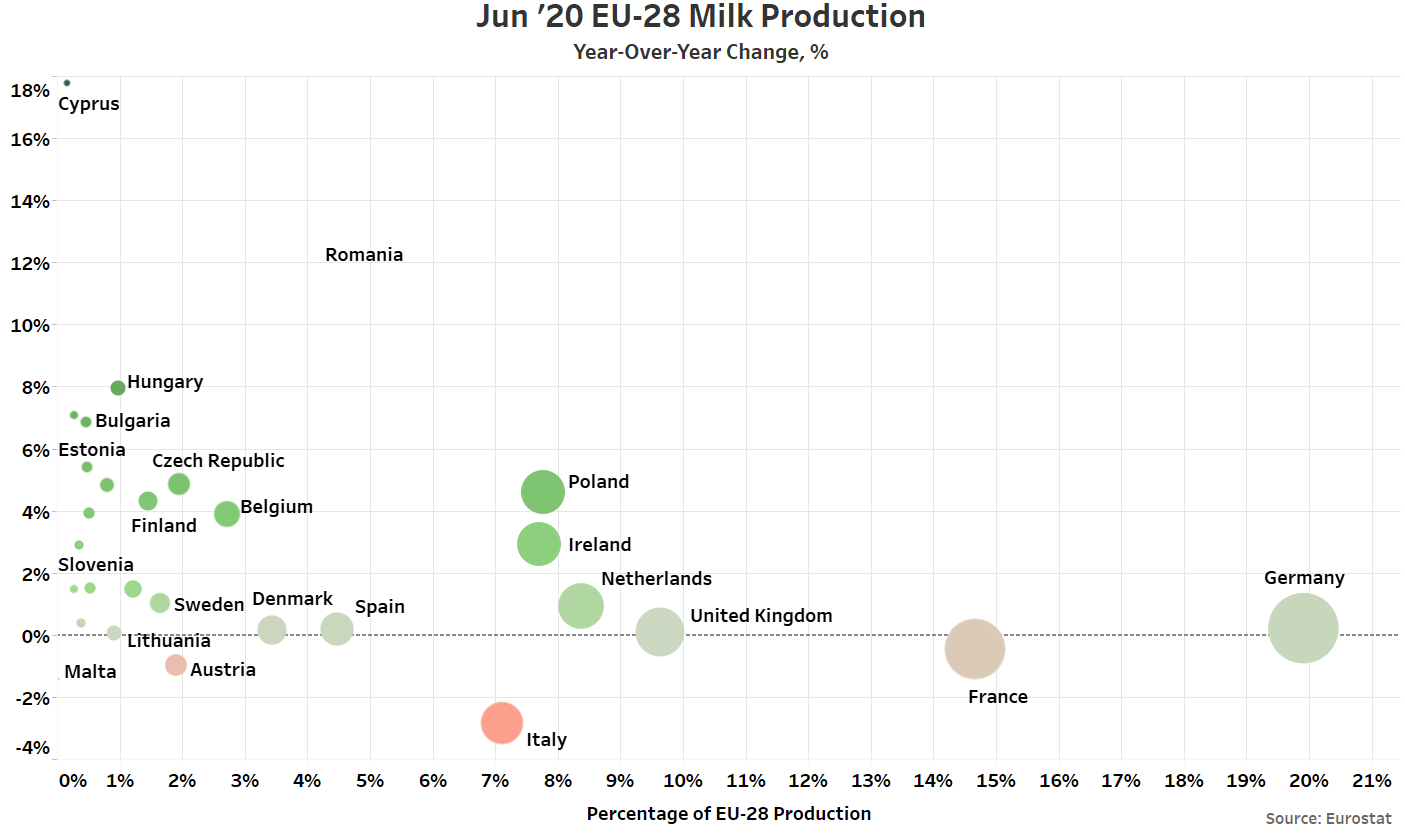

YOY increases in production on a percentage basis were led by Cyprus (+17.8%), followed by Hungary (+7.9%) and Luxembourg (+7.1%), while declines in production on a percentage basis were most significant within Italy (-2.8%), followed by Malta (-1.4%) and Austria (-1.0%).

YOY increases in production on a percentage basis were led by Cyprus (+17.8%), followed by Hungary (+7.9%) and Luxembourg (+7.1%), while declines in production on a percentage basis were most significant within Italy (-2.8%), followed by Malta (-1.4%) and Austria (-1.0%).

Eight of the top ten milk producing member states experienced YOY increases in milk production during Jun ’20, resulting in production within the top ten milk producing member states increasing by a weighted average of 0.7% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Overall, 24 of the 28 member states experienced YOY increases in production volumes during Jun ’20.

Eight of the top ten milk producing member states experienced YOY increases in milk production during Jun ’20, resulting in production within the top ten milk producing member states increasing by a weighted average of 0.7% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Overall, 24 of the 28 member states experienced YOY increases in production volumes during Jun ’20.

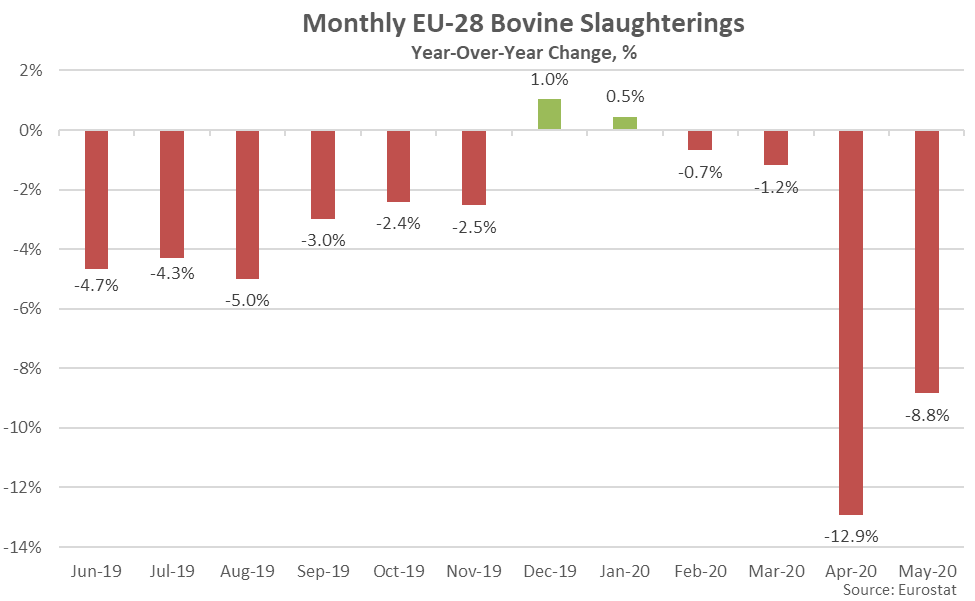

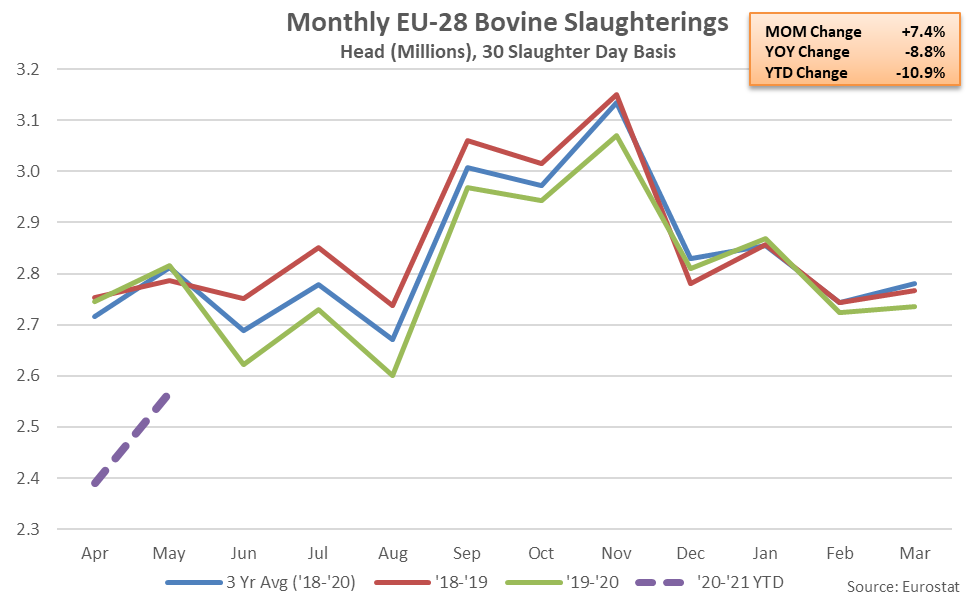

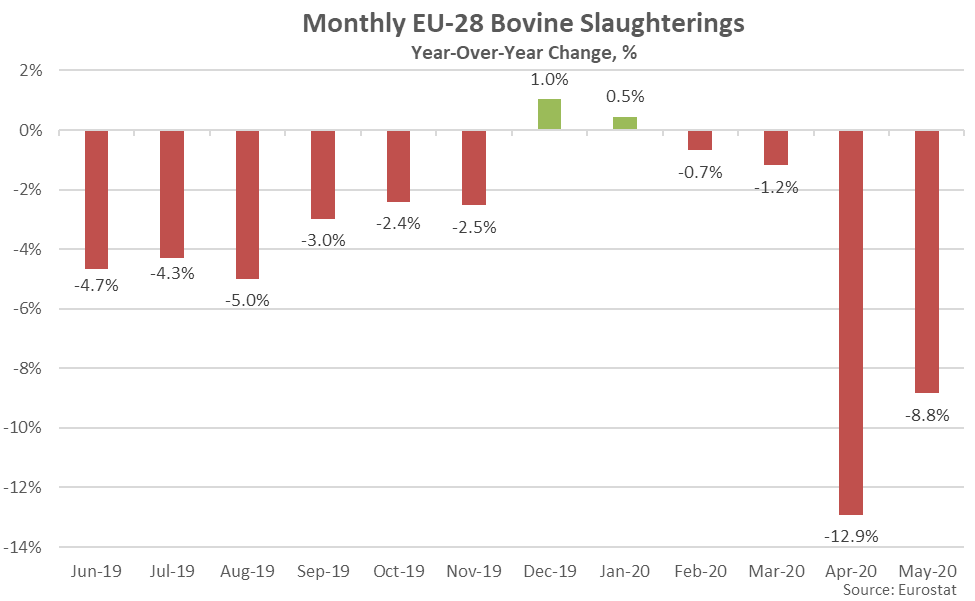

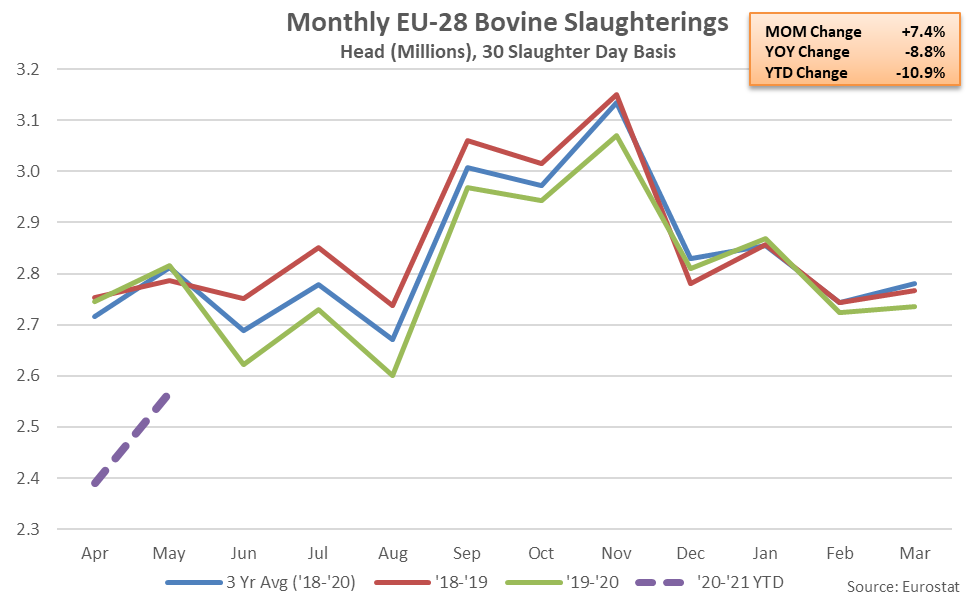

EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the tenth time in the past 12 months during May ’20 when normalizing for slaughter days, declining by 8.8% and remaining at a record low seasonal level for the second consecutive month. The decline in beef & dairy cow slaughter rates was likely amplified by dislocations in meat processing caused by COVID-19, although slaughter rates rebounded from the April lows. YOY declines in beef & dairy cow slaughter were most significant throughout Germany, followed by Spain and Ireland.

EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the tenth time in the past 12 months during May ’20 when normalizing for slaughter days, declining by 8.8% and remaining at a record low seasonal level for the second consecutive month. The decline in beef & dairy cow slaughter rates was likely amplified by dislocations in meat processing caused by COVID-19, although slaughter rates rebounded from the April lows. YOY declines in beef & dairy cow slaughter were most significant throughout Germany, followed by Spain and Ireland.

’19-’20 annual EU-28 bovine slaughter declined on a YOY basis for the first time in the past six years, finishing down 1.8% and reaching a four year low level. USDA expects the EU-28 dairy cow herd to decline 1.2% throughout the 2020 calendar year, due to feed shortages stemming from the recent droughts but noted additional culling rates, coupled with improved genetics, are expected to have a positive impact on future per cow productivity as lower producing animals are culled.

’19-’20 annual EU-28 bovine slaughter declined on a YOY basis for the first time in the past six years, finishing down 1.8% and reaching a four year low level. USDA expects the EU-28 dairy cow herd to decline 1.2% throughout the 2020 calendar year, due to feed shortages stemming from the recent droughts but noted additional culling rates, coupled with improved genetics, are expected to have a positive impact on future per cow productivity as lower producing animals are culled.

- Jun ’20 EU-28 milk production finished 1.0% higher on a YOY basis throughout Jun ’20, reaching a record high seasonal level. The YOY increase in EU-28 milk production volumes was the 16th experienced throughout the past 17 months.

- Jun ’20 YOY increases in milk production were led by Poland, followed by Ireland, while YOY declines in milk production were led by Italy. Overall, 24 of the 28 member states experienced YOY increases in milk production throughout the month.

- EU-28 beef & dairy cow slaughter rates finished lower on a YOY basis for the tenth time in the past 12 months during May ’20 when normalizing for slaughter days, declining by 8.8% and remaining at a record low seasonal level for the second consecutive month.

The Jun ’20 YOY increase in EU-28 milk production volumes was the 16th experienced throughout the past 17 months. EU-28 milk production volumes declined on a YOY basis for the first time in 16 months throughout May ’20 as warm and dry conditions adversely impacted pastures, particularly throughout Eastern Europe. Weather conditions have begun to improve throughout the months of June and July, however.

The Jun ’20 YOY increase in EU-28 milk production volumes was the 16th experienced throughout the past 17 months. EU-28 milk production volumes declined on a YOY basis for the first time in 16 months throughout May ’20 as warm and dry conditions adversely impacted pastures, particularly throughout Eastern Europe. Weather conditions have begun to improve throughout the months of June and July, however.

Jun ’20 YOY increases in production on an absolute basis were led by Poland, followed by Ireland, while YOY declines in production on an absolute basis were led by Italy. Western European producers including Poland have experienced more favorable weather conditions than their Eastern counterparts over recent months while Italian borders remained closed through the end of Jun ’20 due to COVID-19.

Jun ’20 YOY increases in production on an absolute basis were led by Poland, followed by Ireland, while YOY declines in production on an absolute basis were led by Italy. Western European producers including Poland have experienced more favorable weather conditions than their Eastern counterparts over recent months while Italian borders remained closed through the end of Jun ’20 due to COVID-19.

YOY increases in production on a percentage basis were led by Cyprus (+17.8%), followed by Hungary (+7.9%) and Luxembourg (+7.1%), while declines in production on a percentage basis were most significant within Italy (-2.8%), followed by Malta (-1.4%) and Austria (-1.0%).

YOY increases in production on a percentage basis were led by Cyprus (+17.8%), followed by Hungary (+7.9%) and Luxembourg (+7.1%), while declines in production on a percentage basis were most significant within Italy (-2.8%), followed by Malta (-1.4%) and Austria (-1.0%).

Eight of the top ten milk producing member states experienced YOY increases in milk production during Jun ’20, resulting in production within the top ten milk producing member states increasing by a weighted average of 0.7% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Overall, 24 of the 28 member states experienced YOY increases in production volumes during Jun ’20.

Eight of the top ten milk producing member states experienced YOY increases in milk production during Jun ’20, resulting in production within the top ten milk producing member states increasing by a weighted average of 0.7% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Overall, 24 of the 28 member states experienced YOY increases in production volumes during Jun ’20.

EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the tenth time in the past 12 months during May ’20 when normalizing for slaughter days, declining by 8.8% and remaining at a record low seasonal level for the second consecutive month. The decline in beef & dairy cow slaughter rates was likely amplified by dislocations in meat processing caused by COVID-19, although slaughter rates rebounded from the April lows. YOY declines in beef & dairy cow slaughter were most significant throughout Germany, followed by Spain and Ireland.

EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the tenth time in the past 12 months during May ’20 when normalizing for slaughter days, declining by 8.8% and remaining at a record low seasonal level for the second consecutive month. The decline in beef & dairy cow slaughter rates was likely amplified by dislocations in meat processing caused by COVID-19, although slaughter rates rebounded from the April lows. YOY declines in beef & dairy cow slaughter were most significant throughout Germany, followed by Spain and Ireland.

’19-’20 annual EU-28 bovine slaughter declined on a YOY basis for the first time in the past six years, finishing down 1.8% and reaching a four year low level. USDA expects the EU-28 dairy cow herd to decline 1.2% throughout the 2020 calendar year, due to feed shortages stemming from the recent droughts but noted additional culling rates, coupled with improved genetics, are expected to have a positive impact on future per cow productivity as lower producing animals are culled.

’19-’20 annual EU-28 bovine slaughter declined on a YOY basis for the first time in the past six years, finishing down 1.8% and reaching a four year low level. USDA expects the EU-28 dairy cow herd to decline 1.2% throughout the 2020 calendar year, due to feed shortages stemming from the recent droughts but noted additional culling rates, coupled with improved genetics, are expected to have a positive impact on future per cow productivity as lower producing animals are culled.