U.S. Cattle on Feed Update – Sep ’19

Executive Summary

U.S. cattle on feed figures provided by USDA were recently updated with values spanning through the end of Aug ’19. Highlights from the updated report include:

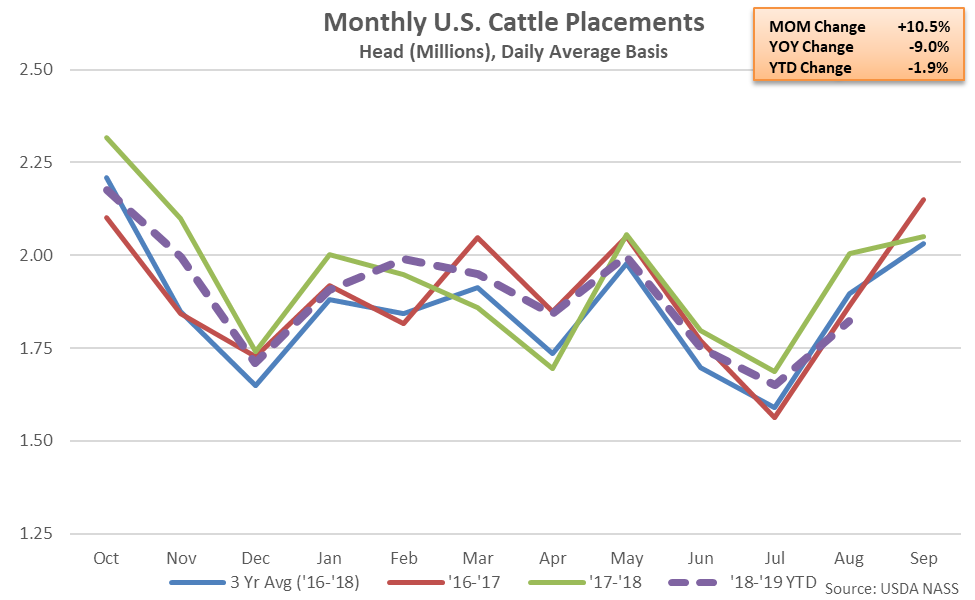

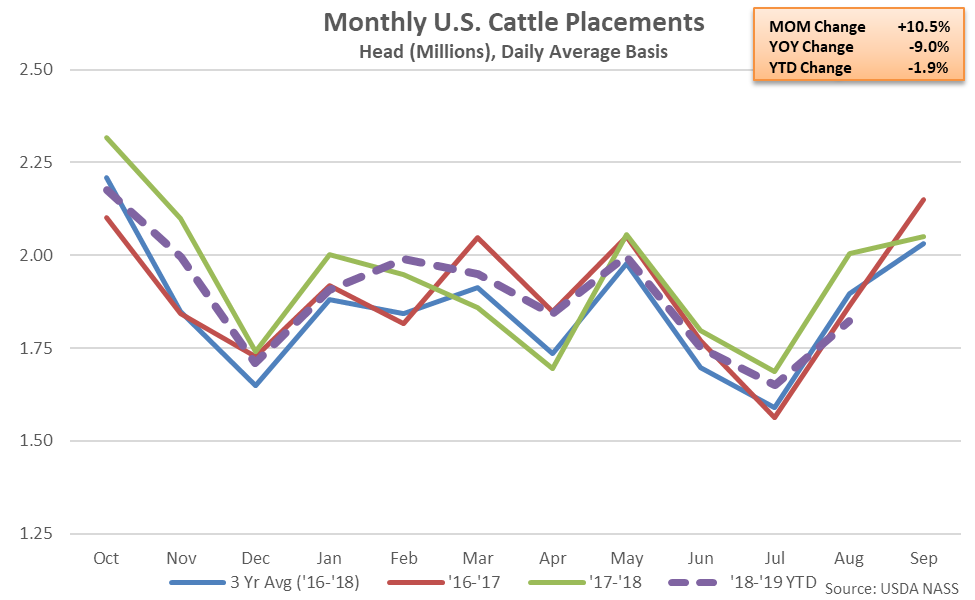

Placements in feedlots during Aug ‘19 declined 9.0% from August of last year, finishing lower on a YOY basis for the fourth consecutive month and reaching a three year seasonal low level. The YOY decline in placements was the largest experienced throughout the past 17 months on a percentage basis and was greater than average analyst expectations of a 5.5% decline. Placements for those weighing 600 pounds or less declined the most on a YOY basis throughout Aug ’19, finishing down 10.4%, followed by placements weighing 800 pounds or more (-8.3%), 700-799 pounds (-8.3%) and 600-699 pounds (-7.8%). Total placements in feedlots increased 2.4% YOY throughout the ’17-’18 production season, finishing at a seven year seasonal high level, but have declined 1.9% YOY heading into the final month of the ’18-’19 production season.

Placements in feedlots during Aug ‘19 declined 9.0% from August of last year, finishing lower on a YOY basis for the fourth consecutive month and reaching a three year seasonal low level. The YOY decline in placements was the largest experienced throughout the past 17 months on a percentage basis and was greater than average analyst expectations of a 5.5% decline. Placements for those weighing 600 pounds or less declined the most on a YOY basis throughout Aug ’19, finishing down 10.4%, followed by placements weighing 800 pounds or more (-8.3%), 700-799 pounds (-8.3%) and 600-699 pounds (-7.8%). Total placements in feedlots increased 2.4% YOY throughout the ’17-’18 production season, finishing at a seven year seasonal high level, but have declined 1.9% YOY heading into the final month of the ’18-’19 production season.

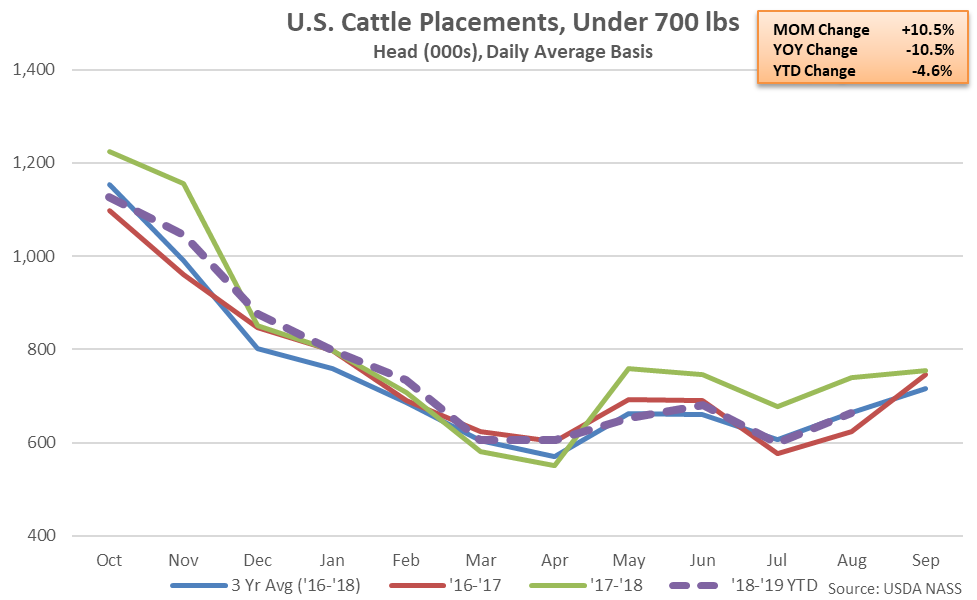

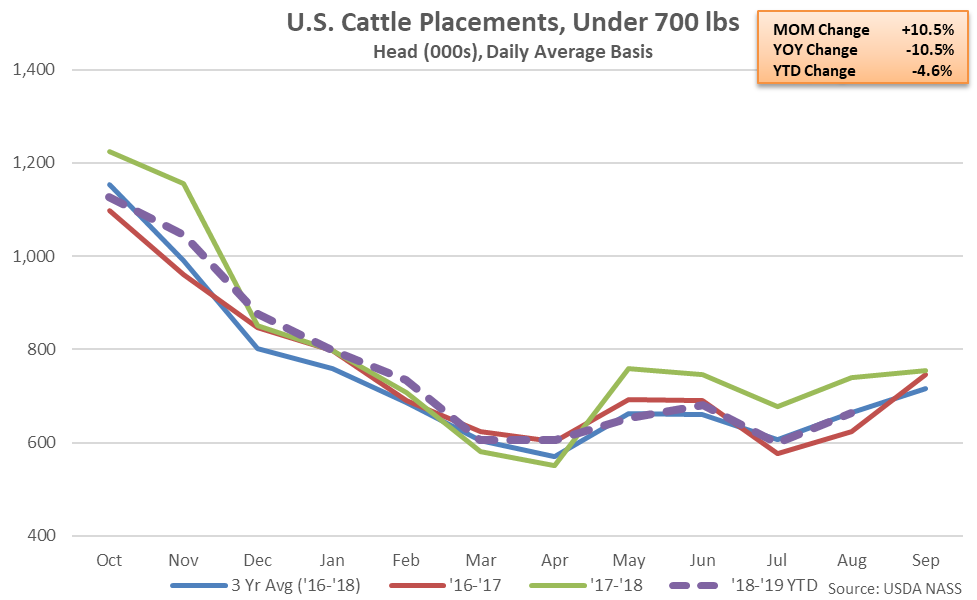

Aug ’19 cattle placements weighing under 700 pounds declined 10.5% on a YOY basis, finishing lower on a YOY basis for the fourth consecutive month. Cattle placements weighing under 700 pounds increased 6.7% throughout the ’17-’18 production season, reaching a four year high, but have declined 4.6% YOY heading into the final month of the ’18-’19 production season.

Aug ’19 cattle placements weighing under 700 pounds declined 10.5% on a YOY basis, finishing lower on a YOY basis for the fourth consecutive month. Cattle placements weighing under 700 pounds increased 6.7% throughout the ’17-’18 production season, reaching a four year high, but have declined 4.6% YOY heading into the final month of the ’18-’19 production season.

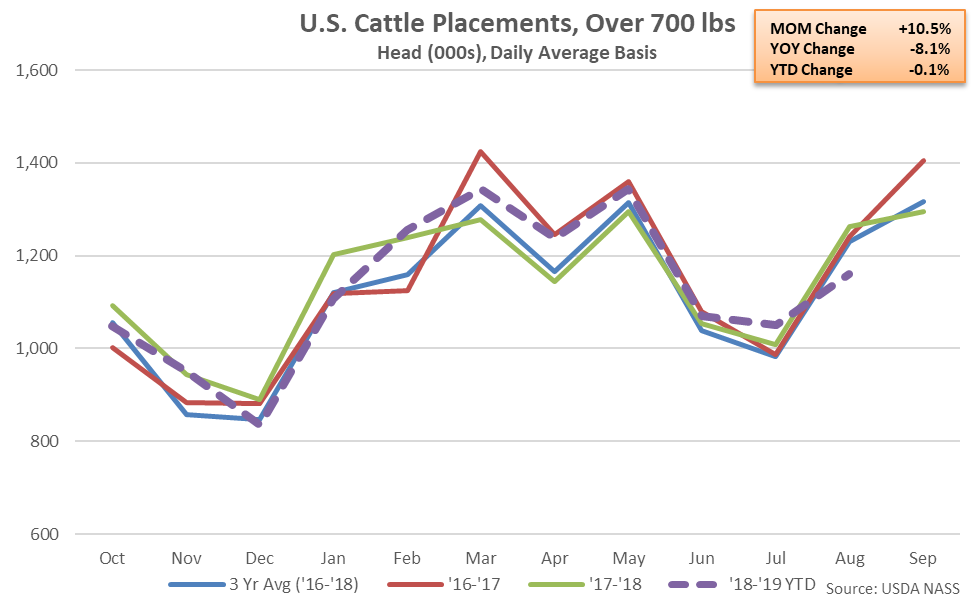

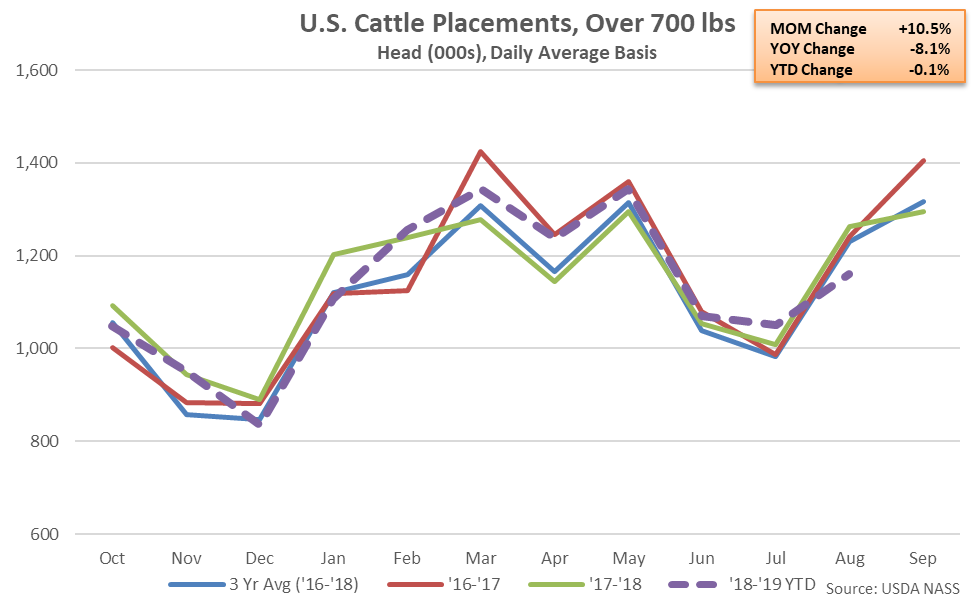

Aug ’19 cattle placements weighing 700 pounds or more declined 8.1% on a YOY basis, finishing lower on a YOY basis for the first time in the past seven months. Cattle placements weighing 700 pounds or more declined 0.3% YOY throughout the ’17-’18 production season but remained at the second highest annual figure on record. ’18-’19 YTD cattle placements weighing 700 pounds or more have declined an additional 0.1% YOY heading into the final month of the production season.

Aug ’19 cattle placements weighing 700 pounds or more declined 8.1% on a YOY basis, finishing lower on a YOY basis for the first time in the past seven months. Cattle placements weighing 700 pounds or more declined 0.3% YOY throughout the ’17-’18 production season but remained at the second highest annual figure on record. ’18-’19 YTD cattle placements weighing 700 pounds or more have declined an additional 0.1% YOY heading into the final month of the production season.

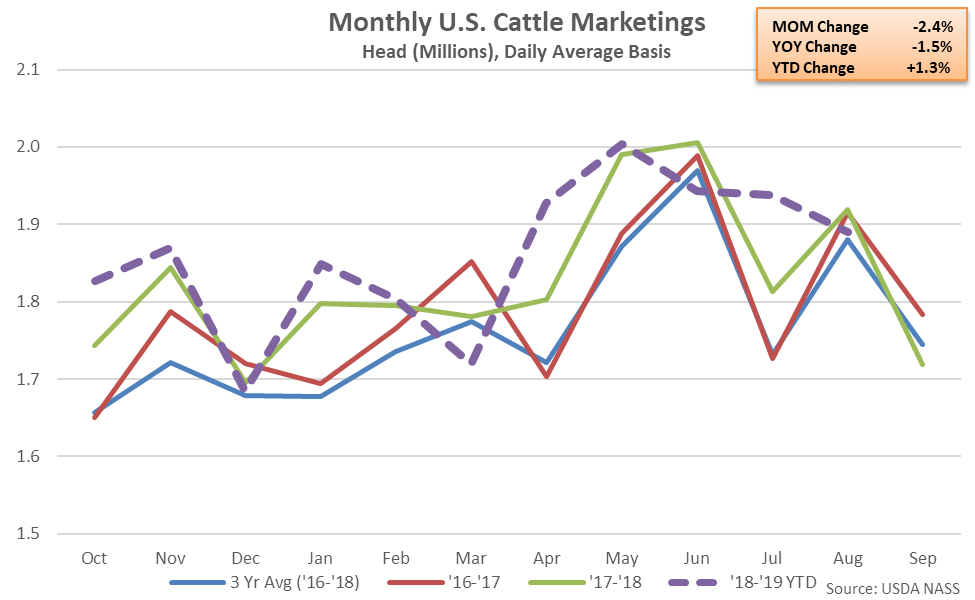

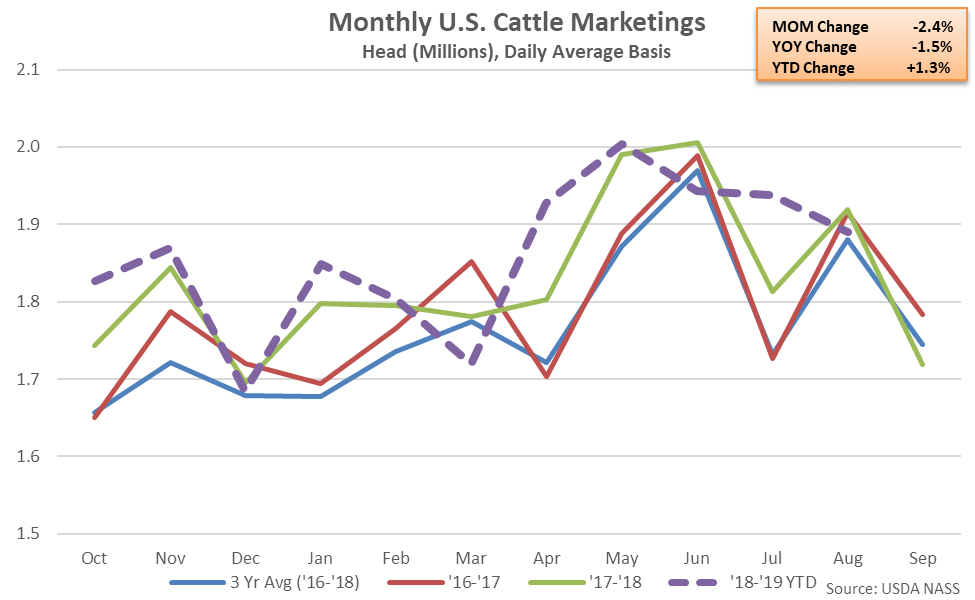

Marketings of fed cattle during Aug ’19 declined 1.5% from August of last year, reaching a three year seasonal low level. The 1.5% YOY decline in marketings was consistent with average analyst expectations of a 1.6% decline. ’17-’18 annual marketings of fed cattle increased 2.0% YOY, reaching a seven year high seasonal level, while ’18-’19 YTD marketings have increased an additional 1.3% YOY heading into the final month of the production season, despite the most recent YOY decline.

Marketings of fed cattle during Aug ’19 declined 1.5% from August of last year, reaching a three year seasonal low level. The 1.5% YOY decline in marketings was consistent with average analyst expectations of a 1.6% decline. ’17-’18 annual marketings of fed cattle increased 2.0% YOY, reaching a seven year high seasonal level, while ’18-’19 YTD marketings have increased an additional 1.3% YOY heading into the final month of the production season, despite the most recent YOY decline.

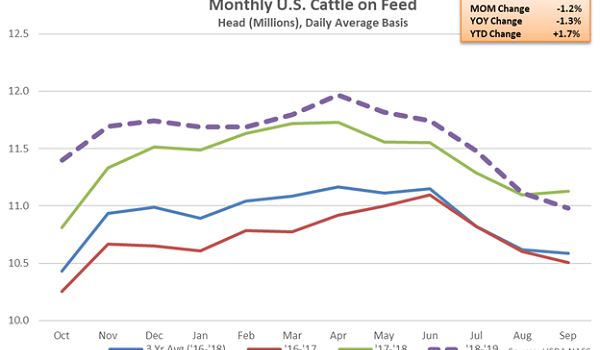

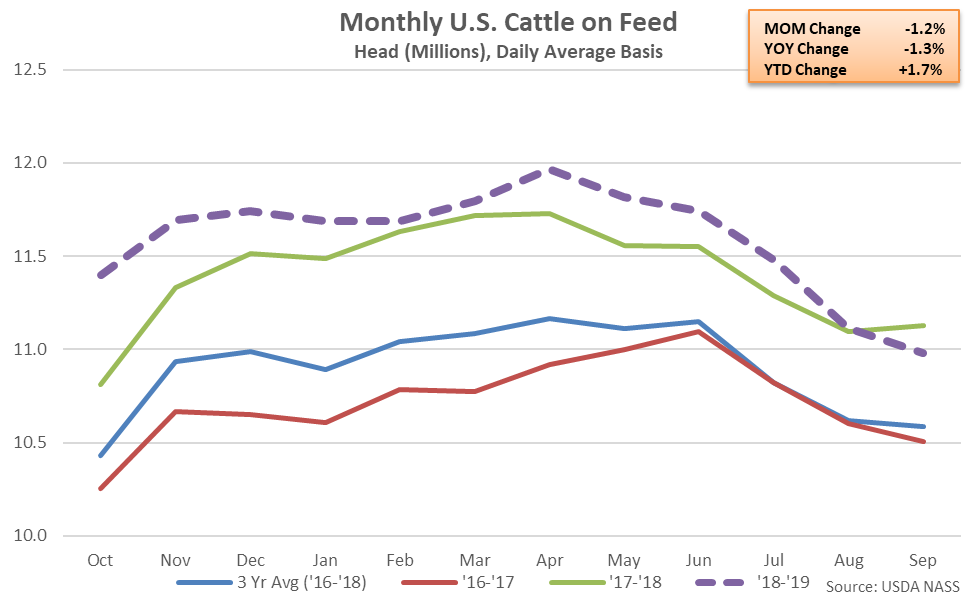

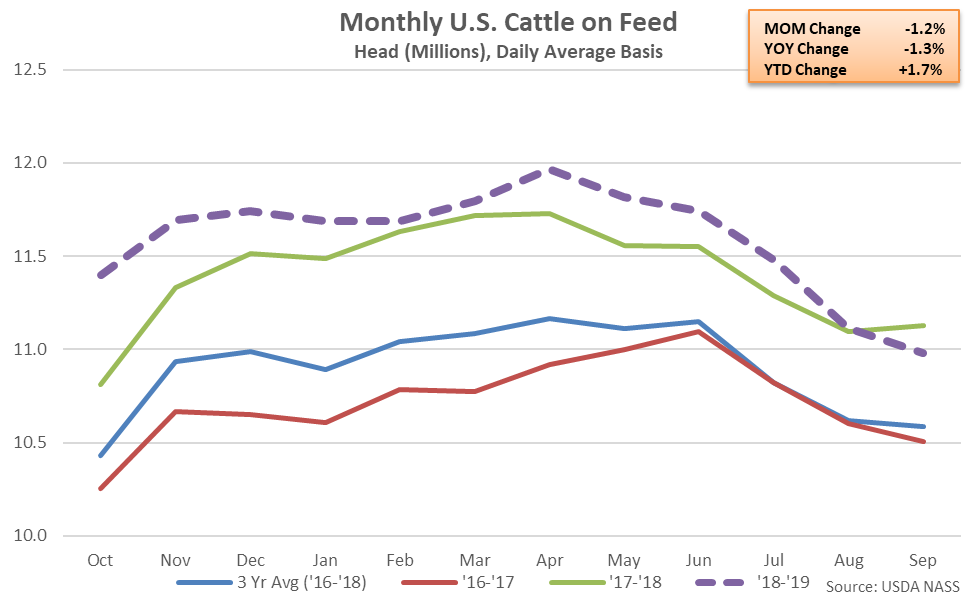

- U.S. cattle and calves on feed for the slaughter market as of Sep 1st declined on a YOY basis for the first time in the past 33 months, finishing down 1.3%.

- Aug ’19 placements in feedlots declined 9.0% YOY, finishing lower on a YOY basis for the fourth consecutive month.

- Marketings of fed cattle declined 1.5% on a YOY basis, reaching a three year seasonal low level.

Placements in feedlots during Aug ‘19 declined 9.0% from August of last year, finishing lower on a YOY basis for the fourth consecutive month and reaching a three year seasonal low level. The YOY decline in placements was the largest experienced throughout the past 17 months on a percentage basis and was greater than average analyst expectations of a 5.5% decline. Placements for those weighing 600 pounds or less declined the most on a YOY basis throughout Aug ’19, finishing down 10.4%, followed by placements weighing 800 pounds or more (-8.3%), 700-799 pounds (-8.3%) and 600-699 pounds (-7.8%). Total placements in feedlots increased 2.4% YOY throughout the ’17-’18 production season, finishing at a seven year seasonal high level, but have declined 1.9% YOY heading into the final month of the ’18-’19 production season.

Placements in feedlots during Aug ‘19 declined 9.0% from August of last year, finishing lower on a YOY basis for the fourth consecutive month and reaching a three year seasonal low level. The YOY decline in placements was the largest experienced throughout the past 17 months on a percentage basis and was greater than average analyst expectations of a 5.5% decline. Placements for those weighing 600 pounds or less declined the most on a YOY basis throughout Aug ’19, finishing down 10.4%, followed by placements weighing 800 pounds or more (-8.3%), 700-799 pounds (-8.3%) and 600-699 pounds (-7.8%). Total placements in feedlots increased 2.4% YOY throughout the ’17-’18 production season, finishing at a seven year seasonal high level, but have declined 1.9% YOY heading into the final month of the ’18-’19 production season.

Aug ’19 cattle placements weighing under 700 pounds declined 10.5% on a YOY basis, finishing lower on a YOY basis for the fourth consecutive month. Cattle placements weighing under 700 pounds increased 6.7% throughout the ’17-’18 production season, reaching a four year high, but have declined 4.6% YOY heading into the final month of the ’18-’19 production season.

Aug ’19 cattle placements weighing under 700 pounds declined 10.5% on a YOY basis, finishing lower on a YOY basis for the fourth consecutive month. Cattle placements weighing under 700 pounds increased 6.7% throughout the ’17-’18 production season, reaching a four year high, but have declined 4.6% YOY heading into the final month of the ’18-’19 production season.

Aug ’19 cattle placements weighing 700 pounds or more declined 8.1% on a YOY basis, finishing lower on a YOY basis for the first time in the past seven months. Cattle placements weighing 700 pounds or more declined 0.3% YOY throughout the ’17-’18 production season but remained at the second highest annual figure on record. ’18-’19 YTD cattle placements weighing 700 pounds or more have declined an additional 0.1% YOY heading into the final month of the production season.

Aug ’19 cattle placements weighing 700 pounds or more declined 8.1% on a YOY basis, finishing lower on a YOY basis for the first time in the past seven months. Cattle placements weighing 700 pounds or more declined 0.3% YOY throughout the ’17-’18 production season but remained at the second highest annual figure on record. ’18-’19 YTD cattle placements weighing 700 pounds or more have declined an additional 0.1% YOY heading into the final month of the production season.

Marketings of fed cattle during Aug ’19 declined 1.5% from August of last year, reaching a three year seasonal low level. The 1.5% YOY decline in marketings was consistent with average analyst expectations of a 1.6% decline. ’17-’18 annual marketings of fed cattle increased 2.0% YOY, reaching a seven year high seasonal level, while ’18-’19 YTD marketings have increased an additional 1.3% YOY heading into the final month of the production season, despite the most recent YOY decline.

Marketings of fed cattle during Aug ’19 declined 1.5% from August of last year, reaching a three year seasonal low level. The 1.5% YOY decline in marketings was consistent with average analyst expectations of a 1.6% decline. ’17-’18 annual marketings of fed cattle increased 2.0% YOY, reaching a seven year high seasonal level, while ’18-’19 YTD marketings have increased an additional 1.3% YOY heading into the final month of the production season, despite the most recent YOY decline.