EU-28 Milk Production Update – Sep ’19

Executive Summary

EU-28 milk production figures provided by Eurostat were recently updated with values spanning through Jul ’19. Highlights from the updated report include:

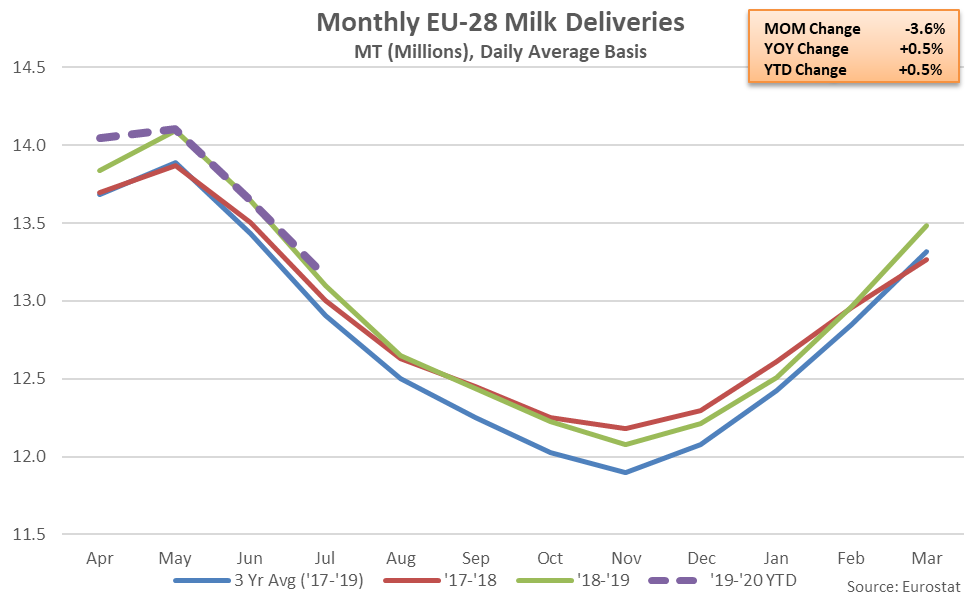

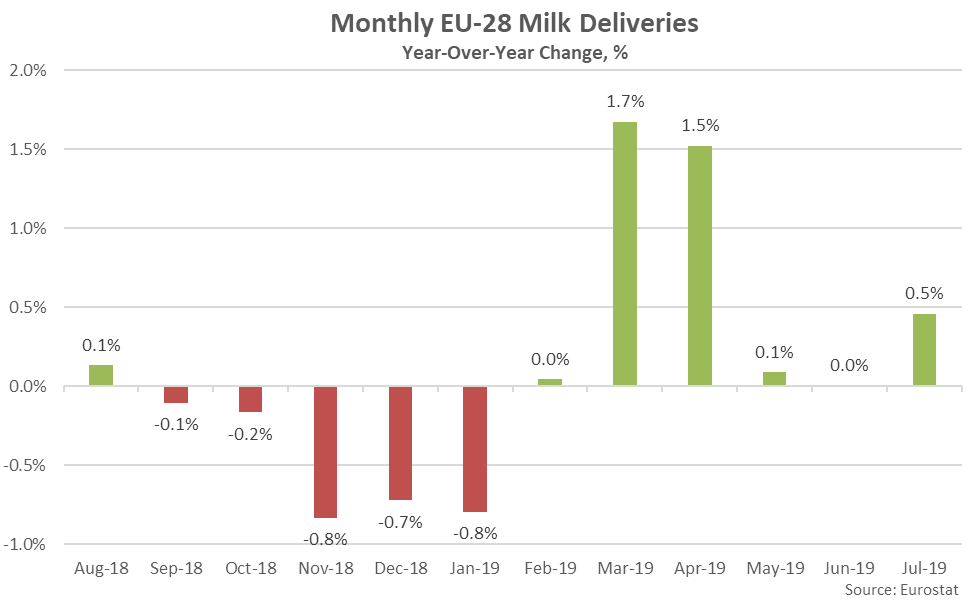

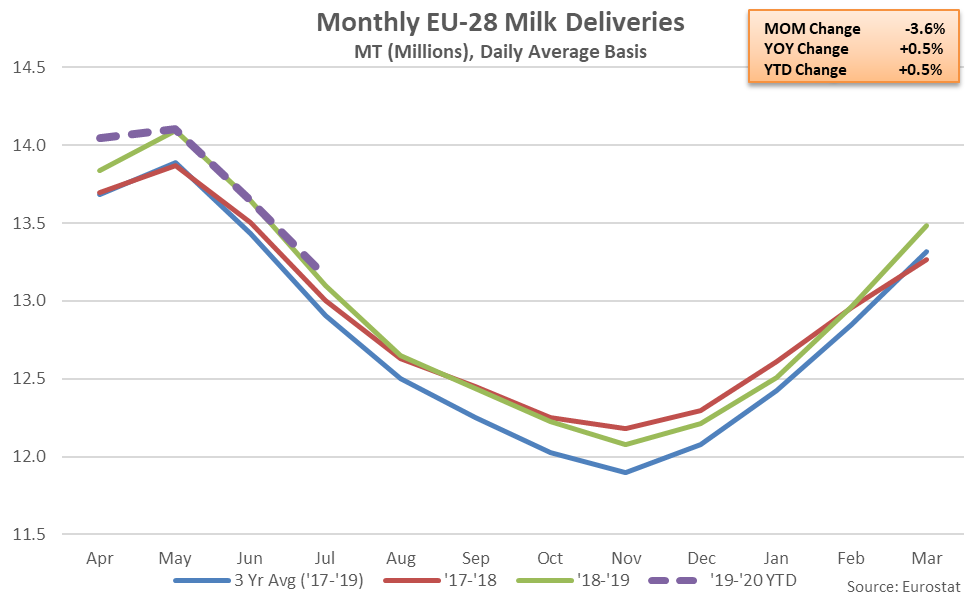

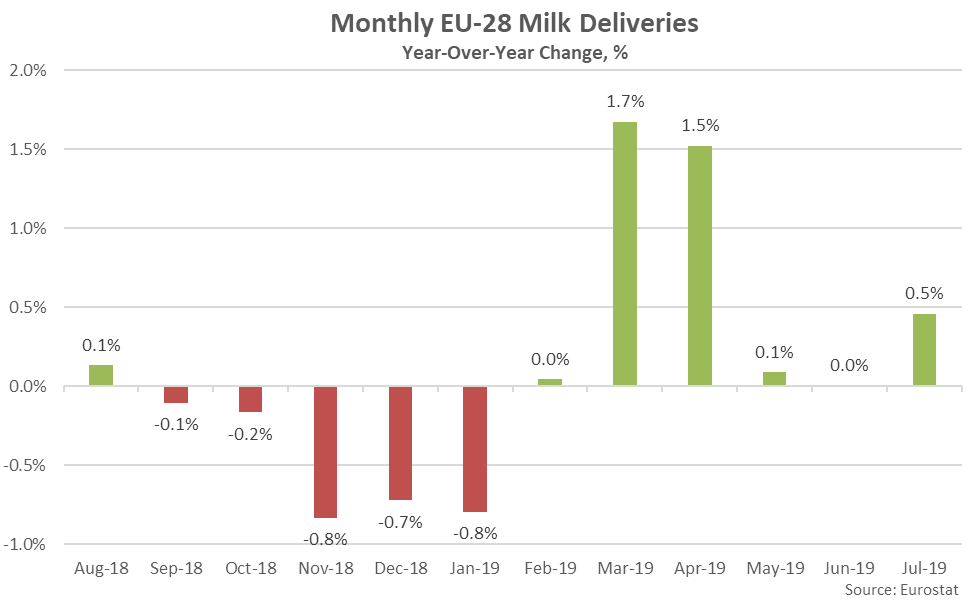

EU-28 milk production volumes have finished flat or higher on a YOY basis over six consecutive months through Jul ’19, despite record high seasonal temperatures contributing to declines in production throughout several major milk producing countries. USDA expects EU-28 milk production volumes to continue to rebound throughout the second half of the year as the feed situation is expected to improve with the new crop. USDA is projecting a 0.9% YOY increase in EU-28 milk production volumes throughout the 2019 calendar year, greater than the 0.4% YOY increase in production volumes experienced throughout the first seven months of the year.

EU-28 milk production volumes have finished flat or higher on a YOY basis over six consecutive months through Jul ’19, despite record high seasonal temperatures contributing to declines in production throughout several major milk producing countries. USDA expects EU-28 milk production volumes to continue to rebound throughout the second half of the year as the feed situation is expected to improve with the new crop. USDA is projecting a 0.9% YOY increase in EU-28 milk production volumes throughout the 2019 calendar year, greater than the 0.4% YOY increase in production volumes experienced throughout the first seven months of the year.

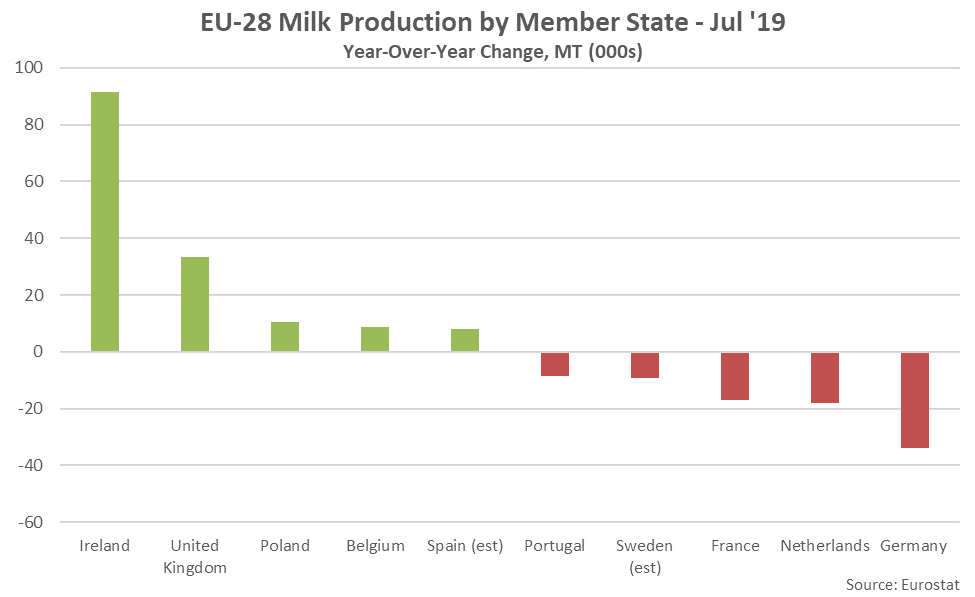

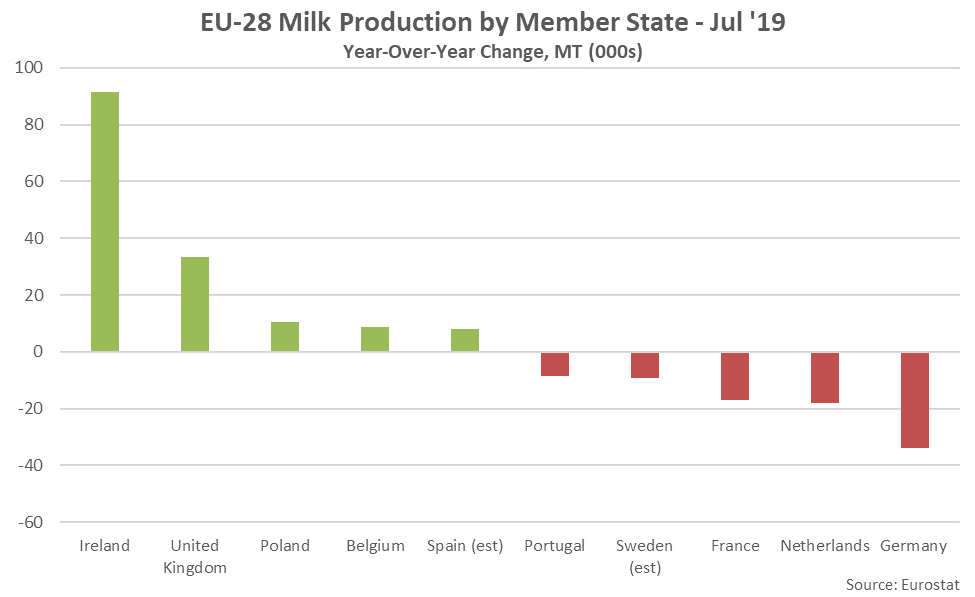

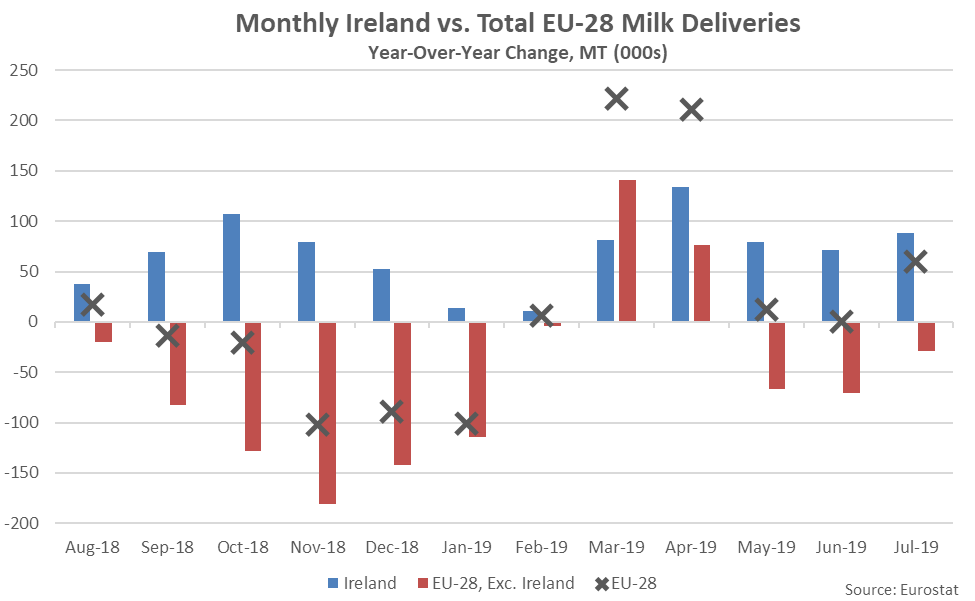

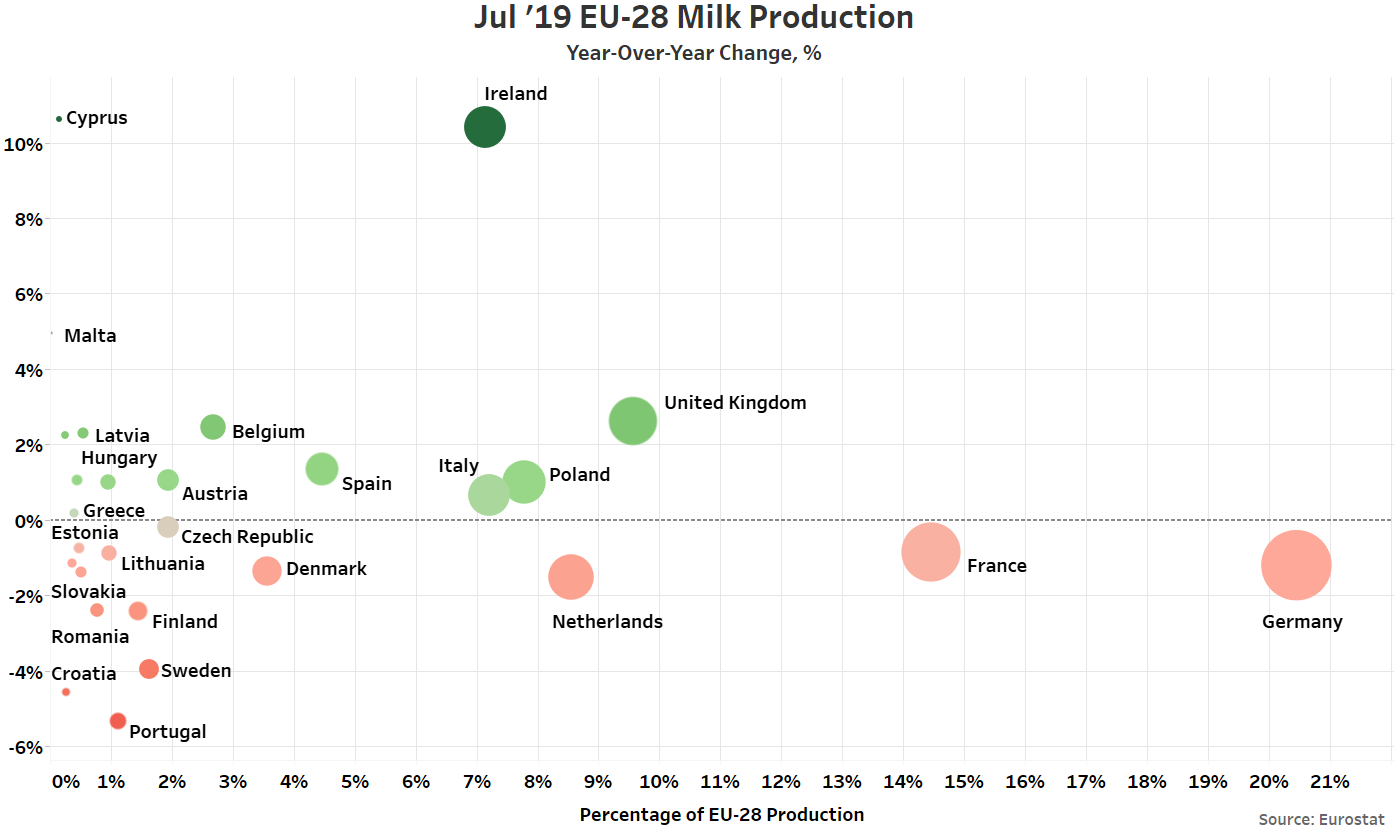

Jul ’19 YOY increases in production on an absolute basis continue to be led by Ireland, followed by the United Kingdom and Poland, while YOY declines in production on an absolute basis were led by Germany, followed by the Netherlands and France.

Jul ’19 YOY increases in production on an absolute basis continue to be led by Ireland, followed by the United Kingdom and Poland, while YOY declines in production on an absolute basis were led by Germany, followed by the Netherlands and France.

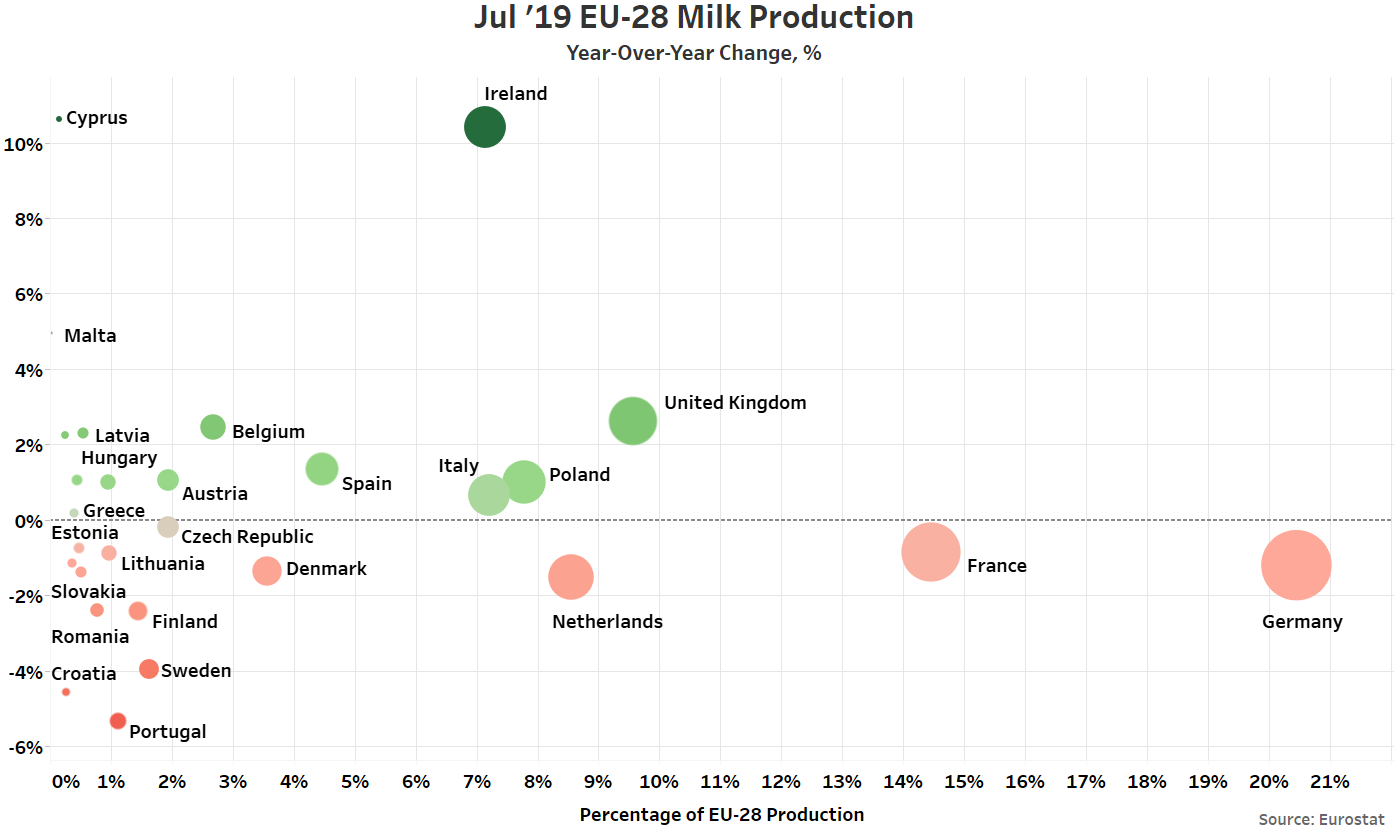

YOY increases in production on a percentage basis were led by Cyprus (+10.6%), followed by Ireland (+10.4%) and Malta (+5.0%), while declines in production on a percentage basis were most significant within Ireland Portugal (-5.3%), followed by Croatia (-4.6%).

YOY increases in production on a percentage basis were led by Cyprus (+10.6%), followed by Ireland (+10.4%) and Malta (+5.0%), while declines in production on a percentage basis were most significant within Ireland Portugal (-5.3%), followed by Croatia (-4.6%).

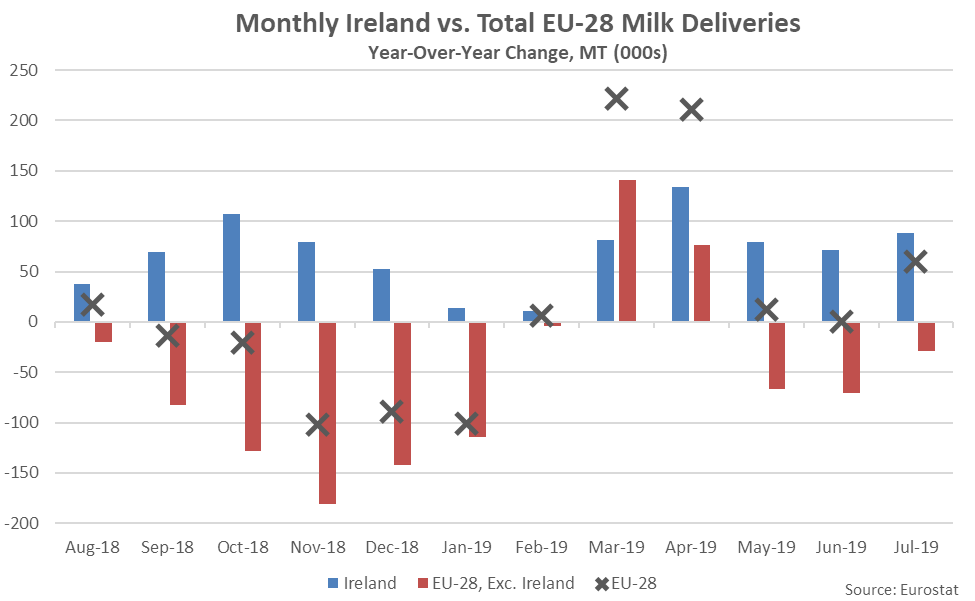

Irish milk production volumes finished higher on a YOY basis for the 12th consecutive month throughout Jul ’19, remaining at a record high seasonal level. Excluding Ireland, EU-28 milk production volumes declined by 0.2% on a YOY basis throughout Jul ’19.

Irish milk production volumes finished higher on a YOY basis for the 12th consecutive month throughout Jul ’19, remaining at a record high seasonal level. Excluding Ireland, EU-28 milk production volumes declined by 0.2% on a YOY basis throughout Jul ’19.

Six of the top ten milk producing member states experienced YOY increases in milk production during Jul ’19 as production within the top ten milk producing member states increased by a weighted average of 0.8% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Combined production volumes outside of the top ten milk producing member states declined by 1.0% on a YOY basis throughout the month, however. Overall, 14 of the 28 member states experienced YOY increases in production volumes during Jul ’19.

Six of the top ten milk producing member states experienced YOY increases in milk production during Jul ’19 as production within the top ten milk producing member states increased by a weighted average of 0.8% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Combined production volumes outside of the top ten milk producing member states declined by 1.0% on a YOY basis throughout the month, however. Overall, 14 of the 28 member states experienced YOY increases in production volumes during Jul ’19.

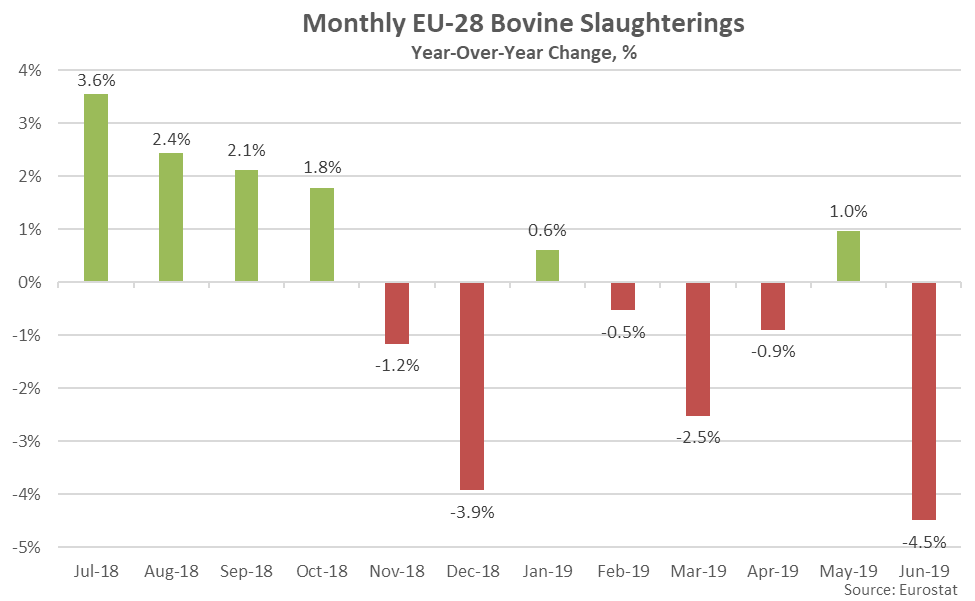

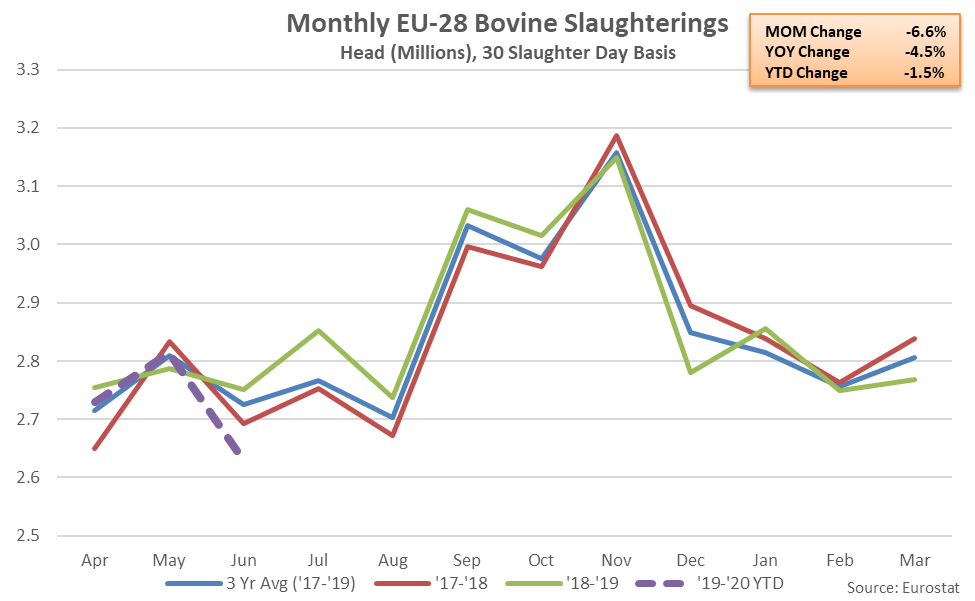

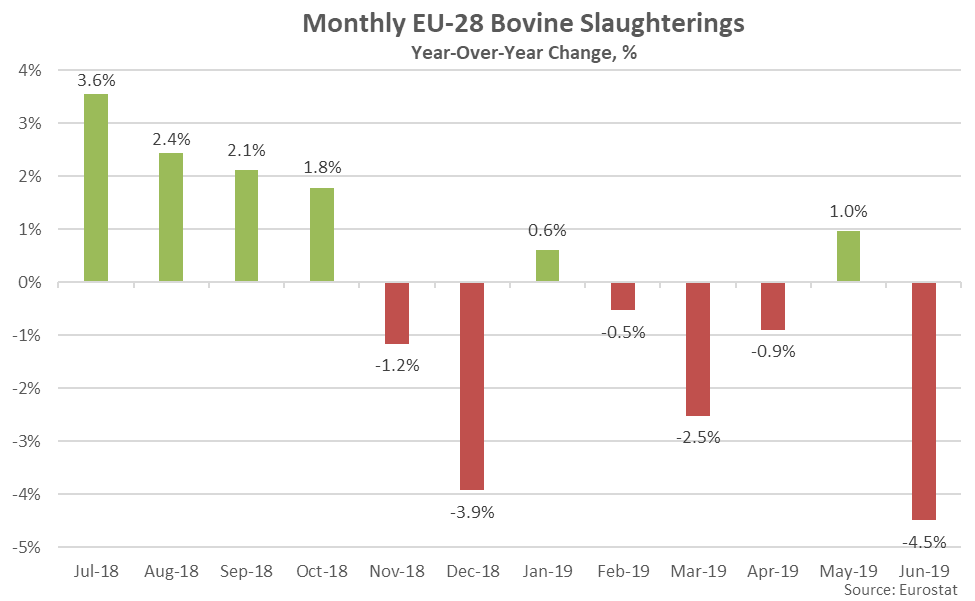

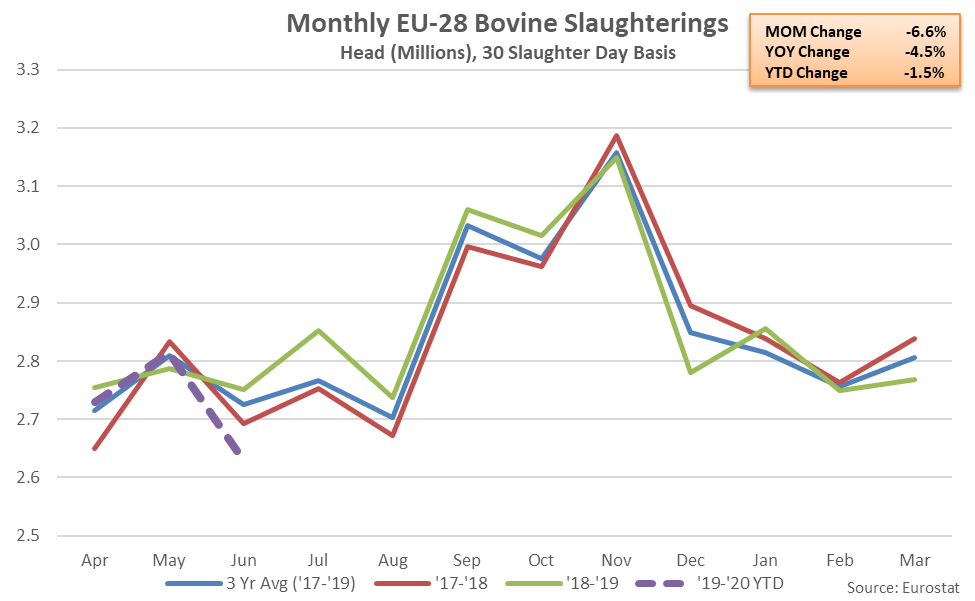

Jun ’19 EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the fourth time in the past five months when normalizing for slaughter days, declining by 4.5%. The YOY decline in beef & dairy cow slaughter was the largest experienced throughout the past five and a half years on a percentage basis. YOY declines in beef & dairy cow slaughter were most significant within Poland, followed by Germany and the Netherlands.

Jun ’19 EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the fourth time in the past five months when normalizing for slaughter days, declining by 4.5%. The YOY decline in beef & dairy cow slaughter was the largest experienced throughout the past five and a half years on a percentage basis. YOY declines in beef & dairy cow slaughter were most significant within Poland, followed by Germany and the Netherlands.

’18-’19 annual EU-28 bovine slaughter increased on a YOY basis for the fifth consecutive year, finishing up 0.5% to the highest figure on record, despite declining by 1.0% on a YOY basis over the second half of the production season. USDA expects the EU-28 dairy cow herd to decline 1.3% throughout the 2019 calendar year due to feed shortages stemming from the recent drought but noted additional culling rates are expected to have a positive impact on future per cow productivity as lower producing animals are culled.

’18-’19 annual EU-28 bovine slaughter increased on a YOY basis for the fifth consecutive year, finishing up 0.5% to the highest figure on record, despite declining by 1.0% on a YOY basis over the second half of the production season. USDA expects the EU-28 dairy cow herd to decline 1.3% throughout the 2019 calendar year due to feed shortages stemming from the recent drought but noted additional culling rates are expected to have a positive impact on future per cow productivity as lower producing animals are culled.

- EU-28 milk production finished flat or higher on a YOY basis for the sixth consecutive month during Jul ’19, finishing up 0.5% to a record high seasonal level.

- Jul ’19 YOY increases in milk production were led by Ireland, followed by the United Kingdom and Poland, while YOY declines in production were most significant throughout Germany, followed by the Netherlands and France. Overall, 14 of the 28 member states experienced YOY increases in production volumes during Jul ’19.

- EU-28 beef & dairy cow slaughter rates finished lower on a YOY basis for the fourth time in the past five months during Jun ’19 when normalizing for slaughter days, declining by 4.5%. The YOY decline in beef & dairy cow slaughter was the largest experienced throughout the past five and a half years on a percentage basis. YOY declines in slaughter rates were most significant within Poland, followed by Germany and the Netherlands.

EU-28 milk production volumes have finished flat or higher on a YOY basis over six consecutive months through Jul ’19, despite record high seasonal temperatures contributing to declines in production throughout several major milk producing countries. USDA expects EU-28 milk production volumes to continue to rebound throughout the second half of the year as the feed situation is expected to improve with the new crop. USDA is projecting a 0.9% YOY increase in EU-28 milk production volumes throughout the 2019 calendar year, greater than the 0.4% YOY increase in production volumes experienced throughout the first seven months of the year.

EU-28 milk production volumes have finished flat or higher on a YOY basis over six consecutive months through Jul ’19, despite record high seasonal temperatures contributing to declines in production throughout several major milk producing countries. USDA expects EU-28 milk production volumes to continue to rebound throughout the second half of the year as the feed situation is expected to improve with the new crop. USDA is projecting a 0.9% YOY increase in EU-28 milk production volumes throughout the 2019 calendar year, greater than the 0.4% YOY increase in production volumes experienced throughout the first seven months of the year.

Jul ’19 YOY increases in production on an absolute basis continue to be led by Ireland, followed by the United Kingdom and Poland, while YOY declines in production on an absolute basis were led by Germany, followed by the Netherlands and France.

Jul ’19 YOY increases in production on an absolute basis continue to be led by Ireland, followed by the United Kingdom and Poland, while YOY declines in production on an absolute basis were led by Germany, followed by the Netherlands and France.

YOY increases in production on a percentage basis were led by Cyprus (+10.6%), followed by Ireland (+10.4%) and Malta (+5.0%), while declines in production on a percentage basis were most significant within Ireland Portugal (-5.3%), followed by Croatia (-4.6%).

YOY increases in production on a percentage basis were led by Cyprus (+10.6%), followed by Ireland (+10.4%) and Malta (+5.0%), while declines in production on a percentage basis were most significant within Ireland Portugal (-5.3%), followed by Croatia (-4.6%).

Irish milk production volumes finished higher on a YOY basis for the 12th consecutive month throughout Jul ’19, remaining at a record high seasonal level. Excluding Ireland, EU-28 milk production volumes declined by 0.2% on a YOY basis throughout Jul ’19.

Irish milk production volumes finished higher on a YOY basis for the 12th consecutive month throughout Jul ’19, remaining at a record high seasonal level. Excluding Ireland, EU-28 milk production volumes declined by 0.2% on a YOY basis throughout Jul ’19.

Six of the top ten milk producing member states experienced YOY increases in milk production during Jul ’19 as production within the top ten milk producing member states increased by a weighted average of 0.8% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Combined production volumes outside of the top ten milk producing member states declined by 1.0% on a YOY basis throughout the month, however. Overall, 14 of the 28 member states experienced YOY increases in production volumes during Jul ’19.

Six of the top ten milk producing member states experienced YOY increases in milk production during Jul ’19 as production within the top ten milk producing member states increased by a weighted average of 0.8% throughout the month. The top ten EU-28 milk producing member states accounted for over 85% of the total EU-28 milk production experienced throughout the month. Combined production volumes outside of the top ten milk producing member states declined by 1.0% on a YOY basis throughout the month, however. Overall, 14 of the 28 member states experienced YOY increases in production volumes during Jul ’19.

Jun ’19 EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the fourth time in the past five months when normalizing for slaughter days, declining by 4.5%. The YOY decline in beef & dairy cow slaughter was the largest experienced throughout the past five and a half years on a percentage basis. YOY declines in beef & dairy cow slaughter were most significant within Poland, followed by Germany and the Netherlands.

Jun ’19 EU-28 beef & dairy cow slaughter finished lower on a YOY basis for the fourth time in the past five months when normalizing for slaughter days, declining by 4.5%. The YOY decline in beef & dairy cow slaughter was the largest experienced throughout the past five and a half years on a percentage basis. YOY declines in beef & dairy cow slaughter were most significant within Poland, followed by Germany and the Netherlands.

’18-’19 annual EU-28 bovine slaughter increased on a YOY basis for the fifth consecutive year, finishing up 0.5% to the highest figure on record, despite declining by 1.0% on a YOY basis over the second half of the production season. USDA expects the EU-28 dairy cow herd to decline 1.3% throughout the 2019 calendar year due to feed shortages stemming from the recent drought but noted additional culling rates are expected to have a positive impact on future per cow productivity as lower producing animals are culled.

’18-’19 annual EU-28 bovine slaughter increased on a YOY basis for the fifth consecutive year, finishing up 0.5% to the highest figure on record, despite declining by 1.0% on a YOY basis over the second half of the production season. USDA expects the EU-28 dairy cow herd to decline 1.3% throughout the 2019 calendar year due to feed shortages stemming from the recent drought but noted additional culling rates are expected to have a positive impact on future per cow productivity as lower producing animals are culled.