Chinese Dairy Imports Update – Sep ’16

Executive Summary

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Aug ’16. Highlights from the updated report include:

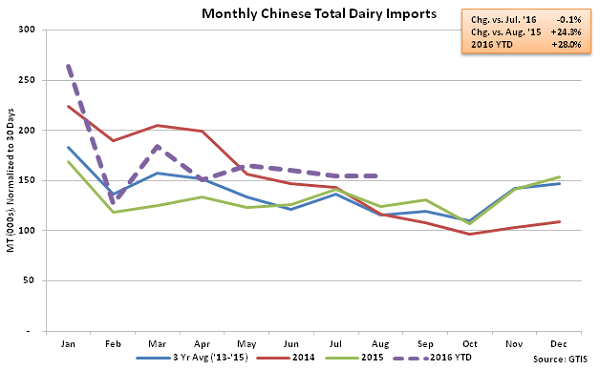

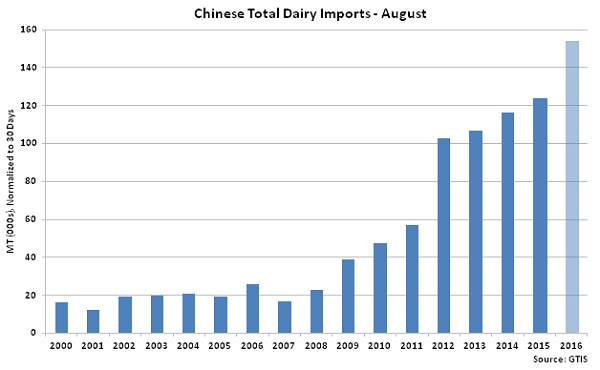

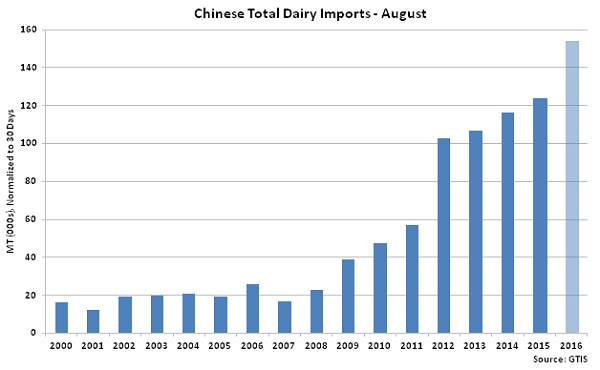

• Total Chinese dairy import volumes increased on a YOY basis for the 13th consecutive month during Aug ‘16, finishing up 24.3% to a new record high figure for the month of August.

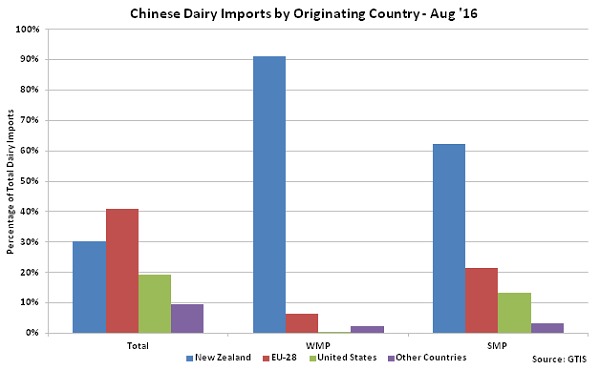

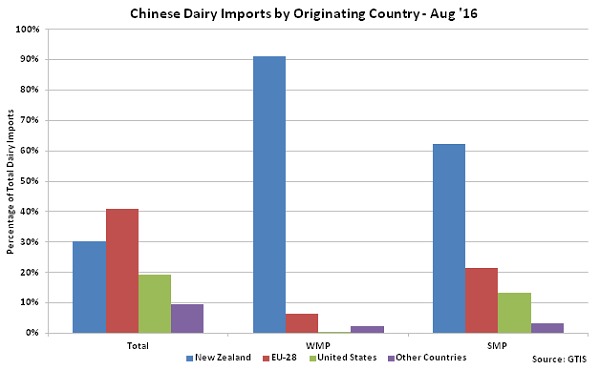

• Chinese dairy import volumes originating from within the EU-28 exceeded volumes originating from within New Zealand for the fifth consecutive month during Aug ’16, accounting for over 40% of total import volumes.

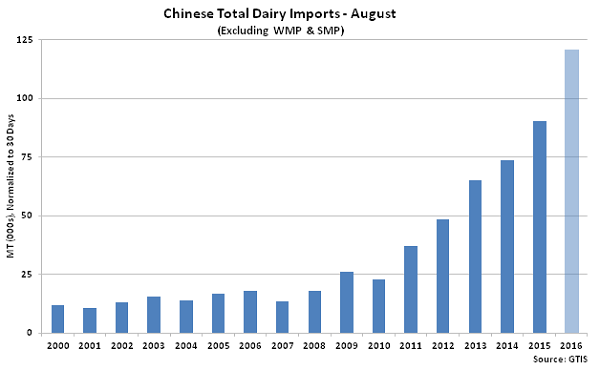

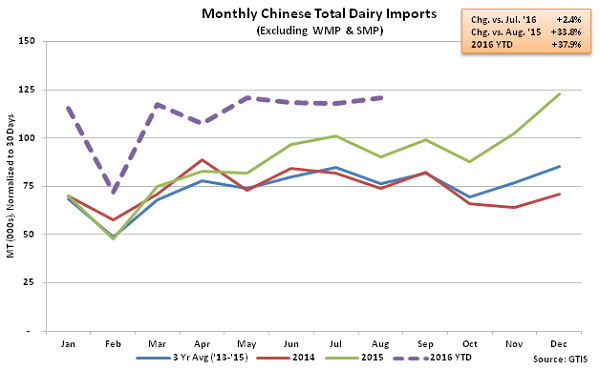

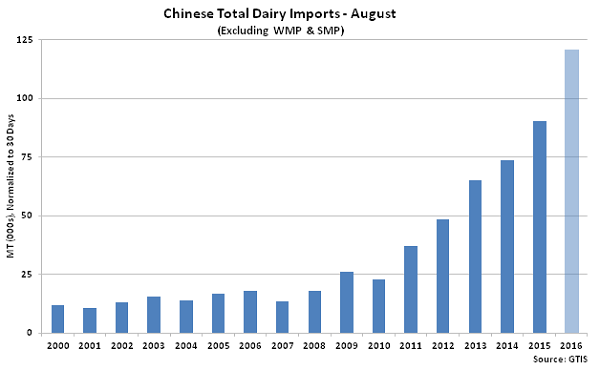

• Aug ’16 Chinese dairy imports excluding whole milk powder and skim milk powder remained strong, finishing up 33.8% YOY to a new record high for the month of August.

Additional Report Details

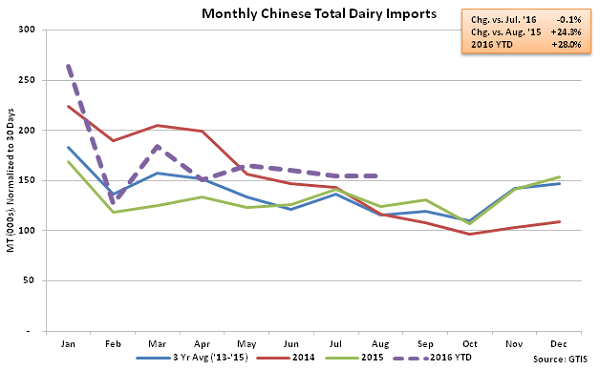

According to GTIS, Aug ’16 total Chinese dairy import volumes declined 0.1% MOM on a daily average basis but remained 24.3% higher YOY, finishing at a record high level for the month of August. Total Chinese dairy import volumes have increased YOY for 13 consecutive months through August. Import volumes originating from within the EU-28 continued to exceed volumes originating from within New Zealand for the fifth consecutive month during Aug ’16, accounting for over 40% of total import volumes.

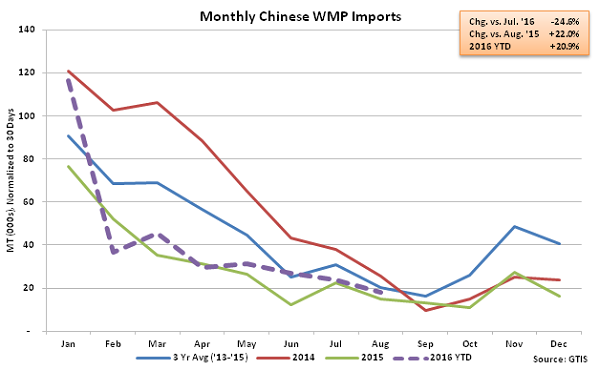

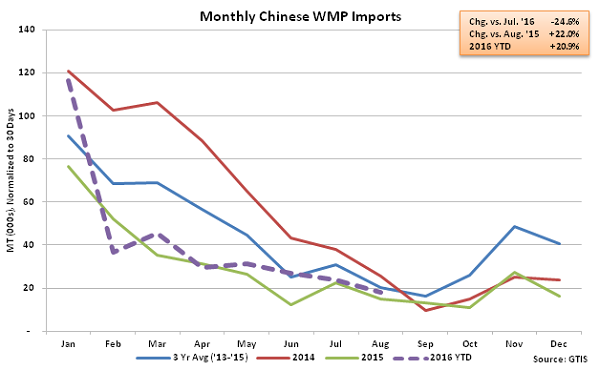

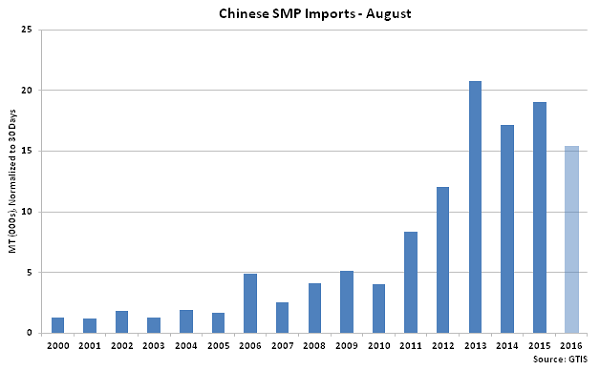

Aug ’16 Chinese whole milk powder (WMP) import volumes increased 22.0% YOY however skim milk powder (SMP) import volumes finished lower on a YOY basis for the fifth consecutive month, declining by 18.9%. Aug ’16 Chinese dairy imports excluding WMP and SMP remained particularly strong, increasing by 33.8% YOY and finishing at a new record high for the month of August.

Aug ’16 Total Chinese Dairy Import Volumes Remained Below the Jan ’16 Highs

Aug ’16 Total Chinese Dairy Import Volumes Declined 0.1% MOM but Finished up 24.3% YOY

Aug ’16 Total Chinese Dairy Import Volumes Declined 0.1% MOM but Finished up 24.3% YOY

Chinese Dairy Import Volumes Increased to a Record High for the Month of August

Chinese Dairy Import Volumes Increased to a Record High for the Month of August

Aug ’16 Chinese WMP Import Volumes Declined 24.6% MOM but Remained up 22.0% YOY

Aug ’16 Chinese WMP Import Volumes Declined 24.6% MOM but Remained up 22.0% YOY

Chinese WMP Imports Finished Near a Five Year Low for the Month of August

Chinese WMP Imports Finished Near a Five Year Low for the Month of August

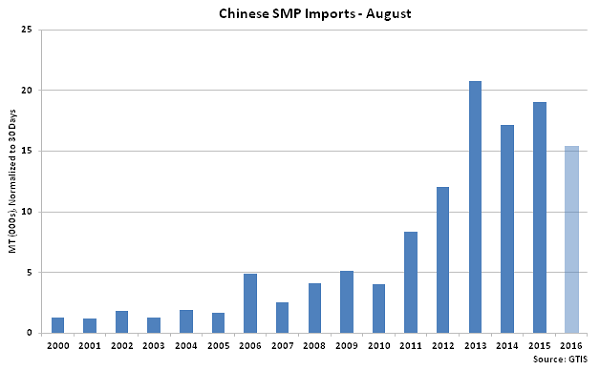

Aug ’16 Chinese SMP Import Volumes Increased 22.0% MOM but Finished 18.9% Lower YOY

Aug ’16 Chinese SMP Import Volumes Increased 22.0% MOM but Finished 18.9% Lower YOY

Chinese SMP Imports Finished at a Four Year Low for the Month of August

Chinese SMP Imports Finished at a Four Year Low for the Month of August

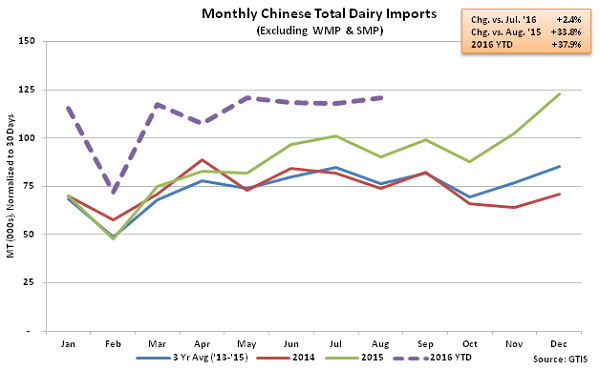

Aug ’16 Chinese Dairy Imports Excluding WMP & SMP Finished up 2.4% MOM and 33.8% YOY

Aug ’16 Chinese Dairy Imports Excluding WMP & SMP Finished up 2.4% MOM and 33.8% YOY

Chinese Dairy Imports Excluding WMP & SMP Finished at an August Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at an August Record High

The EU-28 Accounted for Over 40% of the Total Aug ’16 Chinese Dairy Import Volumes

The EU-28 Accounted for Over 40% of the Total Aug ’16 Chinese Dairy Import Volumes

Aug ’16 Total Chinese Dairy Import Volumes Declined 0.1% MOM but Finished up 24.3% YOY

Aug ’16 Total Chinese Dairy Import Volumes Declined 0.1% MOM but Finished up 24.3% YOY

Chinese Dairy Import Volumes Increased to a Record High for the Month of August

Chinese Dairy Import Volumes Increased to a Record High for the Month of August

Aug ’16 Chinese WMP Import Volumes Declined 24.6% MOM but Remained up 22.0% YOY

Aug ’16 Chinese WMP Import Volumes Declined 24.6% MOM but Remained up 22.0% YOY

Chinese WMP Imports Finished Near a Five Year Low for the Month of August

Chinese WMP Imports Finished Near a Five Year Low for the Month of August

Aug ’16 Chinese SMP Import Volumes Increased 22.0% MOM but Finished 18.9% Lower YOY

Aug ’16 Chinese SMP Import Volumes Increased 22.0% MOM but Finished 18.9% Lower YOY

Chinese SMP Imports Finished at a Four Year Low for the Month of August

Chinese SMP Imports Finished at a Four Year Low for the Month of August

Aug ’16 Chinese Dairy Imports Excluding WMP & SMP Finished up 2.4% MOM and 33.8% YOY

Aug ’16 Chinese Dairy Imports Excluding WMP & SMP Finished up 2.4% MOM and 33.8% YOY

Chinese Dairy Imports Excluding WMP & SMP Finished at an August Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at an August Record High

The EU-28 Accounted for Over 40% of the Total Aug ’16 Chinese Dairy Import Volumes

The EU-28 Accounted for Over 40% of the Total Aug ’16 Chinese Dairy Import Volumes