Chinese Dairy Imports Update – Aug ’19

Executive Summary

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Jul ‘19. Highlights from the updated report include:

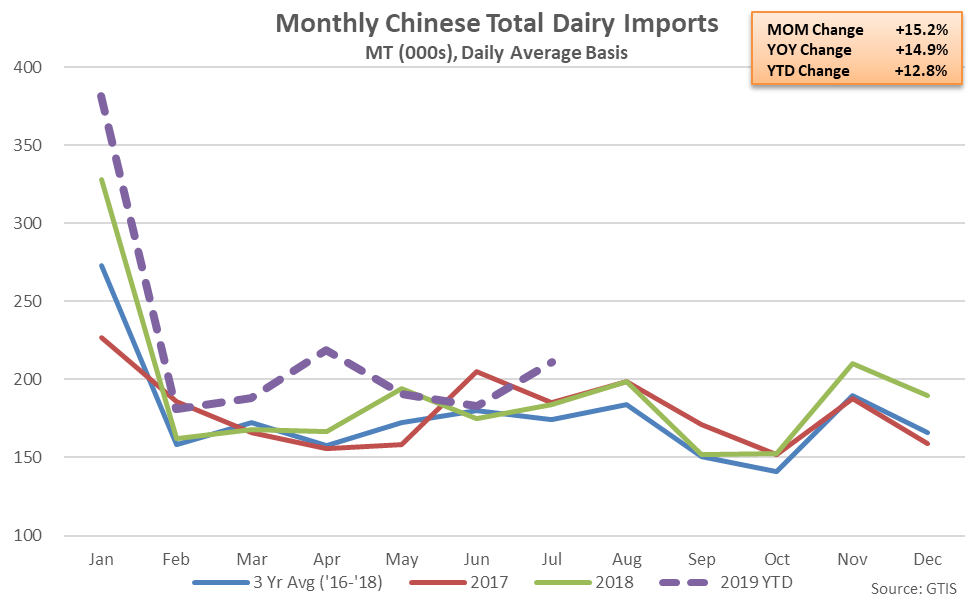

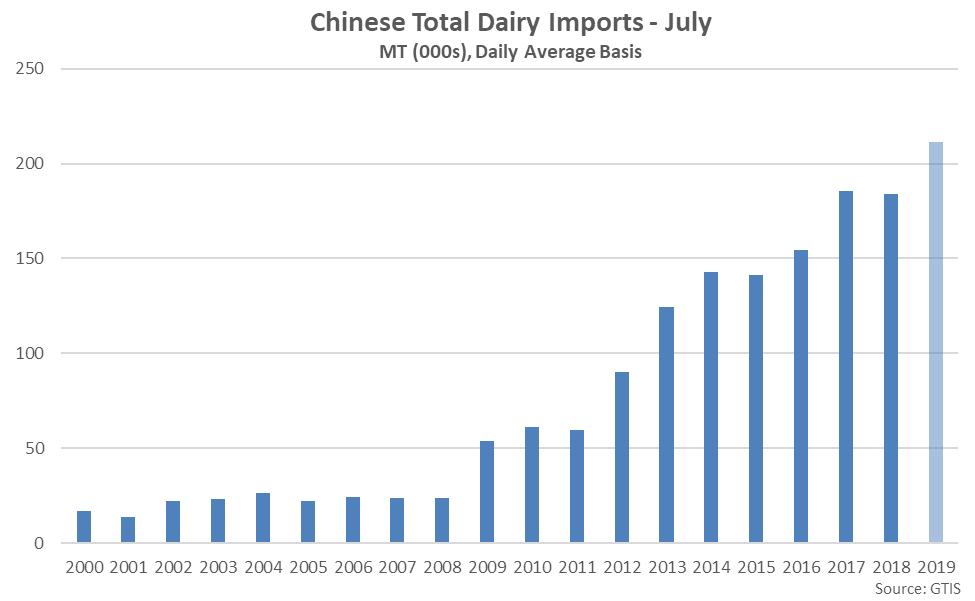

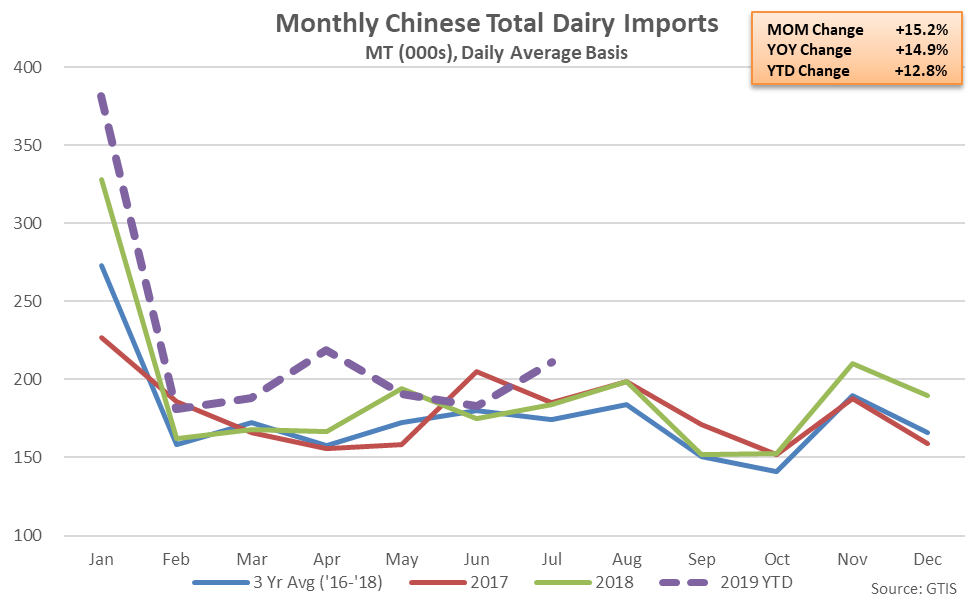

Jul ’19 Chinese Dairy Import Volumes Increased 15.2% MOM and 14.9% YOY

Jul ’19 Chinese Dairy Import Volumes Increased 15.2% MOM and 14.9% YOY

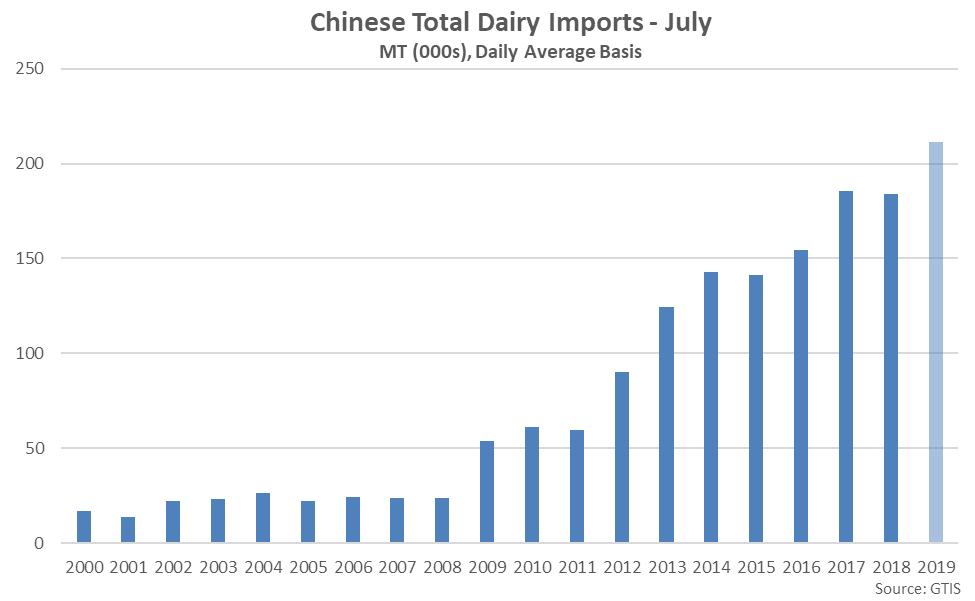

Jul ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Jul ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

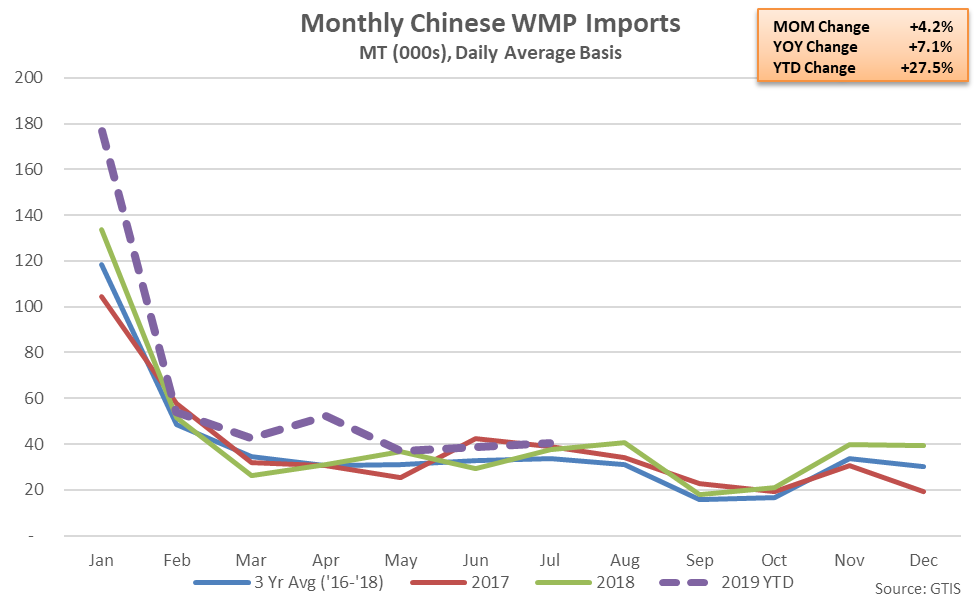

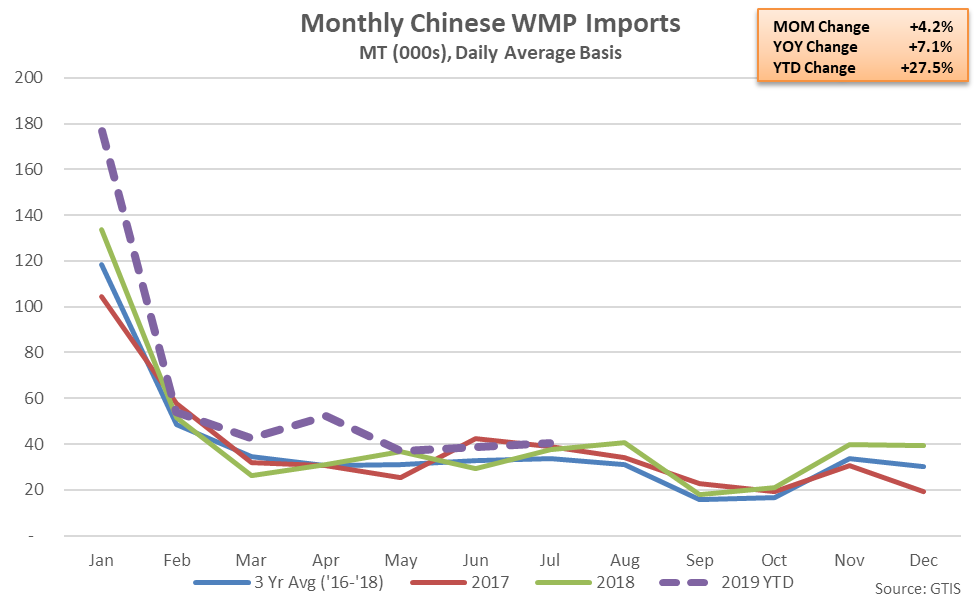

Jul ’19 Chinese WMP Import Volumes Increased 4.2% MOM and 7.1% YOY

Jul ’19 Chinese WMP Import Volumes Increased 4.2% MOM and 7.1% YOY

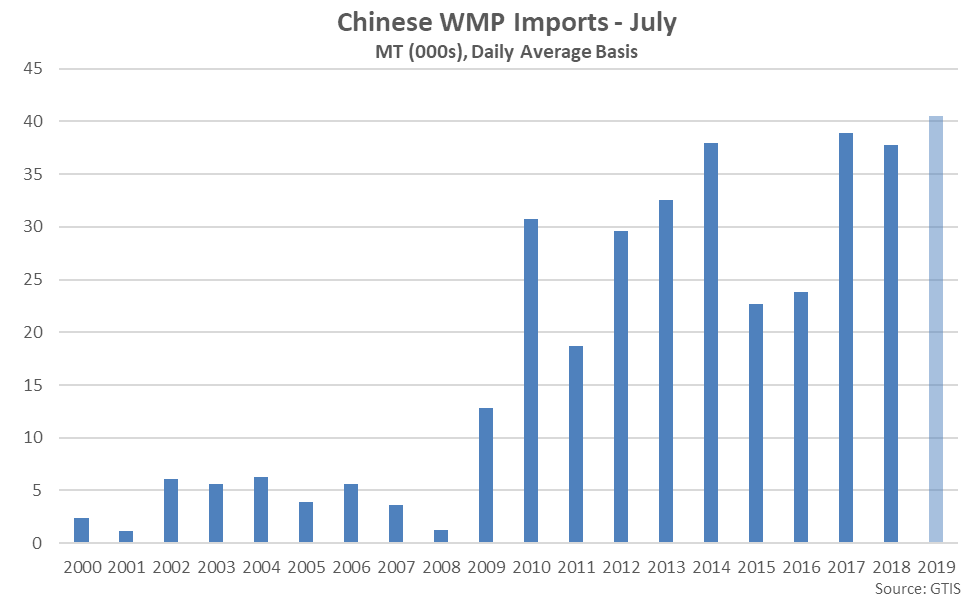

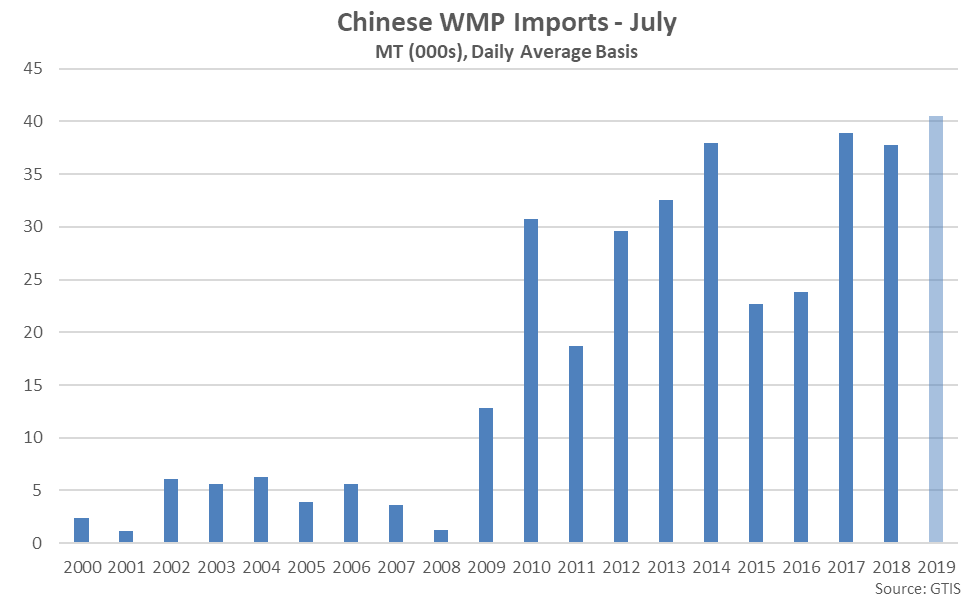

Jul ’19 Chinese WMP Imports Reached a Record High Seasonal Level

Jul ’19 Chinese WMP Imports Reached a Record High Seasonal Level

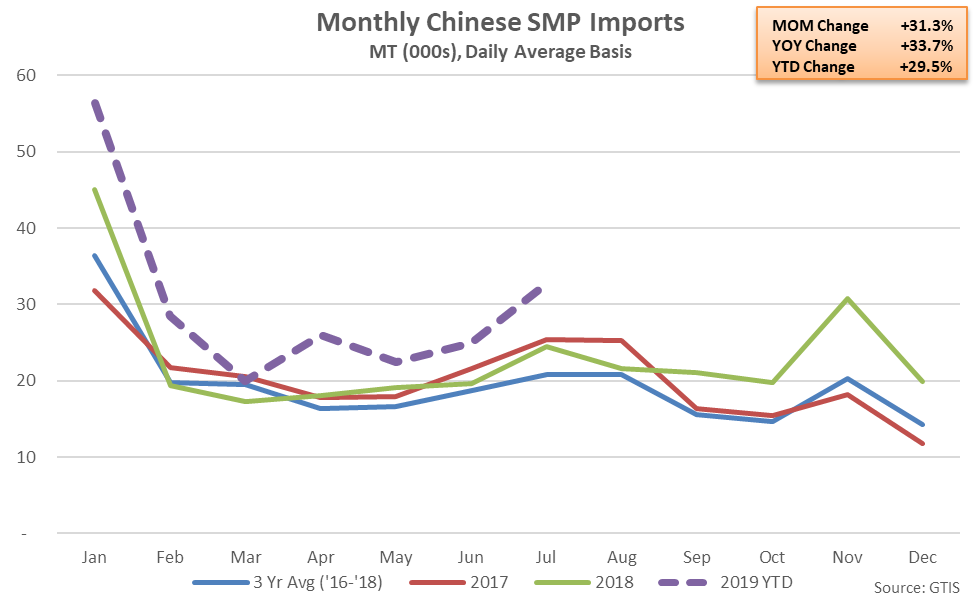

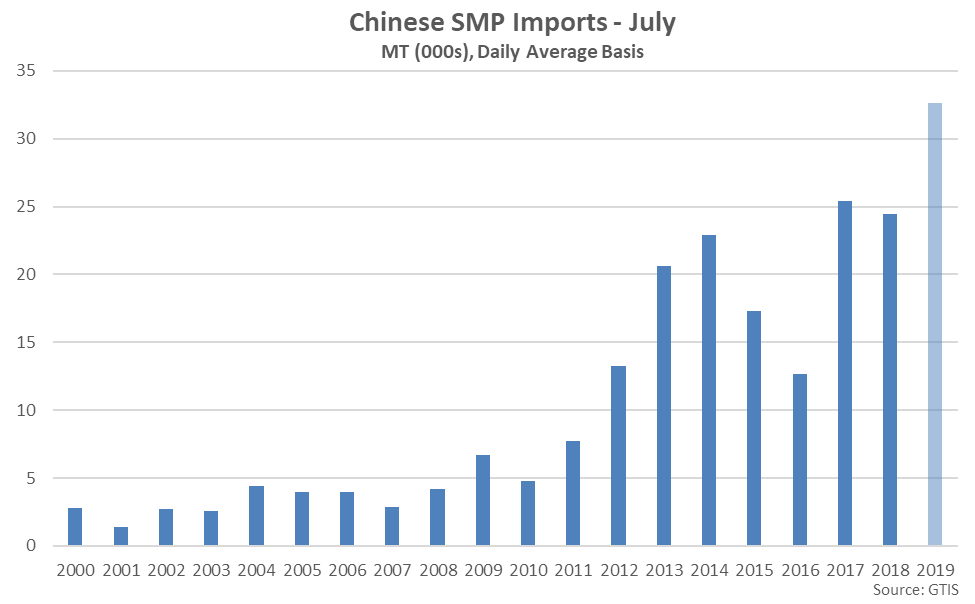

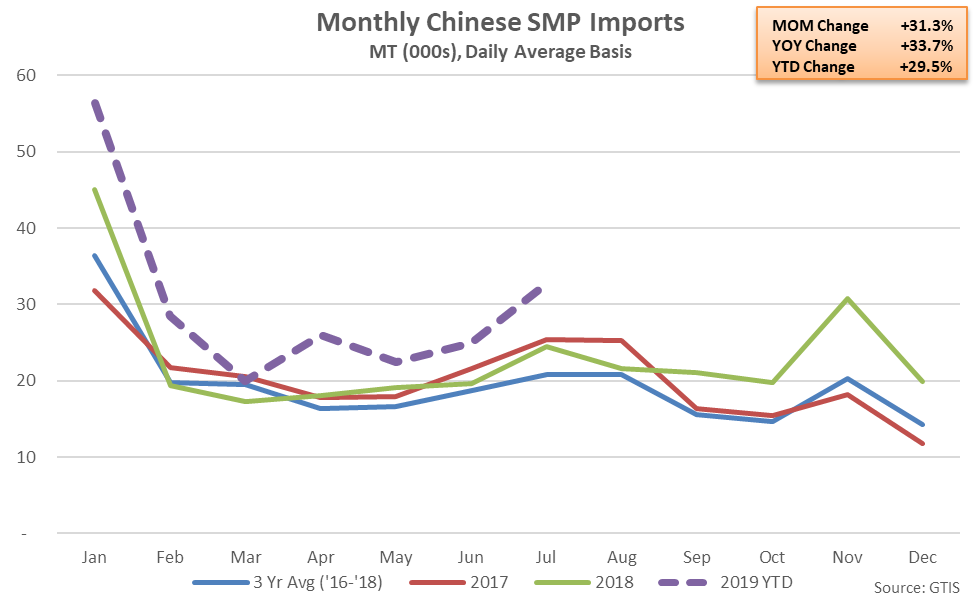

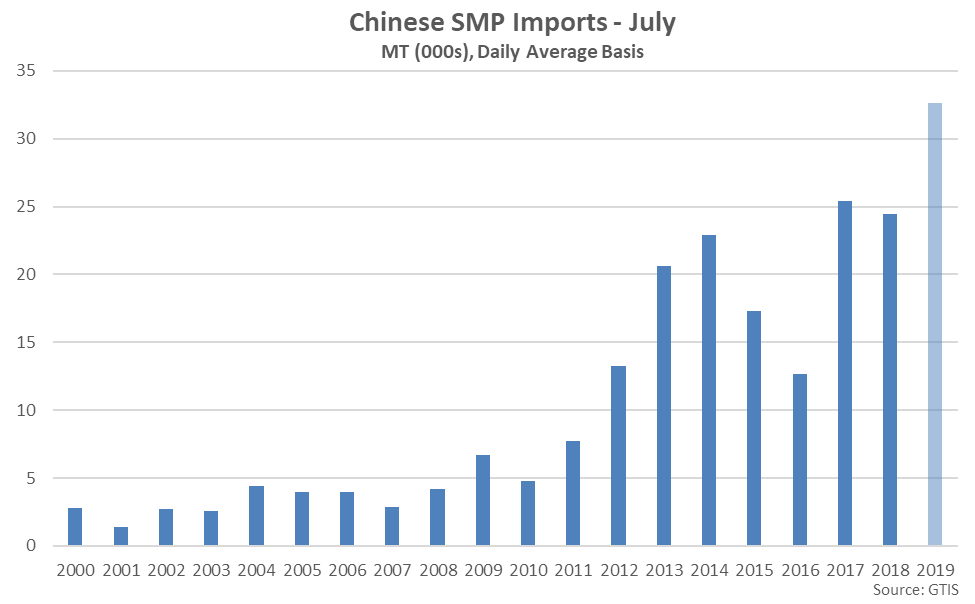

Jul ’19 Chinese SMP Import Volumes Increased 31.3% MOM and 33.7% YOY

Jul ’19 Chinese SMP Import Volumes Increased 31.3% MOM and 33.7% YOY

Jul ’19 Chinese SMP Imports Reached a Record High Seasonal Level

Jul ’19 Chinese SMP Imports Reached a Record High Seasonal Level

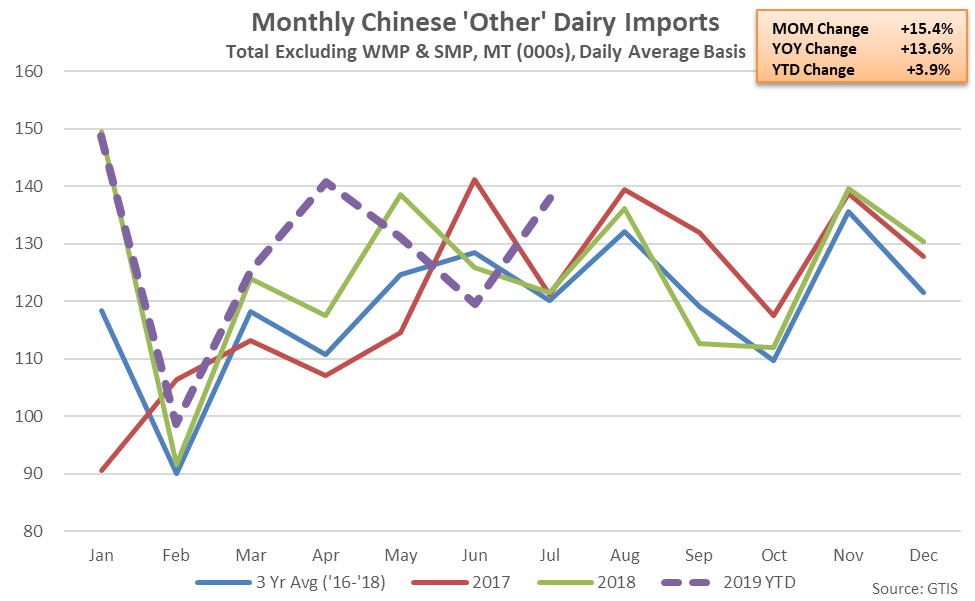

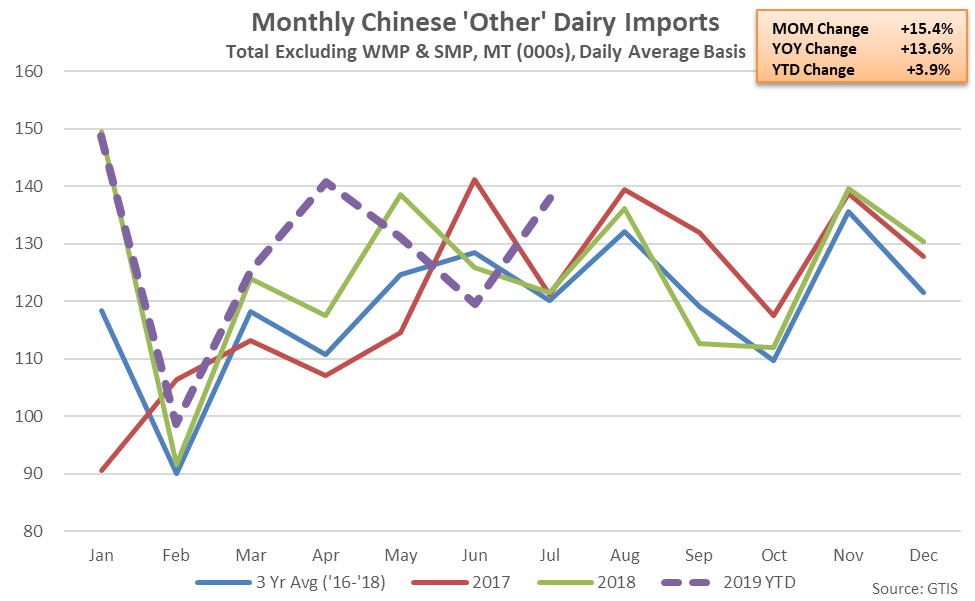

Jul ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 15.4% MOM and 13.6% YOY

Jul ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 15.4% MOM and 13.6% YOY

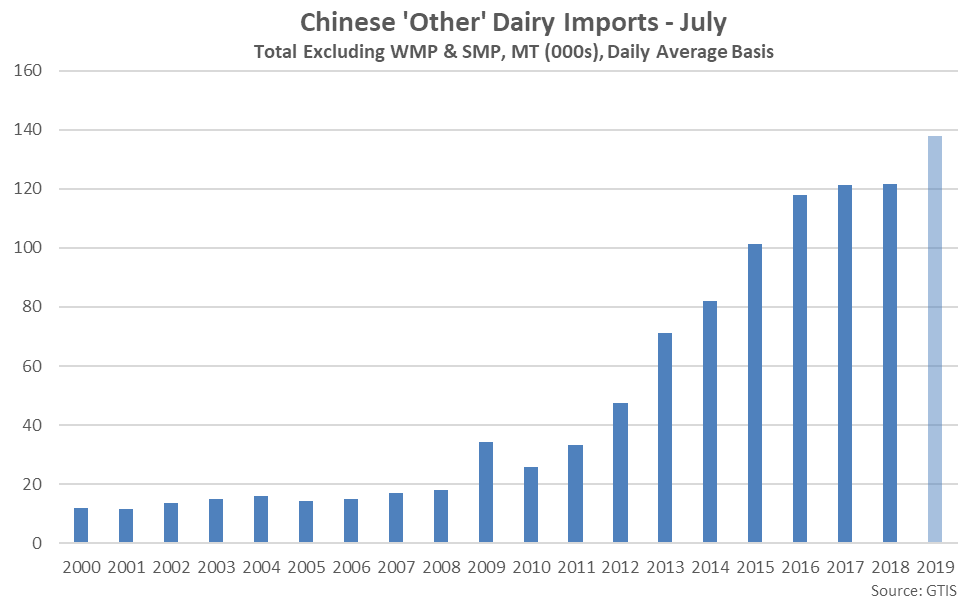

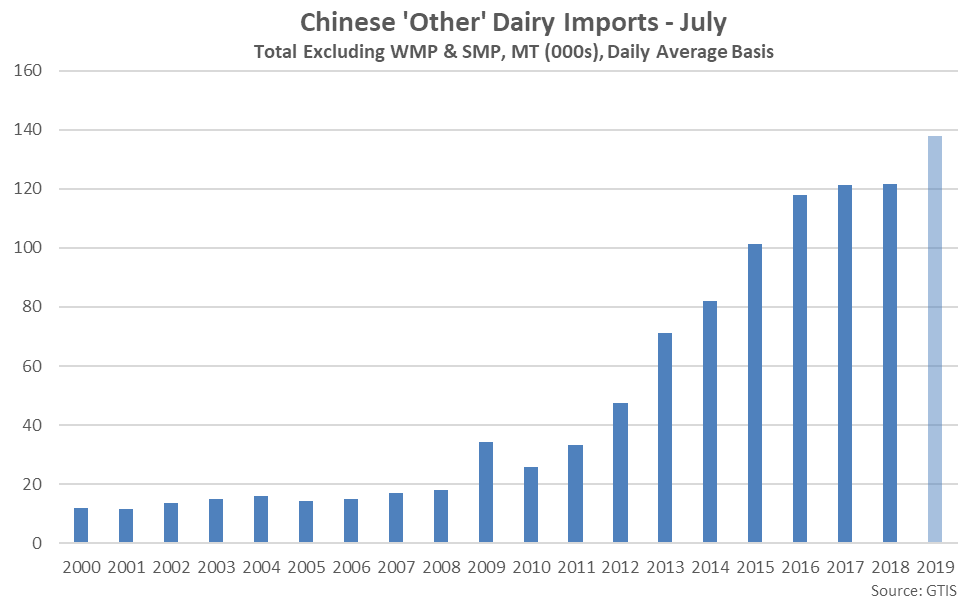

Jul ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Jul ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

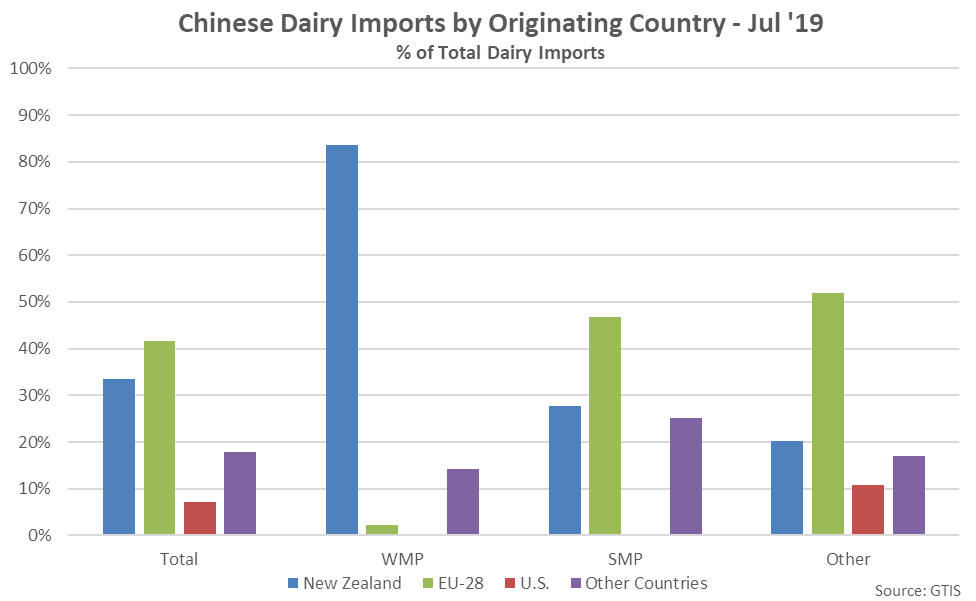

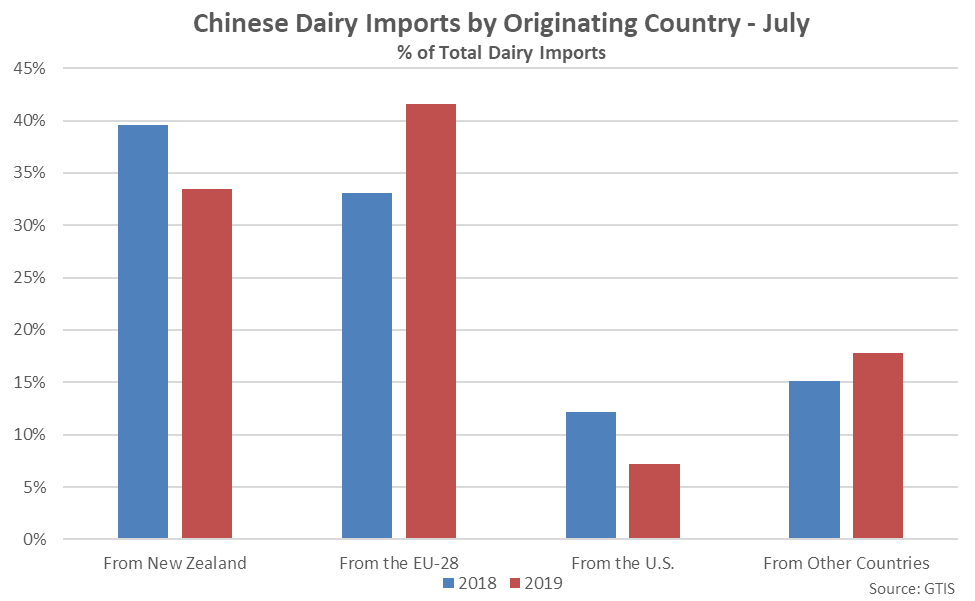

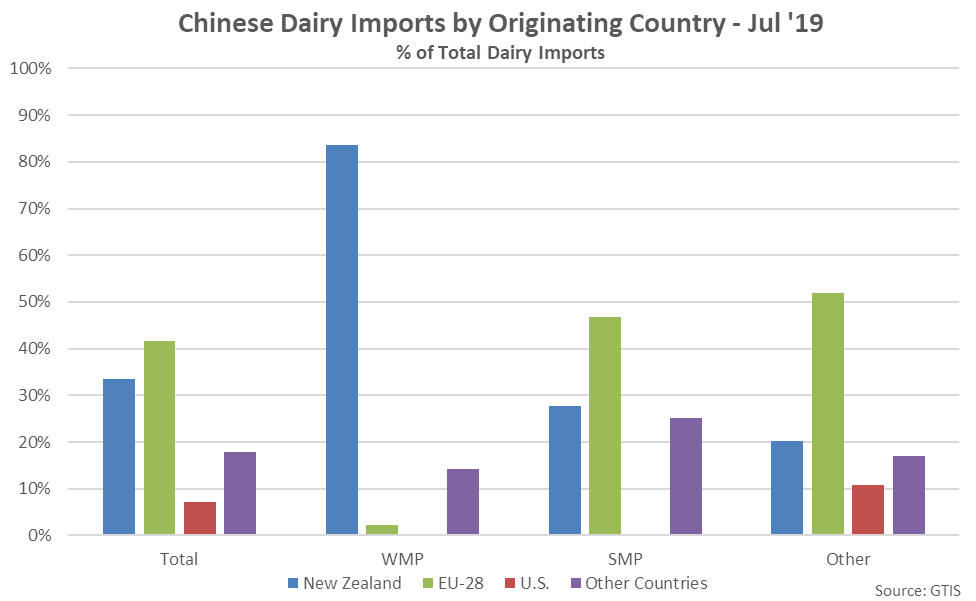

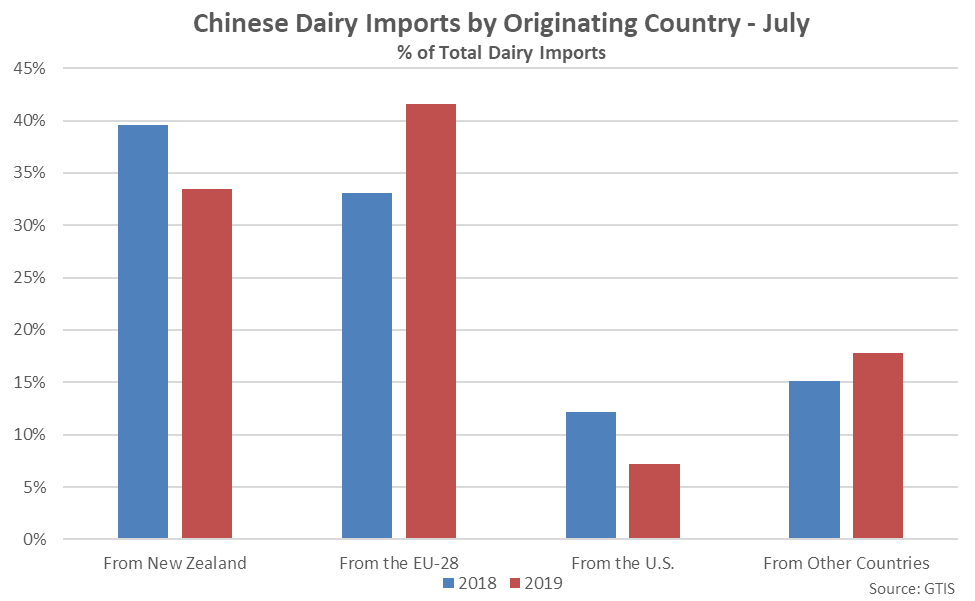

New Zealand and the EU-28 Each Accounted for Over a Third of all Jul ’19 Chinese Imports

New Zealand and the EU-28 Each Accounted for Over a Third of all Jul ’19 Chinese Imports

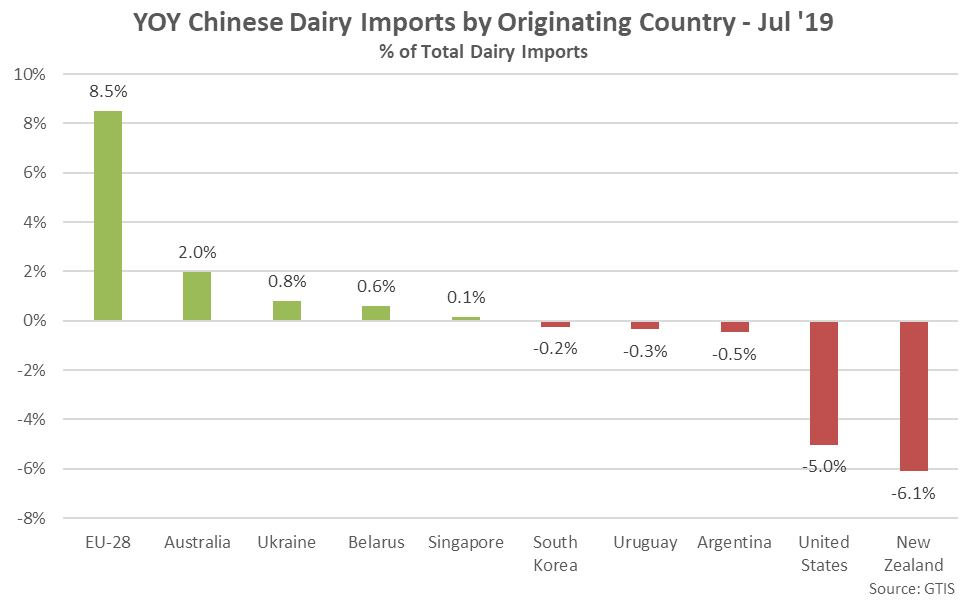

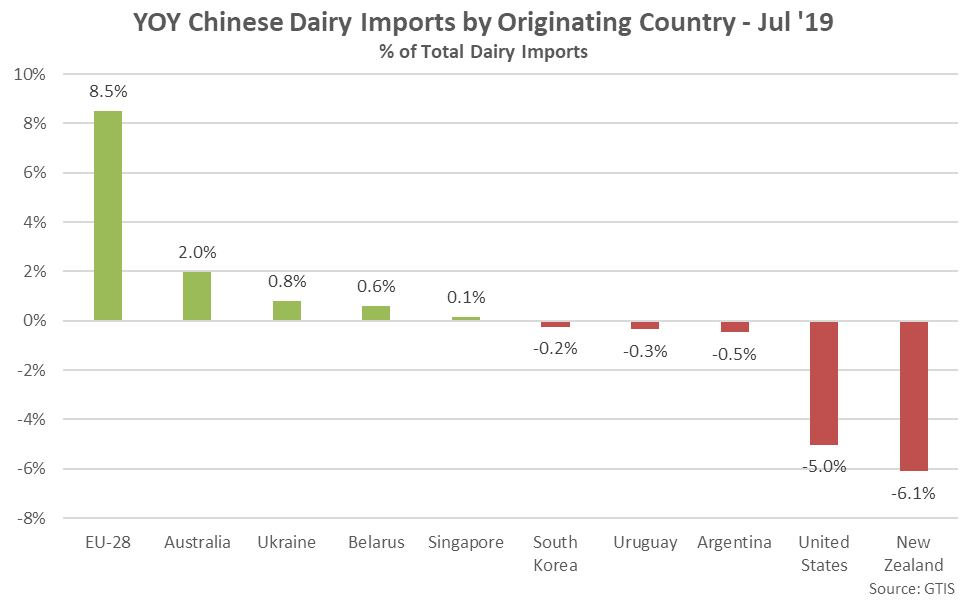

Jul ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined Significantly YOY

Jul ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined Significantly YOY

Jul ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Jul ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

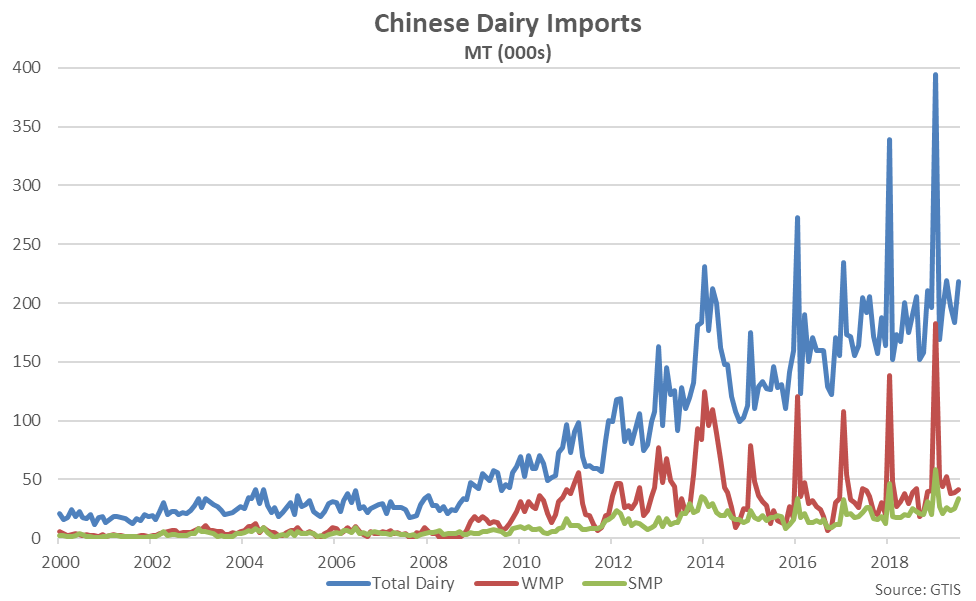

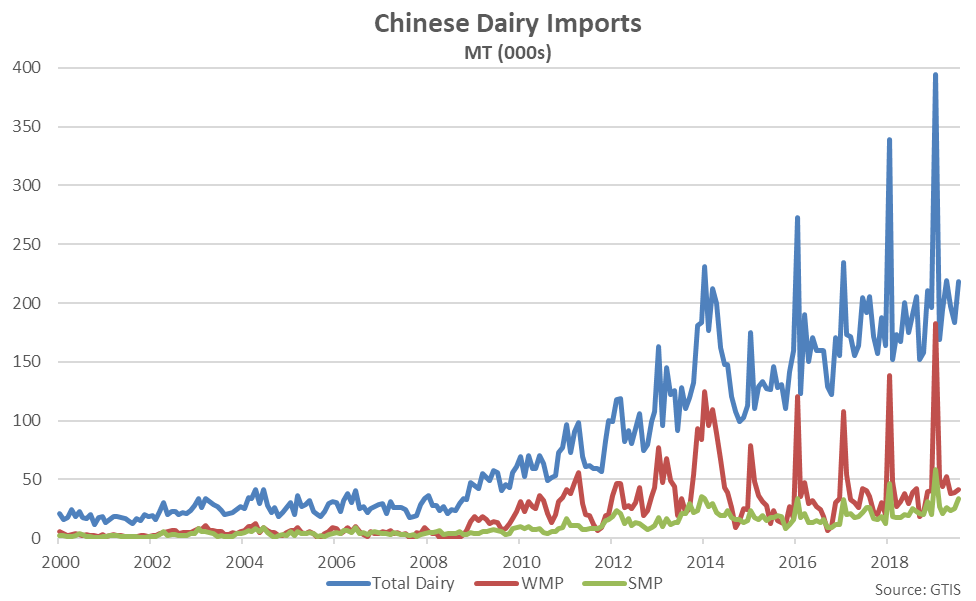

- Jul ’19 Chinese dairy import volumes increased on a YOY basis for the ninth time in the past ten months, finishing up 14.9% to a record high seasonal level for the month of July.

- Jul ’19 Chinese whole milk powder and skim milk powder imports remained higher on a YOY basis throughout the month, increasing 7.1% and 33.7% YOY, respectively and each reaching record high seasonal levels. Jul ’19 Chinese dairy imports excluding whole milk powder and skim milk powder increased 13.6% YOY, also reaching a record high seasonal level.

- Jul ’19 Chinese dairy imports originating from within the EU-28 continued to gain market share from the previous year, while the New Zealand and U.S. market shares finished below previous year levels.

Jul ’19 Chinese Dairy Import Volumes Increased 15.2% MOM and 14.9% YOY

Jul ’19 Chinese Dairy Import Volumes Increased 15.2% MOM and 14.9% YOY

Jul ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Jul ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Jul ’19 Chinese WMP Import Volumes Increased 4.2% MOM and 7.1% YOY

Jul ’19 Chinese WMP Import Volumes Increased 4.2% MOM and 7.1% YOY

Jul ’19 Chinese WMP Imports Reached a Record High Seasonal Level

Jul ’19 Chinese WMP Imports Reached a Record High Seasonal Level

Jul ’19 Chinese SMP Import Volumes Increased 31.3% MOM and 33.7% YOY

Jul ’19 Chinese SMP Import Volumes Increased 31.3% MOM and 33.7% YOY

Jul ’19 Chinese SMP Imports Reached a Record High Seasonal Level

Jul ’19 Chinese SMP Imports Reached a Record High Seasonal Level

Jul ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 15.4% MOM and 13.6% YOY

Jul ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 15.4% MOM and 13.6% YOY

Jul ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Jul ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

New Zealand and the EU-28 Each Accounted for Over a Third of all Jul ’19 Chinese Imports

New Zealand and the EU-28 Each Accounted for Over a Third of all Jul ’19 Chinese Imports

Jul ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined Significantly YOY

Jul ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined Significantly YOY

Jul ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Jul ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY