EU-28 Intervention Stocks Update – Feb ’17

Executive Summary

Market tools including private storage aid and intervention schemes have been made available to European dairy producers and processors since the announcement of the Russian dairy import ban in Sep ’14. Stocks have remained above seasonal levels as excess production continues to be stored away throughout the first three quarters of the ’16-’17 production season. Highlights through the end of 2016 include:

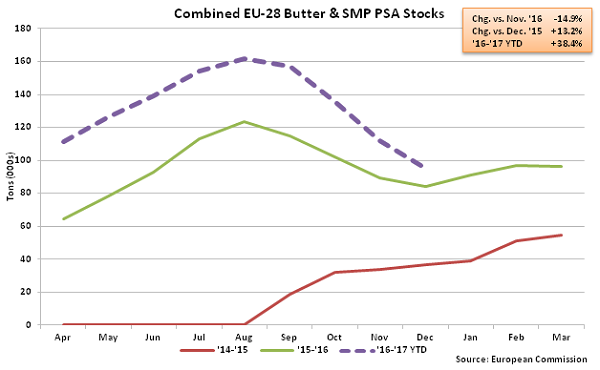

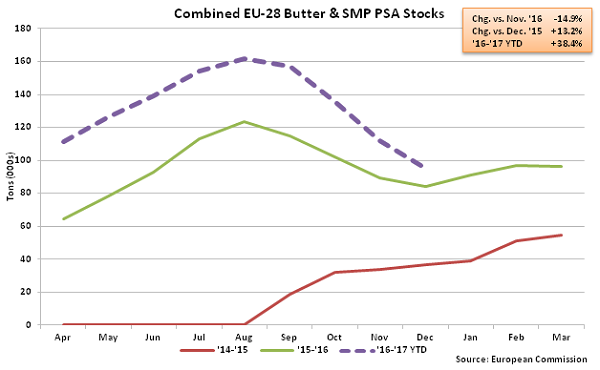

Butter stocks within PSA finished at 27,000 tons during Dec ’16, reaching a 23 month low. Butter PSA stocks peaked at 102,000 tons during Jul ’16. SMP stocks within PSA of 68,000 tons declined for the third consecutive month during Dec ’16, finishing 7,000 tons below the record high volumes experienced during Sep ’16. PSA for SMP is set to close at the end of Feb ’16, however the European Commission has stated it will continue to monitor the markets and will re-open PSA schemes if the markets require it.

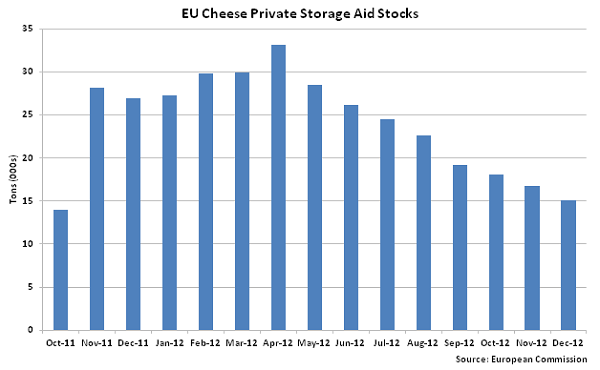

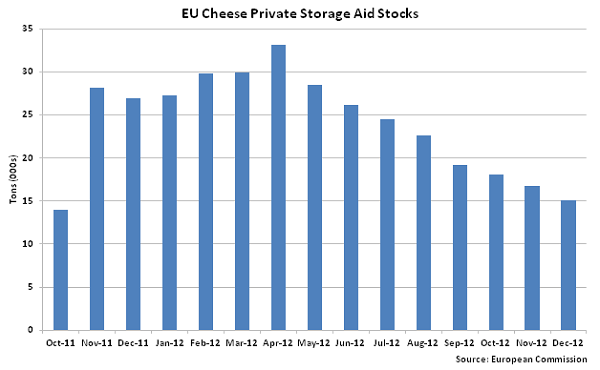

In addition to butter and SMP, PSA for cheese was reopened during Oct ’15, allowing a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. Since opening, EU-28 PSA cheese stocks have not exceeded 33,000 tons. Cheese volumes in storage have declined over eight consecutive months, reaching a 14 month low of approximately 15,000 tons during Dec ’16.PSA for cheese has been closed since the end of Sep ’16.

Butter stocks within PSA finished at 27,000 tons during Dec ’16, reaching a 23 month low. Butter PSA stocks peaked at 102,000 tons during Jul ’16. SMP stocks within PSA of 68,000 tons declined for the third consecutive month during Dec ’16, finishing 7,000 tons below the record high volumes experienced during Sep ’16. PSA for SMP is set to close at the end of Feb ’16, however the European Commission has stated it will continue to monitor the markets and will re-open PSA schemes if the markets require it.

In addition to butter and SMP, PSA for cheese was reopened during Oct ’15, allowing a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. Since opening, EU-28 PSA cheese stocks have not exceeded 33,000 tons. Cheese volumes in storage have declined over eight consecutive months, reaching a 14 month low of approximately 15,000 tons during Dec ’16.PSA for cheese has been closed since the end of Sep ’16.

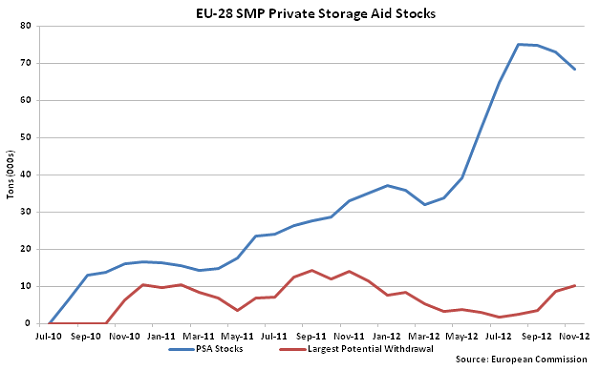

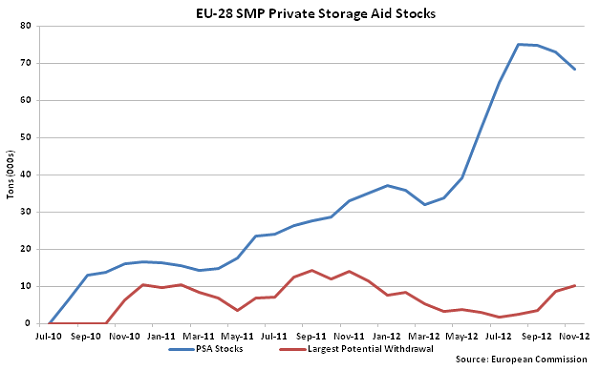

SMP can be stored for between 90 – 210 days or for 365 days within the PSA scheme. Because of the agreed upon storage durations, not all product stored within PSA is available to be withdrawn immediately without penalty. Without incurring a penalty, the largest potential withdrawal in EU-28 SMP PSA is approximately 10,000 MT, or 14.9% of total SMP volumes within PSA as of Dec ’16. Considerably less SMP is available for withdrawal due to the implementation of the 365 day storage program announced during Oct ’15. The 365 day storage program provides a higher rate of aid in exchange for keeping the product off of the market for a longer duration. Over 54,000 MT of SMP has been offered into the 365 day storage program since it was initiated.

SMP can be stored for between 90 – 210 days or for 365 days within the PSA scheme. Because of the agreed upon storage durations, not all product stored within PSA is available to be withdrawn immediately without penalty. Without incurring a penalty, the largest potential withdrawal in EU-28 SMP PSA is approximately 10,000 MT, or 14.9% of total SMP volumes within PSA as of Dec ’16. Considerably less SMP is available for withdrawal due to the implementation of the 365 day storage program announced during Oct ’15. The 365 day storage program provides a higher rate of aid in exchange for keeping the product off of the market for a longer duration. Over 54,000 MT of SMP has been offered into the 365 day storage program since it was initiated.

Intervention Schemes

Intervention schemes, involving selling quantities of products into government owned storage to help stabilize prices, have also been made available to EU-28 dairy producers. Intervention schemes are similar to PSA, as both help to stabilize markets by removing excess supply when prices decline. This can be temporary, where the product is later re-released for sale within the EU, or permanent, where the product is eventually exported from the EU.

Under intervention schemes, the European Commission purchases up to a designated volume of butter and SMP and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year, although the 2016 intervention scheme for SMP was extended until the end of Dec ’16 due to adverse market conditions. Similarly to PSA, the intervention scheme for butter closed at the end of Sep ’16, however a new SMP intervention campaign was opened at the beginning Jan ’17, set to run through the end of Sep ’17.

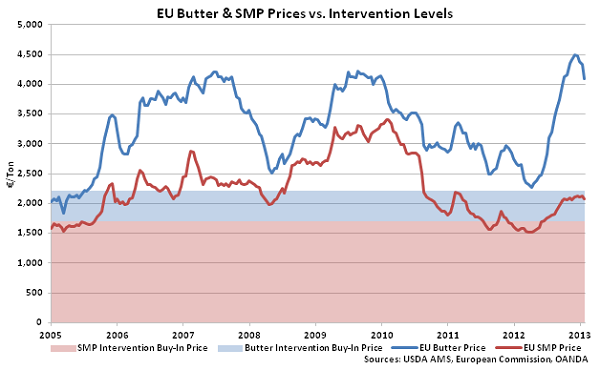

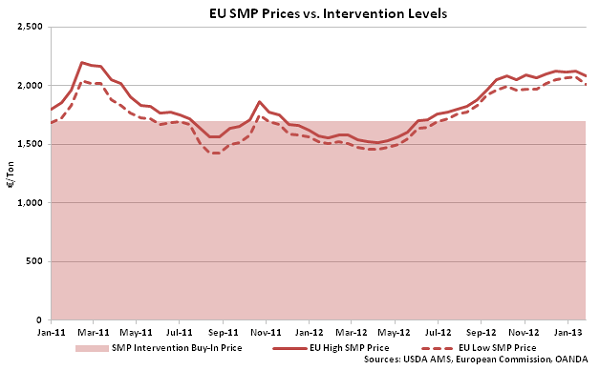

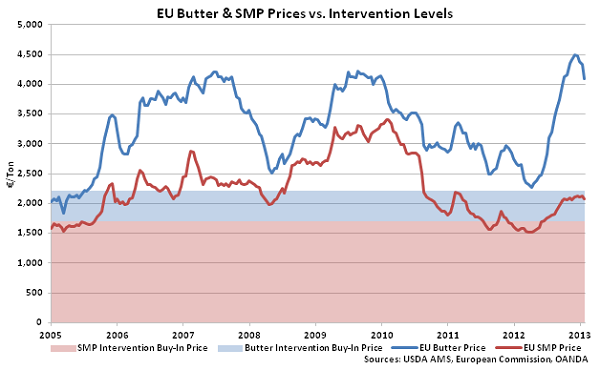

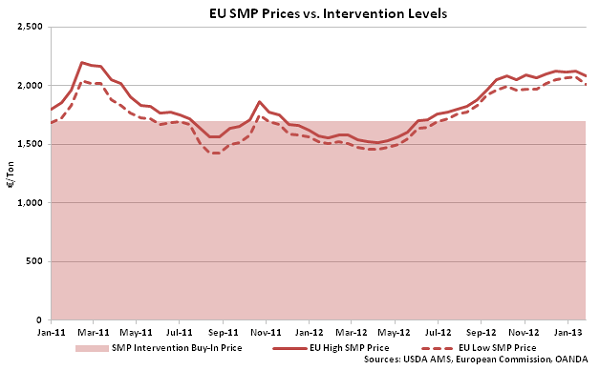

The trigger price for butter intervention is €2,218/ton ($1.12/lb equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price is set at €1,698/ton ($0.86/lb equivalent using a 0.90 USD/EUR exchange rate). As of the first week of Feb ’17, average European butter prices were 84.2% above the intervention trigger price while average SMP prices were 22.7% above the intervention trigger price.

Intervention Schemes

Intervention schemes, involving selling quantities of products into government owned storage to help stabilize prices, have also been made available to EU-28 dairy producers. Intervention schemes are similar to PSA, as both help to stabilize markets by removing excess supply when prices decline. This can be temporary, where the product is later re-released for sale within the EU, or permanent, where the product is eventually exported from the EU.

Under intervention schemes, the European Commission purchases up to a designated volume of butter and SMP and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year, although the 2016 intervention scheme for SMP was extended until the end of Dec ’16 due to adverse market conditions. Similarly to PSA, the intervention scheme for butter closed at the end of Sep ’16, however a new SMP intervention campaign was opened at the beginning Jan ’17, set to run through the end of Sep ’17.

The trigger price for butter intervention is €2,218/ton ($1.12/lb equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price is set at €1,698/ton ($0.86/lb equivalent using a 0.90 USD/EUR exchange rate). As of the first week of Feb ’17, average European butter prices were 84.2% above the intervention trigger price while average SMP prices were 22.7% above the intervention trigger price.

EU-28 butter prices approached intervention trigger price levels during Apr ’16 but have since rebounded by nearly 70%. SMP prices declined below intervention trigger prices over the first half of 2016 however prices have rebounded to above intervention trigger price levels since the beginning of Aug ’16.

EU-28 butter prices approached intervention trigger price levels during Apr ’16 but have since rebounded by nearly 70%. SMP prices declined below intervention trigger prices over the first half of 2016 however prices have rebounded to above intervention trigger price levels since the beginning of Aug ’16.

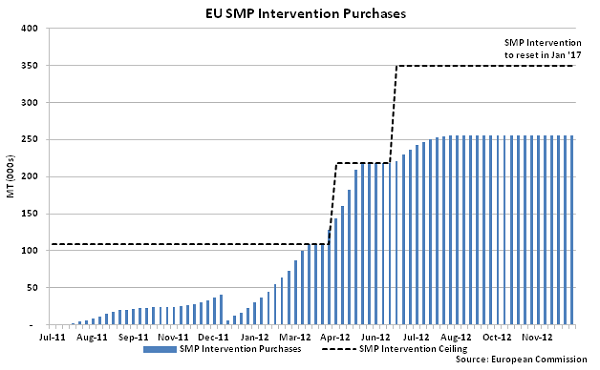

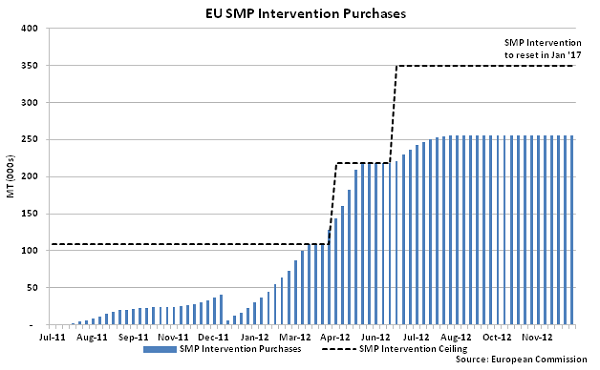

EU-28 SMP offered into intervention has risen dramatically since the beginning of 2016 as prices remained below the intervention buy-in trigger price over much of the year. The intervention schemes originally allowed for up to 60,000 tons of butter and 109,000 tons of SMP to be brought at the designated intervention prices. After the SMP intervention limit was reached in Apr ’16, the European Commission raised the volume ceiling for the 2016 campaign to 218,000 tons, citing ongoing market difficulties. The 218,000 capacity was reached by Jun ’16, when the ceiling was again raised, this time to 350,000 tons of SMP.

EU-28 SMP offered into intervention has risen dramatically since the beginning of 2016 as prices remained below the intervention buy-in trigger price over much of the year. The intervention schemes originally allowed for up to 60,000 tons of butter and 109,000 tons of SMP to be brought at the designated intervention prices. After the SMP intervention limit was reached in Apr ’16, the European Commission raised the volume ceiling for the 2016 campaign to 218,000 tons, citing ongoing market difficulties. The 218,000 capacity was reached by Jun ’16, when the ceiling was again raised, this time to 350,000 tons of SMP.

SMP intervention purchases have recently approached the 25 year high of 260,000 tons experienced during 2009. Current volumes of 256,000 tons are in addition to 78,000 tons of SMP bought in via tender during Apr ’16 and Jun ’16 when offers exceeded the previous ceiling levels. The European Commission began to offer SMP intervention stocks up for sale during Dec ’16 via a tendering process. Over 21,000 tons of SMP were put up for sale, however just 0.2% of the product sold. Three additional tendering processes have taken place since, with no product selling. Bids have been rejected as they were too far from the prevailing market prices.

SMP intervention purchases have recently approached the 25 year high of 260,000 tons experienced during 2009. Current volumes of 256,000 tons are in addition to 78,000 tons of SMP bought in via tender during Apr ’16 and Jun ’16 when offers exceeded the previous ceiling levels. The European Commission began to offer SMP intervention stocks up for sale during Dec ’16 via a tendering process. Over 21,000 tons of SMP were put up for sale, however just 0.2% of the product sold. Three additional tendering processes have taken place since, with no product selling. Bids have been rejected as they were too far from the prevailing market prices.

- EU private storage aid stocks of butter and skim milk powder finished higher on a YOY basis for the 25th consecutive month during Dec ’16. Combined butter and skim milk powder private storage aid stocks of 95,000 tons finished at an 11 month low on an absolute basis, however. In addition, cheese private storage aid stocks have declined throughout eight consecutive months, reaching a 14 month low of 15,000 tons during Dec ’16.

- Private storage aid schemes for butter and cheese were closed at the end of Sep ’16, contributing to recent declines in stocks, while skim milk powder private storage aid will close at the end of Feb ’17.The European Commission has stated it will continue to monitor the markets and will re-open private storage aid schemes if the markets require it.

- Similarly to private storage aid, the intervention scheme for butter closed at the end of Sep ’16 however a new SMP intervention scheme was opened at the beginning of Jan ’17, set to run through the end of Sep ’17. The European Commission began to offer SMP intervention stocks up for sale during Dec ’16 via a tendering process. Over 21,000 tons of SMP were put up for sale, however just 0.2% of the product sold. Three additional tending processes have taken place since, with no product selling. Bids have been rejected as they were too far from the prevailing market prices.

Butter stocks within PSA finished at 27,000 tons during Dec ’16, reaching a 23 month low. Butter PSA stocks peaked at 102,000 tons during Jul ’16. SMP stocks within PSA of 68,000 tons declined for the third consecutive month during Dec ’16, finishing 7,000 tons below the record high volumes experienced during Sep ’16. PSA for SMP is set to close at the end of Feb ’16, however the European Commission has stated it will continue to monitor the markets and will re-open PSA schemes if the markets require it.

In addition to butter and SMP, PSA for cheese was reopened during Oct ’15, allowing a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. Since opening, EU-28 PSA cheese stocks have not exceeded 33,000 tons. Cheese volumes in storage have declined over eight consecutive months, reaching a 14 month low of approximately 15,000 tons during Dec ’16.PSA for cheese has been closed since the end of Sep ’16.

Butter stocks within PSA finished at 27,000 tons during Dec ’16, reaching a 23 month low. Butter PSA stocks peaked at 102,000 tons during Jul ’16. SMP stocks within PSA of 68,000 tons declined for the third consecutive month during Dec ’16, finishing 7,000 tons below the record high volumes experienced during Sep ’16. PSA for SMP is set to close at the end of Feb ’16, however the European Commission has stated it will continue to monitor the markets and will re-open PSA schemes if the markets require it.

In addition to butter and SMP, PSA for cheese was reopened during Oct ’15, allowing a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. Since opening, EU-28 PSA cheese stocks have not exceeded 33,000 tons. Cheese volumes in storage have declined over eight consecutive months, reaching a 14 month low of approximately 15,000 tons during Dec ’16.PSA for cheese has been closed since the end of Sep ’16.

SMP can be stored for between 90 – 210 days or for 365 days within the PSA scheme. Because of the agreed upon storage durations, not all product stored within PSA is available to be withdrawn immediately without penalty. Without incurring a penalty, the largest potential withdrawal in EU-28 SMP PSA is approximately 10,000 MT, or 14.9% of total SMP volumes within PSA as of Dec ’16. Considerably less SMP is available for withdrawal due to the implementation of the 365 day storage program announced during Oct ’15. The 365 day storage program provides a higher rate of aid in exchange for keeping the product off of the market for a longer duration. Over 54,000 MT of SMP has been offered into the 365 day storage program since it was initiated.

SMP can be stored for between 90 – 210 days or for 365 days within the PSA scheme. Because of the agreed upon storage durations, not all product stored within PSA is available to be withdrawn immediately without penalty. Without incurring a penalty, the largest potential withdrawal in EU-28 SMP PSA is approximately 10,000 MT, or 14.9% of total SMP volumes within PSA as of Dec ’16. Considerably less SMP is available for withdrawal due to the implementation of the 365 day storage program announced during Oct ’15. The 365 day storage program provides a higher rate of aid in exchange for keeping the product off of the market for a longer duration. Over 54,000 MT of SMP has been offered into the 365 day storage program since it was initiated.

Intervention Schemes

Intervention schemes, involving selling quantities of products into government owned storage to help stabilize prices, have also been made available to EU-28 dairy producers. Intervention schemes are similar to PSA, as both help to stabilize markets by removing excess supply when prices decline. This can be temporary, where the product is later re-released for sale within the EU, or permanent, where the product is eventually exported from the EU.

Under intervention schemes, the European Commission purchases up to a designated volume of butter and SMP and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year, although the 2016 intervention scheme for SMP was extended until the end of Dec ’16 due to adverse market conditions. Similarly to PSA, the intervention scheme for butter closed at the end of Sep ’16, however a new SMP intervention campaign was opened at the beginning Jan ’17, set to run through the end of Sep ’17.

The trigger price for butter intervention is €2,218/ton ($1.12/lb equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price is set at €1,698/ton ($0.86/lb equivalent using a 0.90 USD/EUR exchange rate). As of the first week of Feb ’17, average European butter prices were 84.2% above the intervention trigger price while average SMP prices were 22.7% above the intervention trigger price.

Intervention Schemes

Intervention schemes, involving selling quantities of products into government owned storage to help stabilize prices, have also been made available to EU-28 dairy producers. Intervention schemes are similar to PSA, as both help to stabilize markets by removing excess supply when prices decline. This can be temporary, where the product is later re-released for sale within the EU, or permanent, where the product is eventually exported from the EU.

Under intervention schemes, the European Commission purchases up to a designated volume of butter and SMP and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year, although the 2016 intervention scheme for SMP was extended until the end of Dec ’16 due to adverse market conditions. Similarly to PSA, the intervention scheme for butter closed at the end of Sep ’16, however a new SMP intervention campaign was opened at the beginning Jan ’17, set to run through the end of Sep ’17.

The trigger price for butter intervention is €2,218/ton ($1.12/lb equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price is set at €1,698/ton ($0.86/lb equivalent using a 0.90 USD/EUR exchange rate). As of the first week of Feb ’17, average European butter prices were 84.2% above the intervention trigger price while average SMP prices were 22.7% above the intervention trigger price.

EU-28 butter prices approached intervention trigger price levels during Apr ’16 but have since rebounded by nearly 70%. SMP prices declined below intervention trigger prices over the first half of 2016 however prices have rebounded to above intervention trigger price levels since the beginning of Aug ’16.

EU-28 butter prices approached intervention trigger price levels during Apr ’16 but have since rebounded by nearly 70%. SMP prices declined below intervention trigger prices over the first half of 2016 however prices have rebounded to above intervention trigger price levels since the beginning of Aug ’16.

EU-28 SMP offered into intervention has risen dramatically since the beginning of 2016 as prices remained below the intervention buy-in trigger price over much of the year. The intervention schemes originally allowed for up to 60,000 tons of butter and 109,000 tons of SMP to be brought at the designated intervention prices. After the SMP intervention limit was reached in Apr ’16, the European Commission raised the volume ceiling for the 2016 campaign to 218,000 tons, citing ongoing market difficulties. The 218,000 capacity was reached by Jun ’16, when the ceiling was again raised, this time to 350,000 tons of SMP.

EU-28 SMP offered into intervention has risen dramatically since the beginning of 2016 as prices remained below the intervention buy-in trigger price over much of the year. The intervention schemes originally allowed for up to 60,000 tons of butter and 109,000 tons of SMP to be brought at the designated intervention prices. After the SMP intervention limit was reached in Apr ’16, the European Commission raised the volume ceiling for the 2016 campaign to 218,000 tons, citing ongoing market difficulties. The 218,000 capacity was reached by Jun ’16, when the ceiling was again raised, this time to 350,000 tons of SMP.

SMP intervention purchases have recently approached the 25 year high of 260,000 tons experienced during 2009. Current volumes of 256,000 tons are in addition to 78,000 tons of SMP bought in via tender during Apr ’16 and Jun ’16 when offers exceeded the previous ceiling levels. The European Commission began to offer SMP intervention stocks up for sale during Dec ’16 via a tendering process. Over 21,000 tons of SMP were put up for sale, however just 0.2% of the product sold. Three additional tendering processes have taken place since, with no product selling. Bids have been rejected as they were too far from the prevailing market prices.

SMP intervention purchases have recently approached the 25 year high of 260,000 tons experienced during 2009. Current volumes of 256,000 tons are in addition to 78,000 tons of SMP bought in via tender during Apr ’16 and Jun ’16 when offers exceeded the previous ceiling levels. The European Commission began to offer SMP intervention stocks up for sale during Dec ’16 via a tendering process. Over 21,000 tons of SMP were put up for sale, however just 0.2% of the product sold. Three additional tendering processes have taken place since, with no product selling. Bids have been rejected as they were too far from the prevailing market prices.