Soybean Complex Crushing & Stocks Update – Jun ’20

Executive Summary

U.S. soybean crush and stocks figures provided by the USDA were recently updated with values spanning through Apr ’20. Highlights from the updated report include:

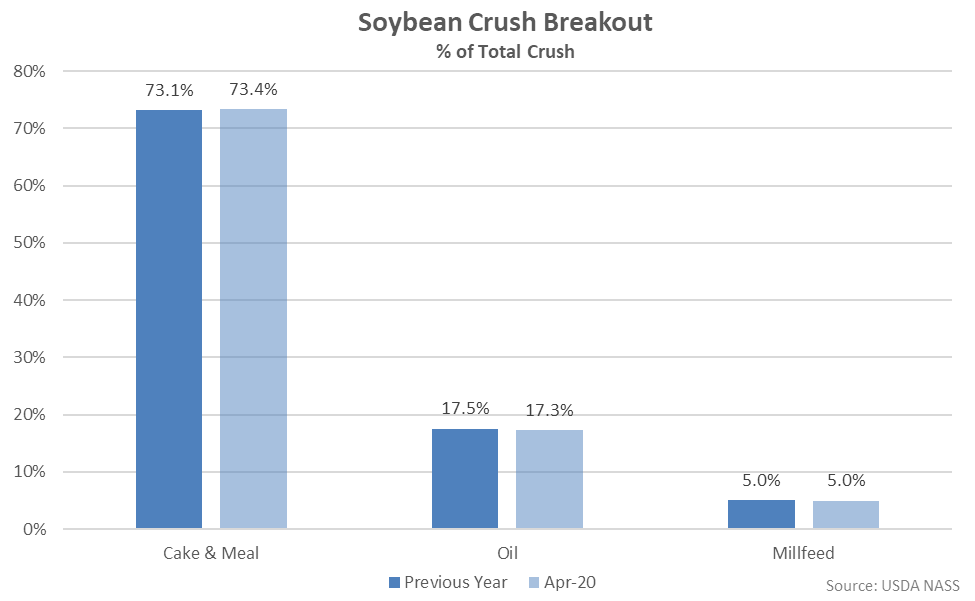

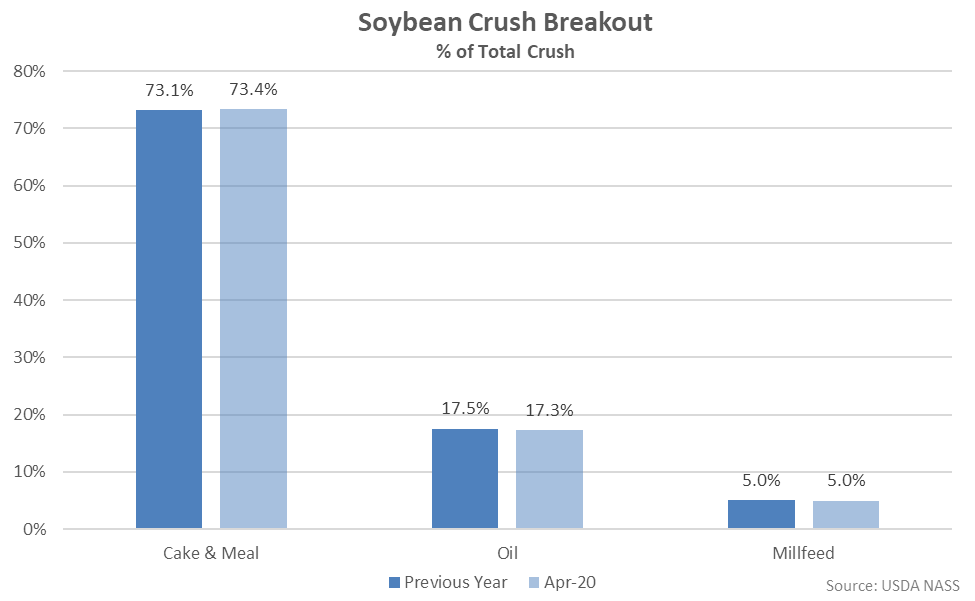

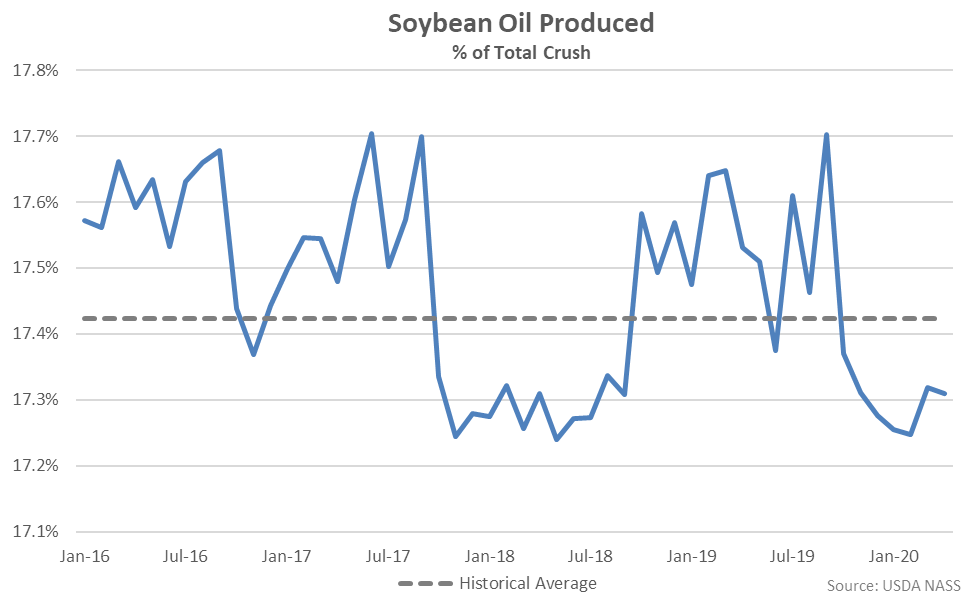

Cake & meal accounted for 73.4% of the total soybean crush throughout Apr ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.4% of the total soybean crush throughout Apr ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

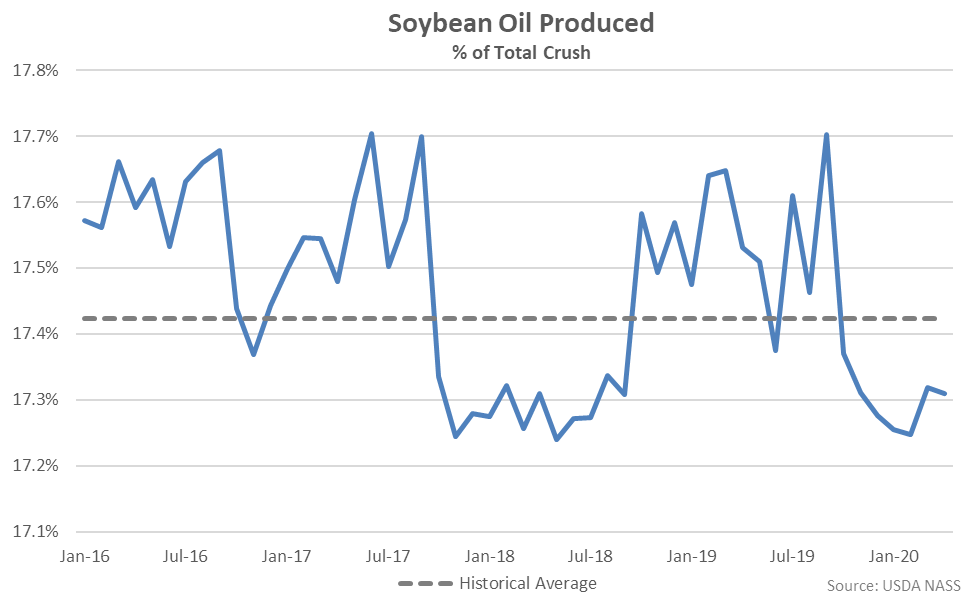

Apr ’20 soybean oil produced as a percentage of total crush remained above recently experienced 21 month low levels but finished below historical average figures for the seventh consecutive month.

Apr ’20 soybean oil produced as a percentage of total crush remained above recently experienced 21 month low levels but finished below historical average figures for the seventh consecutive month.

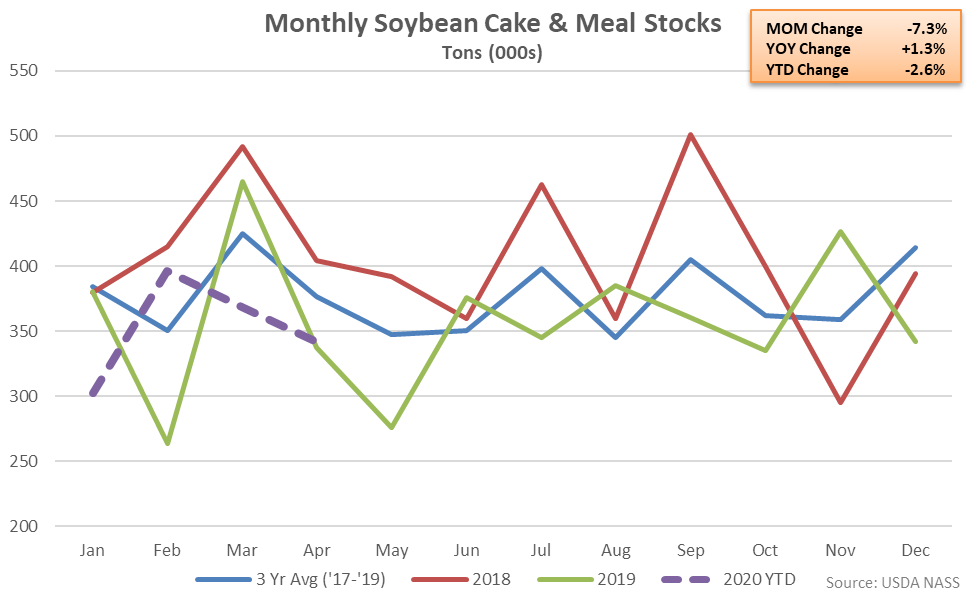

Soybean Cake & Meal Stocks – Stocks Finish 1.3% Higher YOY

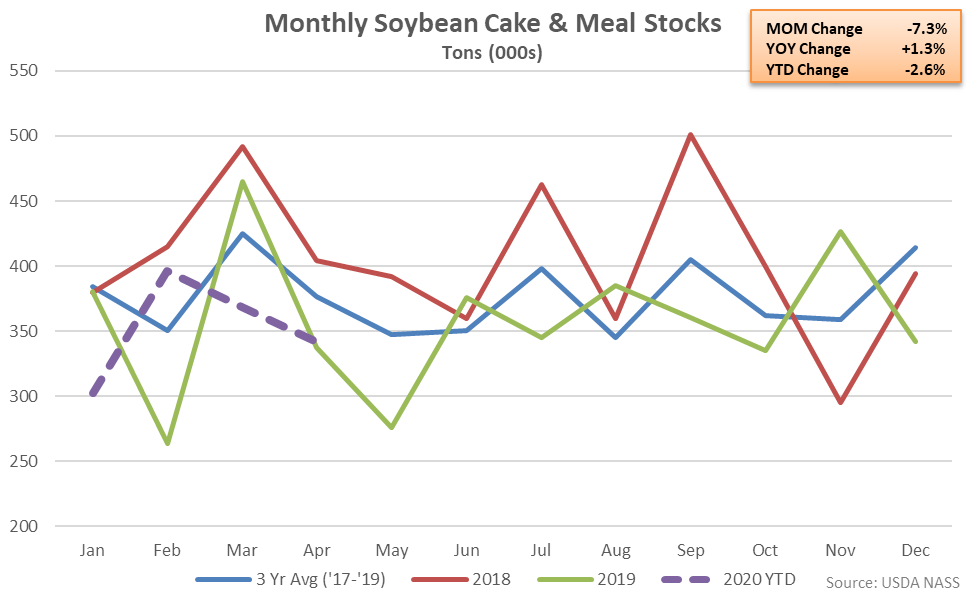

Apr ’20 U.S. soybean cake & meal stocks declined 7.3% MOM but finished 1.3% higher on a YOY basis, increasing on a YOY basis for the second time in the past three months. The month-over-month decline in soybean cake & meal stocks of 7.3% was largely consistent with the three year March – April average seasonal decline in stocks of 7.9%. Apr ’20 soybean cake & meal stocks finished 9.2% below three year average seasonal levels, however, finishing lower for the fourth time in the past five months.

Soybean Cake & Meal Stocks – Stocks Finish 1.3% Higher YOY

Apr ’20 U.S. soybean cake & meal stocks declined 7.3% MOM but finished 1.3% higher on a YOY basis, increasing on a YOY basis for the second time in the past three months. The month-over-month decline in soybean cake & meal stocks of 7.3% was largely consistent with the three year March – April average seasonal decline in stocks of 7.9%. Apr ’20 soybean cake & meal stocks finished 9.2% below three year average seasonal levels, however, finishing lower for the fourth time in the past five months.

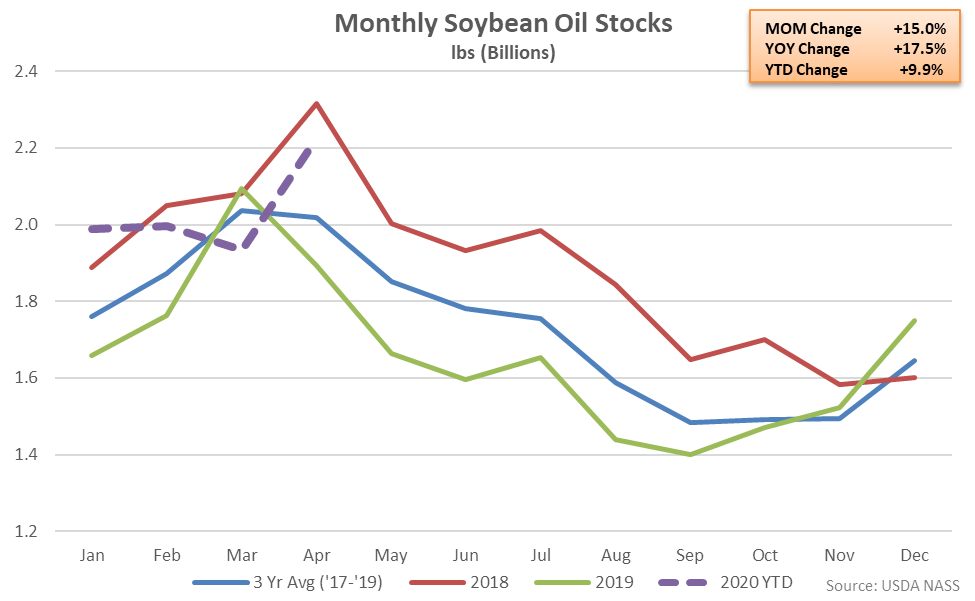

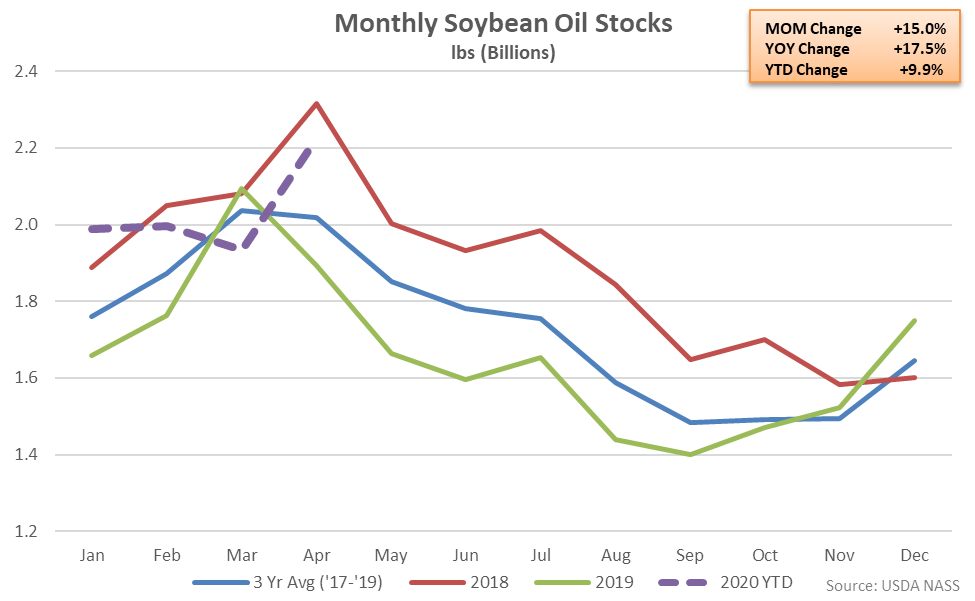

Soybean Oil Stocks – Stocks Reach a 24 Month High Level, Finish up 17.5% YOY

Apr ’20 U.S. soybean oil stocks increased 15.0% MOM to a 24 month high level, finishing 17.5% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout four of the past five months. The month-over-month increase in soybean oil stocks of 15.0% was a contraseasonal move when compared to the three year March – April average seasonal decline of 0.9%. Apr ’20 soybean oil stocks finished 10.1% above three year average seasonal levels, finishing higher for the fourth time in the past five months.

Soybean Oil Stocks – Stocks Reach a 24 Month High Level, Finish up 17.5% YOY

Apr ’20 U.S. soybean oil stocks increased 15.0% MOM to a 24 month high level, finishing 17.5% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout four of the past five months. The month-over-month increase in soybean oil stocks of 15.0% was a contraseasonal move when compared to the three year March – April average seasonal decline of 0.9%. Apr ’20 soybean oil stocks finished 10.1% above three year average seasonal levels, finishing higher for the fourth time in the past five months.

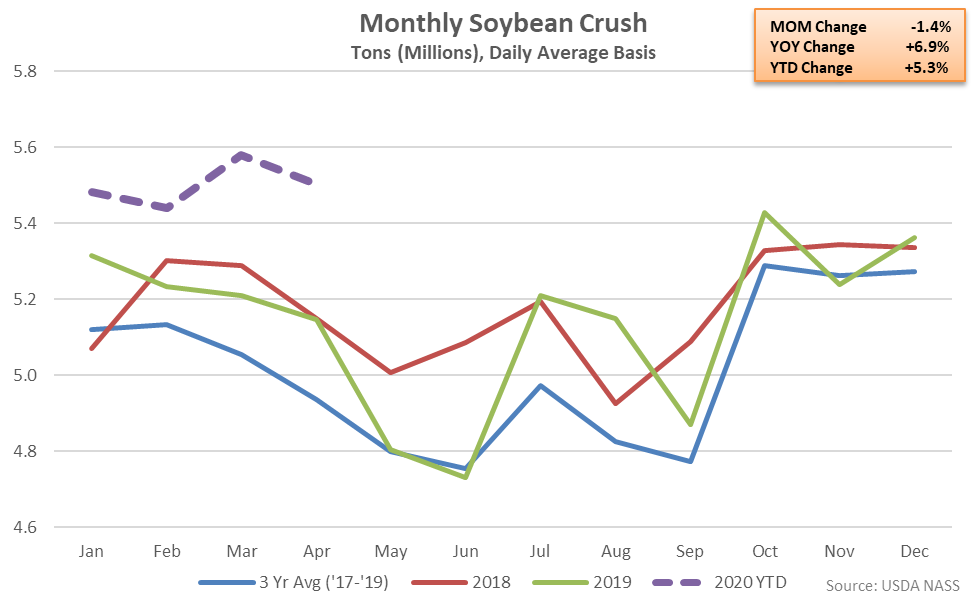

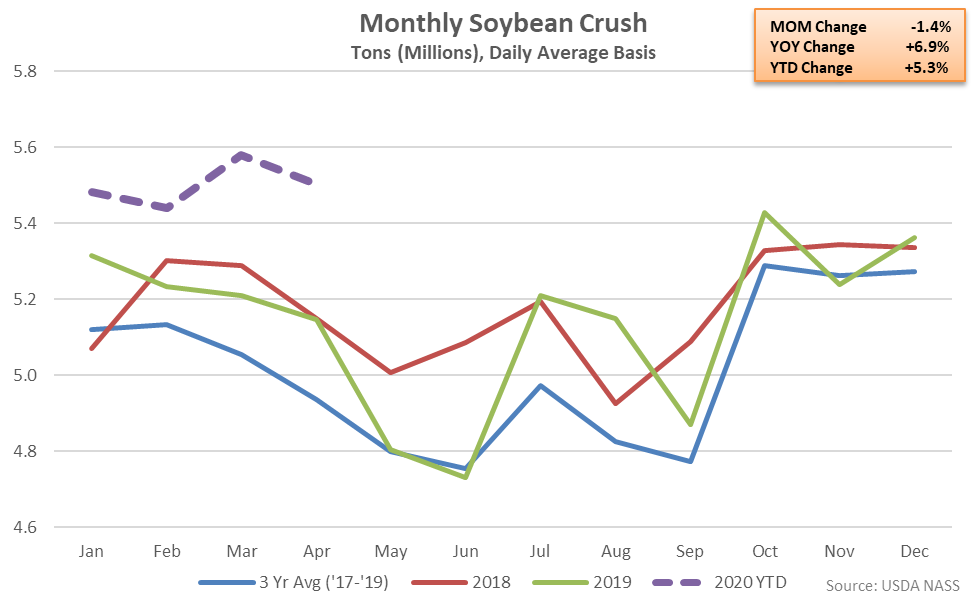

- U.S. soybean crushings increased 6.9% on a YOY basis during Apr ’20, remaining at a record high seasonal level for the fifth consecutive month.

- U.S. soybean cake & meal stocks finished 1.3% higher on a YOY basis during Apr ’20, increasing on a YOY basis for the second time in the past three months.

- U.S. soybean oil stocks finished 17.5% higher on a YOY basis during Apr ’20, reaching a 24 month high level, overall.

Cake & meal accounted for 73.4% of the total soybean crush throughout Apr ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.4% of the total soybean crush throughout Apr ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Apr ’20 soybean oil produced as a percentage of total crush remained above recently experienced 21 month low levels but finished below historical average figures for the seventh consecutive month.

Apr ’20 soybean oil produced as a percentage of total crush remained above recently experienced 21 month low levels but finished below historical average figures for the seventh consecutive month.

Soybean Cake & Meal Stocks – Stocks Finish 1.3% Higher YOY

Apr ’20 U.S. soybean cake & meal stocks declined 7.3% MOM but finished 1.3% higher on a YOY basis, increasing on a YOY basis for the second time in the past three months. The month-over-month decline in soybean cake & meal stocks of 7.3% was largely consistent with the three year March – April average seasonal decline in stocks of 7.9%. Apr ’20 soybean cake & meal stocks finished 9.2% below three year average seasonal levels, however, finishing lower for the fourth time in the past five months.

Soybean Cake & Meal Stocks – Stocks Finish 1.3% Higher YOY

Apr ’20 U.S. soybean cake & meal stocks declined 7.3% MOM but finished 1.3% higher on a YOY basis, increasing on a YOY basis for the second time in the past three months. The month-over-month decline in soybean cake & meal stocks of 7.3% was largely consistent with the three year March – April average seasonal decline in stocks of 7.9%. Apr ’20 soybean cake & meal stocks finished 9.2% below three year average seasonal levels, however, finishing lower for the fourth time in the past five months.

Soybean Oil Stocks – Stocks Reach a 24 Month High Level, Finish up 17.5% YOY

Apr ’20 U.S. soybean oil stocks increased 15.0% MOM to a 24 month high level, finishing 17.5% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout four of the past five months. The month-over-month increase in soybean oil stocks of 15.0% was a contraseasonal move when compared to the three year March – April average seasonal decline of 0.9%. Apr ’20 soybean oil stocks finished 10.1% above three year average seasonal levels, finishing higher for the fourth time in the past five months.

Soybean Oil Stocks – Stocks Reach a 24 Month High Level, Finish up 17.5% YOY

Apr ’20 U.S. soybean oil stocks increased 15.0% MOM to a 24 month high level, finishing 17.5% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout four of the past five months. The month-over-month increase in soybean oil stocks of 15.0% was a contraseasonal move when compared to the three year March – April average seasonal decline of 0.9%. Apr ’20 soybean oil stocks finished 10.1% above three year average seasonal levels, finishing higher for the fourth time in the past five months.