EU-28 Milk Production Update – Jan ’16

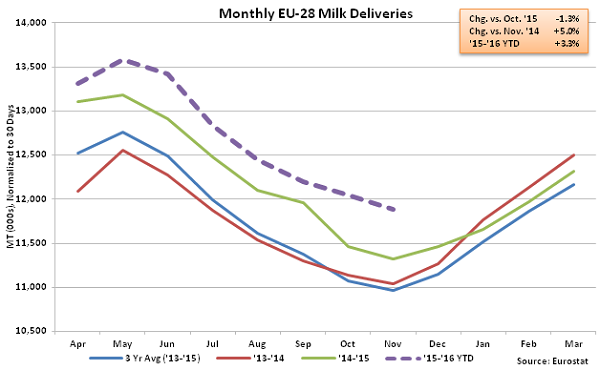

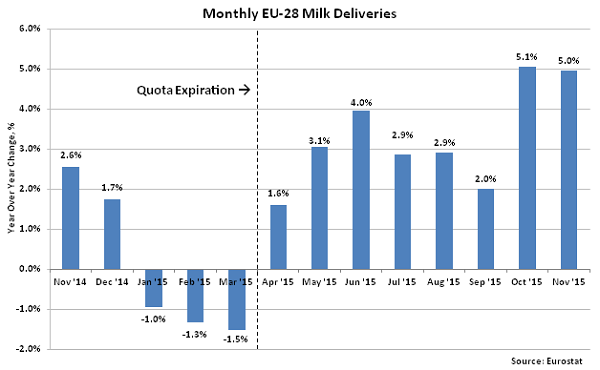

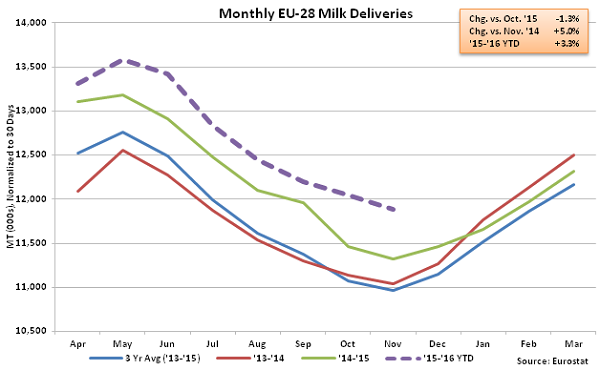

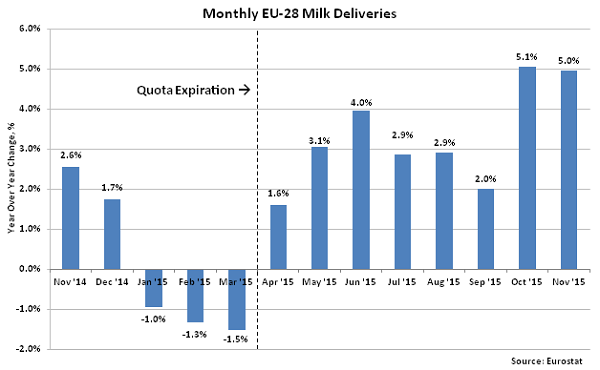

According to Eurostat, Nov ’15 EU-28 milk production increased YOY for the eighth consecutive month, finishing 5.0% above the previous year and setting a new production record for the month of November. The YOY gain in production was the second largest experienced throughout the past 12 months, trailing only the Oct ’15 YOY gain of 5.1%. The recent increases in production have corresponded with the expiration of the EU-28 milk production quota system at the end of Mar ’15. Monthly production growth had decelerated throughout the six months leading up to the quota expiration as over-quota producers attempted to limit superlevy penalties for exceeding milk production quota levels.

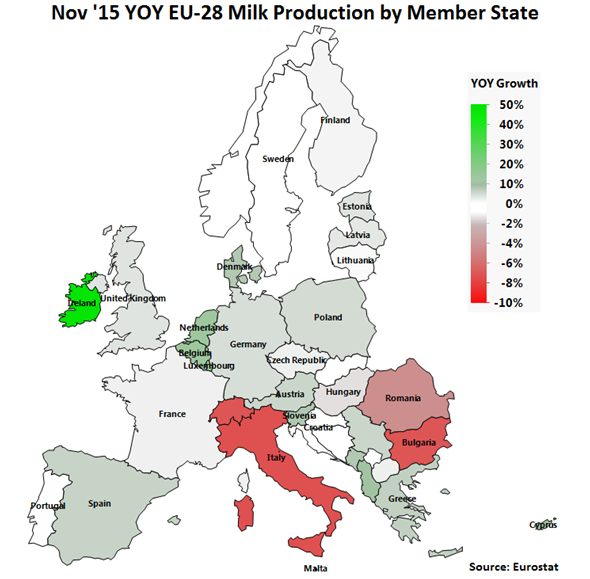

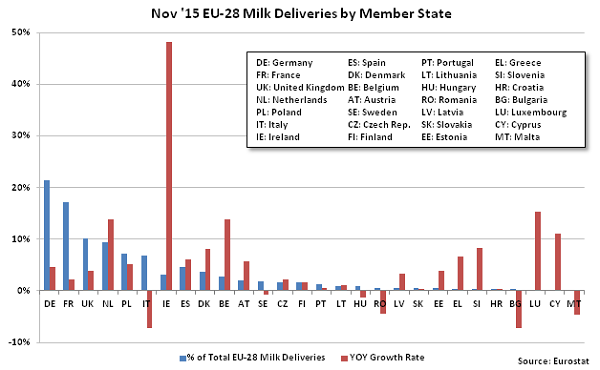

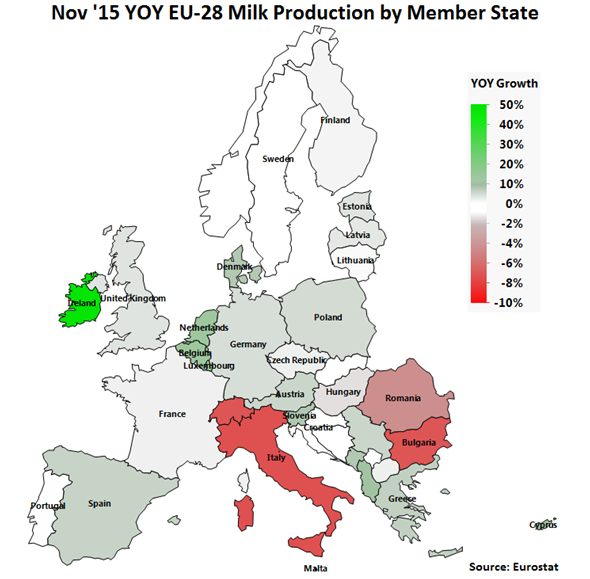

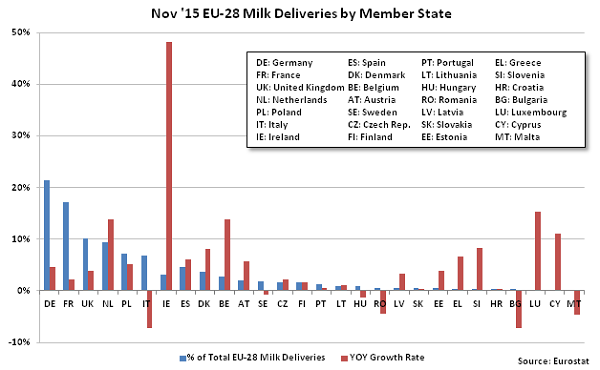

YOY increases in production were led by the Netherlands (+135,100 MT), followed by Ireland (+117,790 MT) and Germany (+113,570 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Nov ’15. YOY increases in production on a percentage basis were led by Ireland (+48.1%), Luxembourg (+15.4%) and the Netherlands (+13.8%).

YOY increases in production were led by the Netherlands (+135,100 MT), followed by Ireland (+117,790 MT) and Germany (+113,570 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Nov ’15. YOY increases in production on a percentage basis were led by Ireland (+48.1%), Luxembourg (+15.4%) and the Netherlands (+13.8%).

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Nov ’15, as production declined 7.3% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Nov ’15. Milk production increased by a weighted average of 6.2% YOY throughout the top ten milk producing Member States during the month of November.

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Nov ’15, as production declined 7.3% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Nov ’15. Milk production increased by a weighted average of 6.2% YOY throughout the top ten milk producing Member States during the month of November.

EU-28 production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season.

EU-28 production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season.

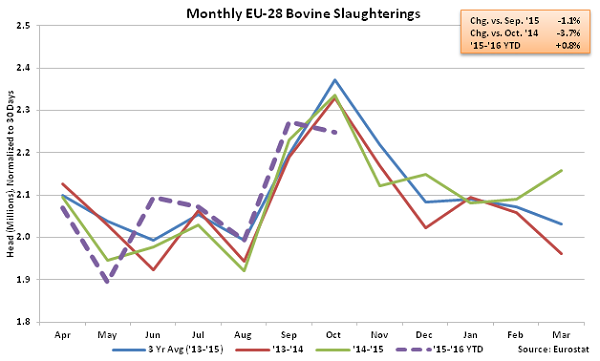

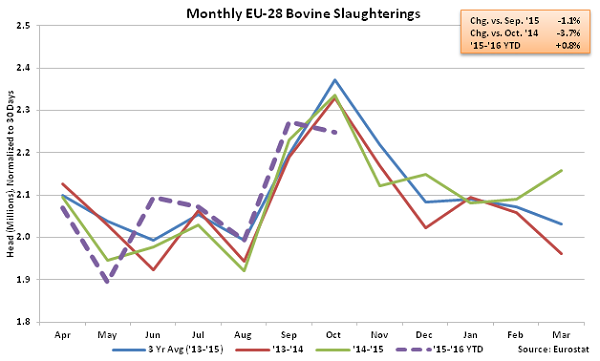

Culling rates increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. According to the USDA EU-28 Livestock and Products Annual report, beginning 2016 dairy cow stocks are estimated at 23.55 million head, down just 0.2% from the 2015 figures. Oct ’15 EU-28 beef & dairy cow slaughter declined 3.7% YOY, which was the largest YOY decline experienced in nearly a year and a half on a percentage basis. YOY declines in beef & dairy cow slaughter were led by France, followed by the Netherlands, Ireland and Germany. Despite the YOY decline, total beef & dairy cow slaughter remains up 0.8% YOY through the first seven months of the ’15-’16 production season.

Culling rates increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. According to the USDA EU-28 Livestock and Products Annual report, beginning 2016 dairy cow stocks are estimated at 23.55 million head, down just 0.2% from the 2015 figures. Oct ’15 EU-28 beef & dairy cow slaughter declined 3.7% YOY, which was the largest YOY decline experienced in nearly a year and a half on a percentage basis. YOY declines in beef & dairy cow slaughter were led by France, followed by the Netherlands, Ireland and Germany. Despite the YOY decline, total beef & dairy cow slaughter remains up 0.8% YOY through the first seven months of the ’15-’16 production season.

YOY increases in production were led by the Netherlands (+135,100 MT), followed by Ireland (+117,790 MT) and Germany (+113,570 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Nov ’15. YOY increases in production on a percentage basis were led by Ireland (+48.1%), Luxembourg (+15.4%) and the Netherlands (+13.8%).

YOY increases in production were led by the Netherlands (+135,100 MT), followed by Ireland (+117,790 MT) and Germany (+113,570 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Nov ’15. YOY increases in production on a percentage basis were led by Ireland (+48.1%), Luxembourg (+15.4%) and the Netherlands (+13.8%).

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Nov ’15, as production declined 7.3% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Nov ’15. Milk production increased by a weighted average of 6.2% YOY throughout the top ten milk producing Member States during the month of November.

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Nov ’15, as production declined 7.3% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Nov ’15. Milk production increased by a weighted average of 6.2% YOY throughout the top ten milk producing Member States during the month of November.

EU-28 production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season.

EU-28 production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season.

Culling rates increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. According to the USDA EU-28 Livestock and Products Annual report, beginning 2016 dairy cow stocks are estimated at 23.55 million head, down just 0.2% from the 2015 figures. Oct ’15 EU-28 beef & dairy cow slaughter declined 3.7% YOY, which was the largest YOY decline experienced in nearly a year and a half on a percentage basis. YOY declines in beef & dairy cow slaughter were led by France, followed by the Netherlands, Ireland and Germany. Despite the YOY decline, total beef & dairy cow slaughter remains up 0.8% YOY through the first seven months of the ’15-’16 production season.

Culling rates increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. According to the USDA EU-28 Livestock and Products Annual report, beginning 2016 dairy cow stocks are estimated at 23.55 million head, down just 0.2% from the 2015 figures. Oct ’15 EU-28 beef & dairy cow slaughter declined 3.7% YOY, which was the largest YOY decline experienced in nearly a year and a half on a percentage basis. YOY declines in beef & dairy cow slaughter were led by France, followed by the Netherlands, Ireland and Germany. Despite the YOY decline, total beef & dairy cow slaughter remains up 0.8% YOY through the first seven months of the ’15-’16 production season.