U.S. Cattle on Feed Update – Oct ’19

Executive Summary

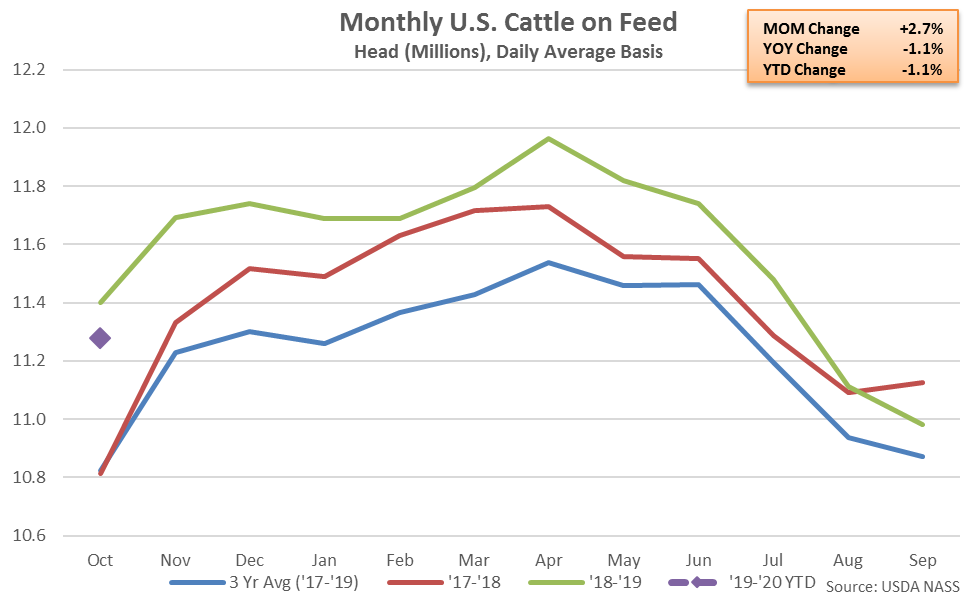

U.S. cattle on feed figures provided by USDA were recently updated with values spanning through the end of Sep ’19. Highlights from the updated report include:

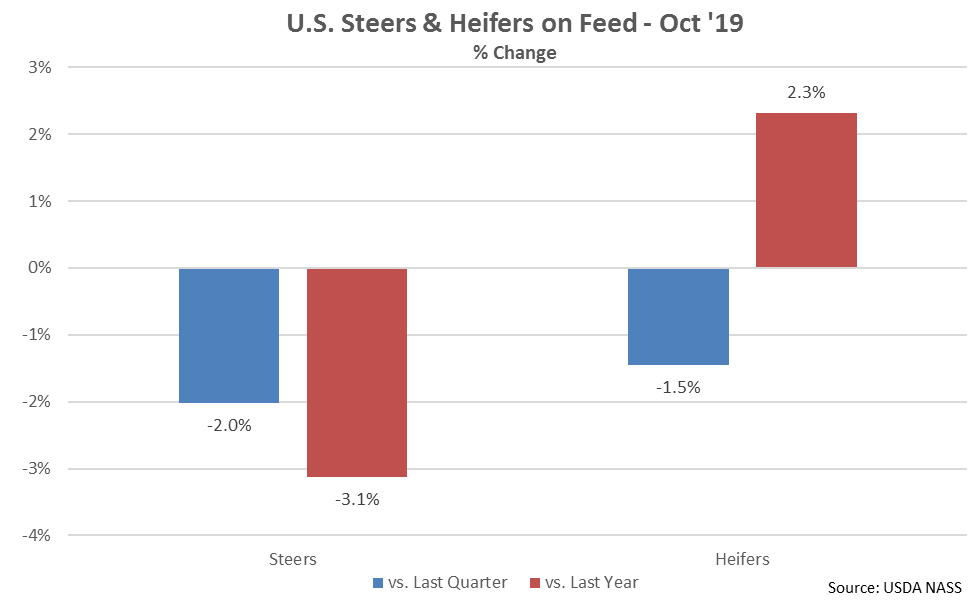

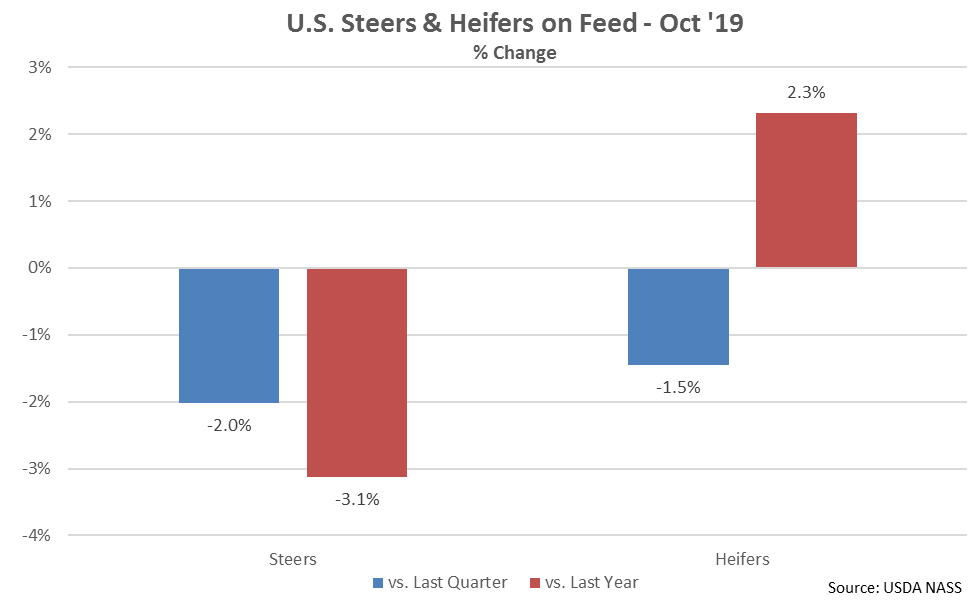

The Oct ’19 cattle on feed inventory included 6.87 million steers and steer calves, down 3.1% from 2018 levels, and 4.41 million heifers and heifer calves, up 2.3% from the previous year.

The Oct ’19 cattle on feed inventory included 6.87 million steers and steer calves, down 3.1% from 2018 levels, and 4.41 million heifers and heifer calves, up 2.3% from the previous year.

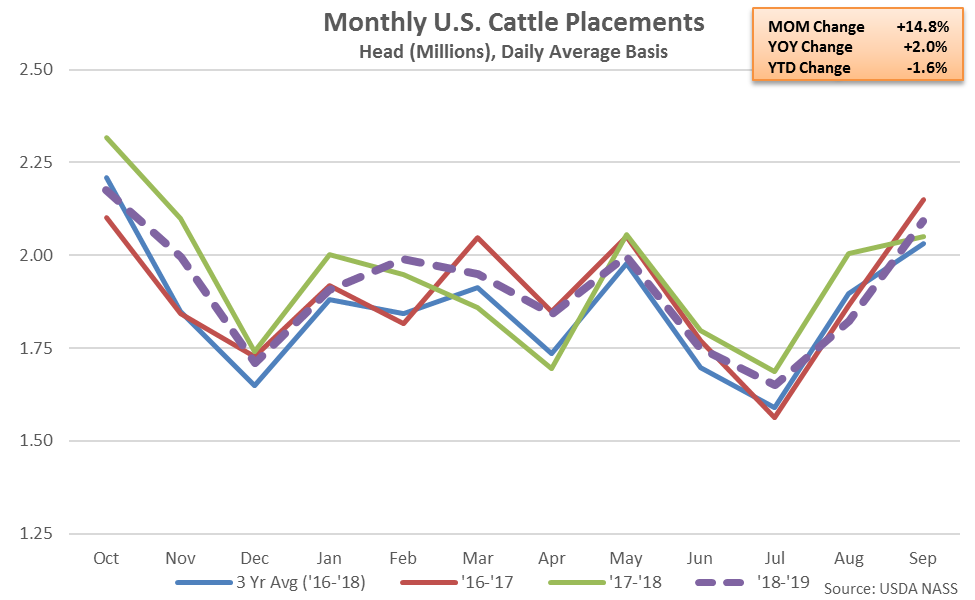

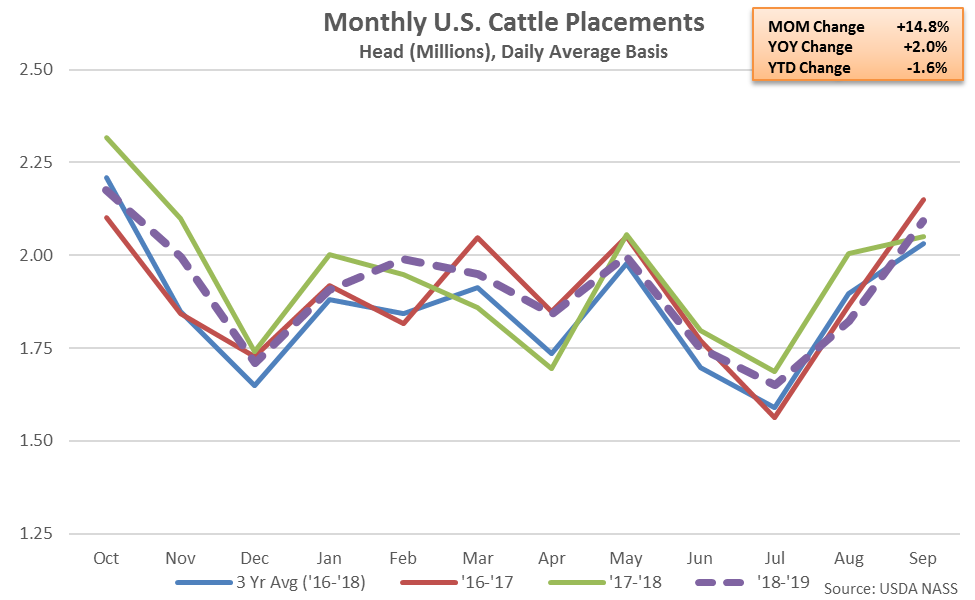

Placements in feedlots during Sep ‘19 increased 2.0% from September of last year, finishing higher on a YOY basis for the first time in the past five months. The YOY increase in placements was significantly below average analyst expectations of a 7.6% increase, however.

Placements for those weighing 600-699 pounds increased the most on a YOY basis throughout Sep ’19, finishing up 7.6%, followed by placements weighing 700-799 pounds (+7.0%). Placements weighing less than 600 pounds declined 1.2% on a YOY basis throughout the month while placements weighing 800 pounds or more declined 0.9%. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however placements remained 2.7% above three year average figures.

Placements in feedlots during Sep ‘19 increased 2.0% from September of last year, finishing higher on a YOY basis for the first time in the past five months. The YOY increase in placements was significantly below average analyst expectations of a 7.6% increase, however.

Placements for those weighing 600-699 pounds increased the most on a YOY basis throughout Sep ’19, finishing up 7.6%, followed by placements weighing 700-799 pounds (+7.0%). Placements weighing less than 600 pounds declined 1.2% on a YOY basis throughout the month while placements weighing 800 pounds or more declined 0.9%. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however placements remained 2.7% above three year average figures.

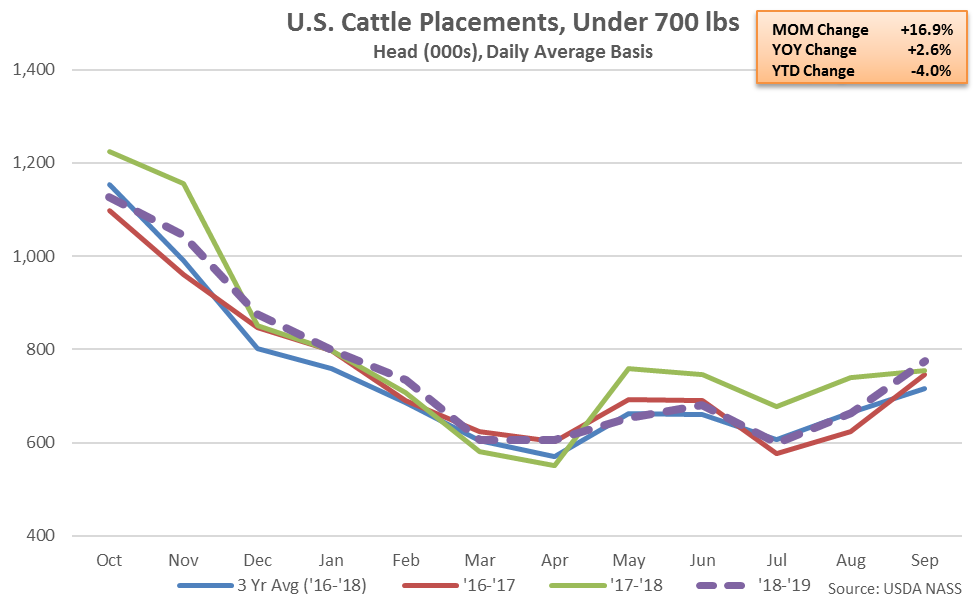

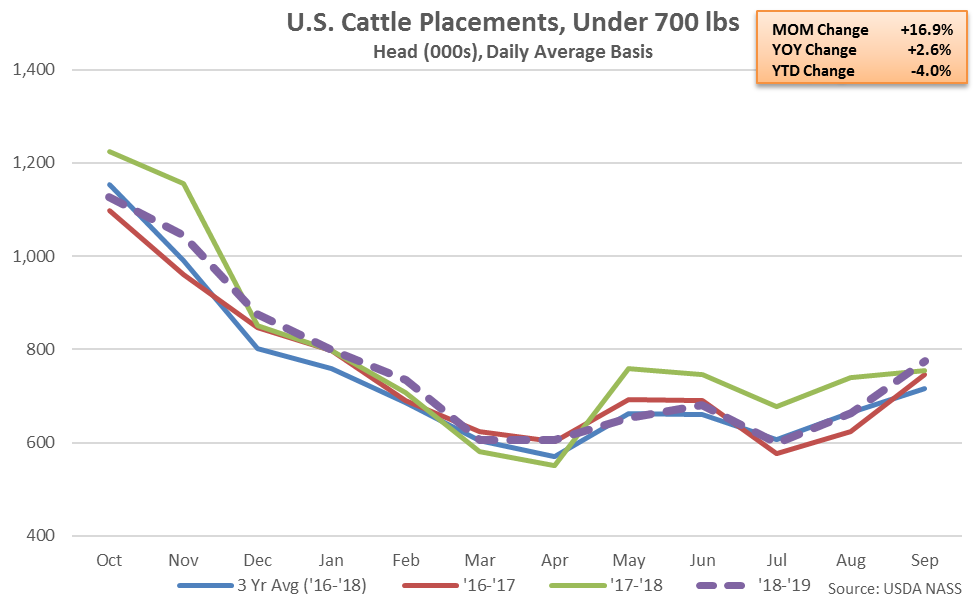

Sep ’19 cattle placements weighing under 700 pounds increased 2.6% on a YOY basis, finishing higher for the first time in the past five months. Cattle placements weighing under 700 pounds finished 4.0% lower on a YOY basis throughout the ’18-’19 production season, however, despite the most recent YOY increase.

Sep ’19 cattle placements weighing under 700 pounds increased 2.6% on a YOY basis, finishing higher for the first time in the past five months. Cattle placements weighing under 700 pounds finished 4.0% lower on a YOY basis throughout the ’18-’19 production season, however, despite the most recent YOY increase.

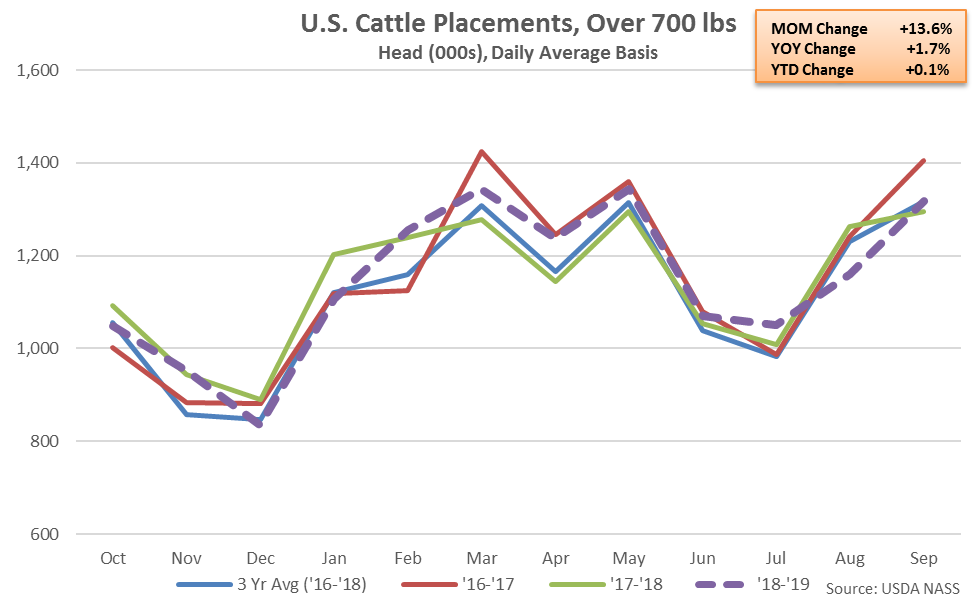

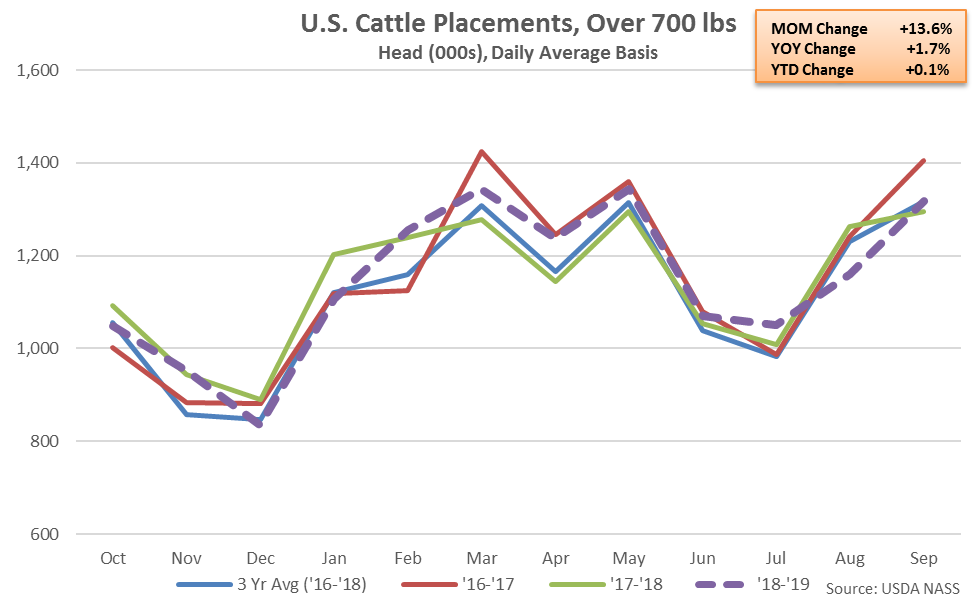

Sep ’19 cattle placements weighing 700 pounds or more increased 1.7% on a YOY basis, finishing higher for the seventh time in the past eight months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

Sep ’19 cattle placements weighing 700 pounds or more increased 1.7% on a YOY basis, finishing higher for the seventh time in the past eight months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

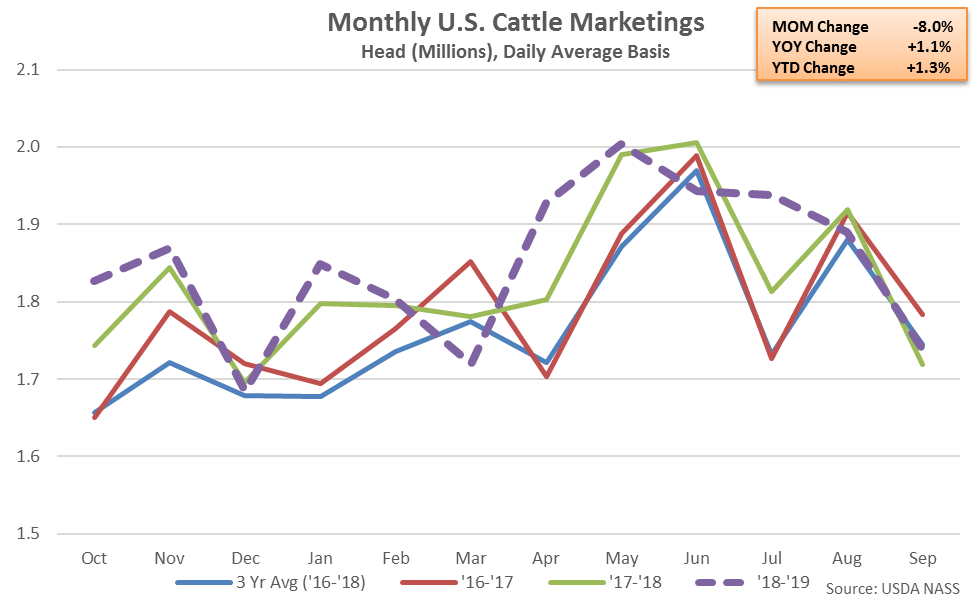

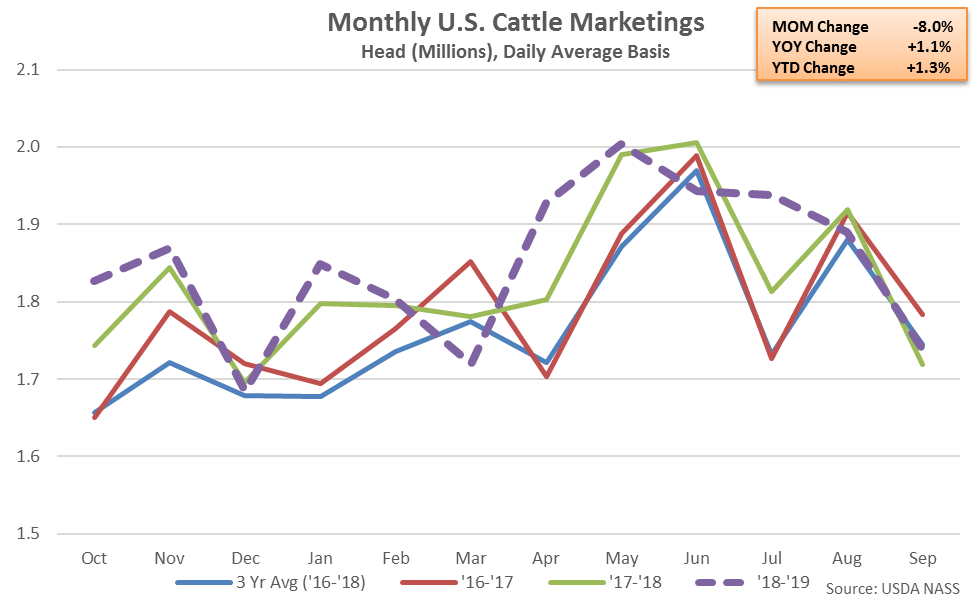

Marketings of fed cattle during Sep ’19 finished 1.1% above September of last year but remained 0.4% below three year average seasonal figures for the month of September. The 1.1% YOY increase in marketings was below average analyst expectations of a 1.5% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.

Marketings of fed cattle during Sep ’19 finished 1.1% above September of last year but remained 0.4% below three year average seasonal figures for the month of September. The 1.1% YOY increase in marketings was below average analyst expectations of a 1.5% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.

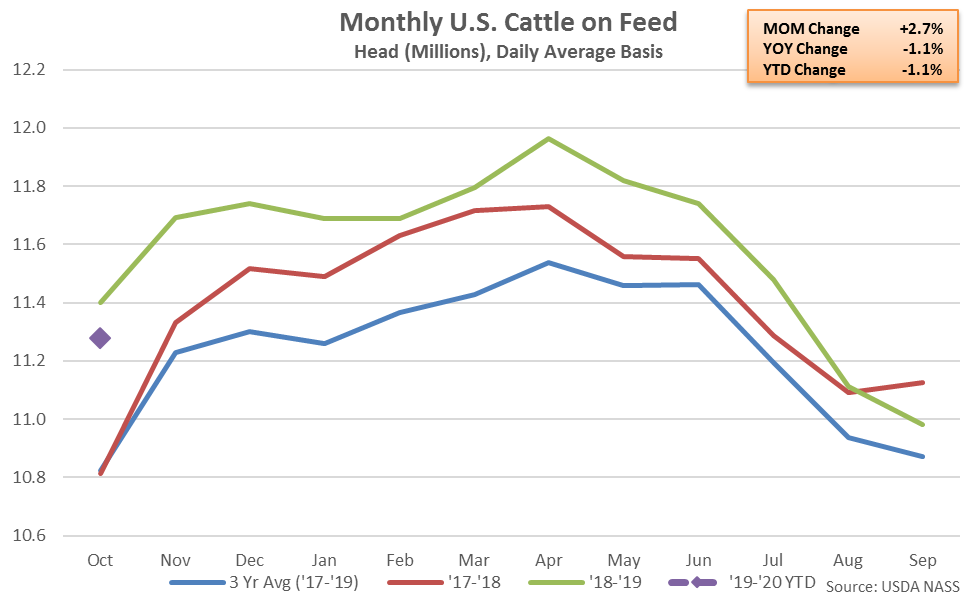

- U.S. cattle and calves on feed for the slaughter market as of Oct 1st declined on a YOY basis for the second consecutive month, finishing down 1.1%. The YOY decline in the cattle on feed supply was greater than average analyst expectations of a 0.2% decline.

- Sep ’19 placements in feedlots increased 2.0% YOY, finishing higher on a YOY basis for the first time in the past five months. The YOY increase in placements was significantly below average analyst expectations of a 7.6% increase, however.

- Sep ’19 marketings of fed cattle increased 1.1% on a YOY basis, however the YOY increase in marketings finished below average analyst expectations of a 1.5% YOY increase.

The Oct ’19 cattle on feed inventory included 6.87 million steers and steer calves, down 3.1% from 2018 levels, and 4.41 million heifers and heifer calves, up 2.3% from the previous year.

The Oct ’19 cattle on feed inventory included 6.87 million steers and steer calves, down 3.1% from 2018 levels, and 4.41 million heifers and heifer calves, up 2.3% from the previous year.

Placements in feedlots during Sep ‘19 increased 2.0% from September of last year, finishing higher on a YOY basis for the first time in the past five months. The YOY increase in placements was significantly below average analyst expectations of a 7.6% increase, however.

Placements for those weighing 600-699 pounds increased the most on a YOY basis throughout Sep ’19, finishing up 7.6%, followed by placements weighing 700-799 pounds (+7.0%). Placements weighing less than 600 pounds declined 1.2% on a YOY basis throughout the month while placements weighing 800 pounds or more declined 0.9%. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however placements remained 2.7% above three year average figures.

Placements in feedlots during Sep ‘19 increased 2.0% from September of last year, finishing higher on a YOY basis for the first time in the past five months. The YOY increase in placements was significantly below average analyst expectations of a 7.6% increase, however.

Placements for those weighing 600-699 pounds increased the most on a YOY basis throughout Sep ’19, finishing up 7.6%, followed by placements weighing 700-799 pounds (+7.0%). Placements weighing less than 600 pounds declined 1.2% on a YOY basis throughout the month while placements weighing 800 pounds or more declined 0.9%. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however placements remained 2.7% above three year average figures.

Sep ’19 cattle placements weighing under 700 pounds increased 2.6% on a YOY basis, finishing higher for the first time in the past five months. Cattle placements weighing under 700 pounds finished 4.0% lower on a YOY basis throughout the ’18-’19 production season, however, despite the most recent YOY increase.

Sep ’19 cattle placements weighing under 700 pounds increased 2.6% on a YOY basis, finishing higher for the first time in the past five months. Cattle placements weighing under 700 pounds finished 4.0% lower on a YOY basis throughout the ’18-’19 production season, however, despite the most recent YOY increase.

Sep ’19 cattle placements weighing 700 pounds or more increased 1.7% on a YOY basis, finishing higher for the seventh time in the past eight months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

Sep ’19 cattle placements weighing 700 pounds or more increased 1.7% on a YOY basis, finishing higher for the seventh time in the past eight months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

Marketings of fed cattle during Sep ’19 finished 1.1% above September of last year but remained 0.4% below three year average seasonal figures for the month of September. The 1.1% YOY increase in marketings was below average analyst expectations of a 1.5% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.

Marketings of fed cattle during Sep ’19 finished 1.1% above September of last year but remained 0.4% below three year average seasonal figures for the month of September. The 1.1% YOY increase in marketings was below average analyst expectations of a 1.5% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.