New Zealand Dairy Exports Update – Jan ’16

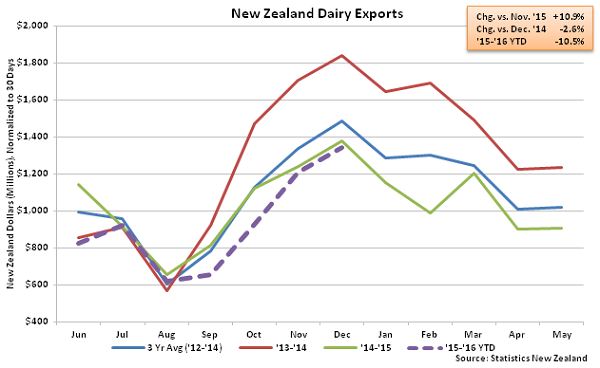

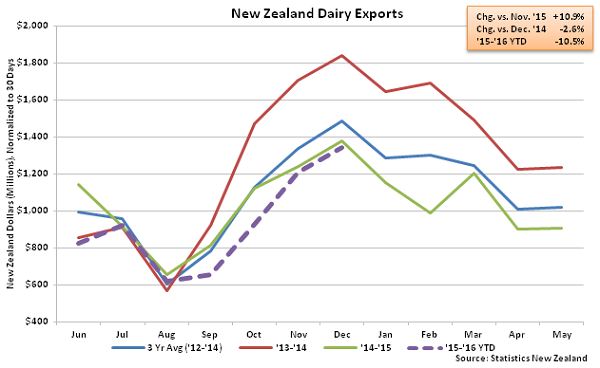

New Zealand dairy exports have been sluggish over recent months, declining on a YOY basis for the fifth consecutive month in Dec ’15 as global dairy demand remains weak. Overall, the total value of New Zealand dairy exports has declined 10.5% YTD over the first seven months of the ’15-’16 production season.

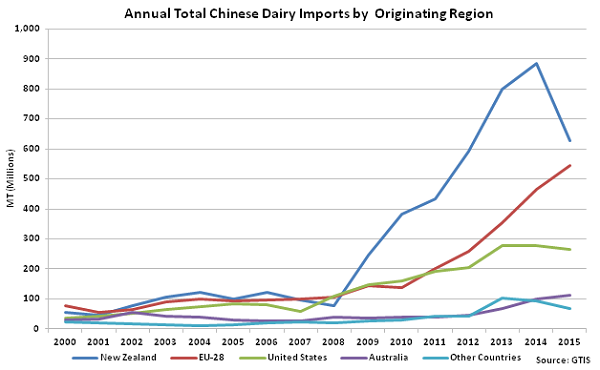

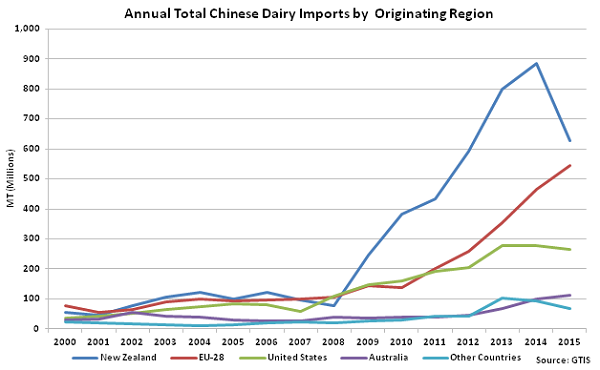

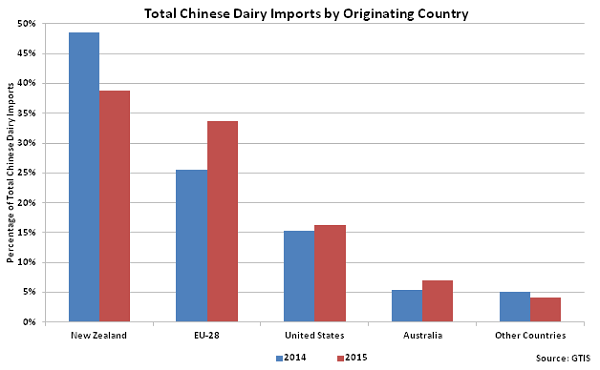

New Zealand dairy exports have weakened in large part due to a decline in demand from China. After increasing YOY to new annual record highs from 2009 – 2014, New Zealand dairy exports to China declined by nearly 30% YOY throughout 2015, finishing at a three year low. New Zealand continued to dominate the market share of Chinese whole milk powder (WMP) imports throughout 2015, accounting for over 95% of WMP imported to China, however increasing EU-28 imports into China have eroded the New Zealand market share of total Chinese dairy imports over recent years. EU-28 dairy export volumes destined to China increased to a new record high for the fifth consecutive year in 2015.

New Zealand dairy exports have weakened in large part due to a decline in demand from China. After increasing YOY to new annual record highs from 2009 – 2014, New Zealand dairy exports to China declined by nearly 30% YOY throughout 2015, finishing at a three year low. New Zealand continued to dominate the market share of Chinese whole milk powder (WMP) imports throughout 2015, accounting for over 95% of WMP imported to China, however increasing EU-28 imports into China have eroded the New Zealand market share of total Chinese dairy imports over recent years. EU-28 dairy export volumes destined to China increased to a new record high for the fifth consecutive year in 2015.

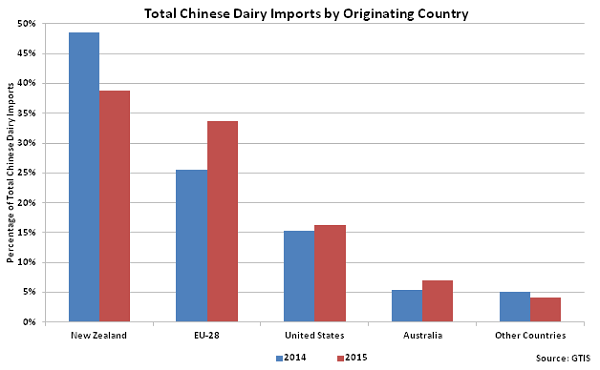

Overall, New Zealand finished 2015 with a 39% market share of Chinese dairy imports, down from a 49% market share in 2014. The decline in the New Zealand market share of Chinese dairy imports was almost exclusively captured by the EU-28, which finished 2015 with a 34% market share, up from 26% in 2014.

Overall, New Zealand finished 2015 with a 39% market share of Chinese dairy imports, down from a 49% market share in 2014. The decline in the New Zealand market share of Chinese dairy imports was almost exclusively captured by the EU-28, which finished 2015 with a 34% market share, up from 26% in 2014.

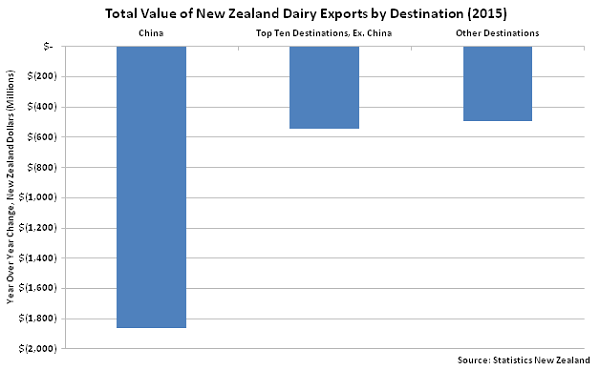

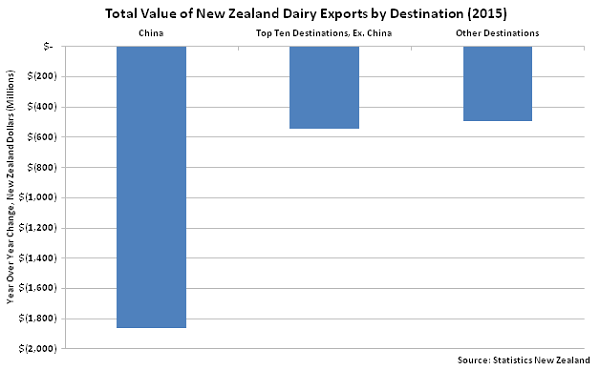

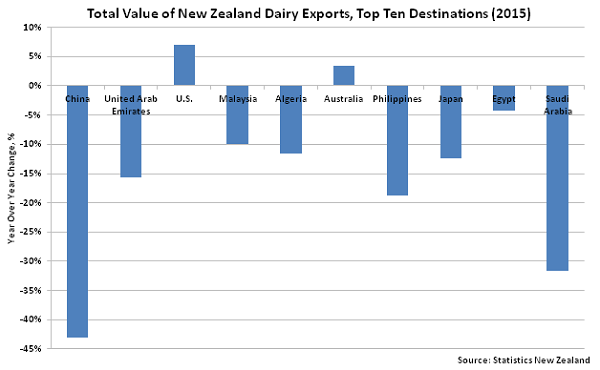

Dairy products destined to China accounted for slightly more than 20% of total New Zealand dairy exports during 2015, down from nearly 35% of total exports throughout 2013. A more diversified base of destinations for New Zealand dairy exports helps to mitigate the impact of weak Chinese dairy demand, however New Zealand dairy export volumes have also declined YOY in several other major importing countries.

Dairy products destined to China accounted for slightly more than 20% of total New Zealand dairy exports during 2015, down from nearly 35% of total exports throughout 2013. A more diversified base of destinations for New Zealand dairy exports helps to mitigate the impact of weak Chinese dairy demand, however New Zealand dairy export volumes have also declined YOY in several other major importing countries.

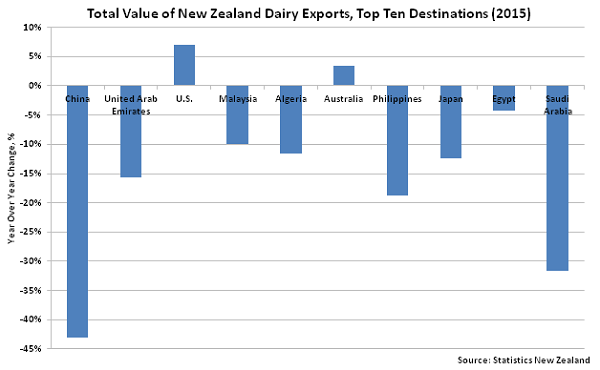

Of the top ten New Zealand dairy export destinations, only exports destined to the U.S. and Australia have increased YOY throughout 2015. Along with New Zealand and the EU-28, the U.S. and Australia are among the largest net exporters of dairy products, so demand for New Zealand dairy products within these markets is unlikely to persist.

Of the top ten New Zealand dairy export destinations, only exports destined to the U.S. and Australia have increased YOY throughout 2015. Along with New Zealand and the EU-28, the U.S. and Australia are among the largest net exporters of dairy products, so demand for New Zealand dairy products within these markets is unlikely to persist.

The total value of New Zealand dairy exports has also declined YOY in regions outside of New Zealand’s top ten importing destinations. The bulk of the YOY declines in New Zealand dairy exports remain due to reduced Chinese demand, however New Zealand dairy exports may continue to decline until global supply and demand return to balance.

The total value of New Zealand dairy exports has also declined YOY in regions outside of New Zealand’s top ten importing destinations. The bulk of the YOY declines in New Zealand dairy exports remain due to reduced Chinese demand, however New Zealand dairy exports may continue to decline until global supply and demand return to balance.

New Zealand dairy exports have weakened in large part due to a decline in demand from China. After increasing YOY to new annual record highs from 2009 – 2014, New Zealand dairy exports to China declined by nearly 30% YOY throughout 2015, finishing at a three year low. New Zealand continued to dominate the market share of Chinese whole milk powder (WMP) imports throughout 2015, accounting for over 95% of WMP imported to China, however increasing EU-28 imports into China have eroded the New Zealand market share of total Chinese dairy imports over recent years. EU-28 dairy export volumes destined to China increased to a new record high for the fifth consecutive year in 2015.

New Zealand dairy exports have weakened in large part due to a decline in demand from China. After increasing YOY to new annual record highs from 2009 – 2014, New Zealand dairy exports to China declined by nearly 30% YOY throughout 2015, finishing at a three year low. New Zealand continued to dominate the market share of Chinese whole milk powder (WMP) imports throughout 2015, accounting for over 95% of WMP imported to China, however increasing EU-28 imports into China have eroded the New Zealand market share of total Chinese dairy imports over recent years. EU-28 dairy export volumes destined to China increased to a new record high for the fifth consecutive year in 2015.

Overall, New Zealand finished 2015 with a 39% market share of Chinese dairy imports, down from a 49% market share in 2014. The decline in the New Zealand market share of Chinese dairy imports was almost exclusively captured by the EU-28, which finished 2015 with a 34% market share, up from 26% in 2014.

Overall, New Zealand finished 2015 with a 39% market share of Chinese dairy imports, down from a 49% market share in 2014. The decline in the New Zealand market share of Chinese dairy imports was almost exclusively captured by the EU-28, which finished 2015 with a 34% market share, up from 26% in 2014.

Dairy products destined to China accounted for slightly more than 20% of total New Zealand dairy exports during 2015, down from nearly 35% of total exports throughout 2013. A more diversified base of destinations for New Zealand dairy exports helps to mitigate the impact of weak Chinese dairy demand, however New Zealand dairy export volumes have also declined YOY in several other major importing countries.

Dairy products destined to China accounted for slightly more than 20% of total New Zealand dairy exports during 2015, down from nearly 35% of total exports throughout 2013. A more diversified base of destinations for New Zealand dairy exports helps to mitigate the impact of weak Chinese dairy demand, however New Zealand dairy export volumes have also declined YOY in several other major importing countries.

Of the top ten New Zealand dairy export destinations, only exports destined to the U.S. and Australia have increased YOY throughout 2015. Along with New Zealand and the EU-28, the U.S. and Australia are among the largest net exporters of dairy products, so demand for New Zealand dairy products within these markets is unlikely to persist.

Of the top ten New Zealand dairy export destinations, only exports destined to the U.S. and Australia have increased YOY throughout 2015. Along with New Zealand and the EU-28, the U.S. and Australia are among the largest net exporters of dairy products, so demand for New Zealand dairy products within these markets is unlikely to persist.

The total value of New Zealand dairy exports has also declined YOY in regions outside of New Zealand’s top ten importing destinations. The bulk of the YOY declines in New Zealand dairy exports remain due to reduced Chinese demand, however New Zealand dairy exports may continue to decline until global supply and demand return to balance.

The total value of New Zealand dairy exports has also declined YOY in regions outside of New Zealand’s top ten importing destinations. The bulk of the YOY declines in New Zealand dairy exports remain due to reduced Chinese demand, however New Zealand dairy exports may continue to decline until global supply and demand return to balance.