U.S. Dairy Dry Product Stocks Update – Jan ’20

Executive Summary

U.S. dairy dry product stock figures provided by USDA were recently updated with values spanning through Nov ’19. Highlights from the updated report include:

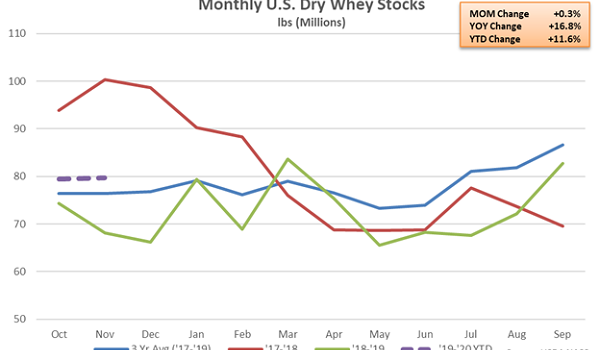

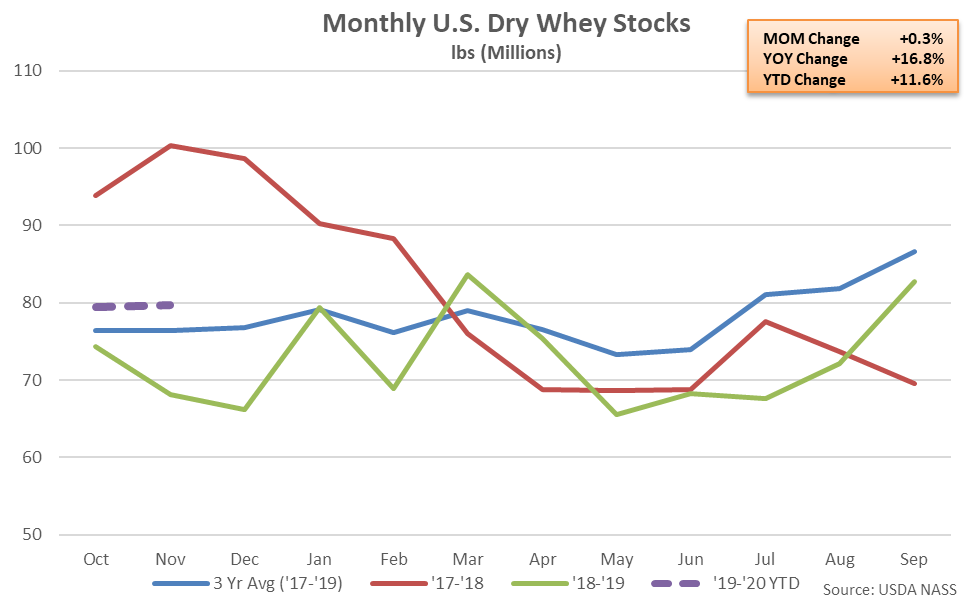

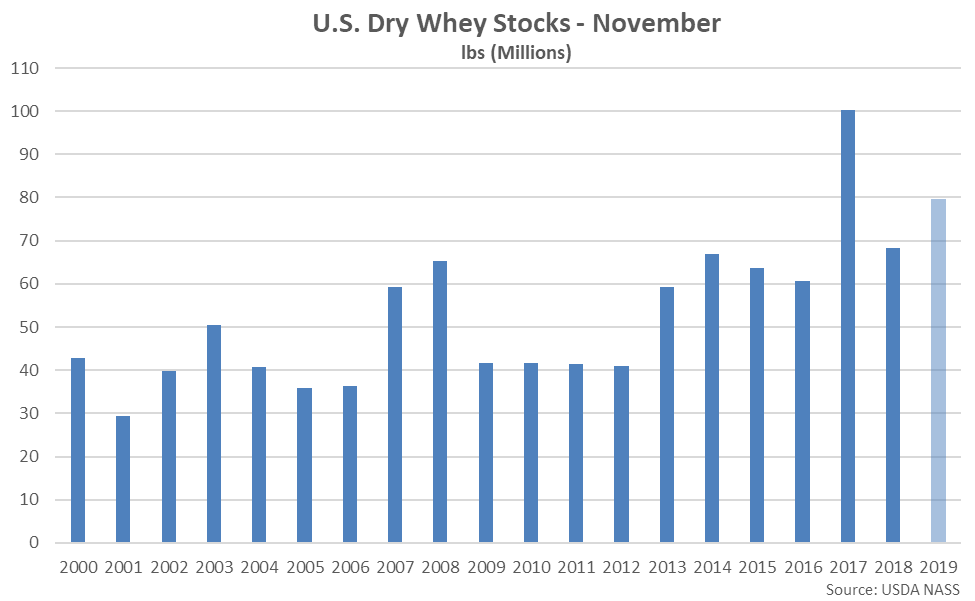

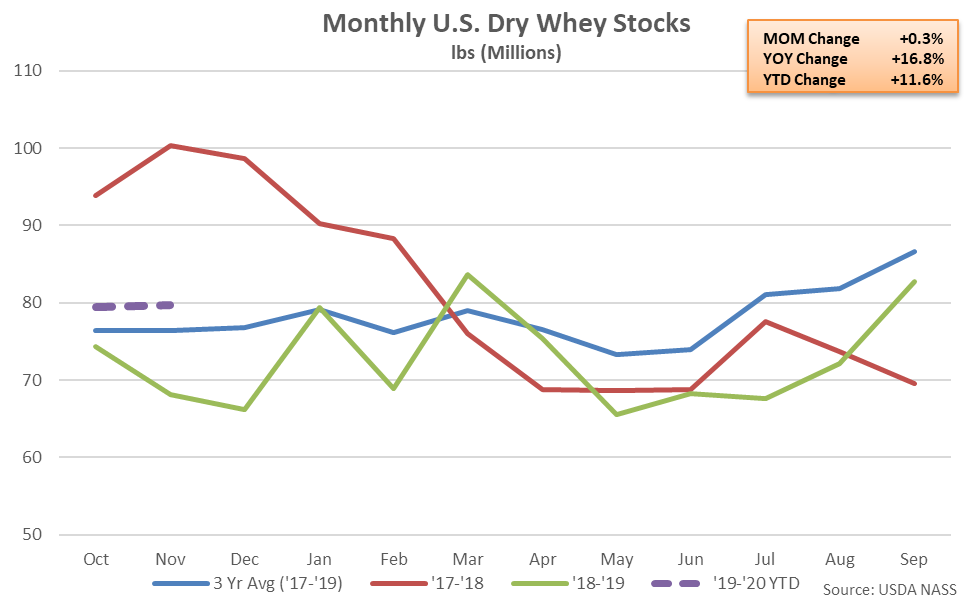

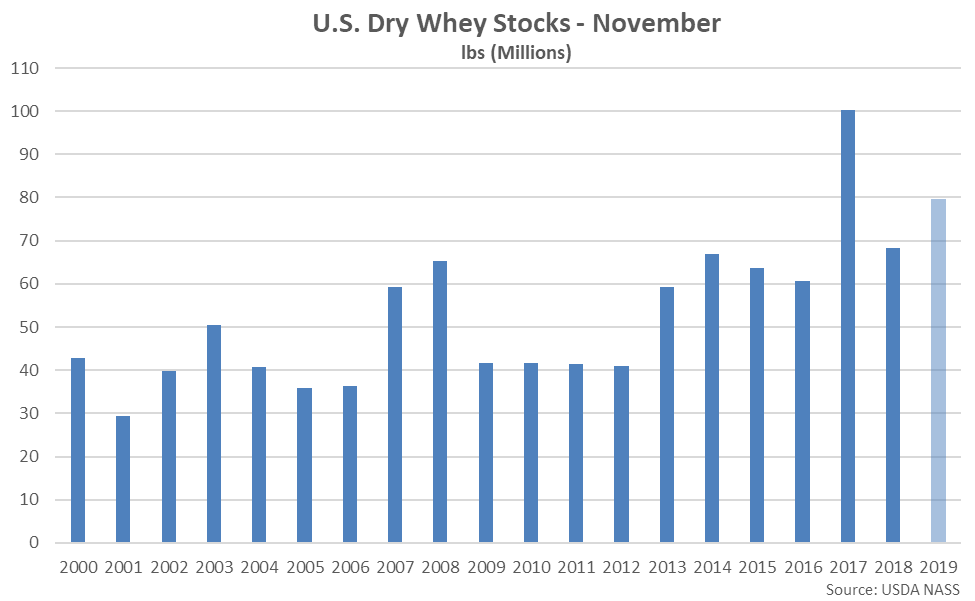

Nov ’19 month-end dry whey stocks increased 0.3% MOM and 16.8% YOY, remaining at the second highest seasonal level on record. The YOY increase in dry whey stocks was the third experienced in a row. The MOM increase in dry whey stocks of 0.2 million pounds, or 0.3%, was smaller than the ten year average October – November seasonal build in dry whey stocks of 1.6 million pounds, or 2.6%. Dry whey production finished 3.9% higher on a YOY basis throughout Nov ’19, increasing for the fourth consecutive month.

Nov ’19 month-end dry whey stocks increased 0.3% MOM and 16.8% YOY, remaining at the second highest seasonal level on record. The YOY increase in dry whey stocks was the third experienced in a row. The MOM increase in dry whey stocks of 0.2 million pounds, or 0.3%, was smaller than the ten year average October – November seasonal build in dry whey stocks of 1.6 million pounds, or 2.6%. Dry whey production finished 3.9% higher on a YOY basis throughout Nov ’19, increasing for the fourth consecutive month.

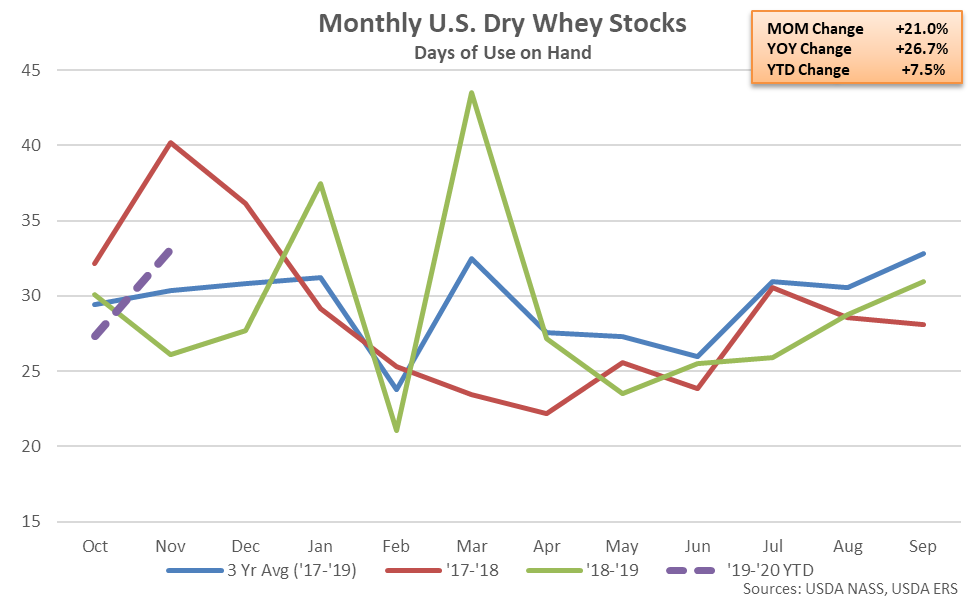

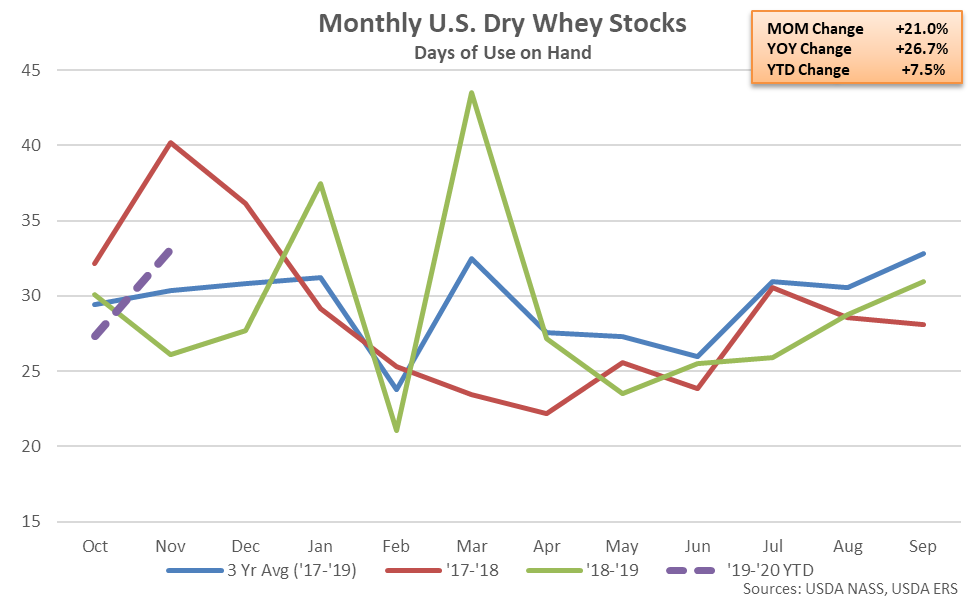

On a days of usage basis, Nov ’19 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, dry whey stocks on a days of usage basis finished up 26.7% YOY, increasing on a YOY basis for the third time in the past four months.

On a days of usage basis, Nov ’19 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, dry whey stocks on a days of usage basis finished up 26.7% YOY, increasing on a YOY basis for the third time in the past four months.

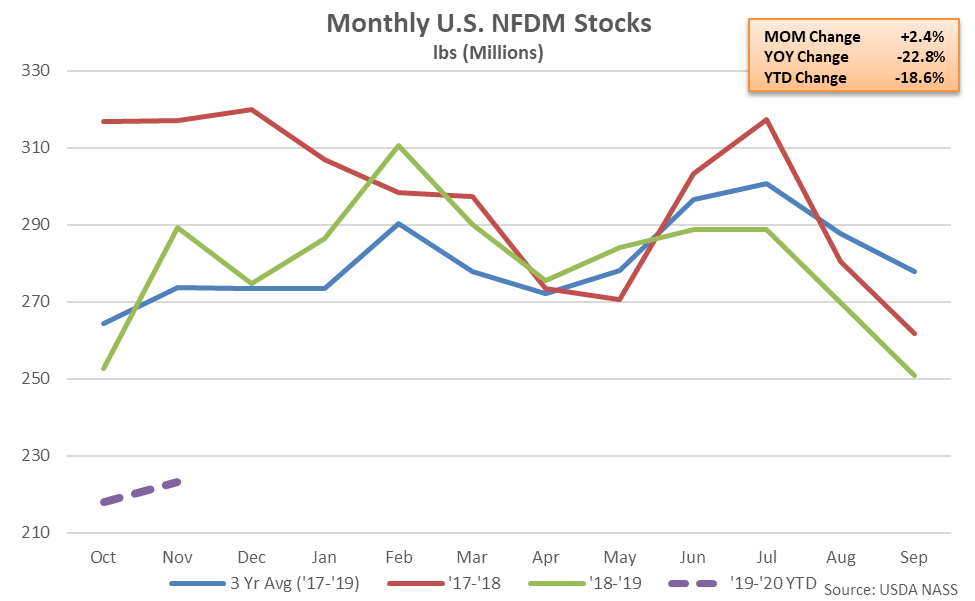

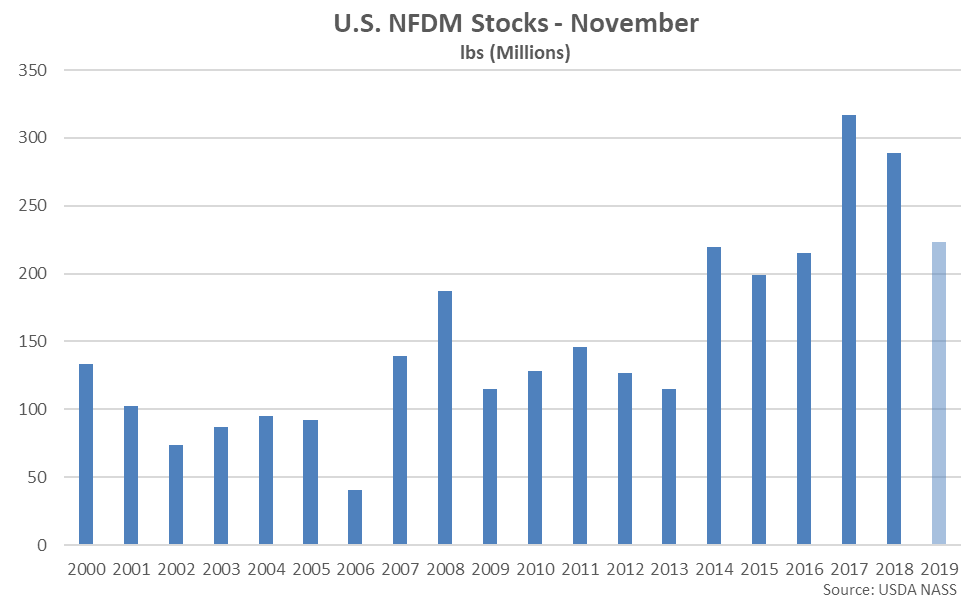

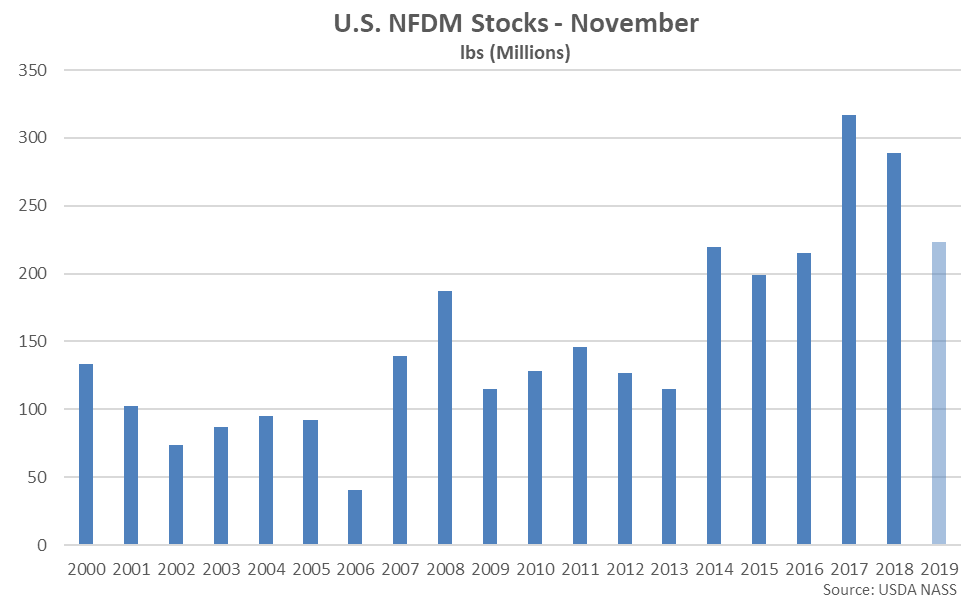

Nonfat Dry Milk – Stocks Remain Significantly Lower on a YOY Basis, Finish Down 22.8%

Nonfat Dry Milk – Stocks Remain Significantly Lower on a YOY Basis, Finish Down 22.8%

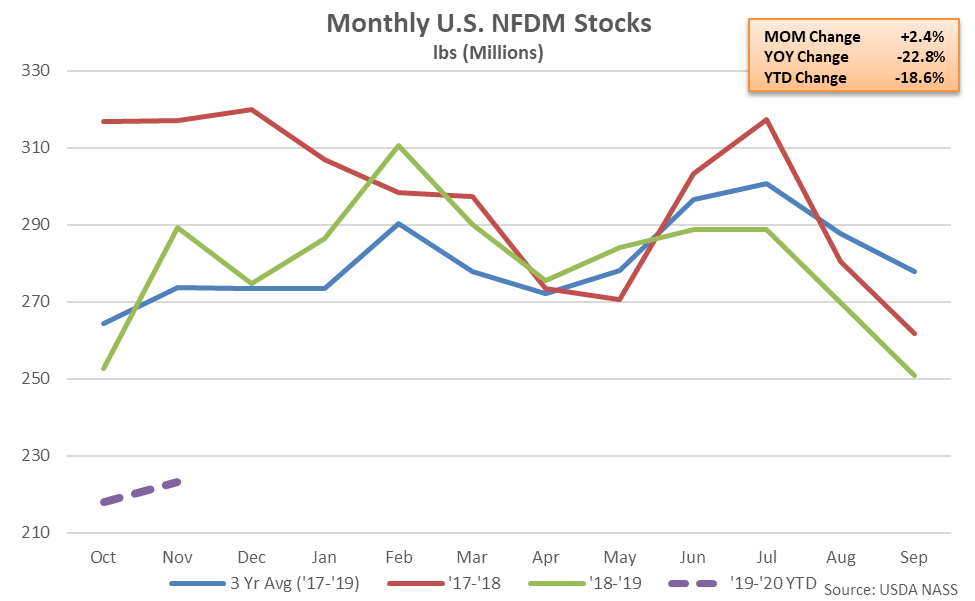

Nov ’19 month-end nonfat dry milk (NFDM) stocks increased 2.4% from the 35 month low level experienced throughout the previous month but remained 22.8% lower on a YOY basis, reaching a three year seasonal low level. The YOY decline in NFDM stocks was the sixth experienced in a row. The MOM increase in NFDM stocks of 5.2 million pounds, or 2.4%, was significantly smaller than the ten year average October – November seasonal build in NFDM stocks of 13.1 million pounds, or 9.1%. The smaller than typical seasonal build in NFDM stocks occurred despite production finishing 5.7% higher on a YOY basis throughout Nov ’19, increasing for the seventh consecutive month.

Nov ’19 month-end nonfat dry milk (NFDM) stocks increased 2.4% from the 35 month low level experienced throughout the previous month but remained 22.8% lower on a YOY basis, reaching a three year seasonal low level. The YOY decline in NFDM stocks was the sixth experienced in a row. The MOM increase in NFDM stocks of 5.2 million pounds, or 2.4%, was significantly smaller than the ten year average October – November seasonal build in NFDM stocks of 13.1 million pounds, or 9.1%. The smaller than typical seasonal build in NFDM stocks occurred despite production finishing 5.7% higher on a YOY basis throughout Nov ’19, increasing for the seventh consecutive month.

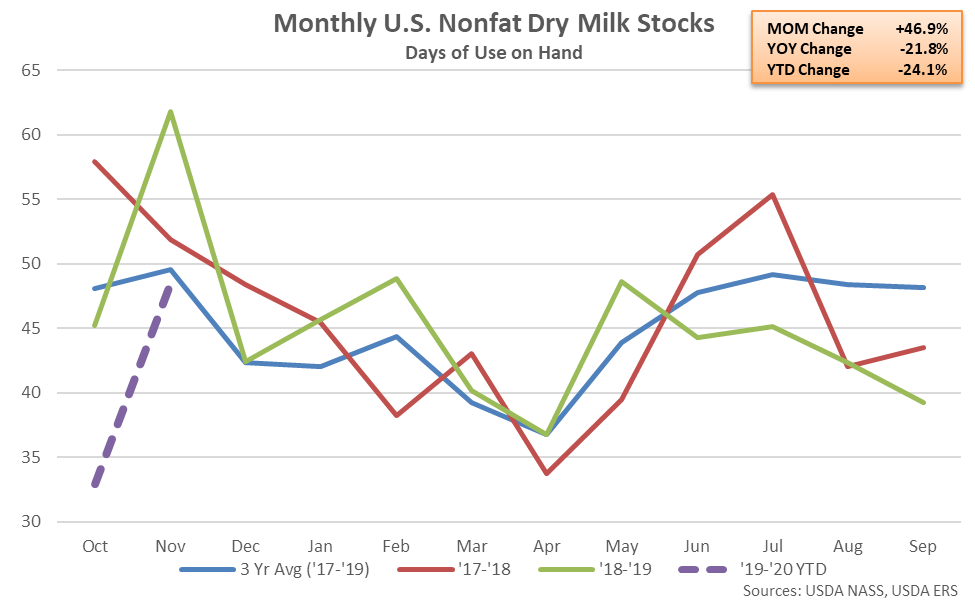

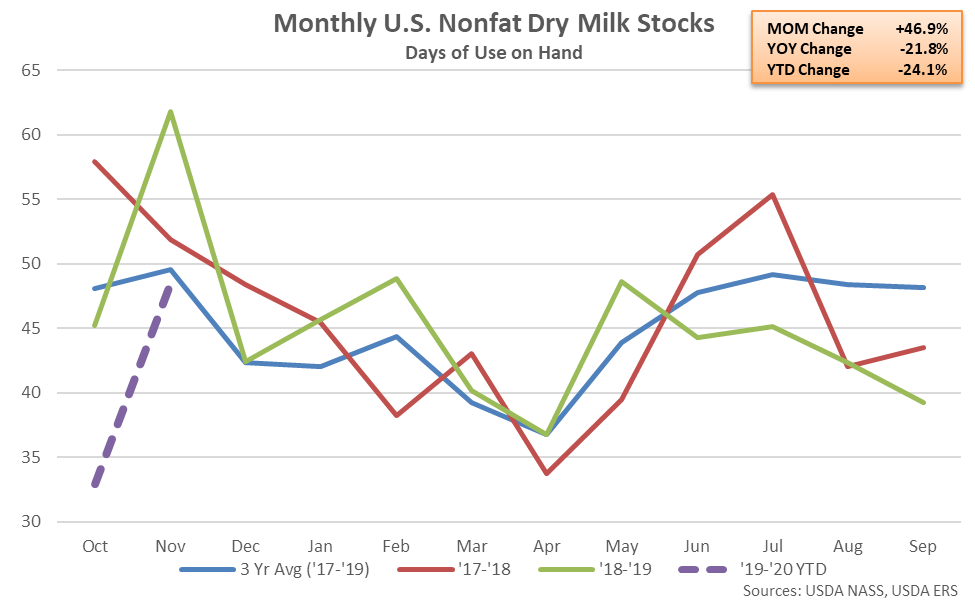

On a days of usage basis, Nov ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, NFDM stocks on a days of usage basis finished down 21.8% YOY, declining on a YOY basis for the third consecutive month.

On a days of usage basis, Nov ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, NFDM stocks on a days of usage basis finished down 21.8% YOY, declining on a YOY basis for the third consecutive month.

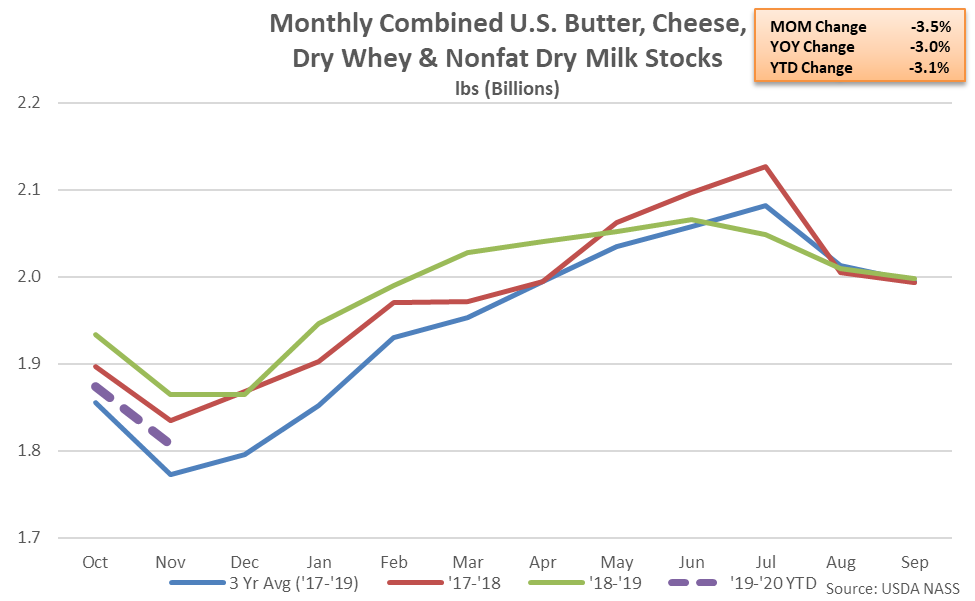

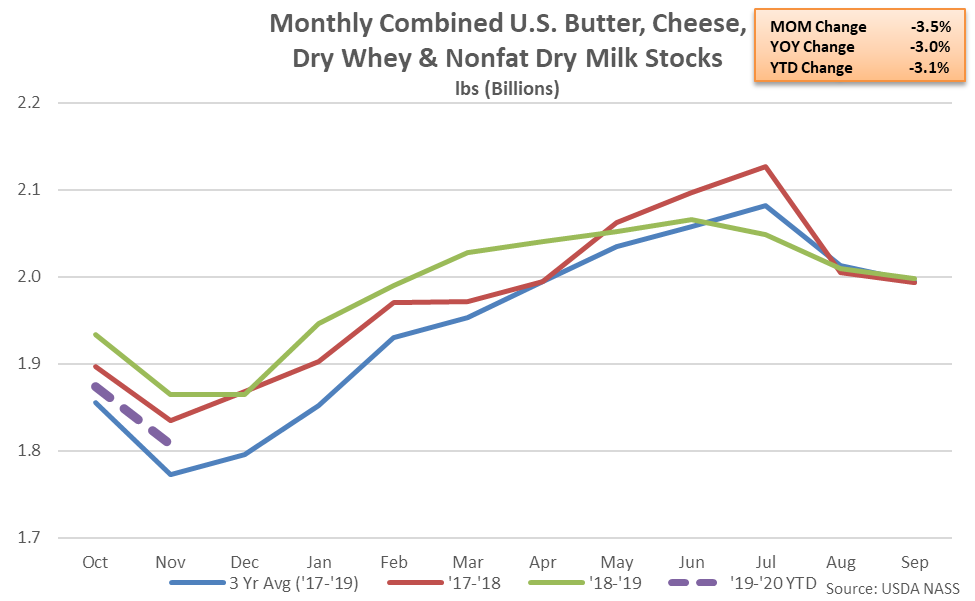

Combined Dairy Product Stocks – Stocks Decline to a Three Year Seasonal Low, Finish Down 3.0% YOY

Combined Dairy Product Stocks – Stocks Decline to a Three Year Seasonal Low, Finish Down 3.0% YOY

Nov ’19 combined stocks of butter, cheese, dry whey and NFDM declined on a YOY basis for the second consecutive month, finishing down 3.0%. Combined dairy product stocks reached a three year seasonal low level but remained 2.0% above three year average seasonal figures.

Nov ’19 combined stocks of butter, cheese, dry whey and NFDM declined on a YOY basis for the second consecutive month, finishing down 3.0%. Combined dairy product stocks reached a three year seasonal low level but remained 2.0% above three year average seasonal figures.

- Nov ’19 U.S. dry whey stocks finished 16.8% higher on a YOY basis, remaining at the second highest seasonal level on record.

- Nov ’19 U.S. nonfat dry milk stocks increased slightly from the 35 month low level experienced throughout the previous month but remained 22.8% lower on a YOY basis, reaching a three year low seasonal level.

Nov ’19 month-end dry whey stocks increased 0.3% MOM and 16.8% YOY, remaining at the second highest seasonal level on record. The YOY increase in dry whey stocks was the third experienced in a row. The MOM increase in dry whey stocks of 0.2 million pounds, or 0.3%, was smaller than the ten year average October – November seasonal build in dry whey stocks of 1.6 million pounds, or 2.6%. Dry whey production finished 3.9% higher on a YOY basis throughout Nov ’19, increasing for the fourth consecutive month.

Nov ’19 month-end dry whey stocks increased 0.3% MOM and 16.8% YOY, remaining at the second highest seasonal level on record. The YOY increase in dry whey stocks was the third experienced in a row. The MOM increase in dry whey stocks of 0.2 million pounds, or 0.3%, was smaller than the ten year average October – November seasonal build in dry whey stocks of 1.6 million pounds, or 2.6%. Dry whey production finished 3.9% higher on a YOY basis throughout Nov ’19, increasing for the fourth consecutive month.

On a days of usage basis, Nov ’19 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, dry whey stocks on a days of usage basis finished up 26.7% YOY, increasing on a YOY basis for the third time in the past four months.

On a days of usage basis, Nov ’19 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, dry whey stocks on a days of usage basis finished up 26.7% YOY, increasing on a YOY basis for the third time in the past four months.

Nonfat Dry Milk – Stocks Remain Significantly Lower on a YOY Basis, Finish Down 22.8%

Nonfat Dry Milk – Stocks Remain Significantly Lower on a YOY Basis, Finish Down 22.8%

Nov ’19 month-end nonfat dry milk (NFDM) stocks increased 2.4% from the 35 month low level experienced throughout the previous month but remained 22.8% lower on a YOY basis, reaching a three year seasonal low level. The YOY decline in NFDM stocks was the sixth experienced in a row. The MOM increase in NFDM stocks of 5.2 million pounds, or 2.4%, was significantly smaller than the ten year average October – November seasonal build in NFDM stocks of 13.1 million pounds, or 9.1%. The smaller than typical seasonal build in NFDM stocks occurred despite production finishing 5.7% higher on a YOY basis throughout Nov ’19, increasing for the seventh consecutive month.

Nov ’19 month-end nonfat dry milk (NFDM) stocks increased 2.4% from the 35 month low level experienced throughout the previous month but remained 22.8% lower on a YOY basis, reaching a three year seasonal low level. The YOY decline in NFDM stocks was the sixth experienced in a row. The MOM increase in NFDM stocks of 5.2 million pounds, or 2.4%, was significantly smaller than the ten year average October – November seasonal build in NFDM stocks of 13.1 million pounds, or 9.1%. The smaller than typical seasonal build in NFDM stocks occurred despite production finishing 5.7% higher on a YOY basis throughout Nov ’19, increasing for the seventh consecutive month.

On a days of usage basis, Nov ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, NFDM stocks on a days of usage basis finished down 21.8% YOY, declining on a YOY basis for the third consecutive month.

On a days of usage basis, Nov ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, NFDM stocks on a days of usage basis finished down 21.8% YOY, declining on a YOY basis for the third consecutive month.

Combined Dairy Product Stocks – Stocks Decline to a Three Year Seasonal Low, Finish Down 3.0% YOY

Combined Dairy Product Stocks – Stocks Decline to a Three Year Seasonal Low, Finish Down 3.0% YOY

Nov ’19 combined stocks of butter, cheese, dry whey and NFDM declined on a YOY basis for the second consecutive month, finishing down 3.0%. Combined dairy product stocks reached a three year seasonal low level but remained 2.0% above three year average seasonal figures.

Nov ’19 combined stocks of butter, cheese, dry whey and NFDM declined on a YOY basis for the second consecutive month, finishing down 3.0%. Combined dairy product stocks reached a three year seasonal low level but remained 2.0% above three year average seasonal figures.