U.S. Oil Rig Count Update – 4/1/20

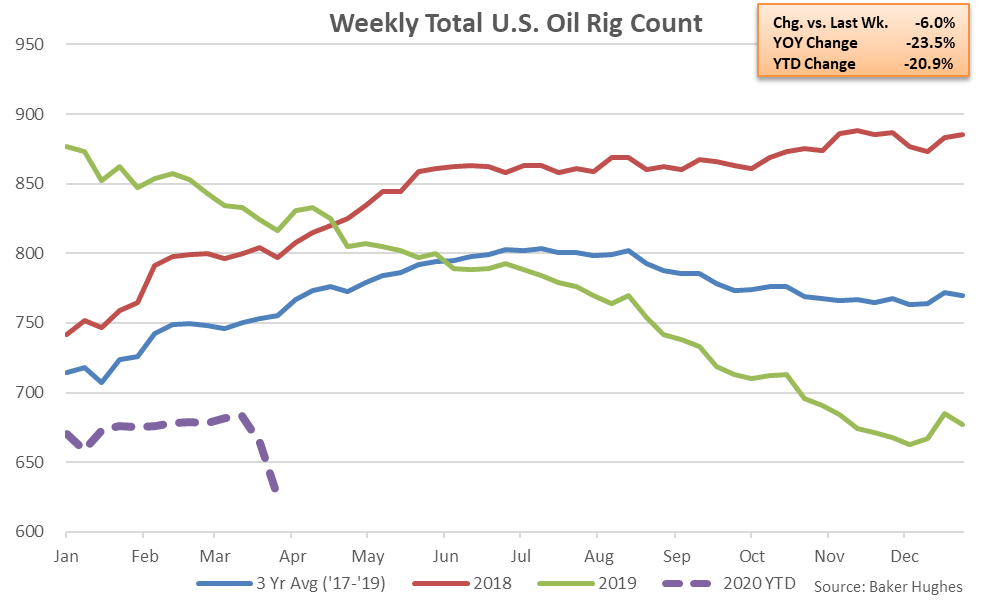

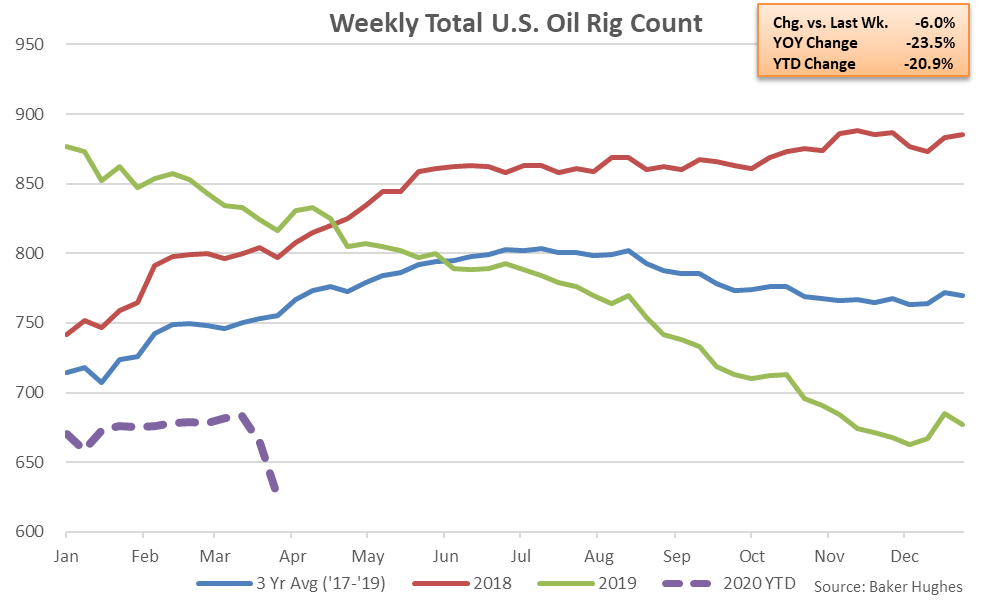

According to Baker Hughes, U.S. oil rig counts declined to a three year low level as of the week ending Mar 27th. Mar 27th oil rig counts declined 6.0% from the previous week while finishing 23.5% lower on a YOY basis and 29.7% below the three and a half year high levels experienced during November of 2018.

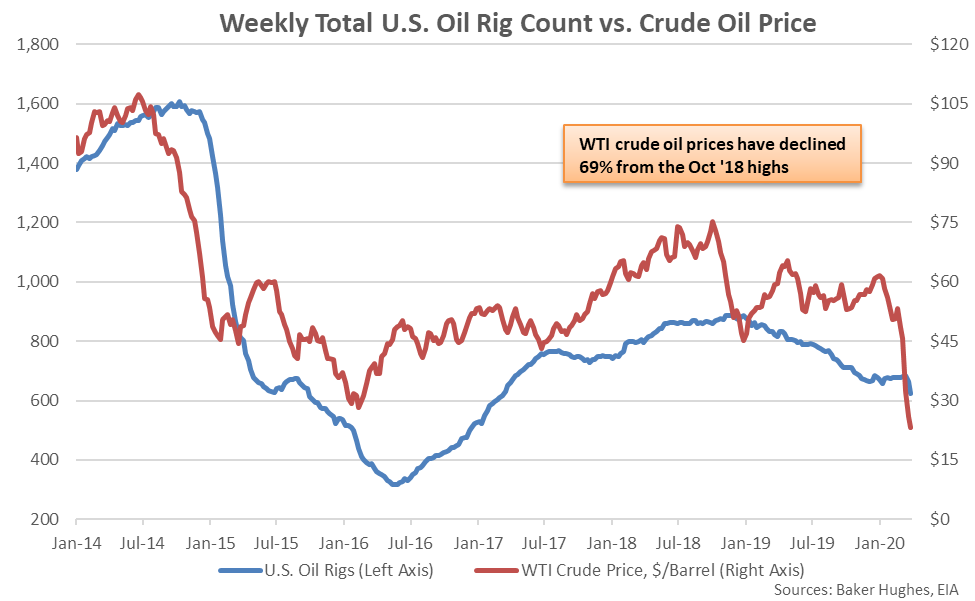

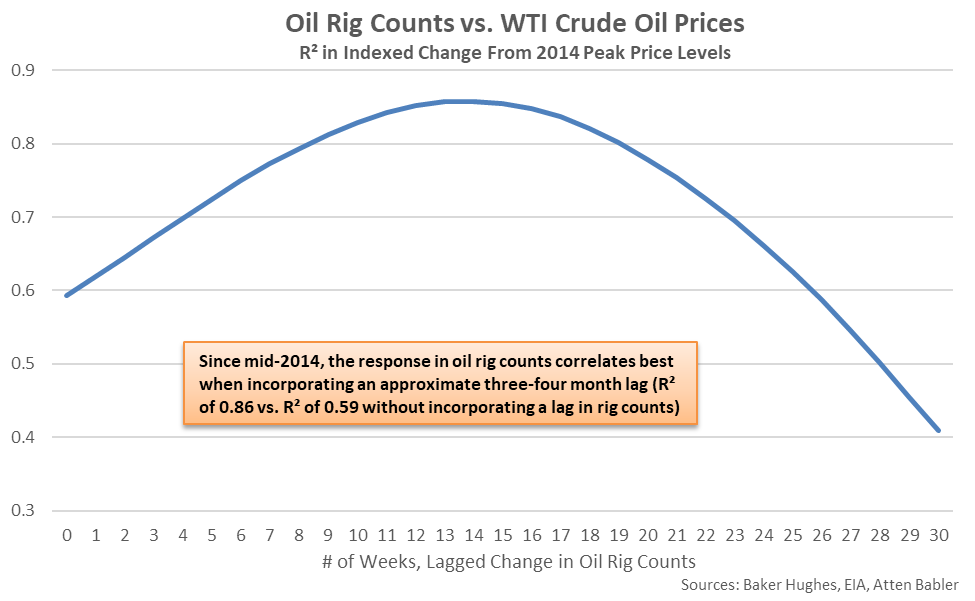

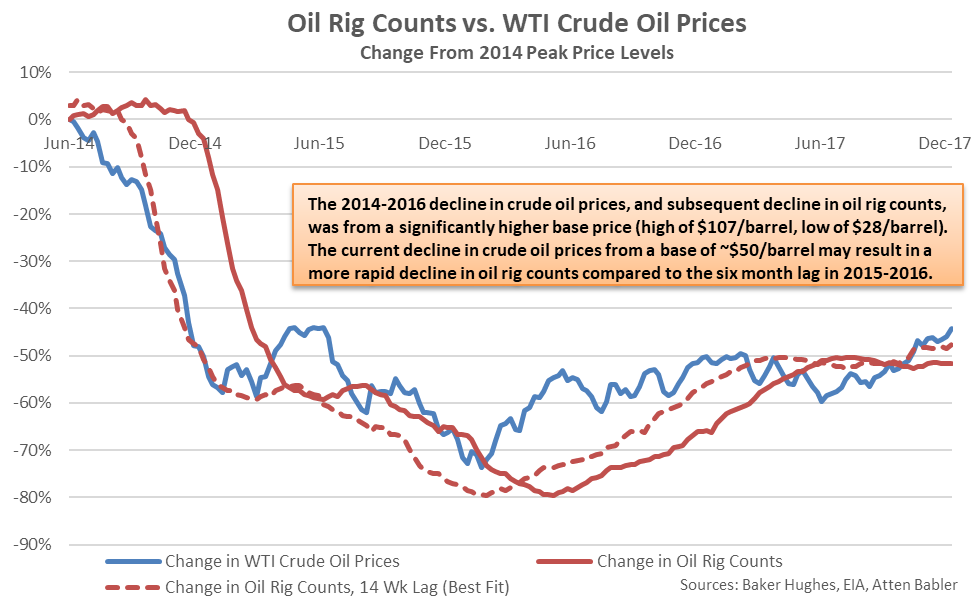

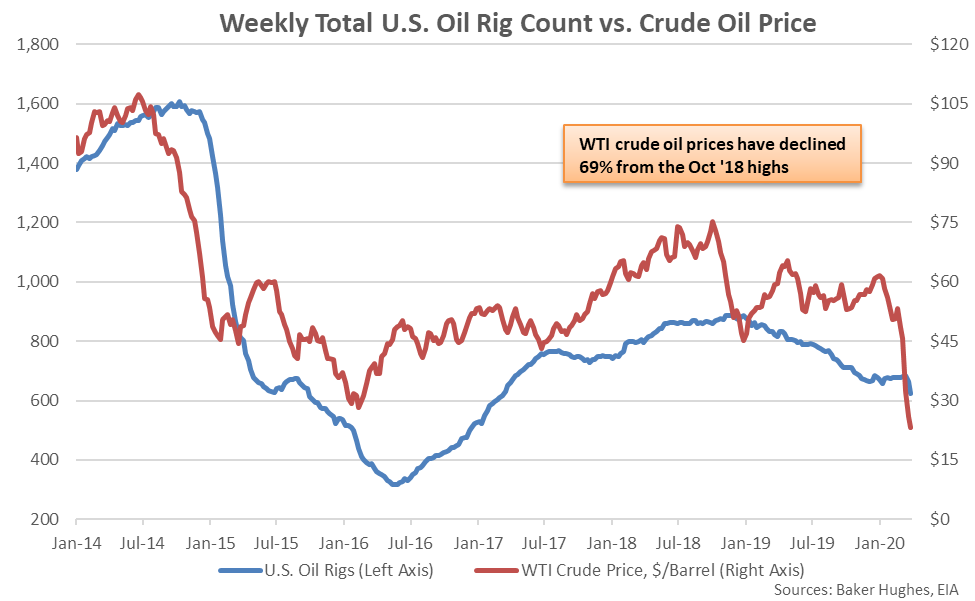

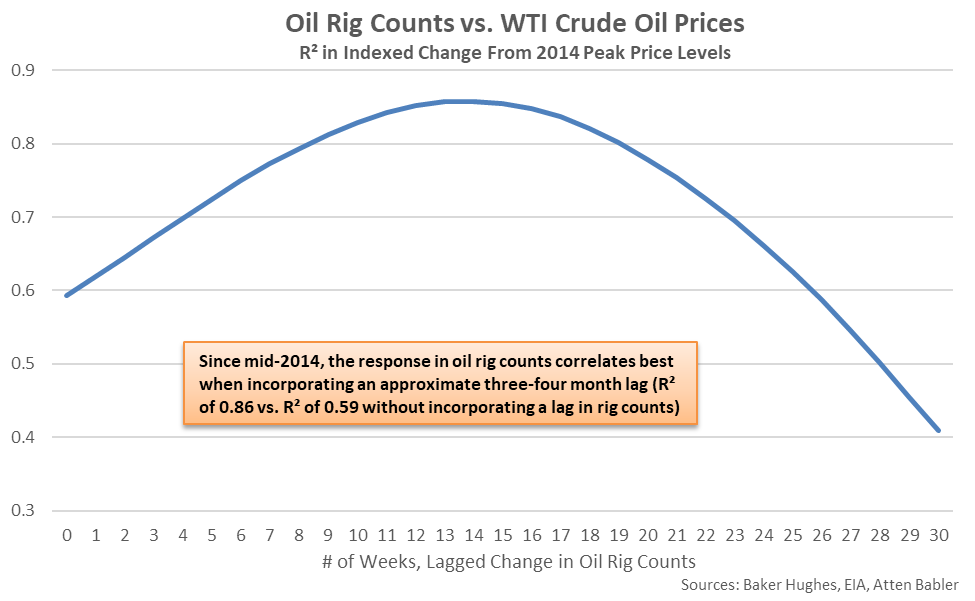

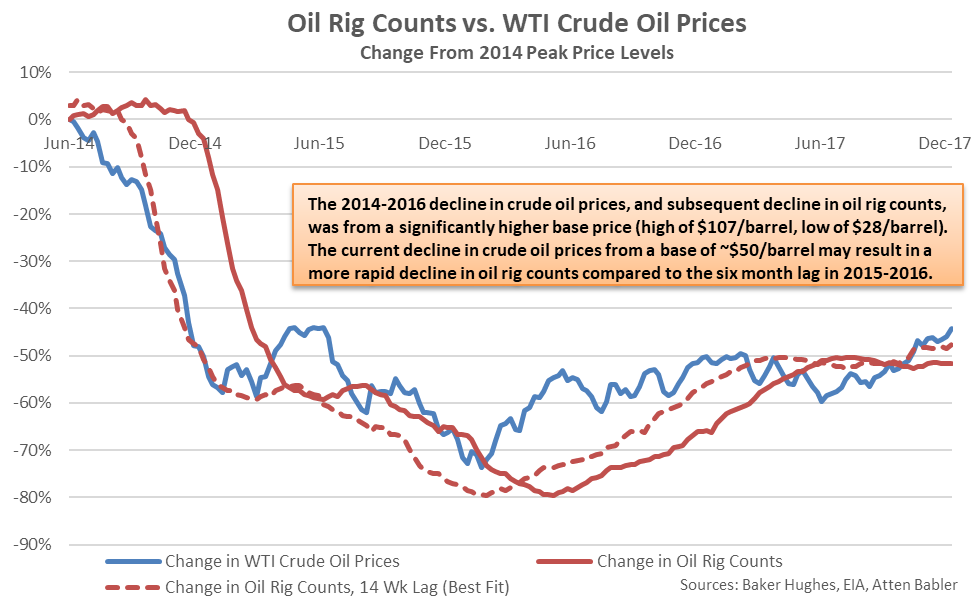

Oil rig counts have declined in response to lower WTI crude oil prices, which finished 69% below the Oct ’18 highs during the week ending Mar 27th. Declines in WTI crude oil prices have accelerated over recent weeks, leading to potential lagged declines in oil rigs throughout weeks to come. Oil rig counts have correlated best with WTI crude oil price movements when utilizing a three-to-four month lag since mid-2014. It remains to be seen whether the most recent significant decline in WTI crude oil prices will result in a more rapid decline in oil rig counts as WTI crude oil prices have declined from a base price of $50/barrel to an 18 year low level approaching $20/barrel.

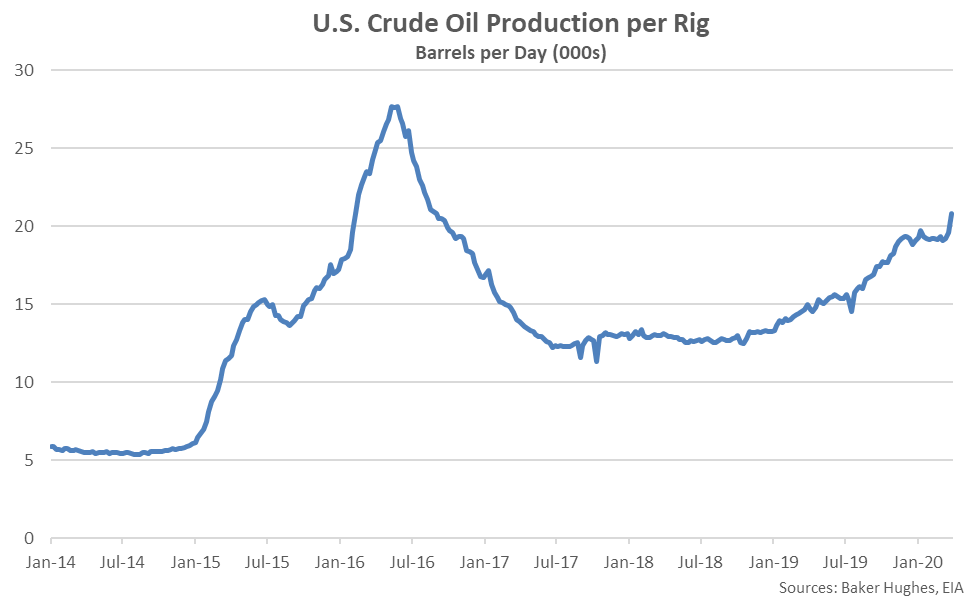

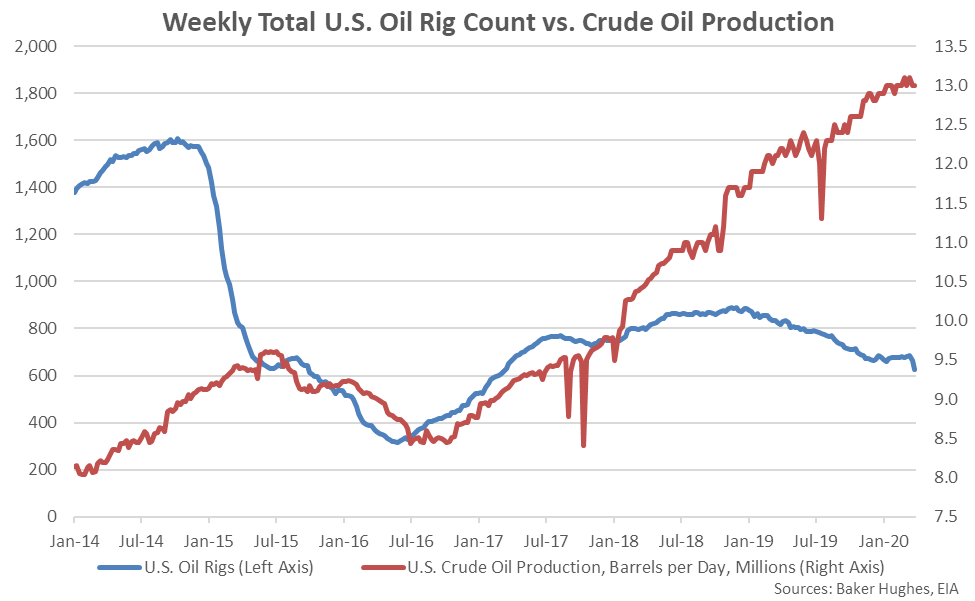

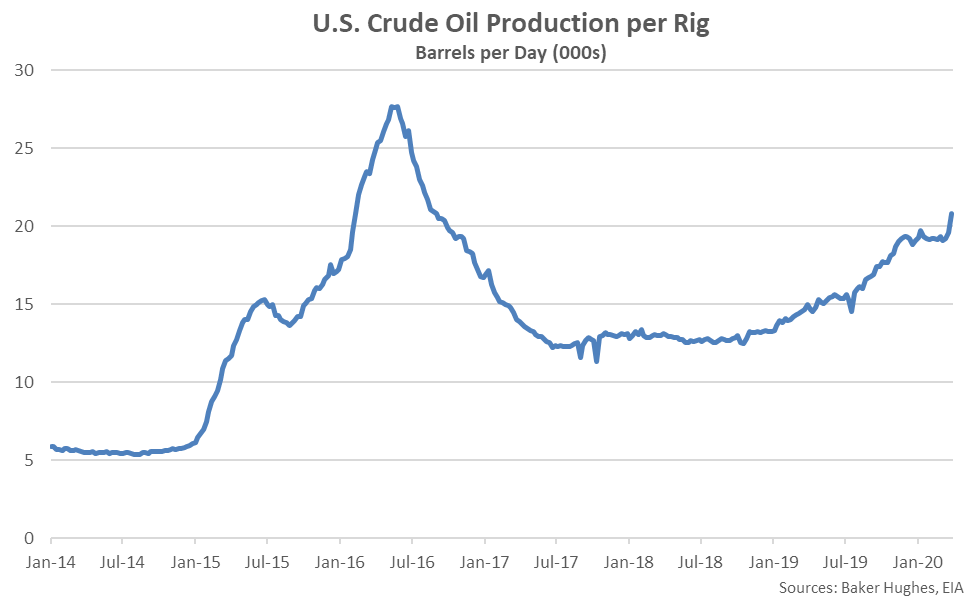

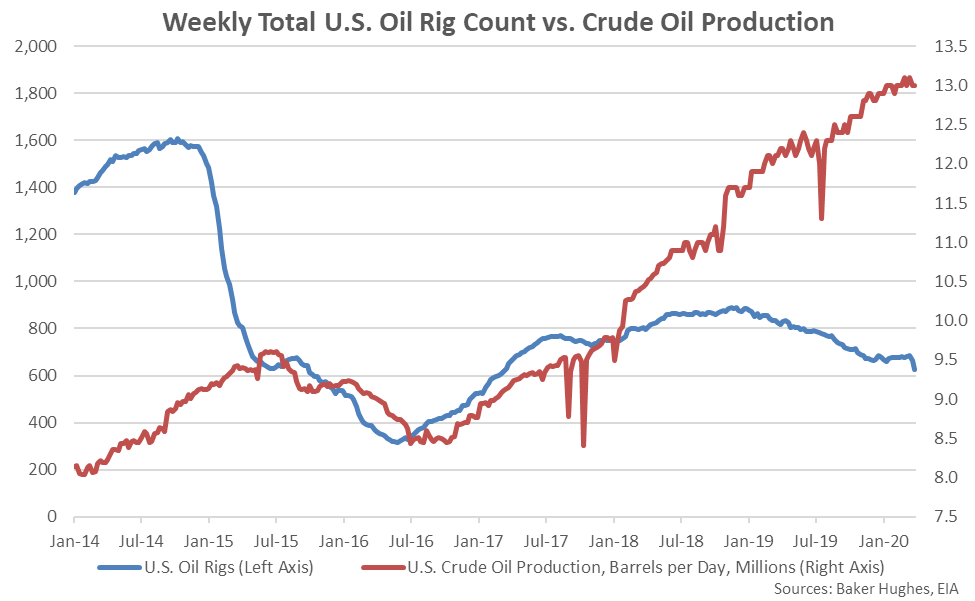

Mar 27th week ending crude oil production remained near recently experienced record high levels, despite the recent reductions in rigs, while oil production per rig increased to a three and a half year high. Crude oil production is expected to continue to strengthen throughout coming months according to drilling productivity estimates compiled throughout areas accounting for 95% of recent production gains, although growth forecasts continue to decelerate as drilled-but-uncompleted wells have reached a 15 month low level.

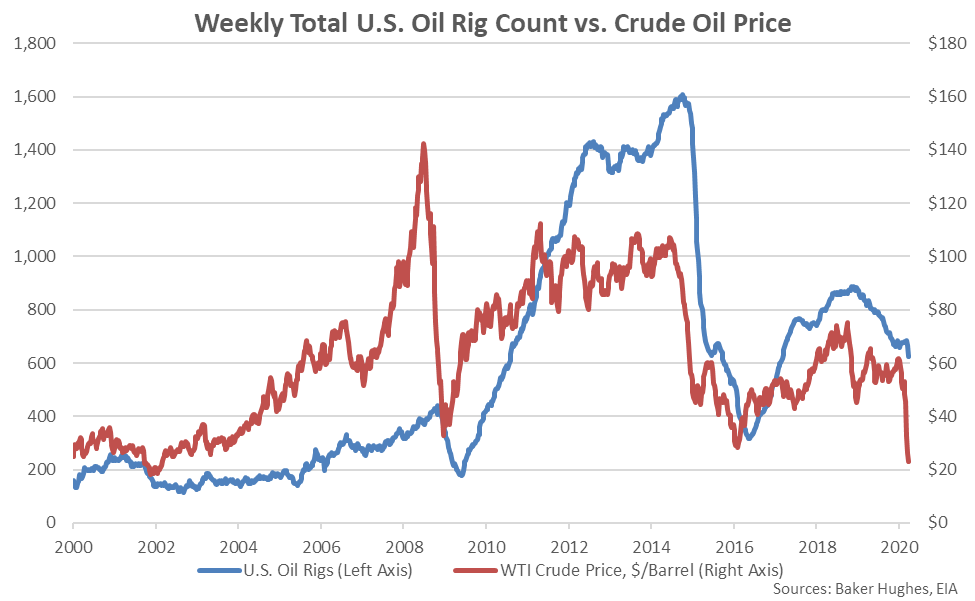

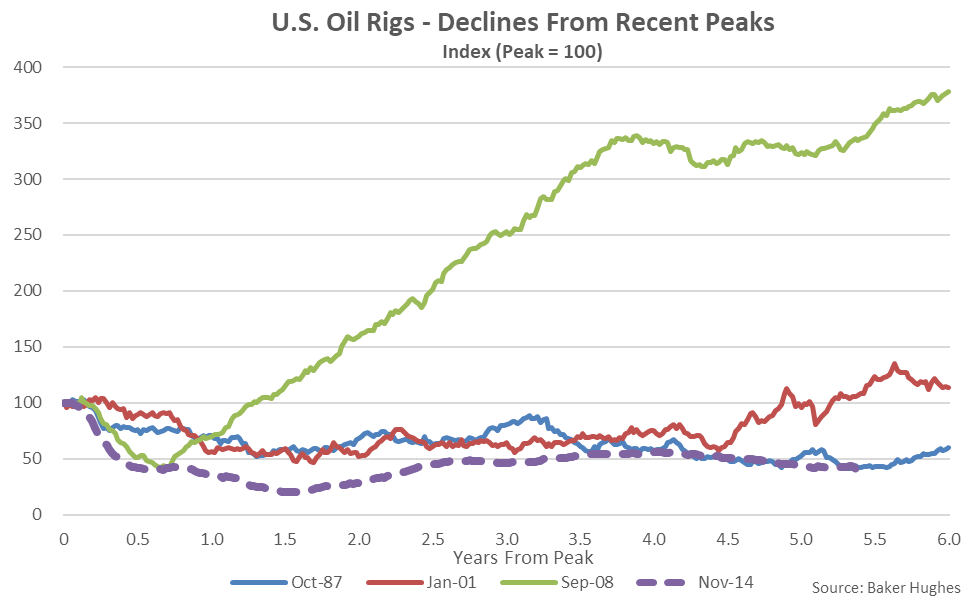

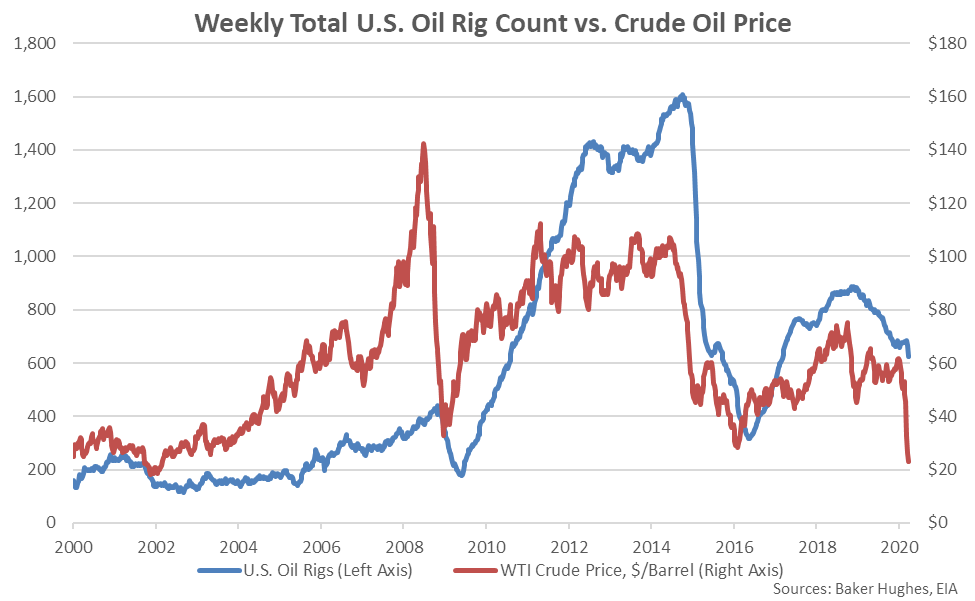

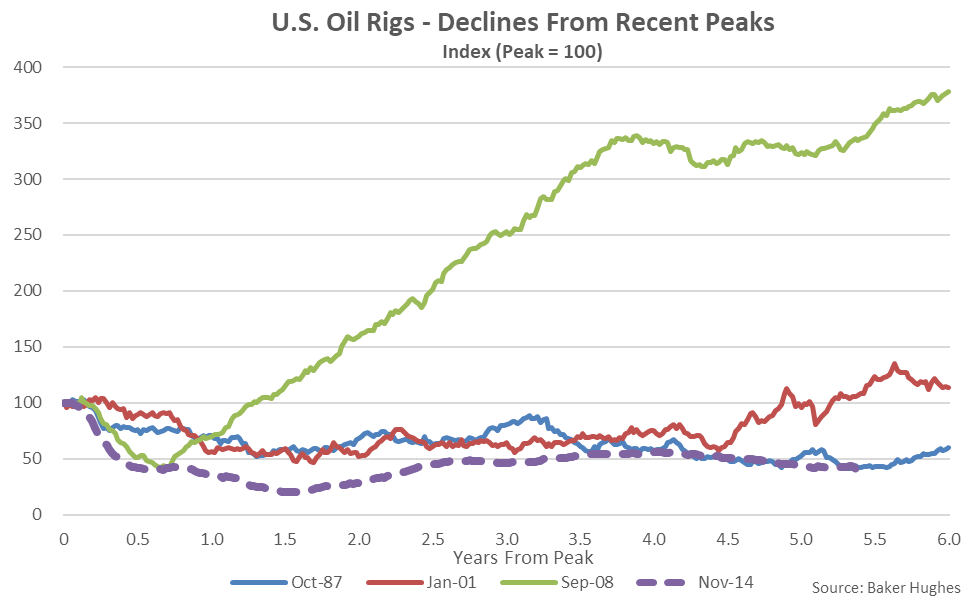

Oil Rig Counts Peaked in Late 2014, Prior to Declining Sharply in Early 2015

Oil Rig Counts Followed Crude Oil Prices Lower but Have Rebounded Since Mid-2016

Oil Rig Counts Followed Crude Oil Prices Lower but Have Rebounded Since Mid-2016

Oil Rig Counts Correlate Best With WTI Price Movements When Utilizing a 3-4 Month Lag

Oil Rig Counts Correlate Best With WTI Price Movements When Utilizing a 3-4 Month Lag

Oil Rig Counts did not Decline Significantly Until Six Months Following the 2014 Price Declines

Oil Rig Counts did not Decline Significantly Until Six Months Following the 2014 Price Declines

Mar 27th Oil Rig Counts Declined 6.0% Week-Over-Week, Finishing 23.5% Lower YOY

Mar 27th Oil Rig Counts Declined 6.0% Week-Over-Week, Finishing 23.5% Lower YOY

The Declines in Oil Rig Counts Since the Nov ’14 Peak Have Been Significant

The Declines in Oil Rig Counts Since the Nov ’14 Peak Have Been Significant

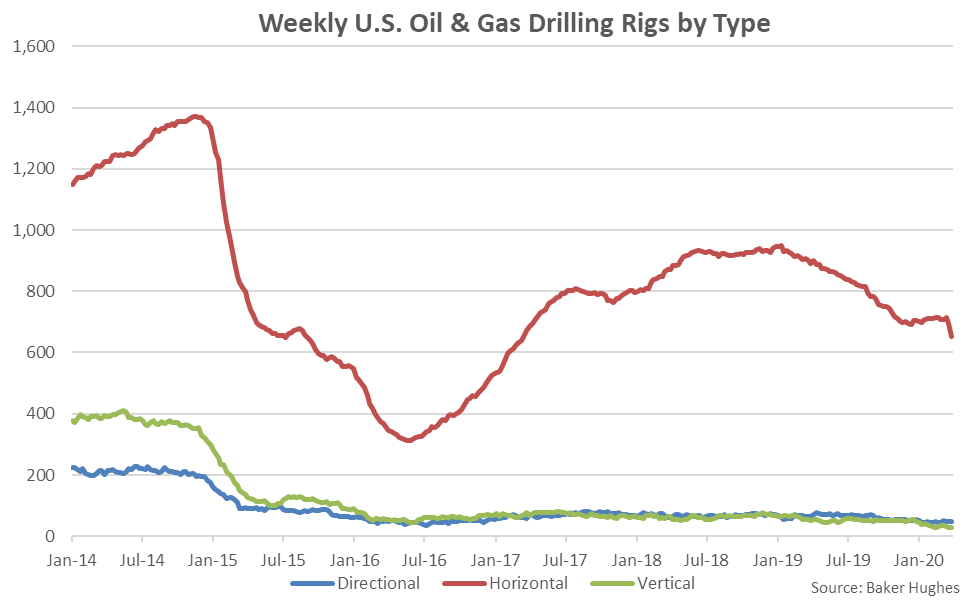

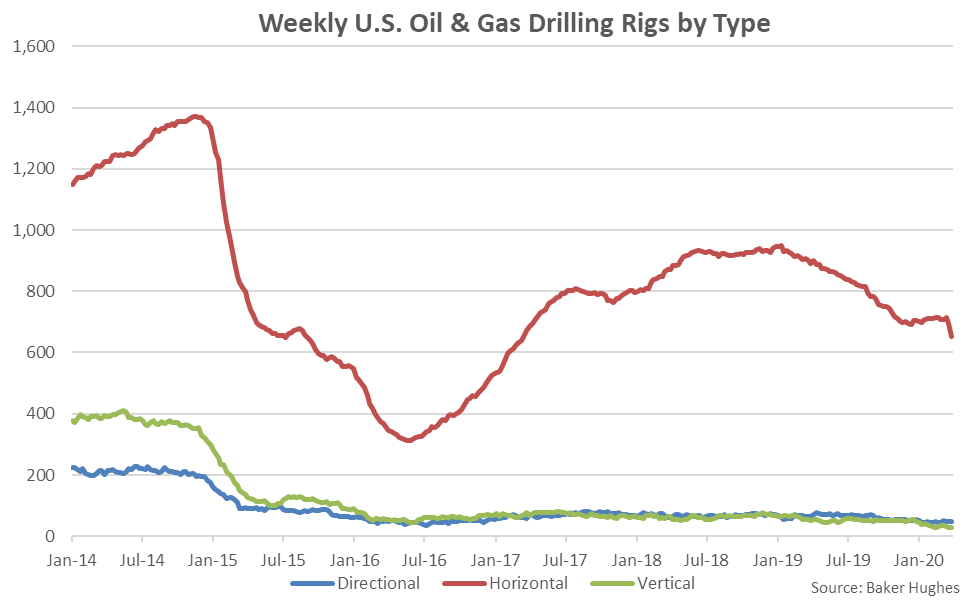

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Mar 27th Weekly Crude Oil Production Volumes Remained Near Recent Record High Levels

Mar 27th Weekly Crude Oil Production Volumes Remained Near Recent Record High Levels

Mar 27th Crude Oil Production per Rig Reached a Three and a Half Year High Level

Mar 27th Crude Oil Production per Rig Reached a Three and a Half Year High Level

Oil Rig Counts Followed Crude Oil Prices Lower but Have Rebounded Since Mid-2016

Oil Rig Counts Followed Crude Oil Prices Lower but Have Rebounded Since Mid-2016

Oil Rig Counts Correlate Best With WTI Price Movements When Utilizing a 3-4 Month Lag

Oil Rig Counts Correlate Best With WTI Price Movements When Utilizing a 3-4 Month Lag

Oil Rig Counts did not Decline Significantly Until Six Months Following the 2014 Price Declines

Oil Rig Counts did not Decline Significantly Until Six Months Following the 2014 Price Declines

Mar 27th Oil Rig Counts Declined 6.0% Week-Over-Week, Finishing 23.5% Lower YOY

Mar 27th Oil Rig Counts Declined 6.0% Week-Over-Week, Finishing 23.5% Lower YOY

The Declines in Oil Rig Counts Since the Nov ’14 Peak Have Been Significant

The Declines in Oil Rig Counts Since the Nov ’14 Peak Have Been Significant

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Mar 27th Weekly Crude Oil Production Volumes Remained Near Recent Record High Levels

Mar 27th Weekly Crude Oil Production Volumes Remained Near Recent Record High Levels

Mar 27th Crude Oil Production per Rig Reached a Three and a Half Year High Level

Mar 27th Crude Oil Production per Rig Reached a Three and a Half Year High Level