Grain & Oilseeds WASDE Update – Jun ’21

Corn – U.S. and Global Ending Stocks Mixed vs. Private Estimates

- ’21-’22 U.S. ending stocks of 1.357 billion bushels below expectations

- ’21-’22 global ending stocks of 289.4 million MT slightly above expectations

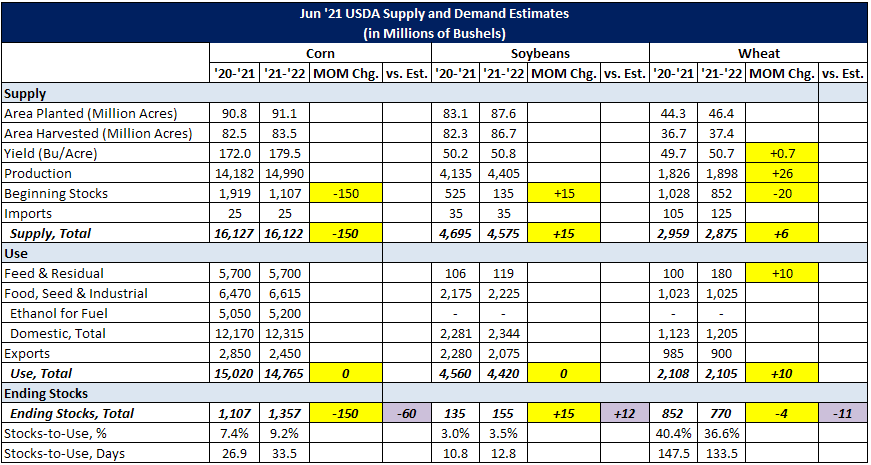

The ’21-’22 U.S. corn supply projection was reduced on a reduction in beginning stocks while the usage projection was unchanged from the previous month. ’21-’22 projected U.S. corn ending stocks of 1.357 billion bushels, or 33.5 days of use, finished 10.0% below the previous month and 4.2% below expectations. The ’21-’22 global corn ending stock projection finished 0.3% above expectations, despite the lower than anticipated domestic stocks, as South African beginning stocks were raised from the previous month.

Soybeans – U.S. and Global Ending Stocks Above Private Estimates

- ’21-’22 U.S. ending stocks of 155 million bushels significantly above expectations

- ’21-’22 global ending stocks of 92.6 million MT above expectations

The ’21-’22 U.S. soybean supply projection was raised on an increase in beginning stocks while the usage projection was unchanged from the previous month. ’21-’22 projected U.S. soybean ending stocks of 155 million bushels, or 12.8 days of use, finished 10.7% above the previous month and 8.4% above expectations. The ’21-’22 global soybean ending stock projection finished 1.6% above expectations, primarily on an increase in Brazilian beginning stocks.

Soybean Complex – U.S. Oil Stocks Reduced Slightly, Meal Stocks Unchanged

The ’21-’22 U.S. soybean oil ending stock projection was reduced slightly from the previous production season on a reduction in beginning stocks while the ’21-’22 U.S. soybean meal ending stock projection was unchanged from the previous month.

Globally, ’21-’22 soybean oil ending stocks were raised slightly from the previous month, primarily on an increase in Chinese beginning stocks, while ’21-’22 global soybean meal ending stocks were largely unchanged from the previous month.

Wheat – U.S. and Global Ending Stocks Mixed vs. Private Estimates

- ’21-’22 U.S. ending stocks of 770 million bushels slightly below expectations

- ’21-’22 global ending stocks of 296.8 million MT slightly above expectations

The ’21-’22 U.S. wheat supply projection was raised slightly as an increase in yields more than more than offset a reduction in beginning stocks while the demand projection was raised slightly on an increase in feed & residual usage. ’21-’22 projected U.S. wheat ending stocks of 770 million bushels, or 135.5 days of use, finished 0.5% below the previous month and 1.4% below expectations. The ’21-’22 global wheat ending stock projection finished 0.7% above expectations, primarily on an increase in European Union production.

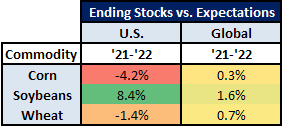

Ending Stocks vs. Expectations Summary

Overall, ’21-’22 projected domestic soybean ending stocks finished most significantly above expectations, followed by global soybean ending stocks, global wheat ending stocks and global corn ending stocks. Domestic corn ending stocks and domestic wheat ending stocks each finished below expectations.