Chinese Dairy Imports Update – Dec ’19

Executive Summary

Chinese dairy import figures provided by IHS Markit were recently updated with values spanning through Nov ‘19. Highlights from the updated report include:

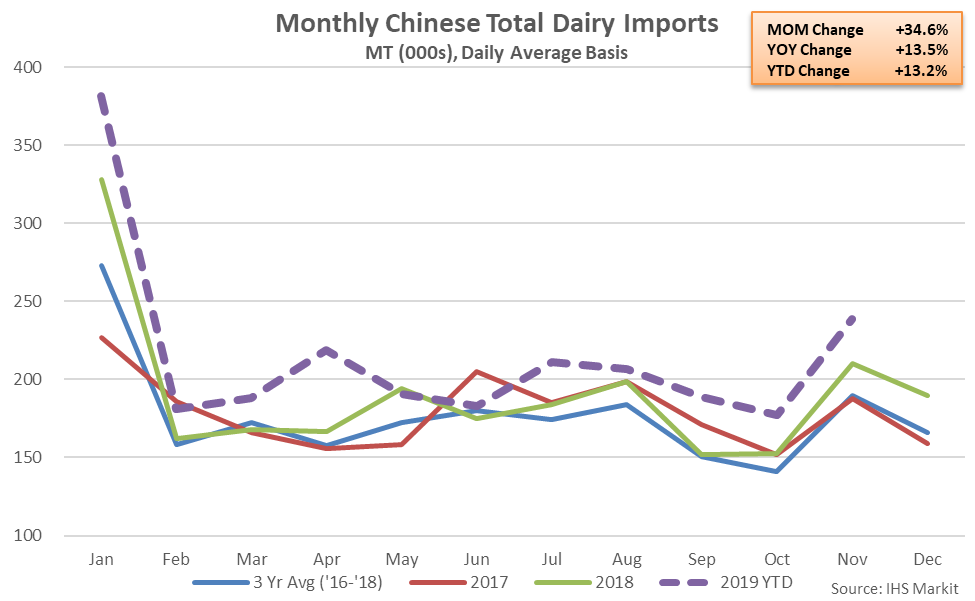

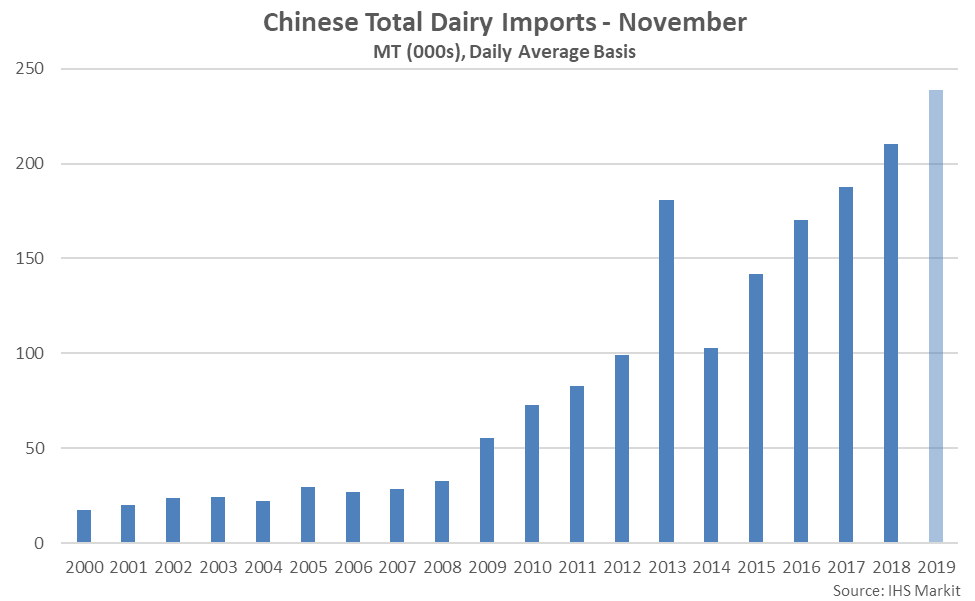

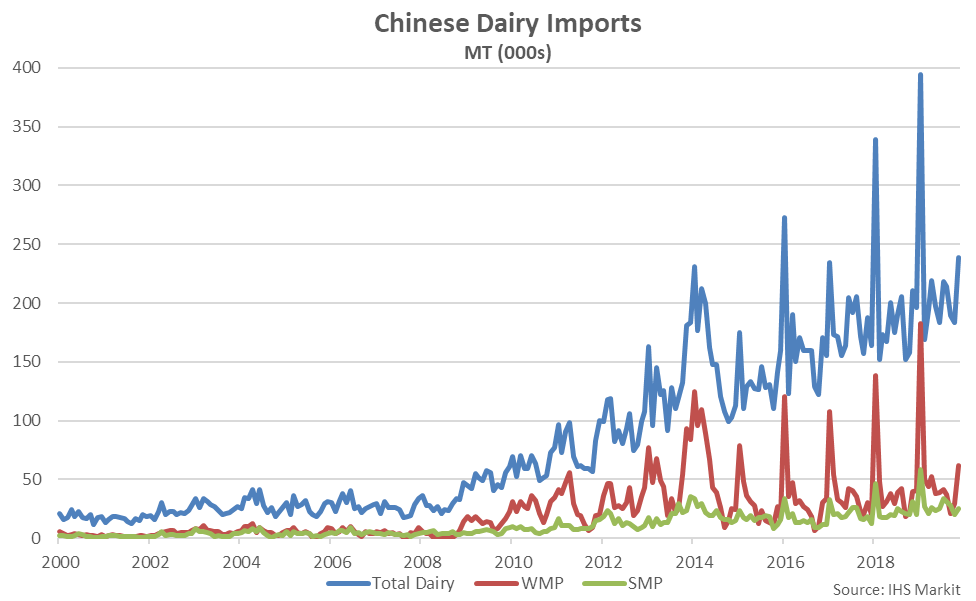

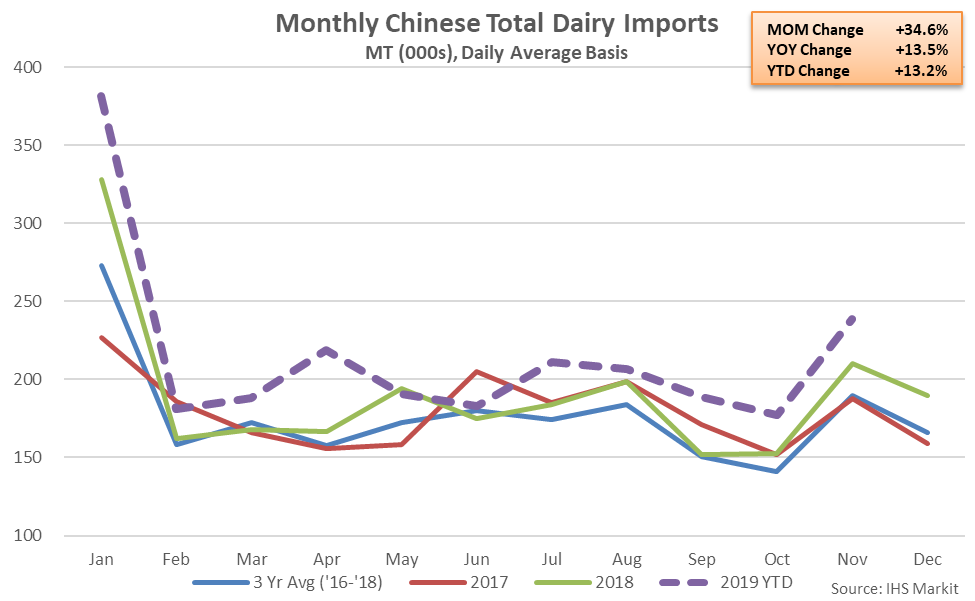

Nov ’19 Chinese Dairy Import Volumes Increased 34.6% MOM and 13.5% YOY

Nov ’19 Chinese Dairy Import Volumes Increased 34.6% MOM and 13.5% YOY

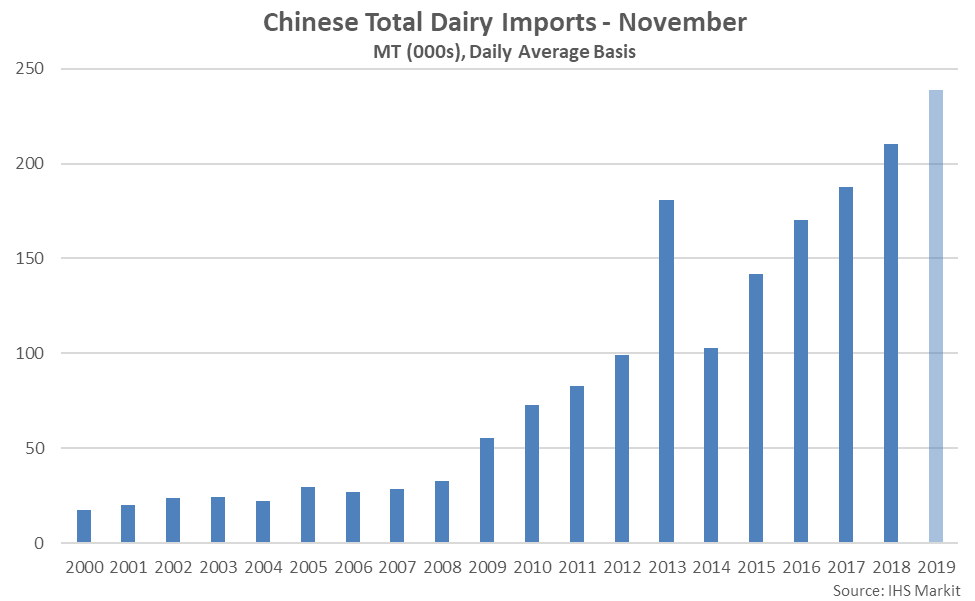

Nov ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Nov ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

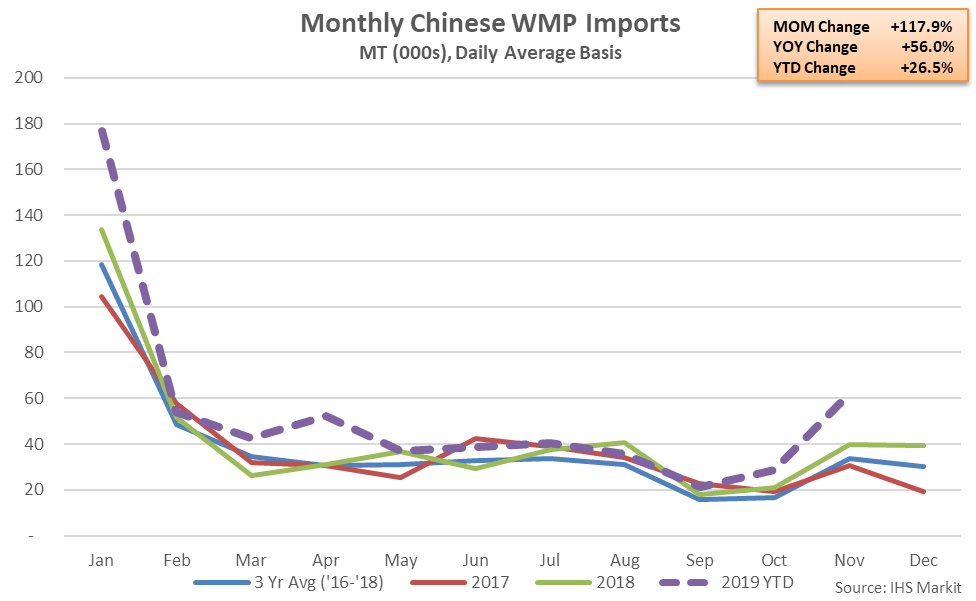

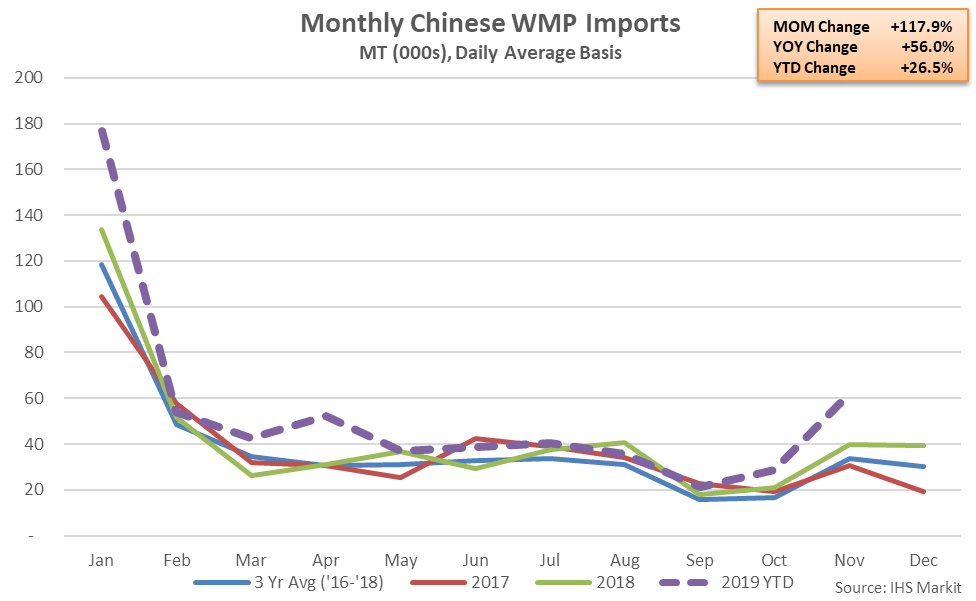

Nov ’19 Chinese WMP Import Volumes Increased 117.9% MOM and 56.0% YOY

Nov ’19 Chinese WMP Import Volumes Increased 117.9% MOM and 56.0% YOY

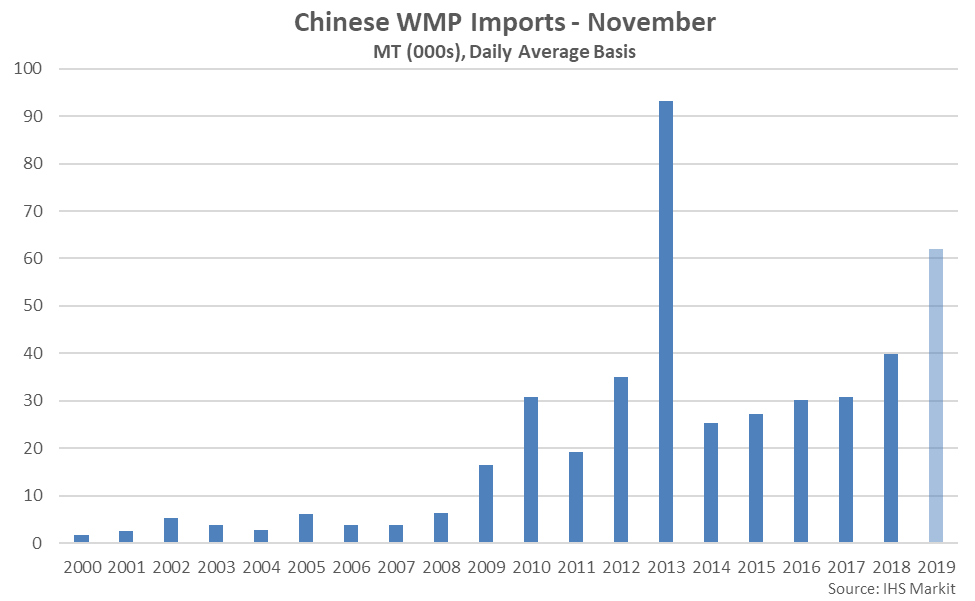

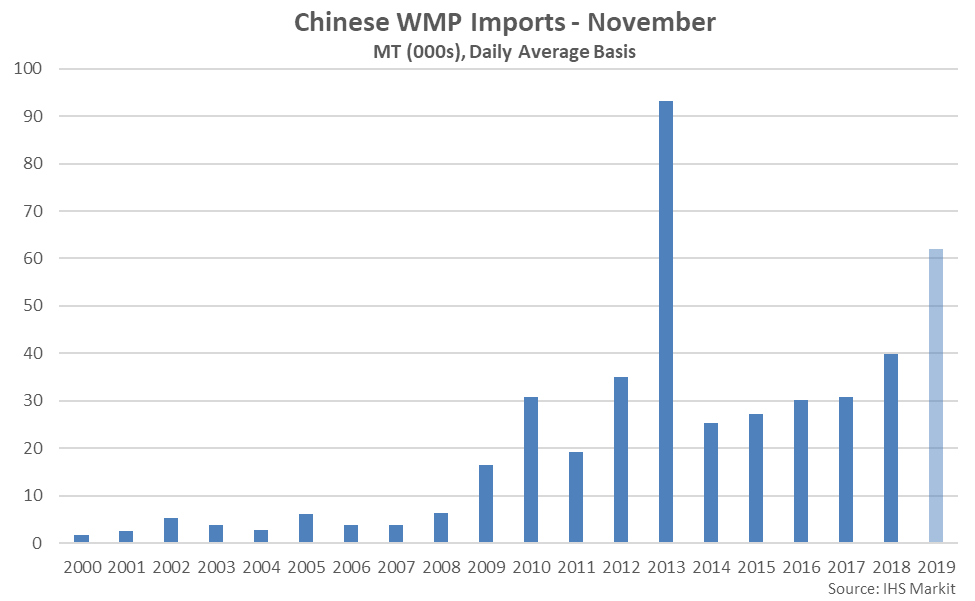

Nov ’19 Chinese WMP Imports Reached a Six Year High Seasonal Level

Nov ’19 Chinese WMP Imports Reached a Six Year High Seasonal Level

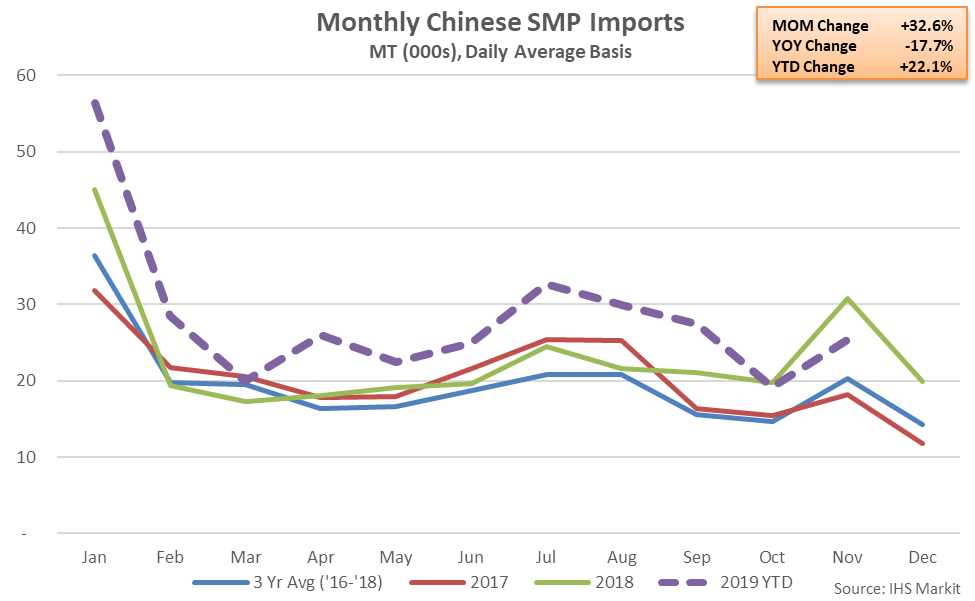

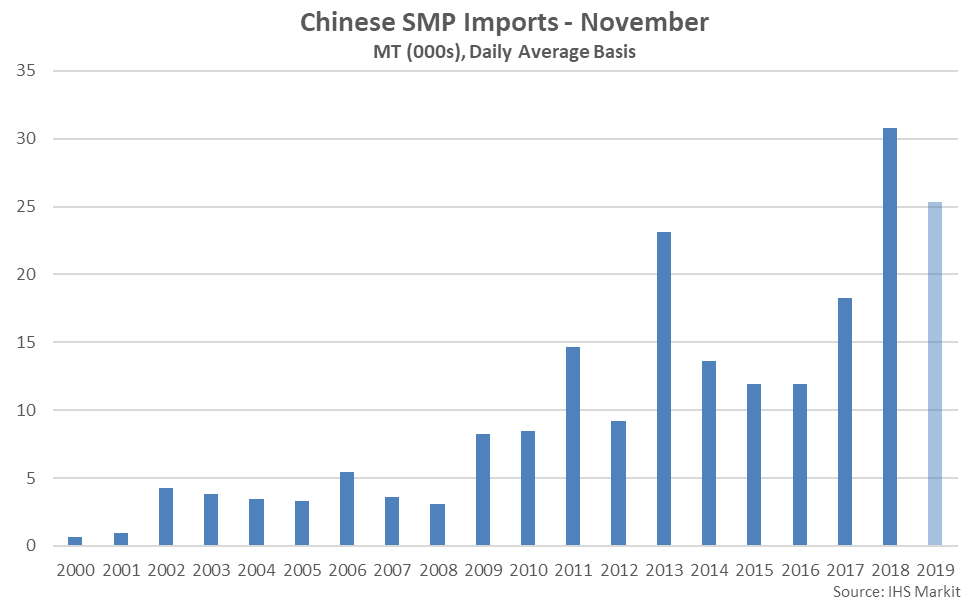

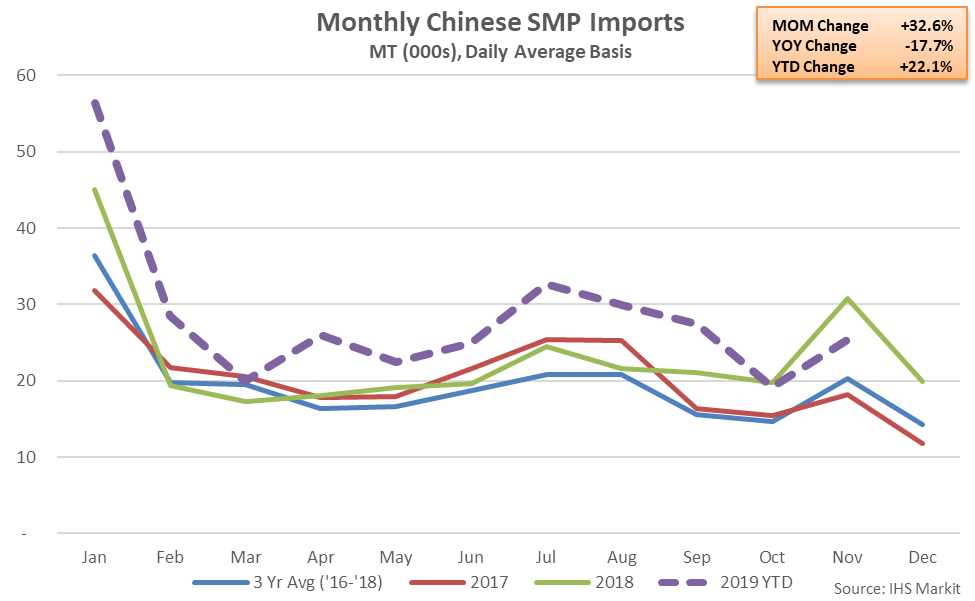

Nov ’19 Chinese SMP Import Volumes Increased 32.6% MOM but Finished Down 17.7% YOY

Nov ’19 Chinese SMP Import Volumes Increased 32.6% MOM but Finished Down 17.7% YOY

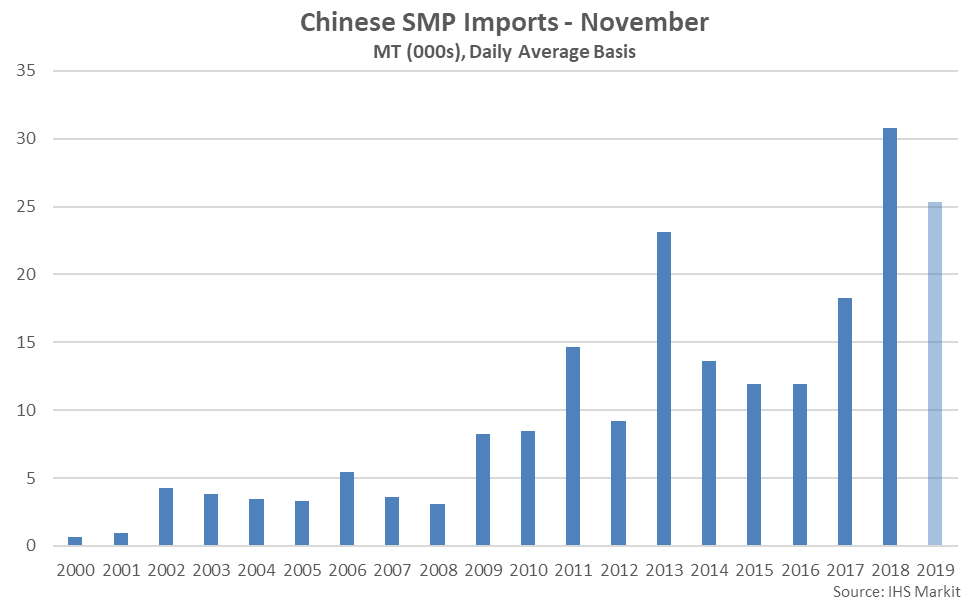

Nov ’19 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

Nov ’19 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

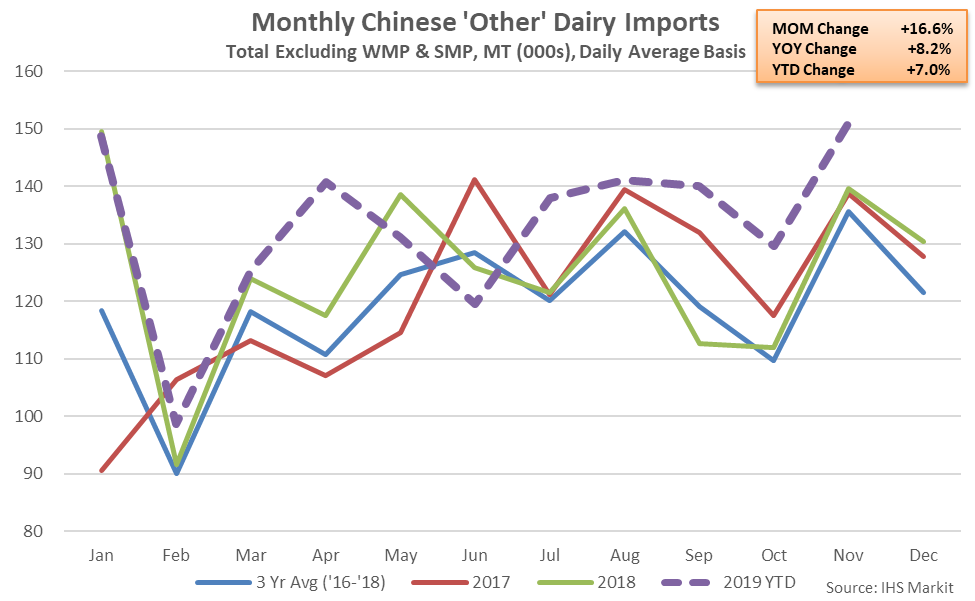

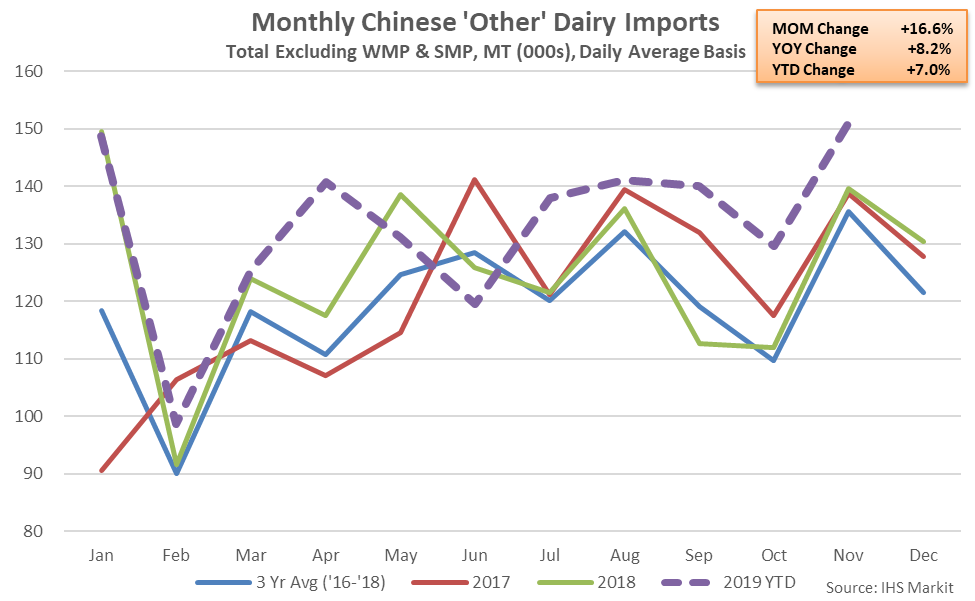

Nov ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 16.6% MOM and 8.2% YOY

Nov ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 16.6% MOM and 8.2% YOY

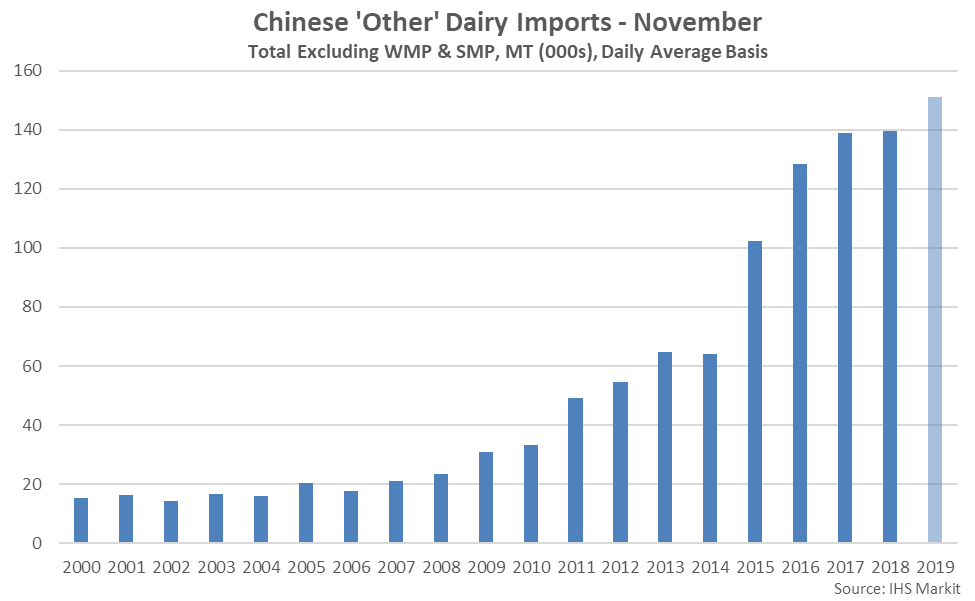

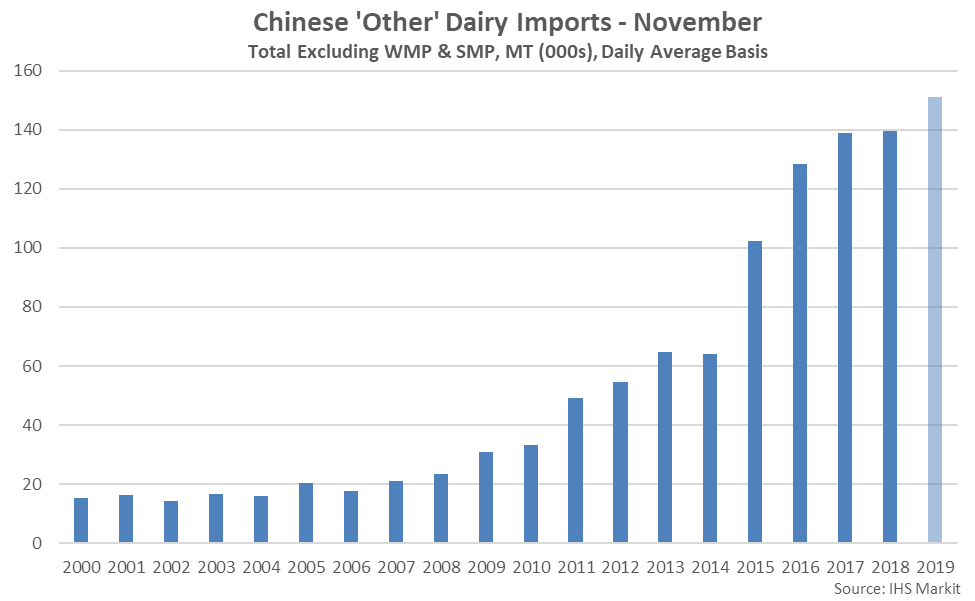

Nov ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Nov ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

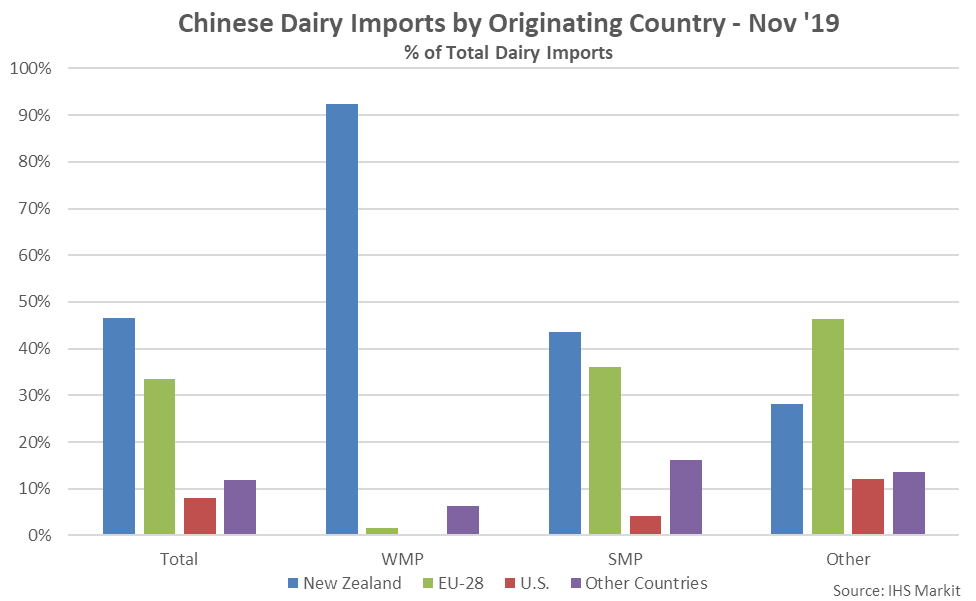

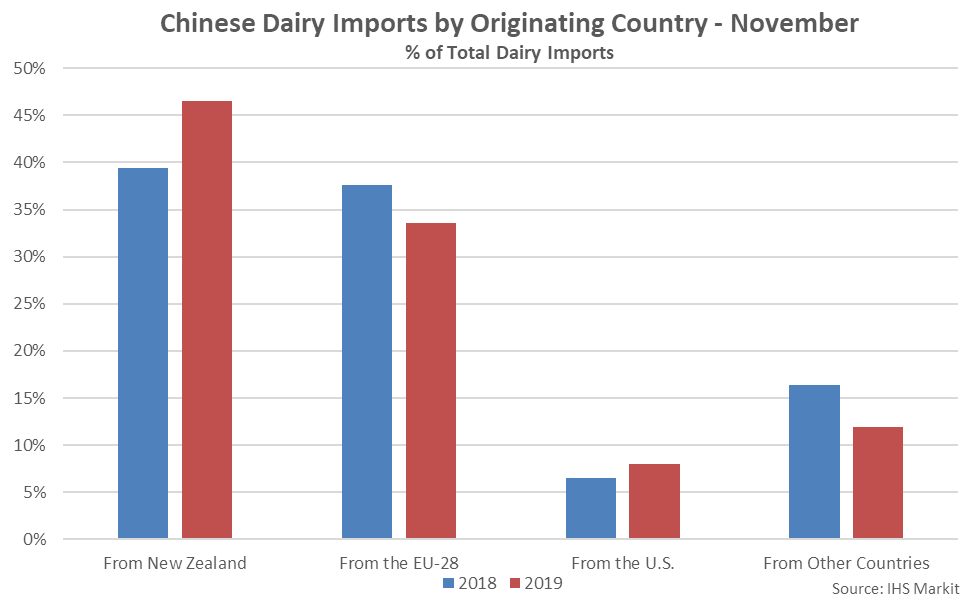

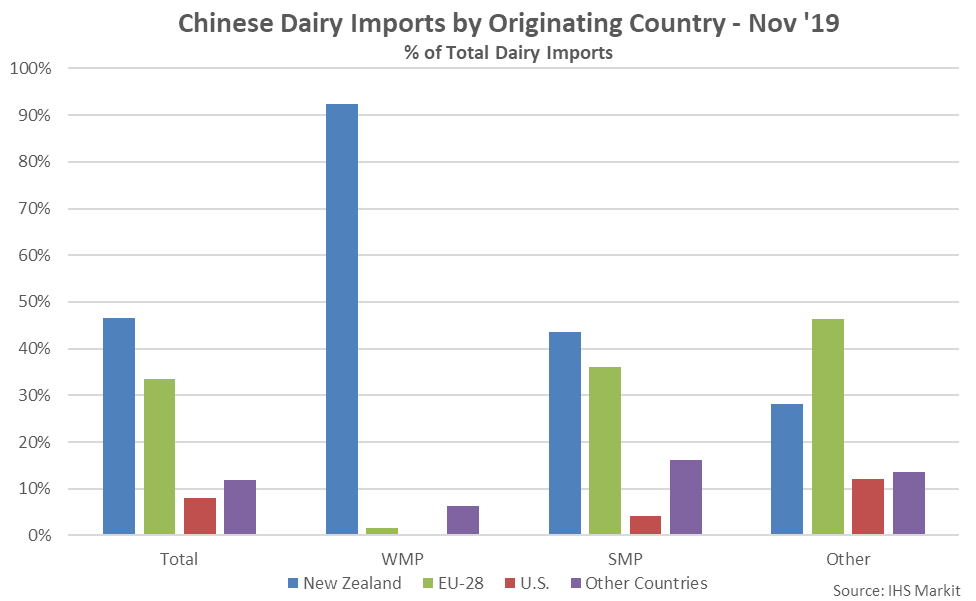

New Zealand Accounted for Nearly Half of All Nov ’19 Chinese Imports

New Zealand Accounted for Nearly Half of All Nov ’19 Chinese Imports

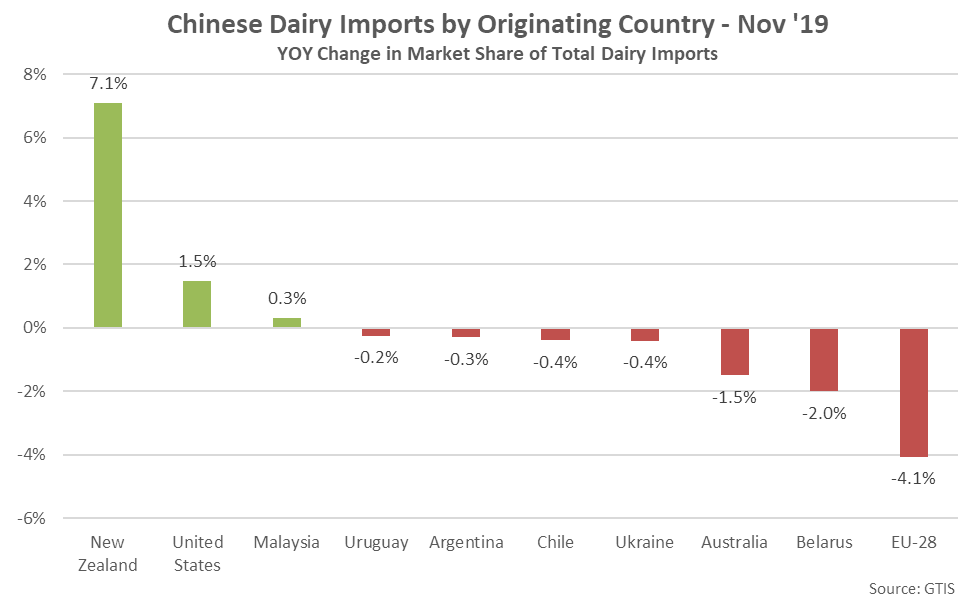

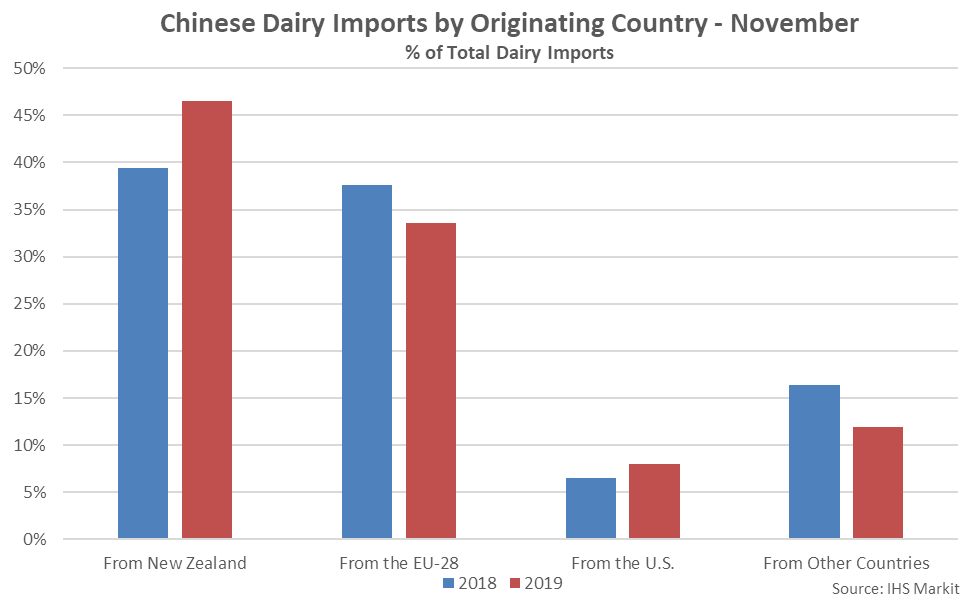

Nov ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

Nov ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

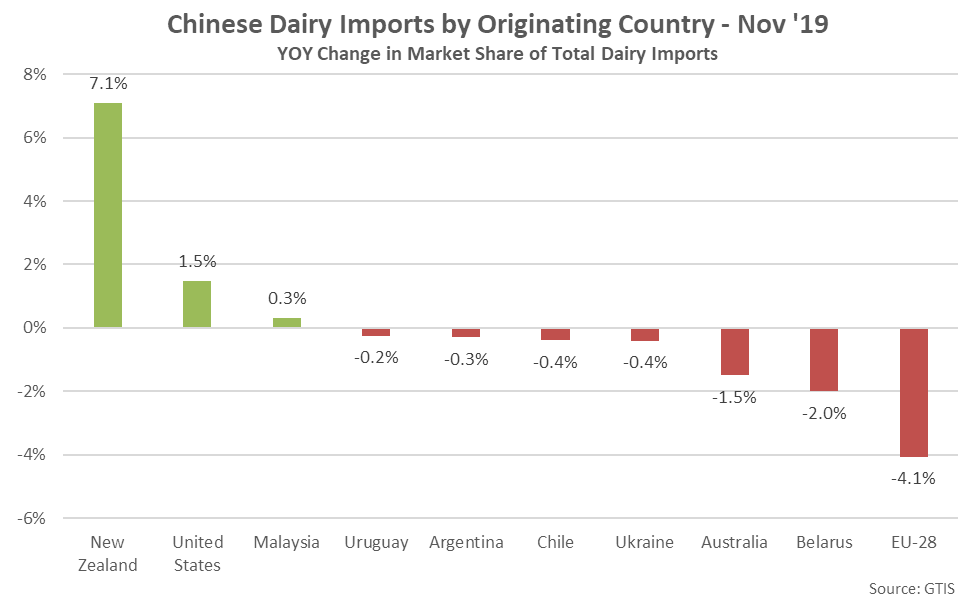

Nov ’19 EU-28 Share of Total Chinese Dairy Imports Declined Most Significantly YOY

Nov ’19 EU-28 Share of Total Chinese Dairy Imports Declined Most Significantly YOY

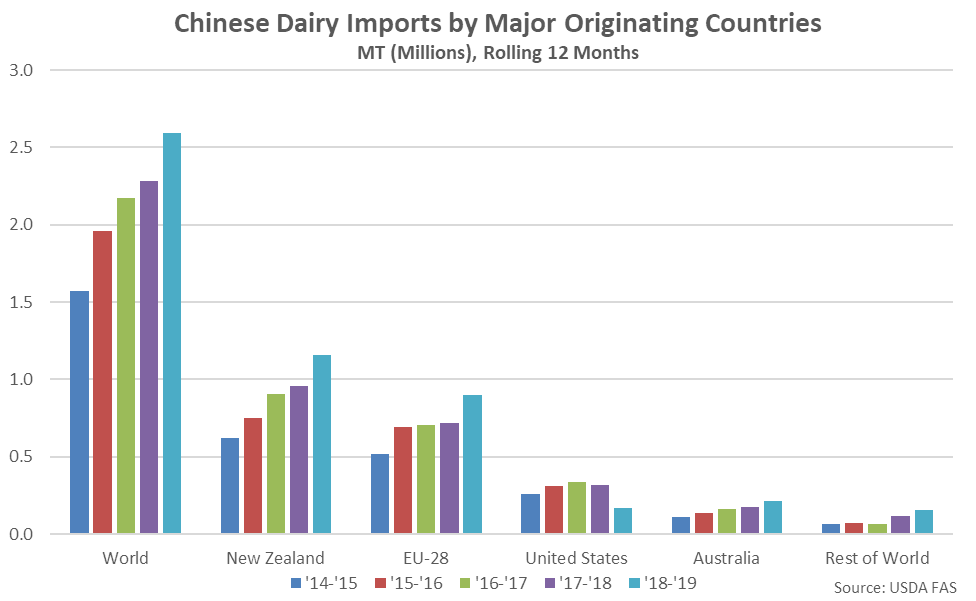

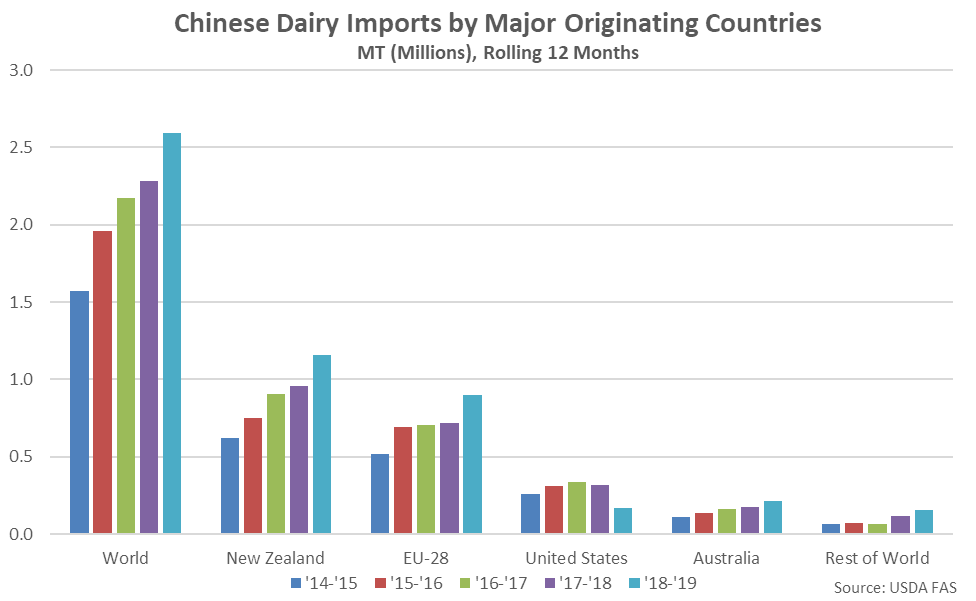

Chinese Dairy Imports From NZ and the EU-28 up Most Significantly Over the Past 12 Months

Chinese Dairy Imports From NZ and the EU-28 up Most Significantly Over the Past 12 Months

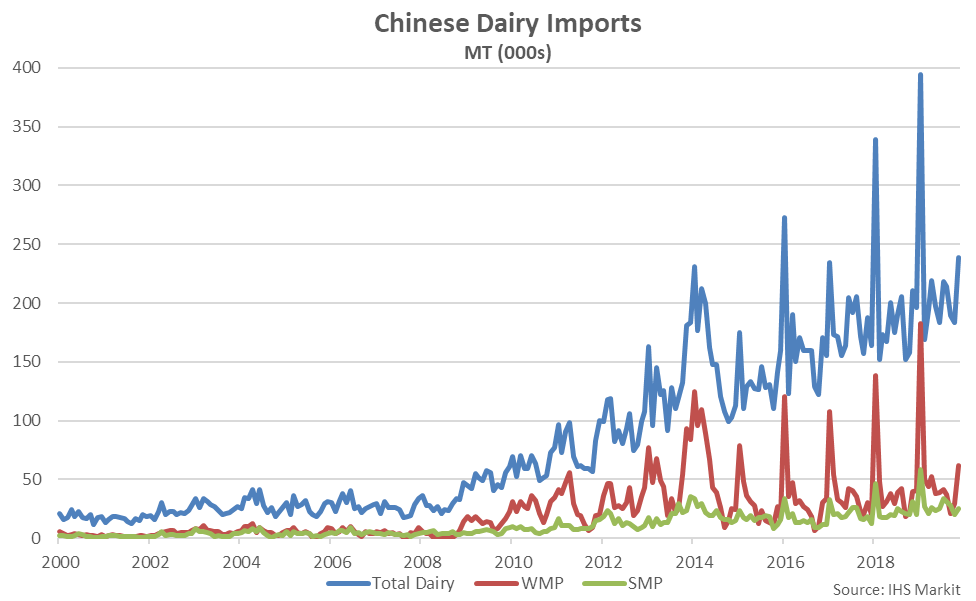

- Nov ’19 Chinese dairy import volumes increased on a YOY basis for the 13th time in the past 14 months, finishing up 13.5% to a record high seasonal level for the month of November.

- Nov ’19 Chinese whole milk powder increased 56.0% YOY, reaching a six year high seasonal level, however Nov ’19 Chinese skim milk powder imports declined 17.7% YOY, finishing lower on a YOY basis for the second consecutive month. Nov ’19 Chinese dairy imports excluding whole milk powder and skim milk powder increased 8.2% YOY, reaching a record high seasonal level.

- Nov ’19 Chinese dairy imports originating from within New Zealand gained market share from the previous year, while the EU-28 market share finished most significantly below previous year levels.

Nov ’19 Chinese Dairy Import Volumes Increased 34.6% MOM and 13.5% YOY

Nov ’19 Chinese Dairy Import Volumes Increased 34.6% MOM and 13.5% YOY

Nov ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Nov ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Nov ’19 Chinese WMP Import Volumes Increased 117.9% MOM and 56.0% YOY

Nov ’19 Chinese WMP Import Volumes Increased 117.9% MOM and 56.0% YOY

Nov ’19 Chinese WMP Imports Reached a Six Year High Seasonal Level

Nov ’19 Chinese WMP Imports Reached a Six Year High Seasonal Level

Nov ’19 Chinese SMP Import Volumes Increased 32.6% MOM but Finished Down 17.7% YOY

Nov ’19 Chinese SMP Import Volumes Increased 32.6% MOM but Finished Down 17.7% YOY

Nov ’19 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

Nov ’19 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

Nov ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 16.6% MOM and 8.2% YOY

Nov ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 16.6% MOM and 8.2% YOY

Nov ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Nov ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

New Zealand Accounted for Nearly Half of All Nov ’19 Chinese Imports

New Zealand Accounted for Nearly Half of All Nov ’19 Chinese Imports

Nov ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

Nov ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

Nov ’19 EU-28 Share of Total Chinese Dairy Imports Declined Most Significantly YOY

Nov ’19 EU-28 Share of Total Chinese Dairy Imports Declined Most Significantly YOY

Chinese Dairy Imports From NZ and the EU-28 up Most Significantly Over the Past 12 Months

Chinese Dairy Imports From NZ and the EU-28 up Most Significantly Over the Past 12 Months