Grain & Oilseeds WASDE Update – Aug ’19

Corn – U.S. and Global Ending Stocks Significantly Above Private Estimates

Corn – U.S. and Global Ending Stocks Significantly Above Private Estimates

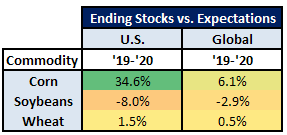

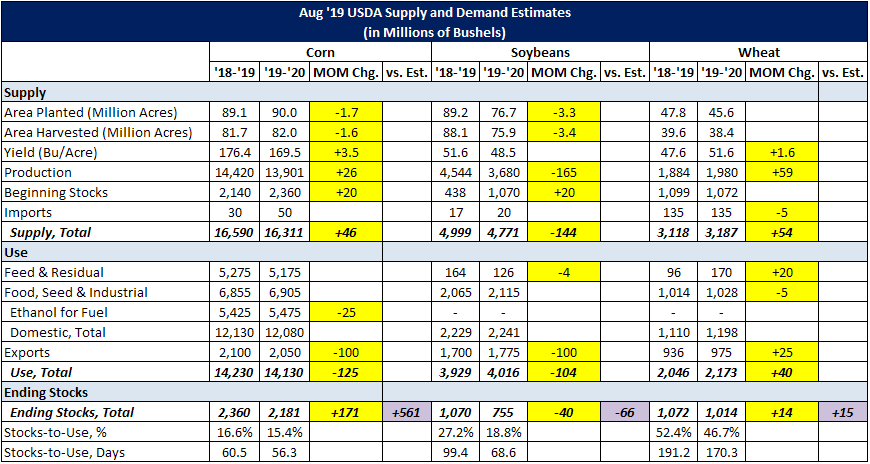

- ’19-’20 U.S. ending stocks of 2.181 billion bushels significantly above expectations

- ’19-’20 global ending stocks of 307.7 million MT significantly above expectations

- ’19-’20 U.S. ending stocks of 755 million bushels significantly below expectations

- ’19-’20 global ending stocks of 101.7 million MT below expectations

- ’19-’20 U.S. ending stocks of 1.014 billion bushels above expectations

- ’19-’20 global ending stocks of 285.4 million MT slightly above expectations