U.S. Dairy Exports Update – Dec ’19

Executive Summary

U.S. dairy export figures provided by USDA were recently updated with values spanning through Oct ’19. Highlights from the updated report include:

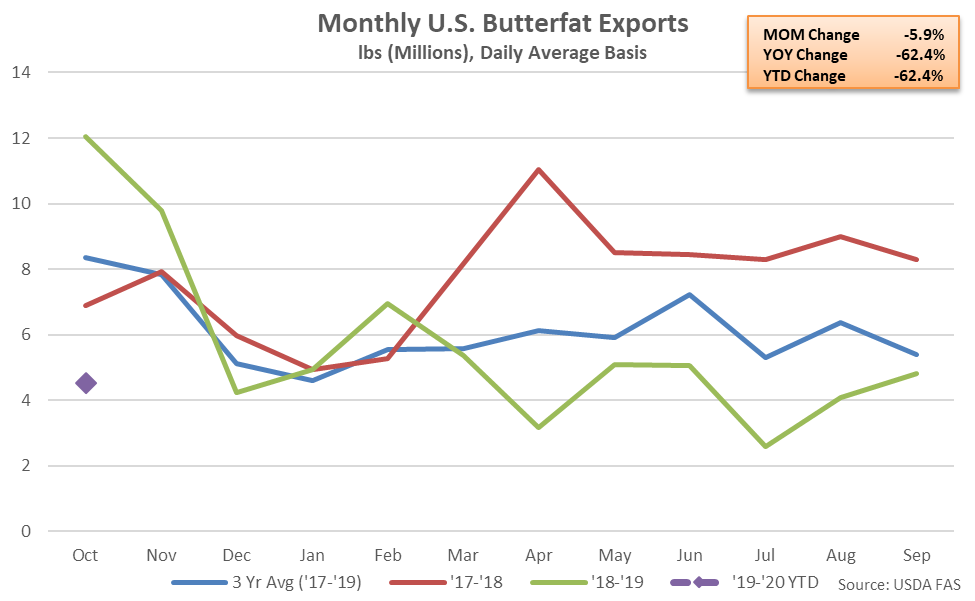

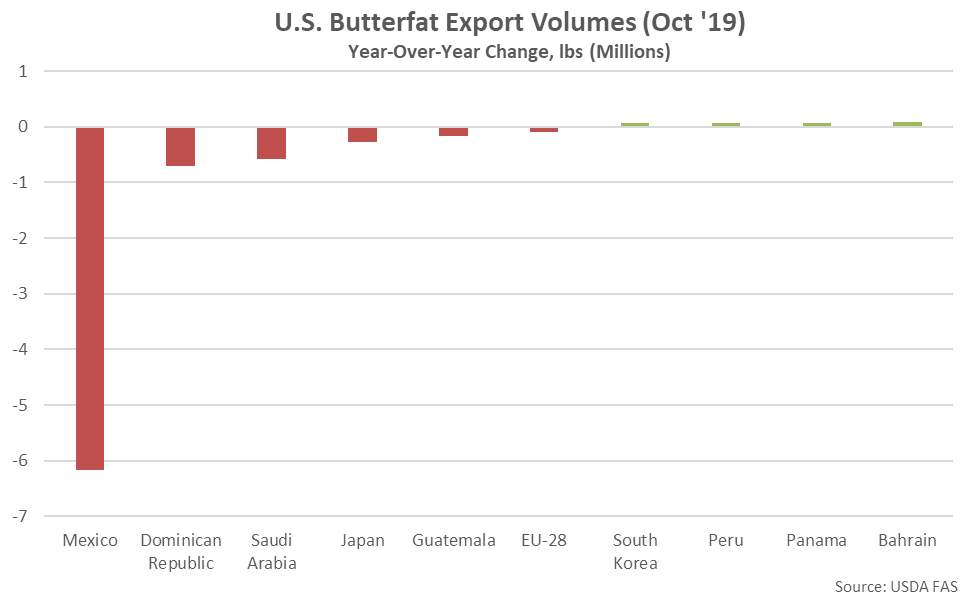

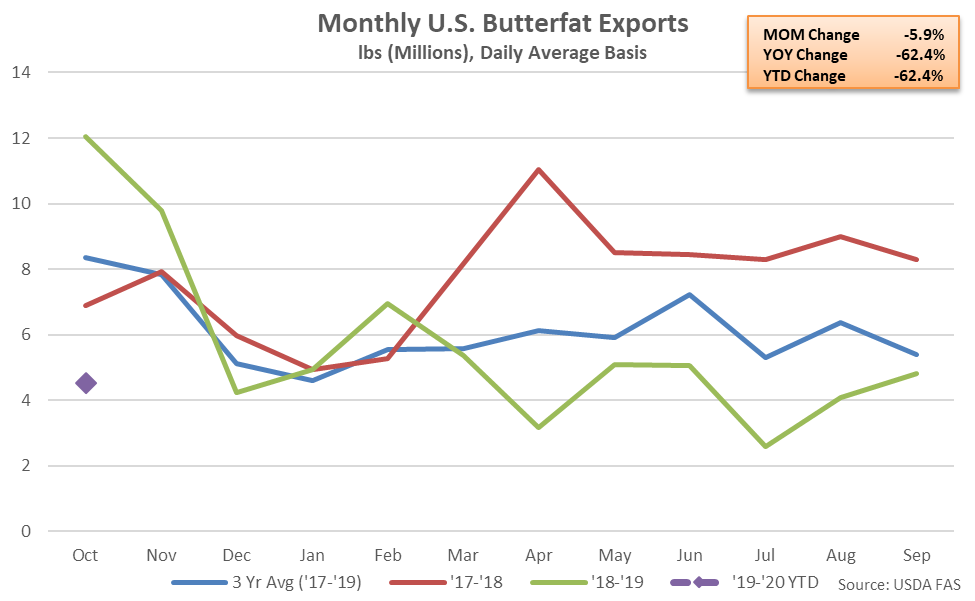

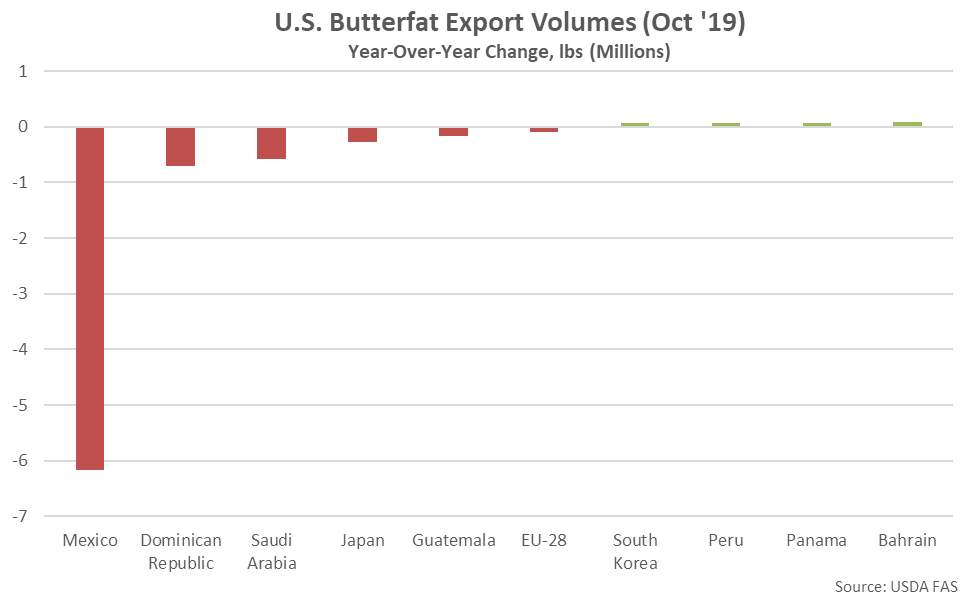

Butterfat export volumes destined to Mexico declined most significantly on a YOY basis throughout the month. Mexico accounted for nearly 80% of the total YOY decline in Oct ’19 U.S. butterfat export volumes.

Butterfat export volumes destined to Mexico declined most significantly on a YOY basis throughout the month. Mexico accounted for nearly 80% of the total YOY decline in Oct ’19 U.S. butterfat export volumes.

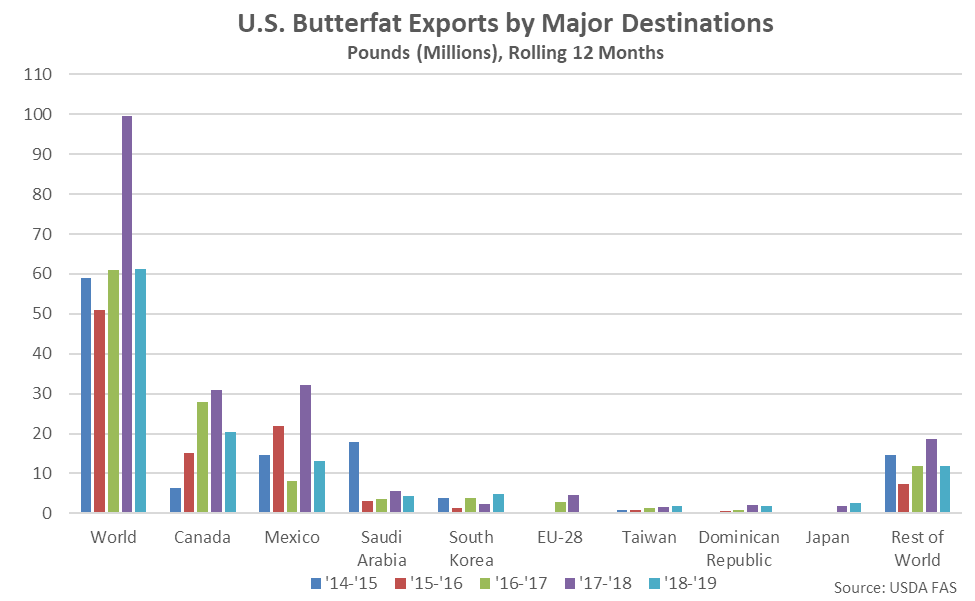

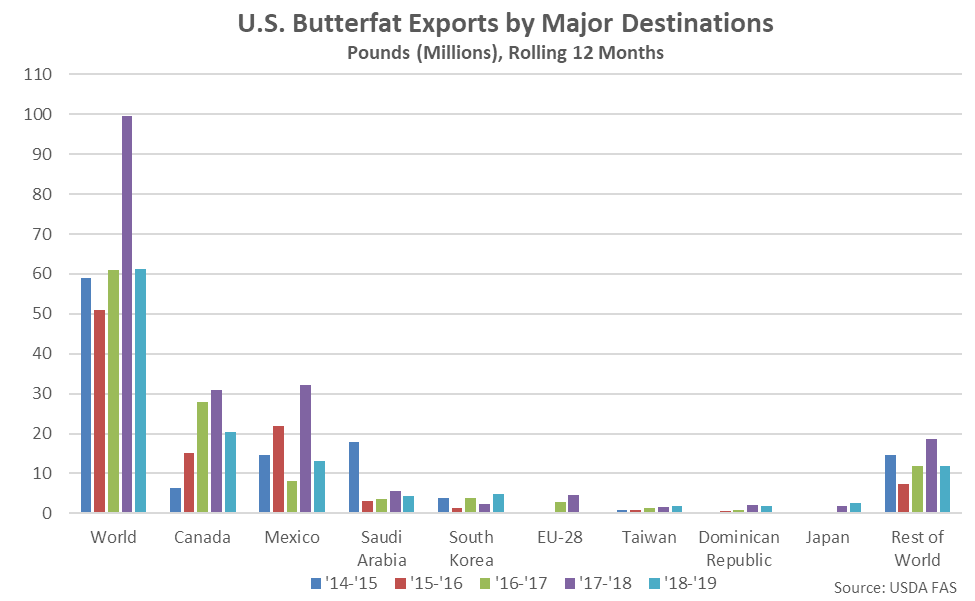

Canada and Mexico have historically been the largest importers of U.S. butterfat, accounting for over half of the total U.S. export volumes experienced throughout the past five years. U.S. butterfat export volumes destined to Canada and Mexico have declined by 33.5% and 59.3%, respectively, on a YOY basis throughout the past 12 months, compared to a 24.6% YOY decline in U.S. butterfat export volumes destined to all other countries.

Canada and Mexico have historically been the largest importers of U.S. butterfat, accounting for over half of the total U.S. export volumes experienced throughout the past five years. U.S. butterfat export volumes destined to Canada and Mexico have declined by 33.5% and 59.3%, respectively, on a YOY basis throughout the past 12 months, compared to a 24.6% YOY decline in U.S. butterfat export volumes destined to all other countries.

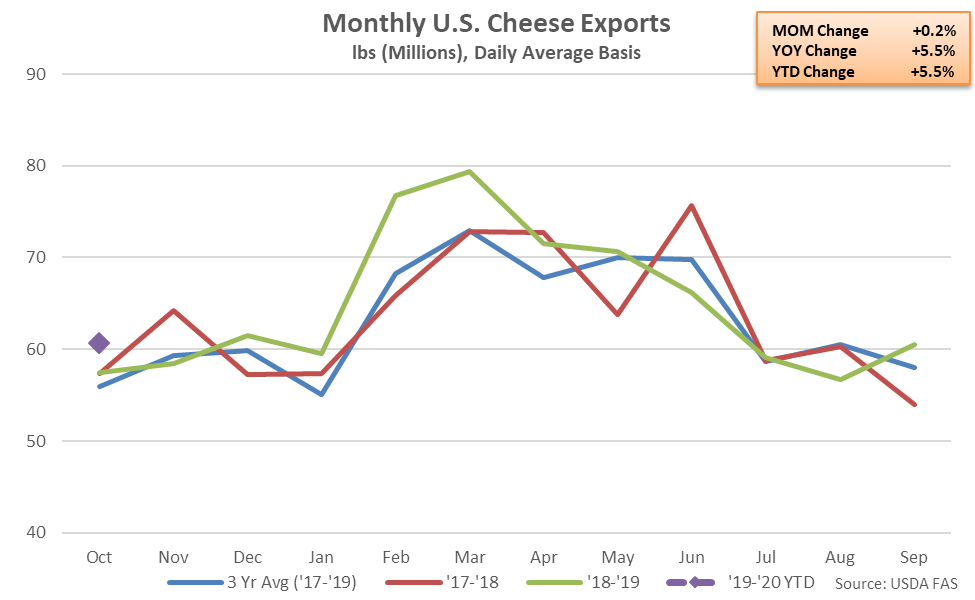

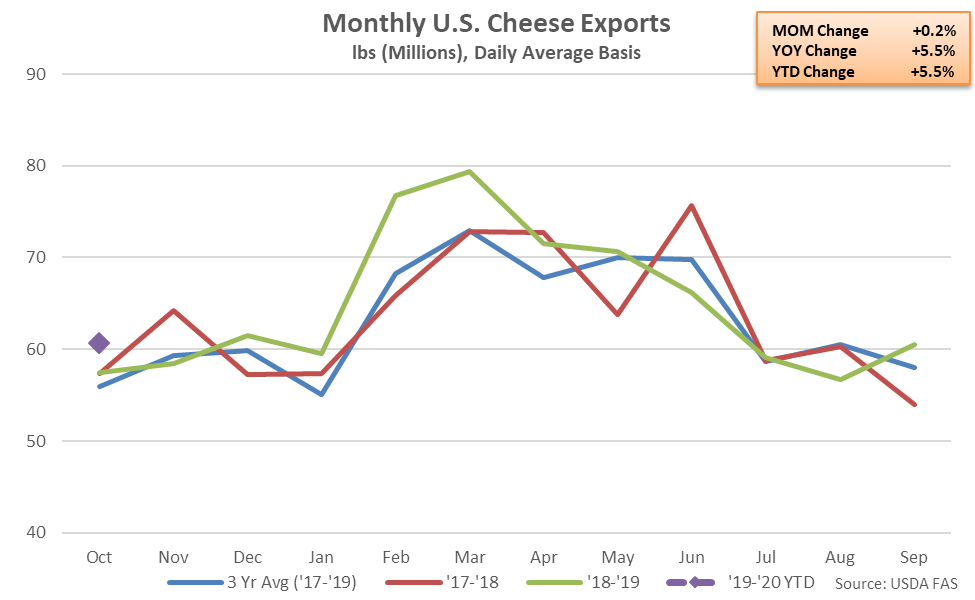

Cheese – Export Volumes Increase 5.5% YOY, Reach a Record High Seasonal Level

Oct ’19 U.S. cheese export volumes increased on a YOY basis for the third time in the past four months, finishing up 5.5% and reaching a record high annual level. Other-than-cheddar cheese export volumes increased 6.8% YOY throughout the month, more than offsetting a 5.6% YOY decline in cheddar cheese export volumes. ’18-’19 annual cheese export volumes increased 2.3% on a YOY basis, reaching a five year high level.

Cheese – Export Volumes Increase 5.5% YOY, Reach a Record High Seasonal Level

Oct ’19 U.S. cheese export volumes increased on a YOY basis for the third time in the past four months, finishing up 5.5% and reaching a record high annual level. Other-than-cheddar cheese export volumes increased 6.8% YOY throughout the month, more than offsetting a 5.6% YOY decline in cheddar cheese export volumes. ’18-’19 annual cheese export volumes increased 2.3% on a YOY basis, reaching a five year high level.

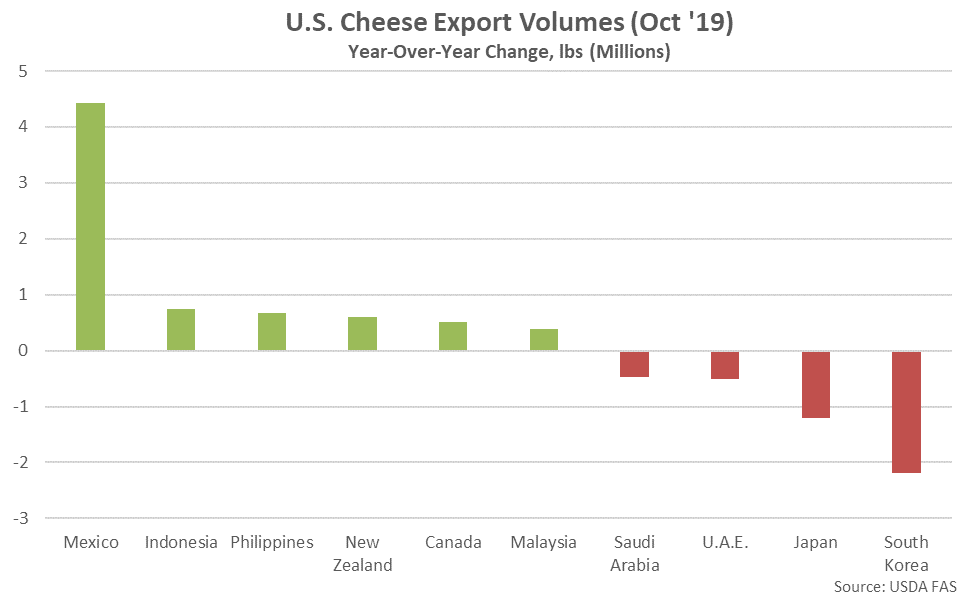

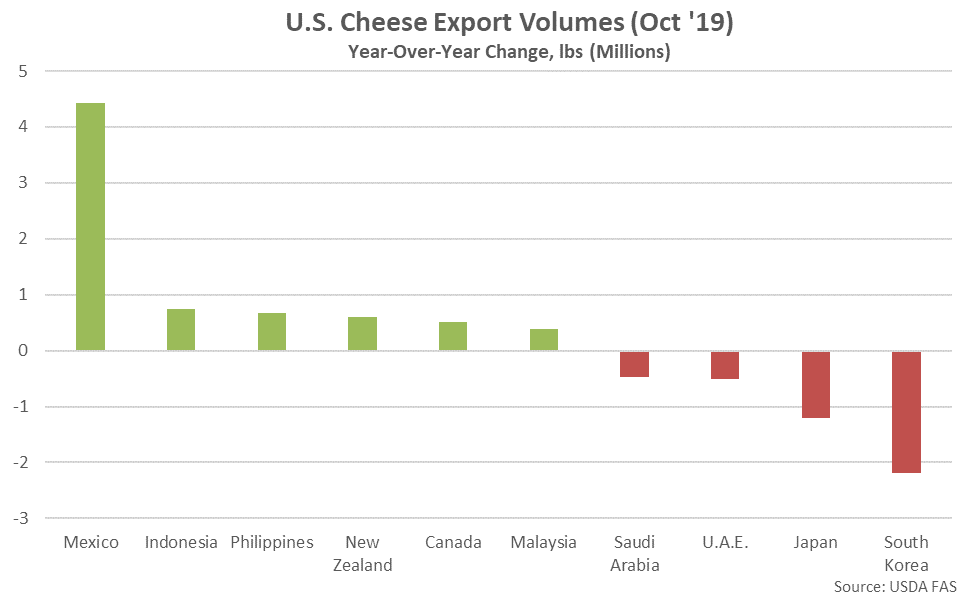

Oct ’19 YOY increases in cheese export volumes were led by product destined to Mexico, while volumes destined to South Korea finished most significantly lower on a YOY basis throughout the month.

Oct ’19 YOY increases in cheese export volumes were led by product destined to Mexico, while volumes destined to South Korea finished most significantly lower on a YOY basis throughout the month.

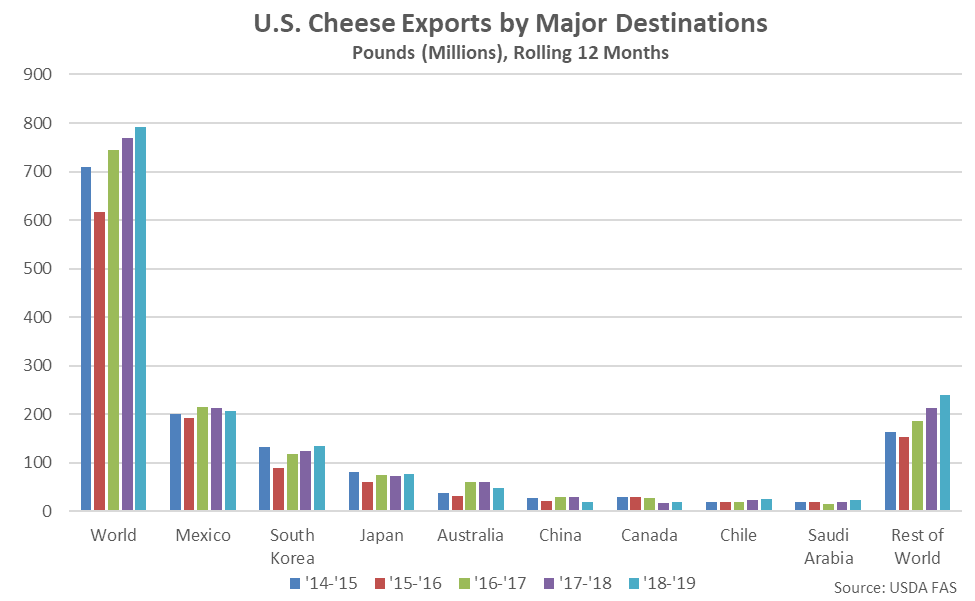

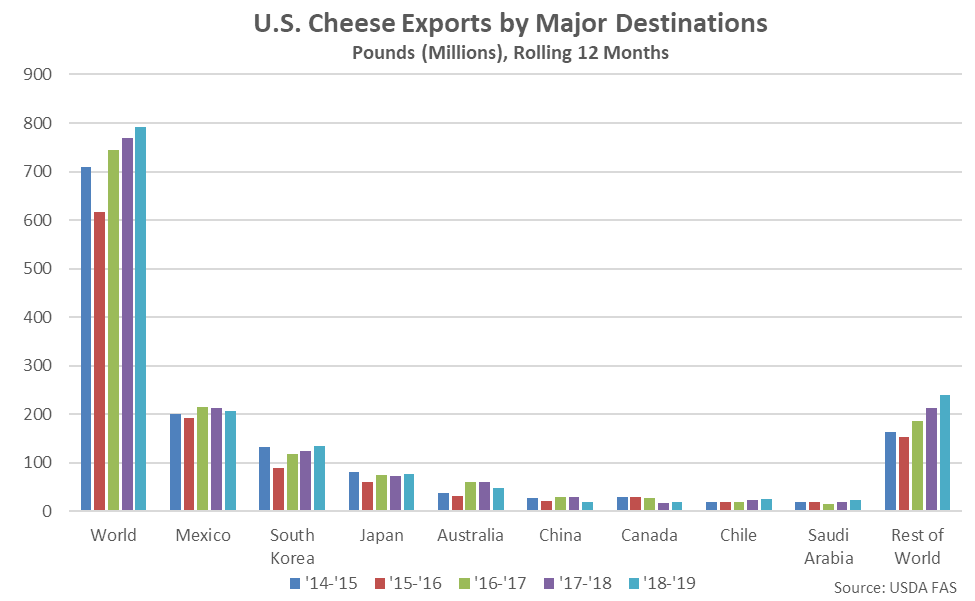

Mexico and South Korea have historically been the largest importers of U.S. cheese, accounting for 45% of total U.S. cheese export volumes throughout the past five years. Combined U.S. cheese export volumes destined to Mexico and South Korea have increased 1.3% on a YOY basis throughout the past 12 months.

Mexico and South Korea have historically been the largest importers of U.S. cheese, accounting for 45% of total U.S. cheese export volumes throughout the past five years. Combined U.S. cheese export volumes destined to Mexico and South Korea have increased 1.3% on a YOY basis throughout the past 12 months.

Whey – Dry Whey Export Volumes Remain Lower YOY, Whey Protein Concentrate Volumes Rebound

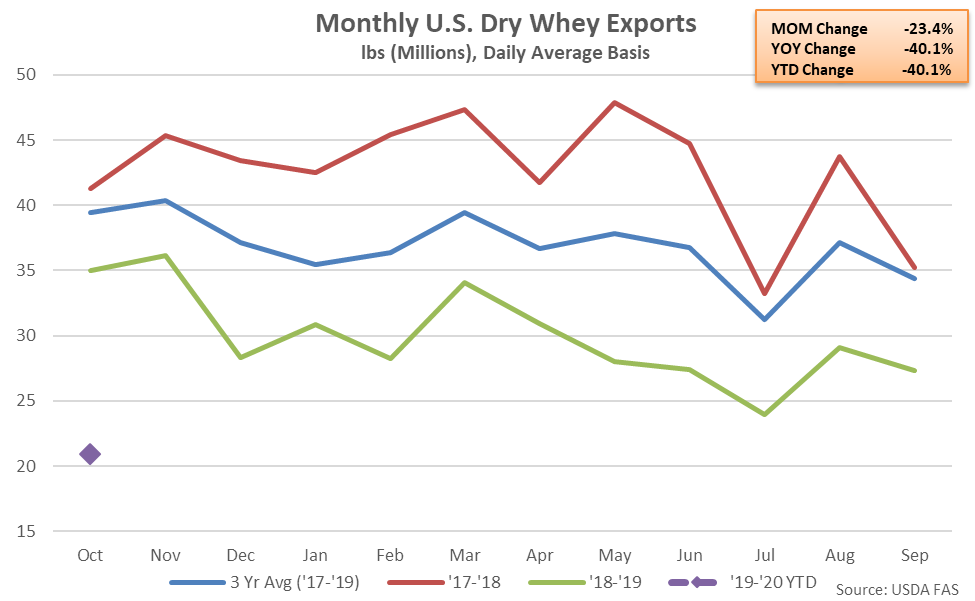

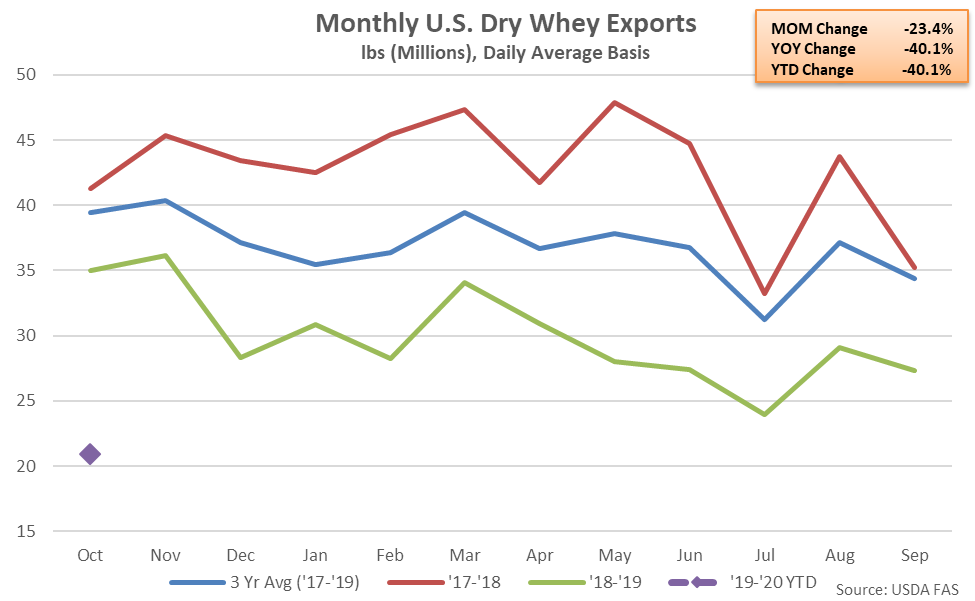

Oct ’19 U.S. dry whey export volumes remained lower on a YOY basis for the 14th consecutive month, declining by 40.1% and reaching a 17 year seasonal low level. ’18-’19 annual dry whey export volumes declined 29.8% from the four year high level experienced throughout the previous production season, finishing at a 15 year low level.

Whey – Dry Whey Export Volumes Remain Lower YOY, Whey Protein Concentrate Volumes Rebound

Oct ’19 U.S. dry whey export volumes remained lower on a YOY basis for the 14th consecutive month, declining by 40.1% and reaching a 17 year seasonal low level. ’18-’19 annual dry whey export volumes declined 29.8% from the four year high level experienced throughout the previous production season, finishing at a 15 year low level.

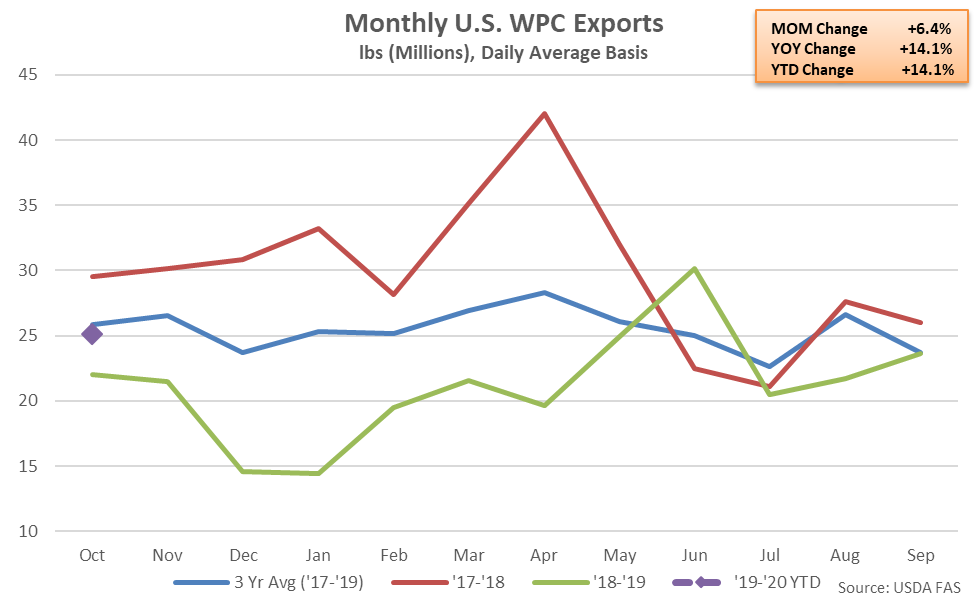

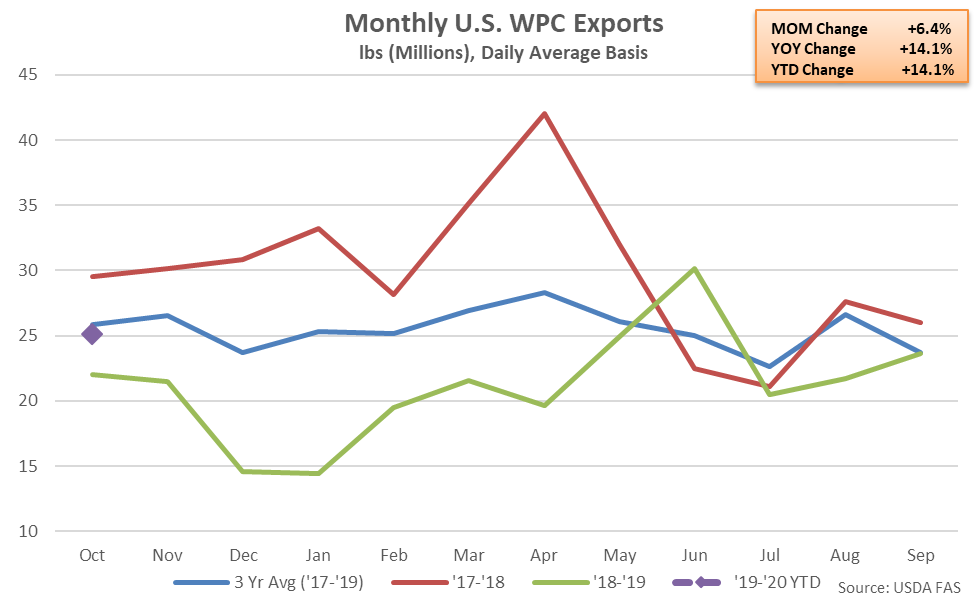

Oct ’19 whey protein concentrate (WPC) export volumes increased 14.1% on a YOY basis, finishing higher for just the second time in the past 13 months. ’18-’19 annual WPC export volumes declined 29.1% from the record high level experienced throughout the previous production season, finishing at a four year low level.

Oct ’19 whey protein concentrate (WPC) export volumes increased 14.1% on a YOY basis, finishing higher for just the second time in the past 13 months. ’18-’19 annual WPC export volumes declined 29.1% from the record high level experienced throughout the previous production season, finishing at a four year low level.

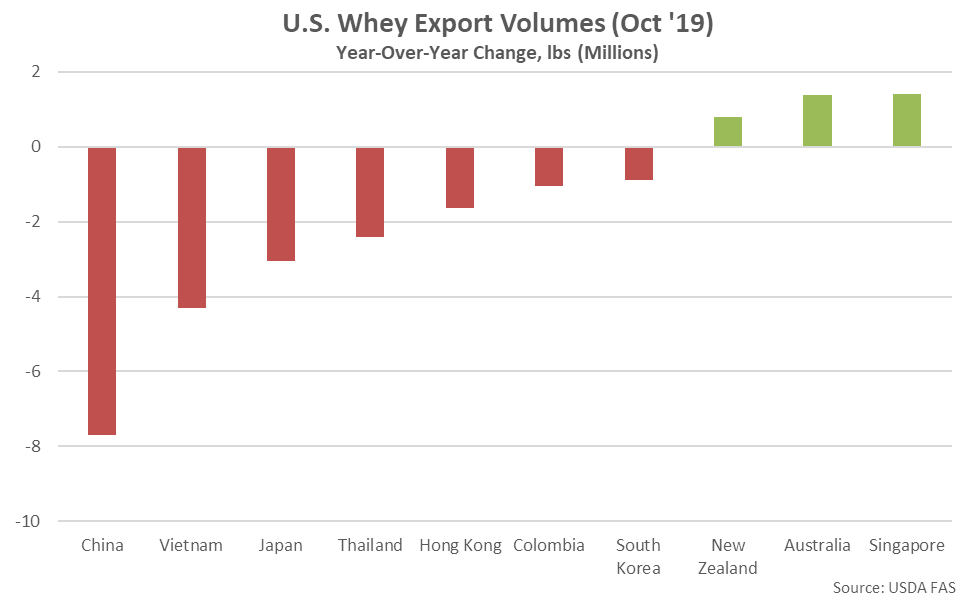

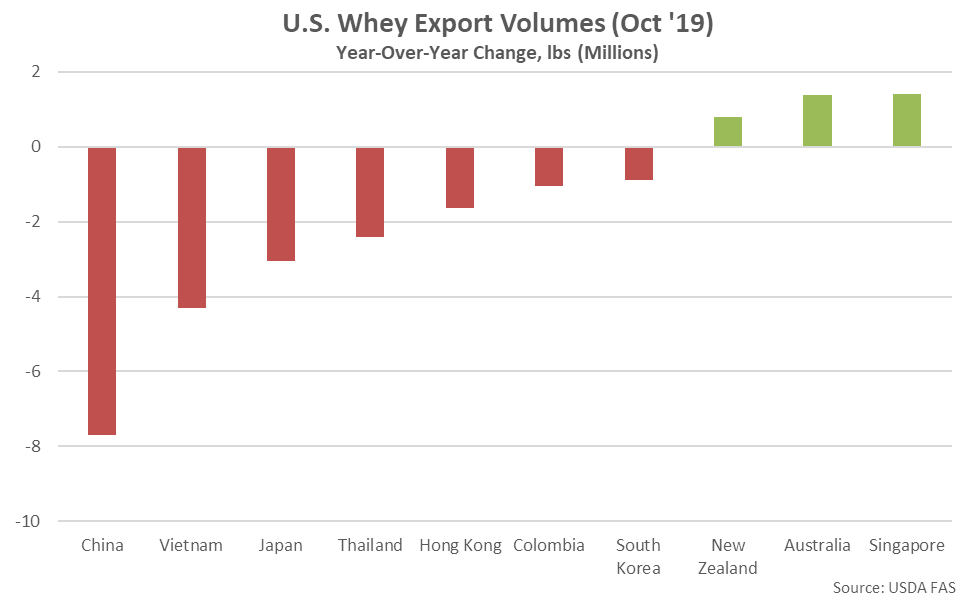

U.S. whey export volumes destined to China remained most significantly lower on a YOY basis throughout the month. China applied a 25% retaliatory tariff to a wide variety of U.S. dairy products including whey during early Jul ’18 while Chinese whey demand has also been reduced on weaker feed demand due to African swine fever. Oct ’19 U.S. whey export volumes destined to Vietnam, Japan and Thailand also declined significantly on a YOY basis throughout the month.

U.S. whey export volumes destined to China remained most significantly lower on a YOY basis throughout the month. China applied a 25% retaliatory tariff to a wide variety of U.S. dairy products including whey during early Jul ’18 while Chinese whey demand has also been reduced on weaker feed demand due to African swine fever. Oct ’19 U.S. whey export volumes destined to Vietnam, Japan and Thailand also declined significantly on a YOY basis throughout the month.

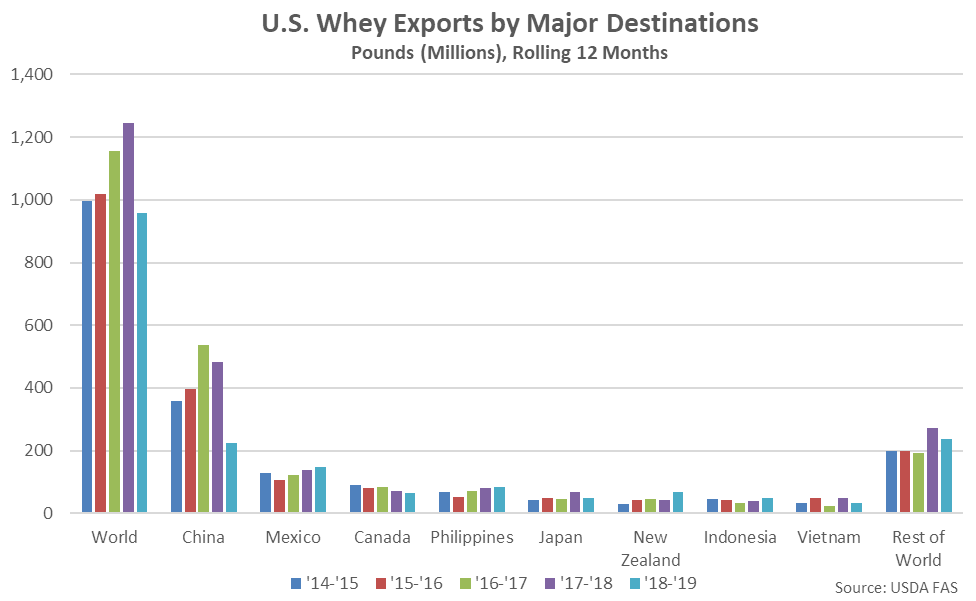

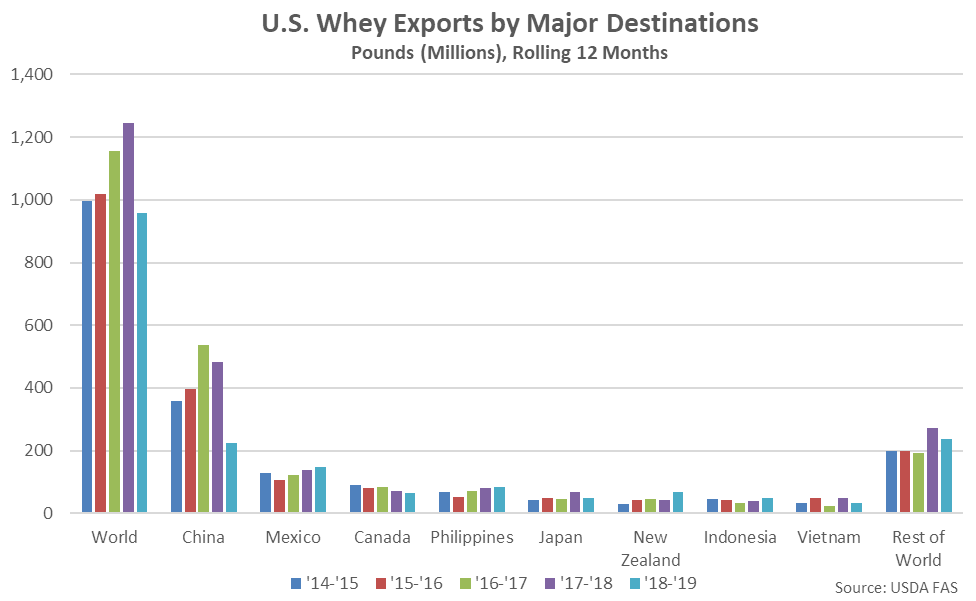

China has historically been the largest importer of U.S. whey products, accounting for over a third of the total U.S. whey export volumes throughout the past five years. U.S. whey export volumes destined to China have declined 53.2% YOY throughout the past 12 months, while whey export volume destined to all other countries have declined by just 3.8% on a YOY basis over the same period.

China has historically been the largest importer of U.S. whey products, accounting for over a third of the total U.S. whey export volumes throughout the past five years. U.S. whey export volumes destined to China have declined 53.2% YOY throughout the past 12 months, while whey export volume destined to all other countries have declined by just 3.8% on a YOY basis over the same period.

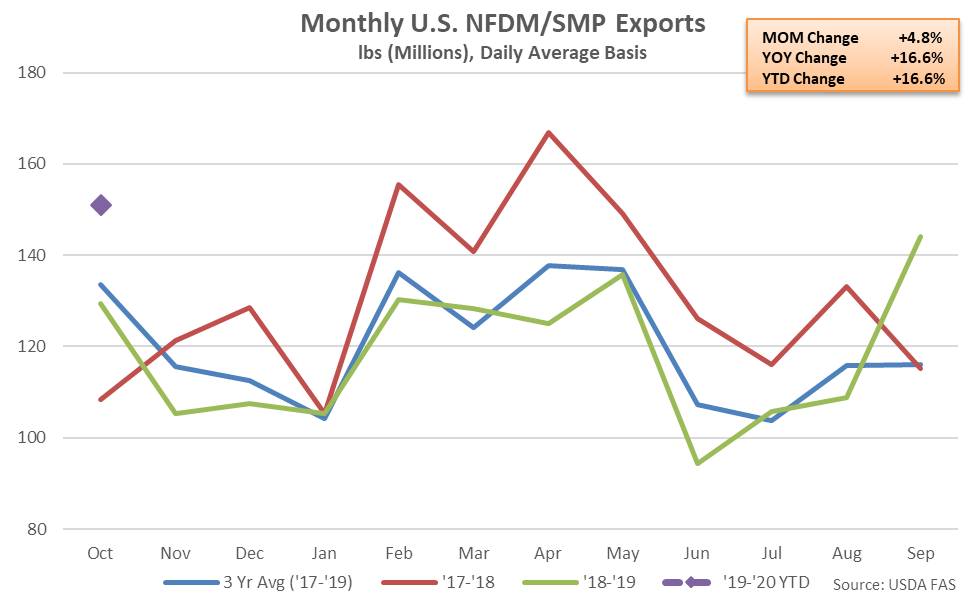

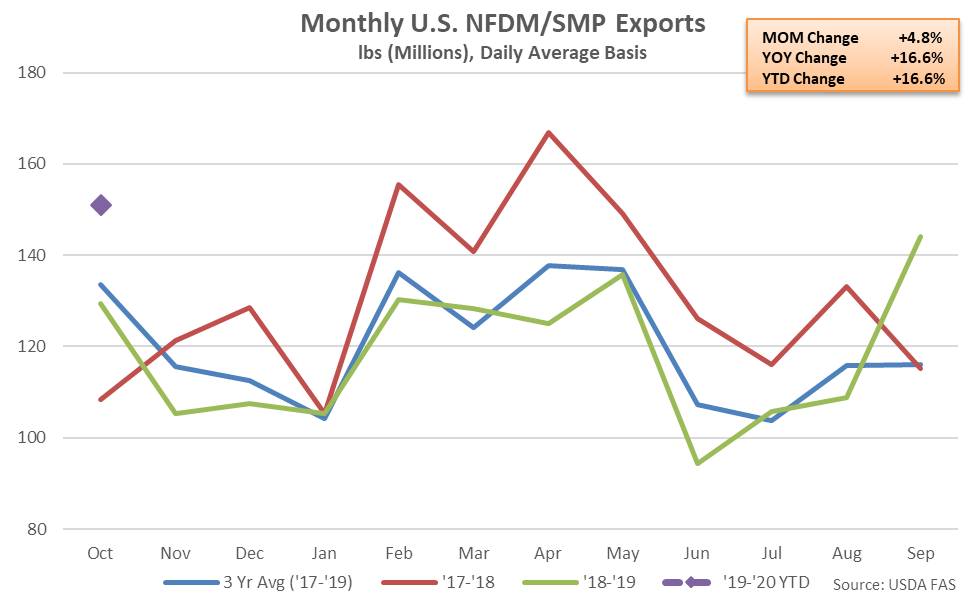

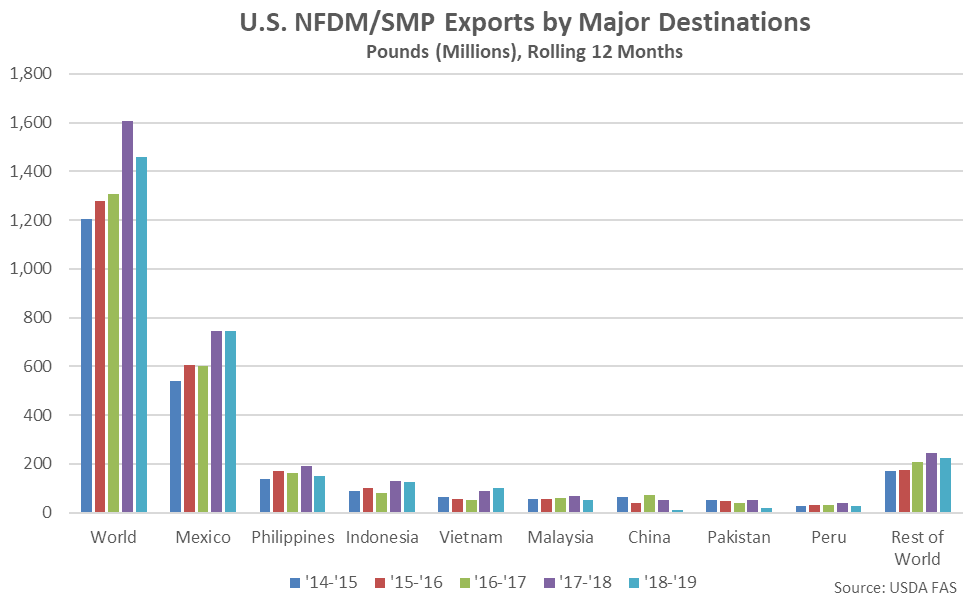

NFDM/SMP – Export Volumes Remain Higher YOY for the Second Consecutive Month, Finish up 16.6%

Oct ’19 U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) finished higher on a YOY basis for the second consecutive month, increasing 16.6% and reaching the second highest seasonal level on record. ’18-’19 annual NFDM/SMP exports declined 9.4% from the record high level experienced throughout the previous production season but remained at the second highest annual figure on record.

NFDM/SMP – Export Volumes Remain Higher YOY for the Second Consecutive Month, Finish up 16.6%

Oct ’19 U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) finished higher on a YOY basis for the second consecutive month, increasing 16.6% and reaching the second highest seasonal level on record. ’18-’19 annual NFDM/SMP exports declined 9.4% from the record high level experienced throughout the previous production season but remained at the second highest annual figure on record.

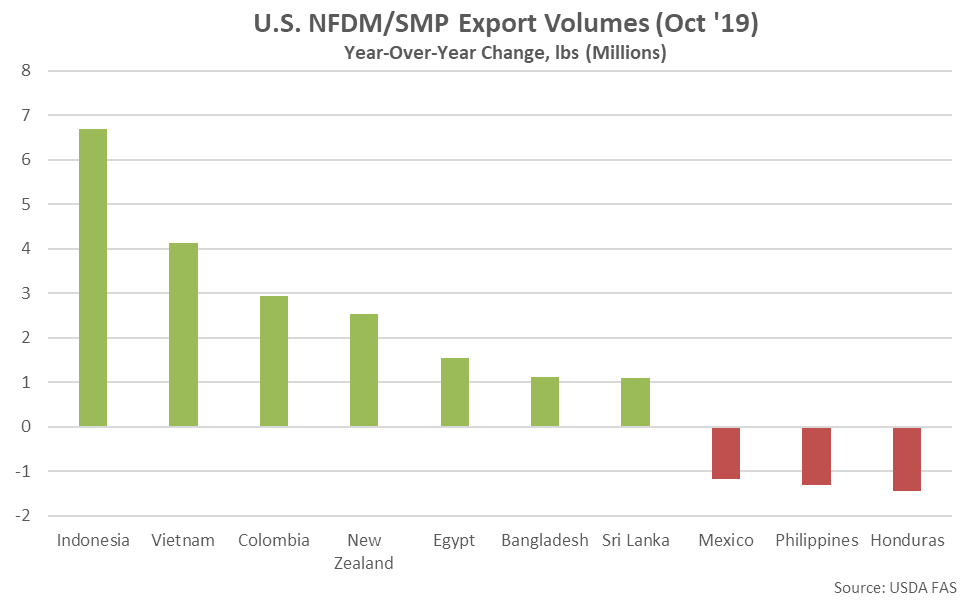

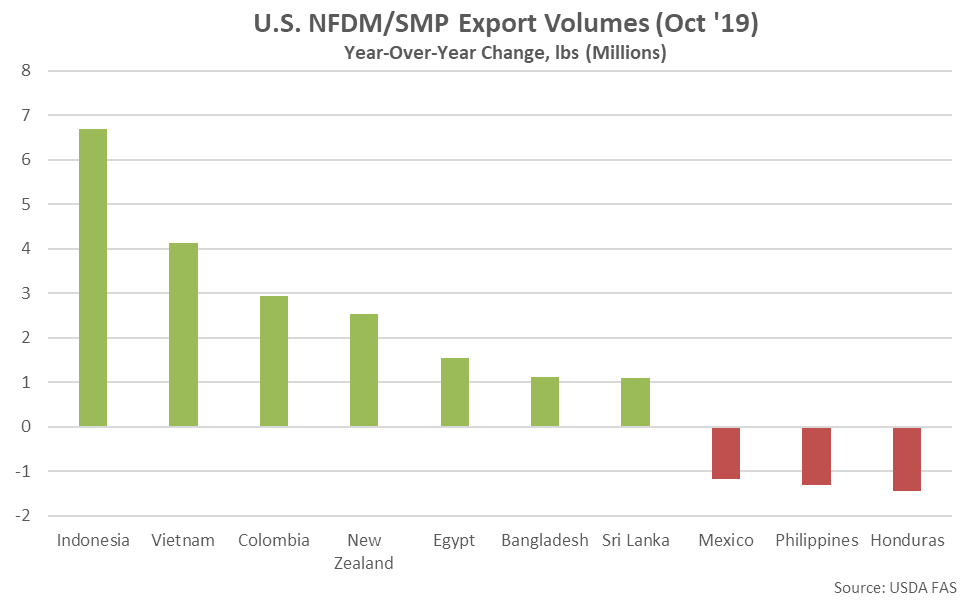

Oct ’19 YOY increases in NFDM/SMP export volumes were led by product destined to Indonesia, Vietnam and Columbia, while export volumes destined to Honduras, the Philippines and Mexico finished most significantly lower on a YOY basis throughout the month.

Oct ’19 YOY increases in NFDM/SMP export volumes were led by product destined to Indonesia, Vietnam and Columbia, while export volumes destined to Honduras, the Philippines and Mexico finished most significantly lower on a YOY basis throughout the month.

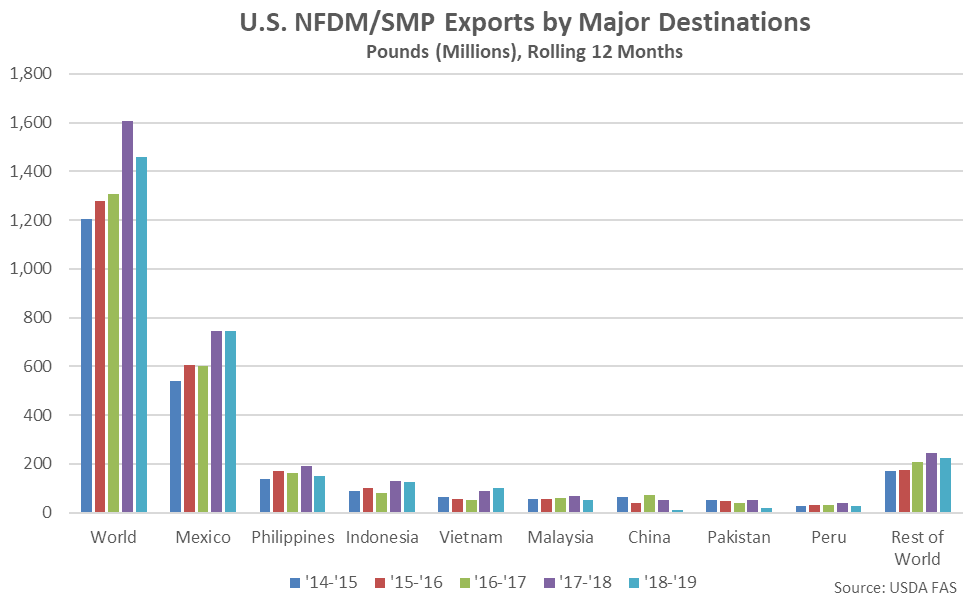

Mexico has historically been the largest importer of U.S. NFDM/SMP, accounting for nearly half of all U.S. NFDM/SMP export volumes throughout the past five years. U.S. NFDM/SMP export volumes destined to Mexico have increased 0.1% YOY throughout the past 12 months however export volumes destined to all other countries have declined by 17.1% on a YOY basis over the same period.

Mexico has historically been the largest importer of U.S. NFDM/SMP, accounting for nearly half of all U.S. NFDM/SMP export volumes throughout the past five years. U.S. NFDM/SMP export volumes destined to Mexico have increased 0.1% YOY throughout the past 12 months however export volumes destined to all other countries have declined by 17.1% on a YOY basis over the same period.

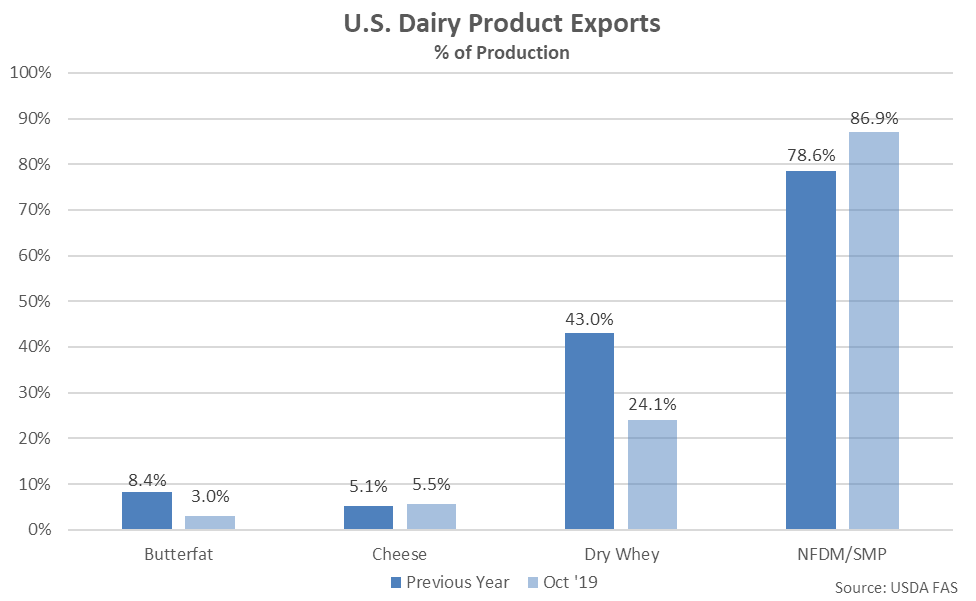

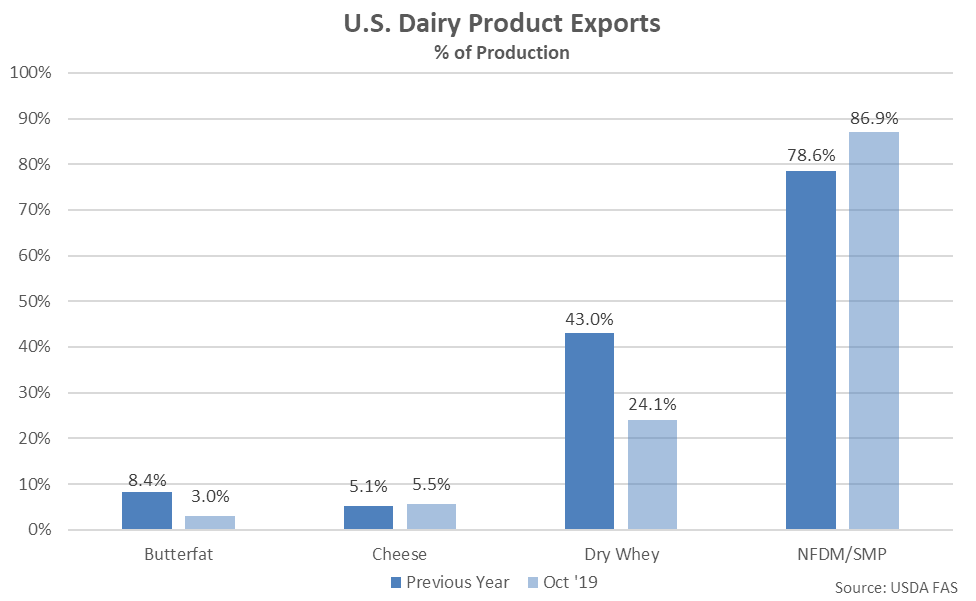

Export Volumes Normalized to Production

U.S. cheese and NFDM/SMP export volumes as a percentage of production finished above previous year figures during Oct ’19 however butterfat and dry whey export volumes as a percentage of production remained lower on a YOY basis.

Export Volumes Normalized to Production

U.S. cheese and NFDM/SMP export volumes as a percentage of production finished above previous year figures during Oct ’19 however butterfat and dry whey export volumes as a percentage of production remained lower on a YOY basis.

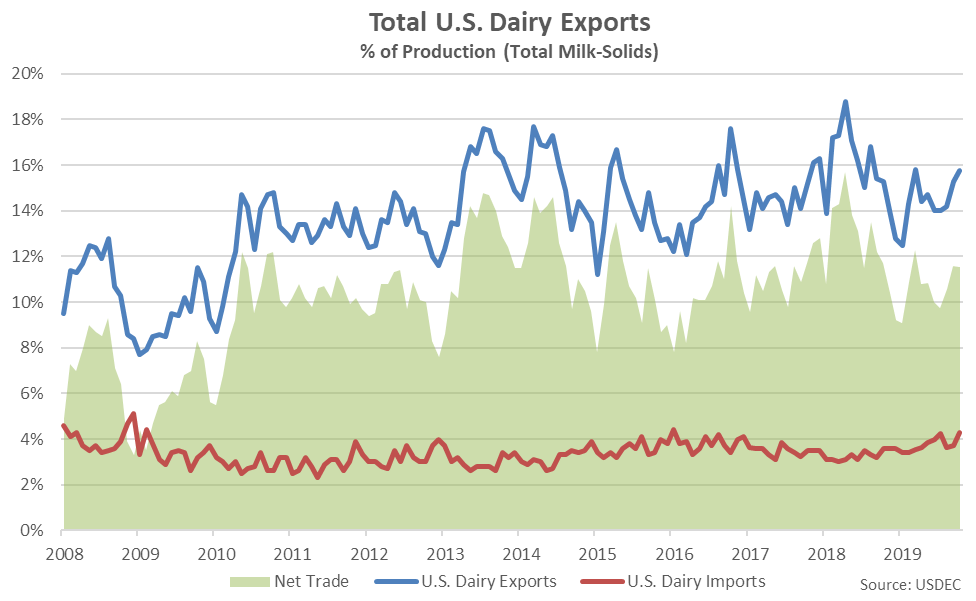

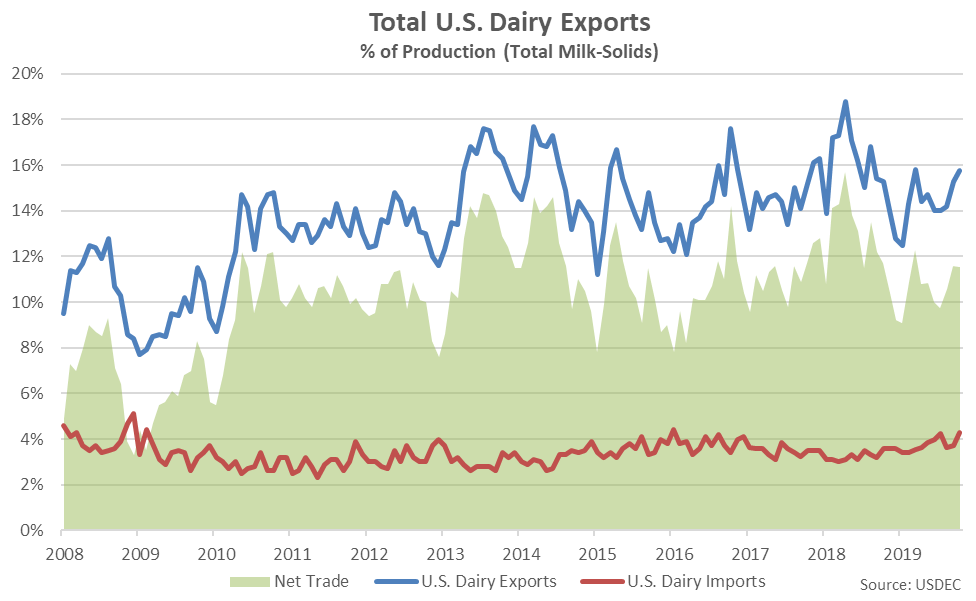

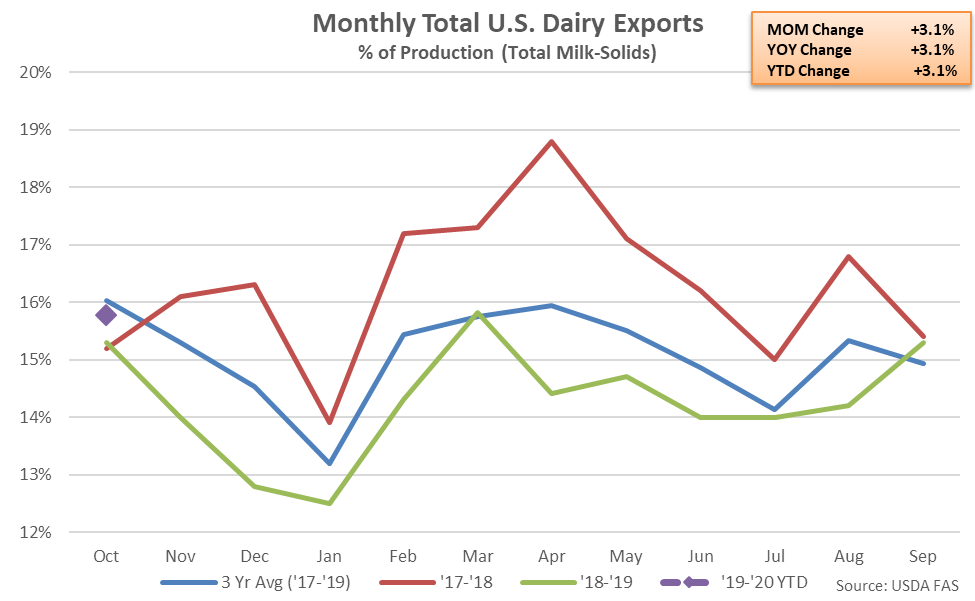

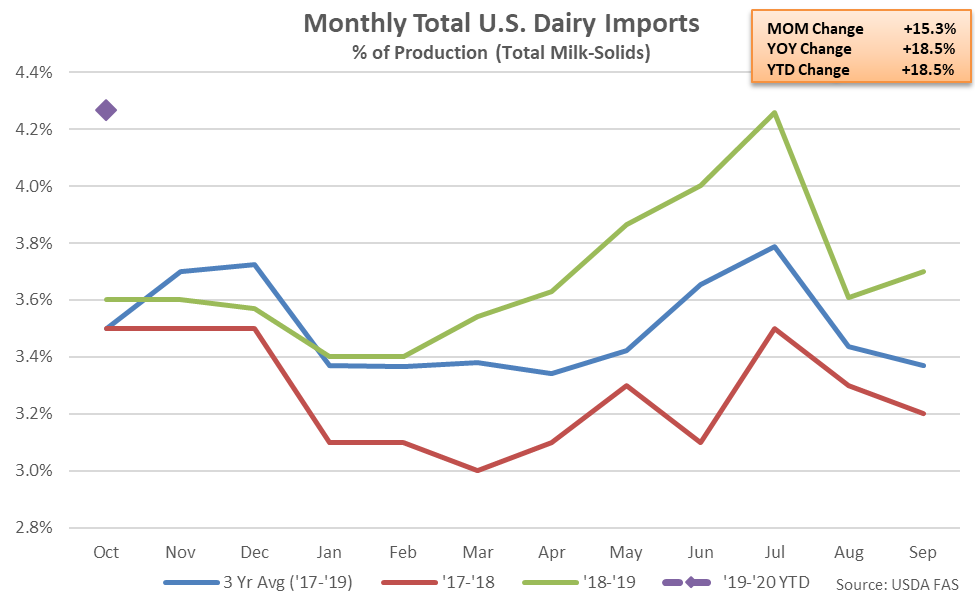

Overall, U.S. dairy export volumes were estimated to be equivalent to approximately 15.8% of total U.S. milk-solids production during Oct ’19 while dairy import volumes were estimated to be equivalent to approximately 4.3% of total U.S. milk-solids production. Oct ’19 net dairy trade was estimated to decline 1.6% on a YOY basis, finishing lower for the 12th consecutive month. The YOY decline in net dairy trade on a percentage of milk-solids production was the smallest experienced throughout the 12 month period, however.

Overall, U.S. dairy export volumes were estimated to be equivalent to approximately 15.8% of total U.S. milk-solids production during Oct ’19 while dairy import volumes were estimated to be equivalent to approximately 4.3% of total U.S. milk-solids production. Oct ’19 net dairy trade was estimated to decline 1.6% on a YOY basis, finishing lower for the 12th consecutive month. The YOY decline in net dairy trade on a percentage of milk-solids production was the smallest experienced throughout the 12 month period, however.

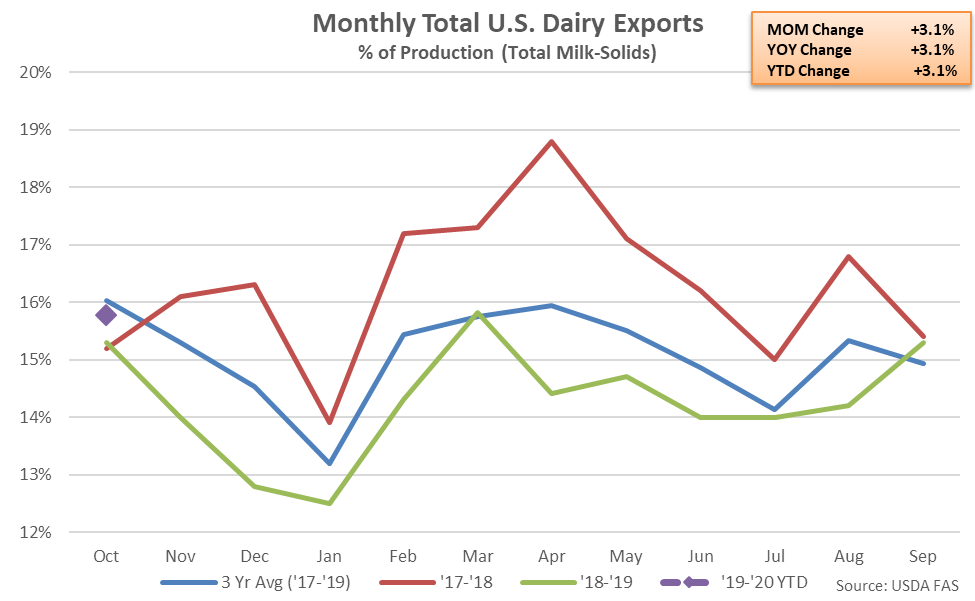

Oct ’19 U.S. dairy exports as a percentage of milk-solids production increased on a YOY basis for the first time in the past 12 months, finishing up 3.1%. ’18-’19 annual dairy exports as a percentage of milk-solids production declined 12.3% from the record high level experienced throughout the previous production season, finishing at a three year low.

Oct ’19 U.S. dairy exports as a percentage of milk-solids production increased on a YOY basis for the first time in the past 12 months, finishing up 3.1%. ’18-’19 annual dairy exports as a percentage of milk-solids production declined 12.3% from the record high level experienced throughout the previous production season, finishing at a three year low.

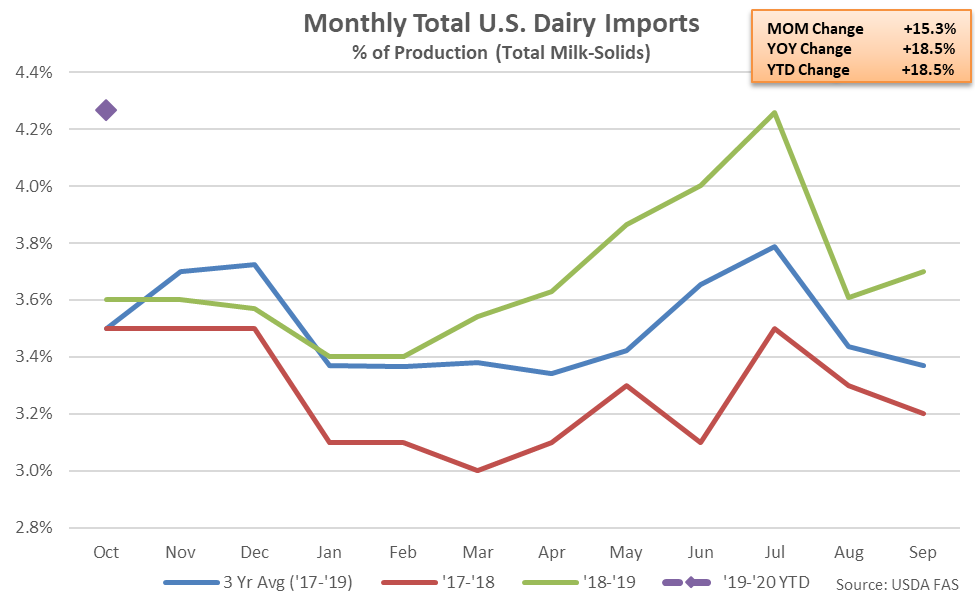

Oct ’19 U.S. dairy imports as a percentage of milk-solids production remained higher on a YOY basis for the 13th consecutive month, finishing up 18.5%. ’18-’19 annual dairy imports as a percentage of milk-solids production rebounded 12.4% from the four year low level experienced throughout the previous production season, reaching a three year high.

Oct ’19 U.S. dairy imports as a percentage of milk-solids production remained higher on a YOY basis for the 13th consecutive month, finishing up 18.5%. ’18-’19 annual dairy imports as a percentage of milk-solids production rebounded 12.4% from the four year low level experienced throughout the previous production season, reaching a three year high.

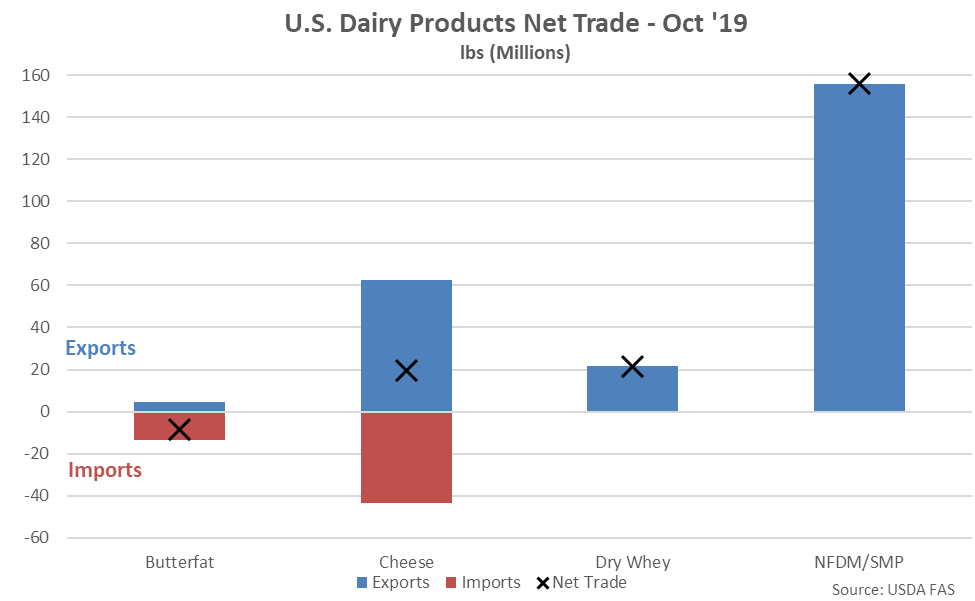

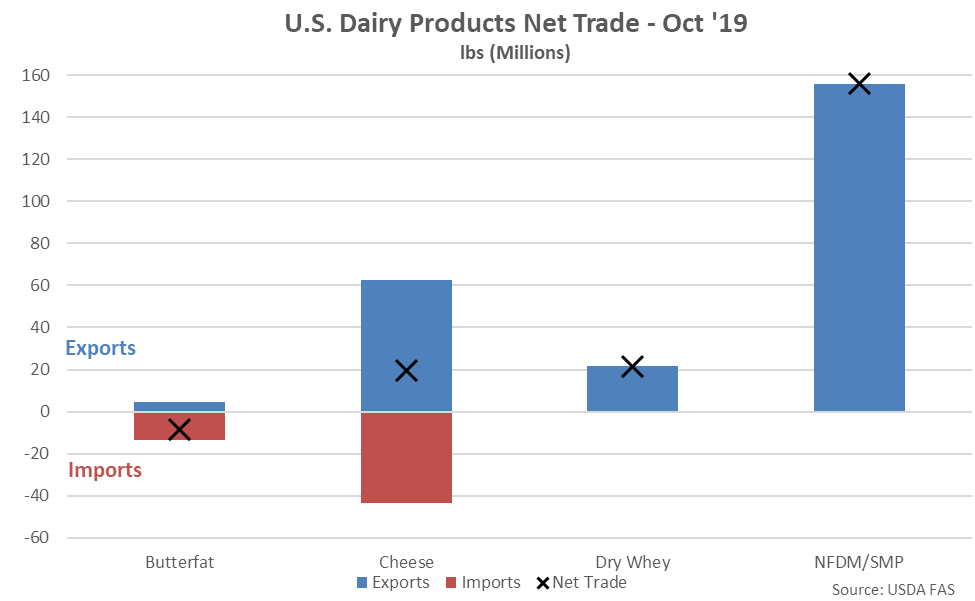

Net trade of U.S. NFDM/SMP continued to outpace that of butter, cheese and dry whey as import volumes remain minimal. Net dry whey trade volumes exceeded net cheese trade volumes for the third consecutive month during Oct ’19 while the U.S. finished as a net importer of butter for the 18th consecutive month.

Net trade of U.S. NFDM/SMP continued to outpace that of butter, cheese and dry whey as import volumes remain minimal. Net dry whey trade volumes exceeded net cheese trade volumes for the third consecutive month during Oct ’19 while the U.S. finished as a net importer of butter for the 18th consecutive month.

- Oct ’19 U.S. butterfat export volumes declined on a YOY basis for the eighth consecutive month, finishing down 62.4% to a four year seasonal low level, however Oct ’19 U.S. cheese export volumes increased 5.5% on a YOY basis throughout the month, reaching a record high seasonal level.

- Oct ’19 U.S. dry whey export volumes declined 40.1% on a YOY basis, reaching a 17 year seasonal low level, however whey protein concentrate export volumes increased 14.1% YOY, finishing higher for just the second time in the past 13 months. Oct ’19 U.S. nonfat dry milk/skim milk powder export volumes increased on a YOY basis for the second consecutive month, finishing up 16.6% and reaching the second highest seasonal level on record.

- Net dairy trade on a percentage of total U.S. milk-solids production basis declined YOY for the 12th consecutive month during Oct ’19, finishing down 1.6%. The YOY decline in net dairy trade on a percentage of milk-solids production was the smallest experienced throughout the 12 month period, however.

Butterfat export volumes destined to Mexico declined most significantly on a YOY basis throughout the month. Mexico accounted for nearly 80% of the total YOY decline in Oct ’19 U.S. butterfat export volumes.

Butterfat export volumes destined to Mexico declined most significantly on a YOY basis throughout the month. Mexico accounted for nearly 80% of the total YOY decline in Oct ’19 U.S. butterfat export volumes.

Canada and Mexico have historically been the largest importers of U.S. butterfat, accounting for over half of the total U.S. export volumes experienced throughout the past five years. U.S. butterfat export volumes destined to Canada and Mexico have declined by 33.5% and 59.3%, respectively, on a YOY basis throughout the past 12 months, compared to a 24.6% YOY decline in U.S. butterfat export volumes destined to all other countries.

Canada and Mexico have historically been the largest importers of U.S. butterfat, accounting for over half of the total U.S. export volumes experienced throughout the past five years. U.S. butterfat export volumes destined to Canada and Mexico have declined by 33.5% and 59.3%, respectively, on a YOY basis throughout the past 12 months, compared to a 24.6% YOY decline in U.S. butterfat export volumes destined to all other countries.

Cheese – Export Volumes Increase 5.5% YOY, Reach a Record High Seasonal Level

Oct ’19 U.S. cheese export volumes increased on a YOY basis for the third time in the past four months, finishing up 5.5% and reaching a record high annual level. Other-than-cheddar cheese export volumes increased 6.8% YOY throughout the month, more than offsetting a 5.6% YOY decline in cheddar cheese export volumes. ’18-’19 annual cheese export volumes increased 2.3% on a YOY basis, reaching a five year high level.

Cheese – Export Volumes Increase 5.5% YOY, Reach a Record High Seasonal Level

Oct ’19 U.S. cheese export volumes increased on a YOY basis for the third time in the past four months, finishing up 5.5% and reaching a record high annual level. Other-than-cheddar cheese export volumes increased 6.8% YOY throughout the month, more than offsetting a 5.6% YOY decline in cheddar cheese export volumes. ’18-’19 annual cheese export volumes increased 2.3% on a YOY basis, reaching a five year high level.

Oct ’19 YOY increases in cheese export volumes were led by product destined to Mexico, while volumes destined to South Korea finished most significantly lower on a YOY basis throughout the month.

Oct ’19 YOY increases in cheese export volumes were led by product destined to Mexico, while volumes destined to South Korea finished most significantly lower on a YOY basis throughout the month.

Mexico and South Korea have historically been the largest importers of U.S. cheese, accounting for 45% of total U.S. cheese export volumes throughout the past five years. Combined U.S. cheese export volumes destined to Mexico and South Korea have increased 1.3% on a YOY basis throughout the past 12 months.

Mexico and South Korea have historically been the largest importers of U.S. cheese, accounting for 45% of total U.S. cheese export volumes throughout the past five years. Combined U.S. cheese export volumes destined to Mexico and South Korea have increased 1.3% on a YOY basis throughout the past 12 months.

Whey – Dry Whey Export Volumes Remain Lower YOY, Whey Protein Concentrate Volumes Rebound

Oct ’19 U.S. dry whey export volumes remained lower on a YOY basis for the 14th consecutive month, declining by 40.1% and reaching a 17 year seasonal low level. ’18-’19 annual dry whey export volumes declined 29.8% from the four year high level experienced throughout the previous production season, finishing at a 15 year low level.

Whey – Dry Whey Export Volumes Remain Lower YOY, Whey Protein Concentrate Volumes Rebound

Oct ’19 U.S. dry whey export volumes remained lower on a YOY basis for the 14th consecutive month, declining by 40.1% and reaching a 17 year seasonal low level. ’18-’19 annual dry whey export volumes declined 29.8% from the four year high level experienced throughout the previous production season, finishing at a 15 year low level.

Oct ’19 whey protein concentrate (WPC) export volumes increased 14.1% on a YOY basis, finishing higher for just the second time in the past 13 months. ’18-’19 annual WPC export volumes declined 29.1% from the record high level experienced throughout the previous production season, finishing at a four year low level.

Oct ’19 whey protein concentrate (WPC) export volumes increased 14.1% on a YOY basis, finishing higher for just the second time in the past 13 months. ’18-’19 annual WPC export volumes declined 29.1% from the record high level experienced throughout the previous production season, finishing at a four year low level.

U.S. whey export volumes destined to China remained most significantly lower on a YOY basis throughout the month. China applied a 25% retaliatory tariff to a wide variety of U.S. dairy products including whey during early Jul ’18 while Chinese whey demand has also been reduced on weaker feed demand due to African swine fever. Oct ’19 U.S. whey export volumes destined to Vietnam, Japan and Thailand also declined significantly on a YOY basis throughout the month.

U.S. whey export volumes destined to China remained most significantly lower on a YOY basis throughout the month. China applied a 25% retaliatory tariff to a wide variety of U.S. dairy products including whey during early Jul ’18 while Chinese whey demand has also been reduced on weaker feed demand due to African swine fever. Oct ’19 U.S. whey export volumes destined to Vietnam, Japan and Thailand also declined significantly on a YOY basis throughout the month.

China has historically been the largest importer of U.S. whey products, accounting for over a third of the total U.S. whey export volumes throughout the past five years. U.S. whey export volumes destined to China have declined 53.2% YOY throughout the past 12 months, while whey export volume destined to all other countries have declined by just 3.8% on a YOY basis over the same period.

China has historically been the largest importer of U.S. whey products, accounting for over a third of the total U.S. whey export volumes throughout the past five years. U.S. whey export volumes destined to China have declined 53.2% YOY throughout the past 12 months, while whey export volume destined to all other countries have declined by just 3.8% on a YOY basis over the same period.

NFDM/SMP – Export Volumes Remain Higher YOY for the Second Consecutive Month, Finish up 16.6%

Oct ’19 U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) finished higher on a YOY basis for the second consecutive month, increasing 16.6% and reaching the second highest seasonal level on record. ’18-’19 annual NFDM/SMP exports declined 9.4% from the record high level experienced throughout the previous production season but remained at the second highest annual figure on record.

NFDM/SMP – Export Volumes Remain Higher YOY for the Second Consecutive Month, Finish up 16.6%

Oct ’19 U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) finished higher on a YOY basis for the second consecutive month, increasing 16.6% and reaching the second highest seasonal level on record. ’18-’19 annual NFDM/SMP exports declined 9.4% from the record high level experienced throughout the previous production season but remained at the second highest annual figure on record.

Oct ’19 YOY increases in NFDM/SMP export volumes were led by product destined to Indonesia, Vietnam and Columbia, while export volumes destined to Honduras, the Philippines and Mexico finished most significantly lower on a YOY basis throughout the month.

Oct ’19 YOY increases in NFDM/SMP export volumes were led by product destined to Indonesia, Vietnam and Columbia, while export volumes destined to Honduras, the Philippines and Mexico finished most significantly lower on a YOY basis throughout the month.

Mexico has historically been the largest importer of U.S. NFDM/SMP, accounting for nearly half of all U.S. NFDM/SMP export volumes throughout the past five years. U.S. NFDM/SMP export volumes destined to Mexico have increased 0.1% YOY throughout the past 12 months however export volumes destined to all other countries have declined by 17.1% on a YOY basis over the same period.

Mexico has historically been the largest importer of U.S. NFDM/SMP, accounting for nearly half of all U.S. NFDM/SMP export volumes throughout the past five years. U.S. NFDM/SMP export volumes destined to Mexico have increased 0.1% YOY throughout the past 12 months however export volumes destined to all other countries have declined by 17.1% on a YOY basis over the same period.

Export Volumes Normalized to Production

U.S. cheese and NFDM/SMP export volumes as a percentage of production finished above previous year figures during Oct ’19 however butterfat and dry whey export volumes as a percentage of production remained lower on a YOY basis.

Export Volumes Normalized to Production

U.S. cheese and NFDM/SMP export volumes as a percentage of production finished above previous year figures during Oct ’19 however butterfat and dry whey export volumes as a percentage of production remained lower on a YOY basis.

Overall, U.S. dairy export volumes were estimated to be equivalent to approximately 15.8% of total U.S. milk-solids production during Oct ’19 while dairy import volumes were estimated to be equivalent to approximately 4.3% of total U.S. milk-solids production. Oct ’19 net dairy trade was estimated to decline 1.6% on a YOY basis, finishing lower for the 12th consecutive month. The YOY decline in net dairy trade on a percentage of milk-solids production was the smallest experienced throughout the 12 month period, however.

Overall, U.S. dairy export volumes were estimated to be equivalent to approximately 15.8% of total U.S. milk-solids production during Oct ’19 while dairy import volumes were estimated to be equivalent to approximately 4.3% of total U.S. milk-solids production. Oct ’19 net dairy trade was estimated to decline 1.6% on a YOY basis, finishing lower for the 12th consecutive month. The YOY decline in net dairy trade on a percentage of milk-solids production was the smallest experienced throughout the 12 month period, however.

Oct ’19 U.S. dairy exports as a percentage of milk-solids production increased on a YOY basis for the first time in the past 12 months, finishing up 3.1%. ’18-’19 annual dairy exports as a percentage of milk-solids production declined 12.3% from the record high level experienced throughout the previous production season, finishing at a three year low.

Oct ’19 U.S. dairy exports as a percentage of milk-solids production increased on a YOY basis for the first time in the past 12 months, finishing up 3.1%. ’18-’19 annual dairy exports as a percentage of milk-solids production declined 12.3% from the record high level experienced throughout the previous production season, finishing at a three year low.

Oct ’19 U.S. dairy imports as a percentage of milk-solids production remained higher on a YOY basis for the 13th consecutive month, finishing up 18.5%. ’18-’19 annual dairy imports as a percentage of milk-solids production rebounded 12.4% from the four year low level experienced throughout the previous production season, reaching a three year high.

Oct ’19 U.S. dairy imports as a percentage of milk-solids production remained higher on a YOY basis for the 13th consecutive month, finishing up 18.5%. ’18-’19 annual dairy imports as a percentage of milk-solids production rebounded 12.4% from the four year low level experienced throughout the previous production season, reaching a three year high.

Net trade of U.S. NFDM/SMP continued to outpace that of butter, cheese and dry whey as import volumes remain minimal. Net dry whey trade volumes exceeded net cheese trade volumes for the third consecutive month during Oct ’19 while the U.S. finished as a net importer of butter for the 18th consecutive month.

Net trade of U.S. NFDM/SMP continued to outpace that of butter, cheese and dry whey as import volumes remain minimal. Net dry whey trade volumes exceeded net cheese trade volumes for the third consecutive month during Oct ’19 while the U.S. finished as a net importer of butter for the 18th consecutive month.