U.S. Dairy Exports Remain Significantly Lower YOY – Jan…

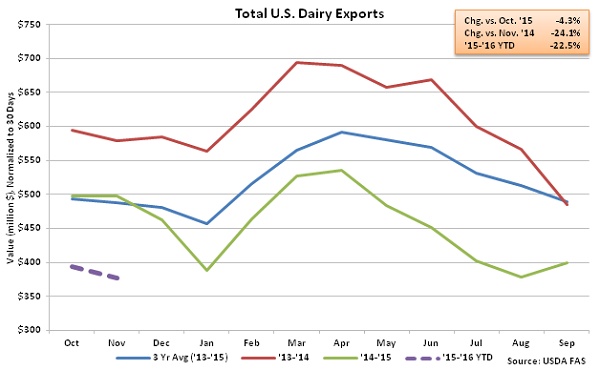

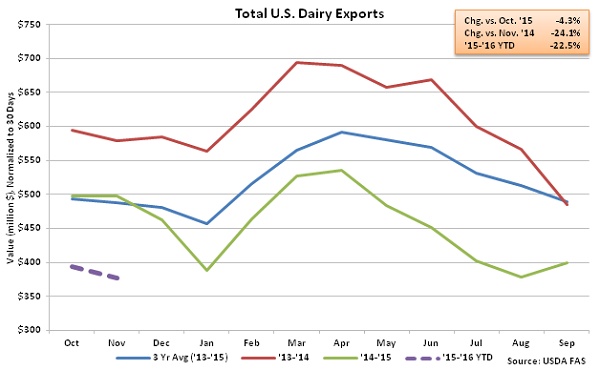

According to USDA, the total value of all U.S. dairy exports declined YOY for the 16th consecutive month in Nov ’15, finishing 24.1% below the previous year. U.S. dairy product prices continued to remain significantly above international prices throughout Nov ’15 while export volumes also continued to be negatively affected by a strengthening dollar relative to the currencies of traditional buyers of U.S. dairy products. A strengthening dollar results in less purchasing power for importing countries, and ultimately less foreign demand for U.S. products, all other factors being equal.

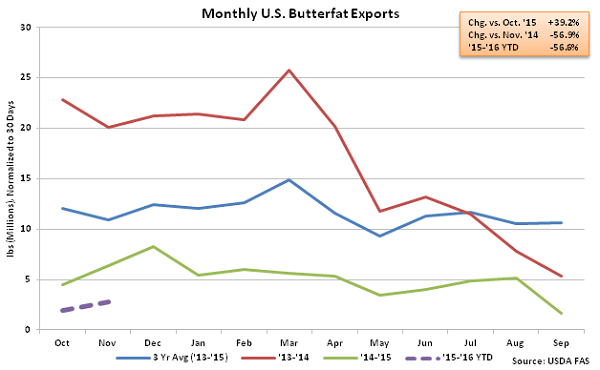

Butter – Export Volumes Remain Lower on YOY Basis for 19th Consecutive Month

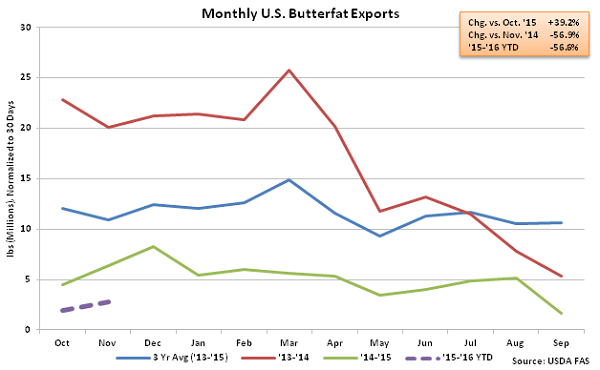

Nov ’15 export volumes of butterfat continued to increase off of the eight and a half year low experienced in Sep ’15 but remained weak on a YOY basis, finishing 56.9% below the previous year. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 19 consecutive months, with total volumes down 62.2% over the period. The U.S. was a net importer of butter for the tenth consecutive month in Nov ’15, with total butterfat import volumes finishing over three times as large as total butterfat export volumes throughout the month.

Butter – Export Volumes Remain Lower on YOY Basis for 19th Consecutive Month

Nov ’15 export volumes of butterfat continued to increase off of the eight and a half year low experienced in Sep ’15 but remained weak on a YOY basis, finishing 56.9% below the previous year. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 19 consecutive months, with total volumes down 62.2% over the period. The U.S. was a net importer of butter for the tenth consecutive month in Nov ’15, with total butterfat import volumes finishing over three times as large as total butterfat export volumes throughout the month.

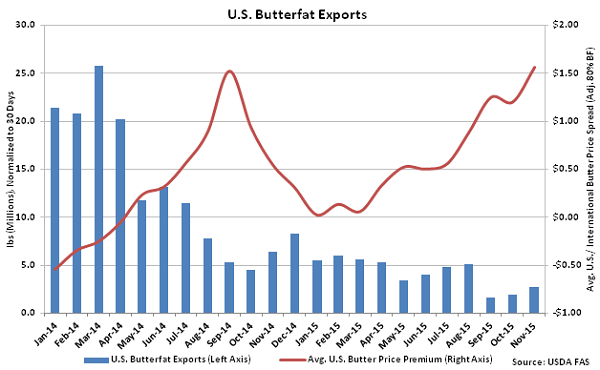

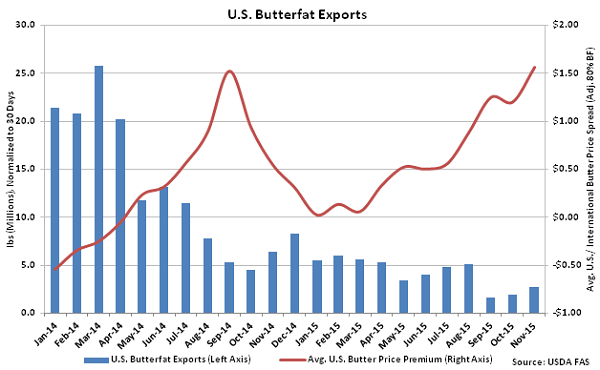

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads reached an 11 year high during Nov ’15, as U.S. butter prices traded at a 108.3% premium to European prices and a 127.3% premium to Oceania prices throughout the month. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads reached an 11 year high during Nov ’15, as U.S. butter prices traded at a 108.3% premium to European prices and a 127.3% premium to Oceania prices throughout the month. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

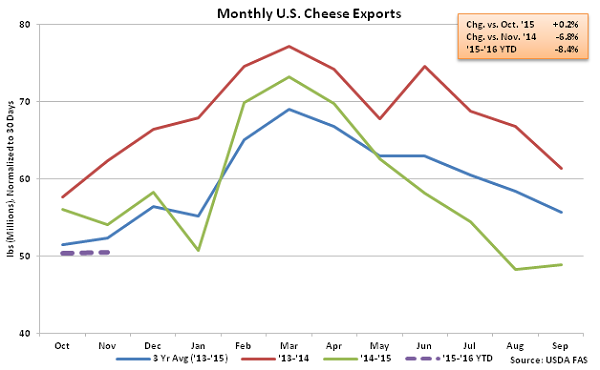

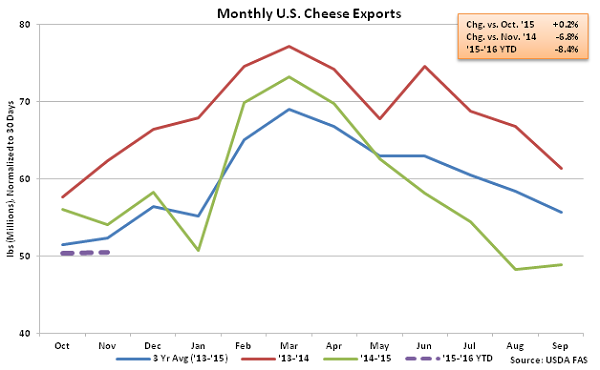

Cheese – Export Volumes Remain Lower on YOY Basis for 14th Consecutive Month

Nov ’15 U.S. cheese export volumes increased 0.2% MOM on a daily average basis but remained lower on a YOY basis for the 14th consecutive month, finishing down 6.8%. Cheddar cheese exports remained particularly weak, declining 10.1% YOY. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for eight consecutive months through Nov ’15. Nov ’15 cheese volumes destined to Mexico increased 4.6% YOY however shipments to South Korea and Japan remained lower, finishing 34.9% and 19.6% below the previous year, respectively. Cheese volumes destined to Mexico, South Korea and Japan consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

Cheese – Export Volumes Remain Lower on YOY Basis for 14th Consecutive Month

Nov ’15 U.S. cheese export volumes increased 0.2% MOM on a daily average basis but remained lower on a YOY basis for the 14th consecutive month, finishing down 6.8%. Cheddar cheese exports remained particularly weak, declining 10.1% YOY. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for eight consecutive months through Nov ’15. Nov ’15 cheese volumes destined to Mexico increased 4.6% YOY however shipments to South Korea and Japan remained lower, finishing 34.9% and 19.6% below the previous year, respectively. Cheese volumes destined to Mexico, South Korea and Japan consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

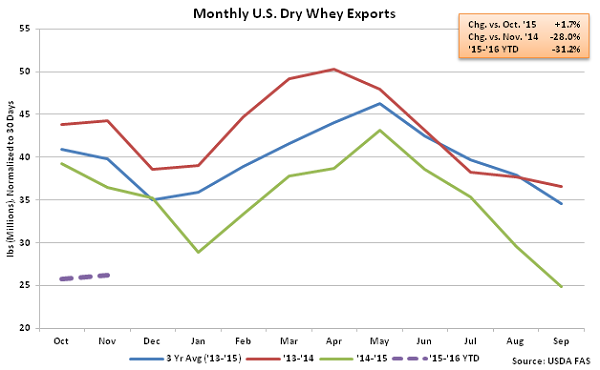

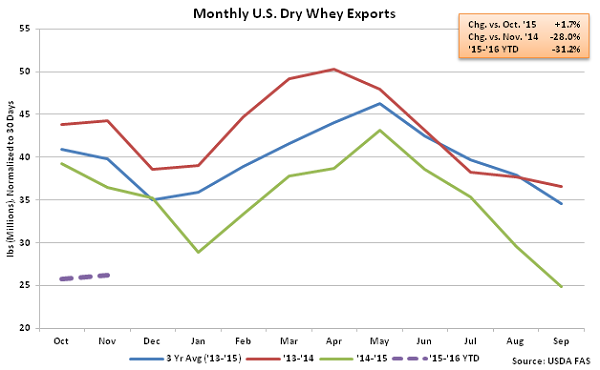

Dry Whey – Export Volumes Remain Lower on YOY Basis for 18th Consecutive Month

Nov ’15 dry whey export volumes remained slightly higher than the 11 year low experienced in Sep ’15 but finished lower on a YOY basis for the 18th consecutive month, declining by 28.0%. Dry whey export volumes reached a 12 year low for the month of November and were the third lowest monthly figure on record over the past seven years on a daily average basis. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

Dry Whey – Export Volumes Remain Lower on YOY Basis for 18th Consecutive Month

Nov ’15 dry whey export volumes remained slightly higher than the 11 year low experienced in Sep ’15 but finished lower on a YOY basis for the 18th consecutive month, declining by 28.0%. Dry whey export volumes reached a 12 year low for the month of November and were the third lowest monthly figure on record over the past seven years on a daily average basis. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

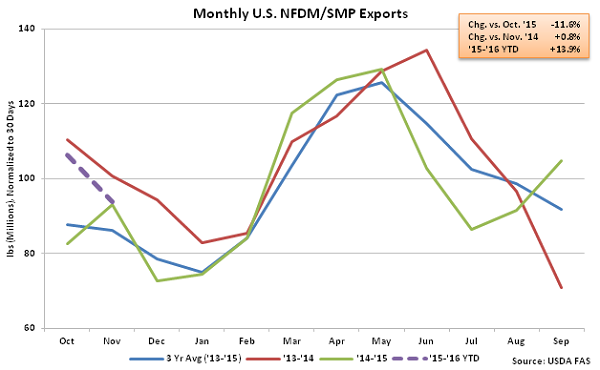

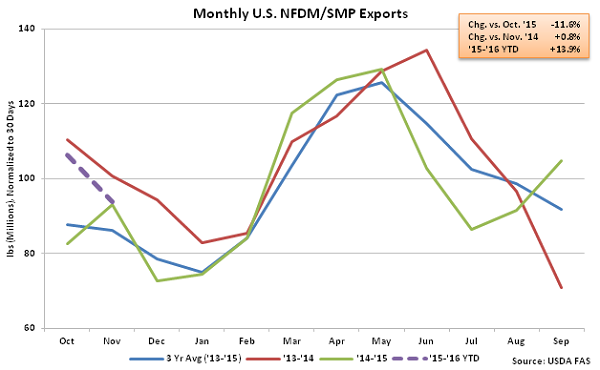

NFDM/SMP – Export Volumes Remain Higher on YOY Basis for Third Consecutive Month

Nov ’15 export volumes of NFDM/SMP declined 11.6% MOM on a daily average but remained higher on a YOY basis for the third consecutive month, finishing up 0.8%. U.S. NFDM/SMP exports to Mexico declined 5.0% YOY while volumes shipped to all other destinations increased by 7.5% YOY. U.S. NDFM/SMP export volumes to Mexico had increased by a combined 109.5% YOY over the past two months prior to the most recent YOY decline. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY however volumes are up 13.9% YOY throughout the first two months of the ’15-’16 production season.

NFDM/SMP – Export Volumes Remain Higher on YOY Basis for Third Consecutive Month

Nov ’15 export volumes of NFDM/SMP declined 11.6% MOM on a daily average but remained higher on a YOY basis for the third consecutive month, finishing up 0.8%. U.S. NFDM/SMP exports to Mexico declined 5.0% YOY while volumes shipped to all other destinations increased by 7.5% YOY. U.S. NDFM/SMP export volumes to Mexico had increased by a combined 109.5% YOY over the past two months prior to the most recent YOY decline. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY however volumes are up 13.9% YOY throughout the first two months of the ’15-’16 production season.

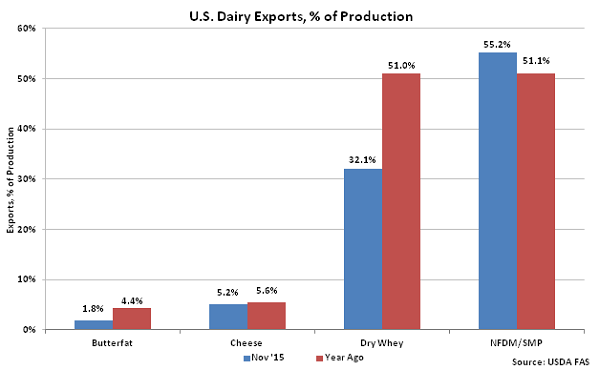

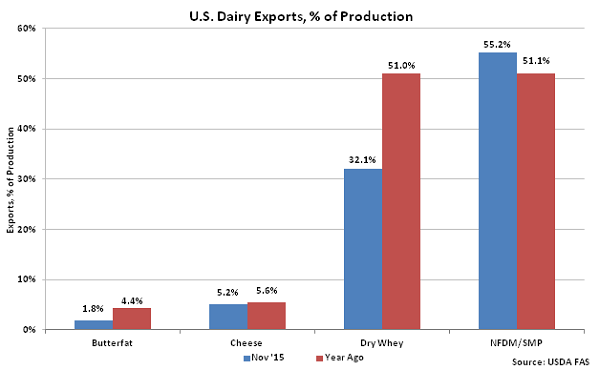

Nov ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production finished higher on a YOY basis for the third consecutive month.

Nov ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production finished higher on a YOY basis for the third consecutive month.

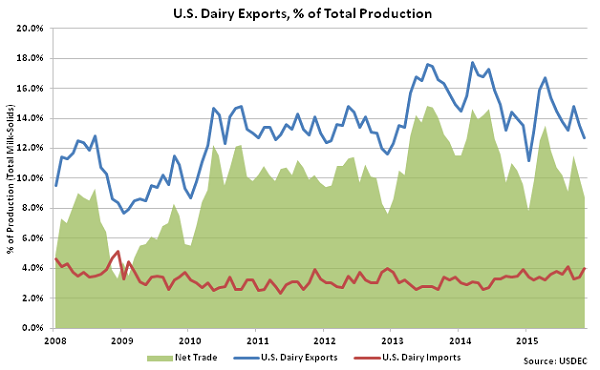

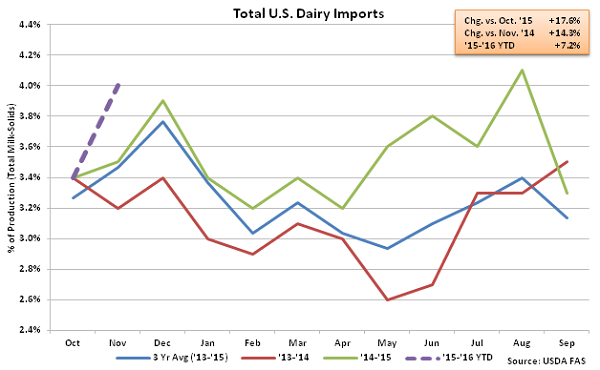

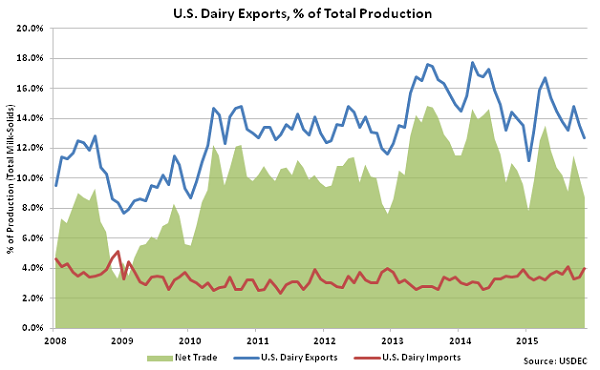

Overall, U.S. dairy export volumes were equivalent to 12.7% of total U.S. milk solids production in Nov ’15, which was a ten month low, while dairy import volumes were equivalent to 4.0% of total U.S. milk solids production.

Overall, U.S. dairy export volumes were equivalent to 12.7% of total U.S. milk solids production in Nov ’15, which was a ten month low, while dairy import volumes were equivalent to 4.0% of total U.S. milk solids production.

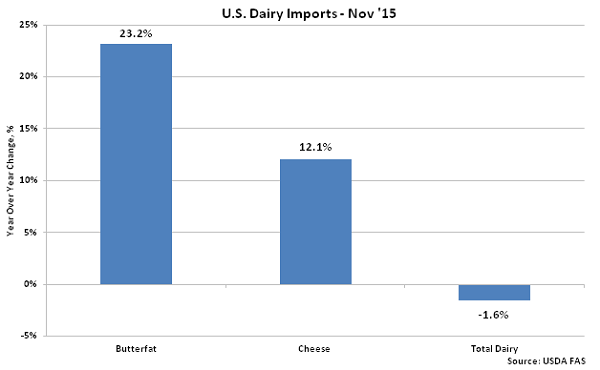

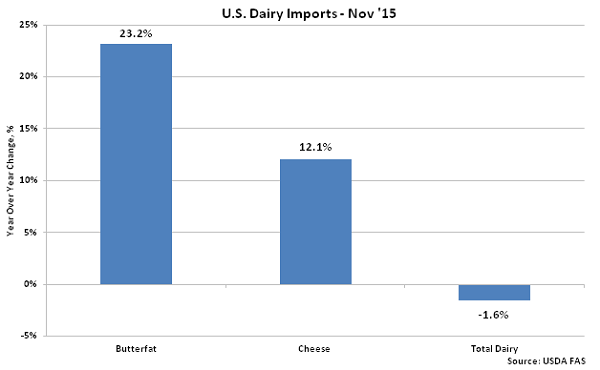

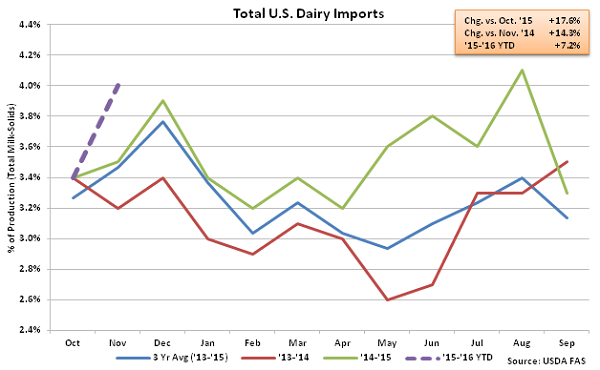

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 23.2% YOY and 12.1% YOY, respectively during Nov ’15. The total value of all dairy import volumes declined 1.6% YOY throughout the month.

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 23.2% YOY and 12.1% YOY, respectively during Nov ’15. The total value of all dairy import volumes declined 1.6% YOY throughout the month.

Butter – Export Volumes Remain Lower on YOY Basis for 19th Consecutive Month

Nov ’15 export volumes of butterfat continued to increase off of the eight and a half year low experienced in Sep ’15 but remained weak on a YOY basis, finishing 56.9% below the previous year. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 19 consecutive months, with total volumes down 62.2% over the period. The U.S. was a net importer of butter for the tenth consecutive month in Nov ’15, with total butterfat import volumes finishing over three times as large as total butterfat export volumes throughout the month.

Butter – Export Volumes Remain Lower on YOY Basis for 19th Consecutive Month

Nov ’15 export volumes of butterfat continued to increase off of the eight and a half year low experienced in Sep ’15 but remained weak on a YOY basis, finishing 56.9% below the previous year. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 19 consecutive months, with total volumes down 62.2% over the period. The U.S. was a net importer of butter for the tenth consecutive month in Nov ’15, with total butterfat import volumes finishing over three times as large as total butterfat export volumes throughout the month.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads reached an 11 year high during Nov ’15, as U.S. butter prices traded at a 108.3% premium to European prices and a 127.3% premium to Oceania prices throughout the month. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads reached an 11 year high during Nov ’15, as U.S. butter prices traded at a 108.3% premium to European prices and a 127.3% premium to Oceania prices throughout the month. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

Cheese – Export Volumes Remain Lower on YOY Basis for 14th Consecutive Month

Nov ’15 U.S. cheese export volumes increased 0.2% MOM on a daily average basis but remained lower on a YOY basis for the 14th consecutive month, finishing down 6.8%. Cheddar cheese exports remained particularly weak, declining 10.1% YOY. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for eight consecutive months through Nov ’15. Nov ’15 cheese volumes destined to Mexico increased 4.6% YOY however shipments to South Korea and Japan remained lower, finishing 34.9% and 19.6% below the previous year, respectively. Cheese volumes destined to Mexico, South Korea and Japan consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

Cheese – Export Volumes Remain Lower on YOY Basis for 14th Consecutive Month

Nov ’15 U.S. cheese export volumes increased 0.2% MOM on a daily average basis but remained lower on a YOY basis for the 14th consecutive month, finishing down 6.8%. Cheddar cheese exports remained particularly weak, declining 10.1% YOY. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for eight consecutive months through Nov ’15. Nov ’15 cheese volumes destined to Mexico increased 4.6% YOY however shipments to South Korea and Japan remained lower, finishing 34.9% and 19.6% below the previous year, respectively. Cheese volumes destined to Mexico, South Korea and Japan consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

Dry Whey – Export Volumes Remain Lower on YOY Basis for 18th Consecutive Month

Nov ’15 dry whey export volumes remained slightly higher than the 11 year low experienced in Sep ’15 but finished lower on a YOY basis for the 18th consecutive month, declining by 28.0%. Dry whey export volumes reached a 12 year low for the month of November and were the third lowest monthly figure on record over the past seven years on a daily average basis. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

Dry Whey – Export Volumes Remain Lower on YOY Basis for 18th Consecutive Month

Nov ’15 dry whey export volumes remained slightly higher than the 11 year low experienced in Sep ’15 but finished lower on a YOY basis for the 18th consecutive month, declining by 28.0%. Dry whey export volumes reached a 12 year low for the month of November and were the third lowest monthly figure on record over the past seven years on a daily average basis. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

NFDM/SMP – Export Volumes Remain Higher on YOY Basis for Third Consecutive Month

Nov ’15 export volumes of NFDM/SMP declined 11.6% MOM on a daily average but remained higher on a YOY basis for the third consecutive month, finishing up 0.8%. U.S. NFDM/SMP exports to Mexico declined 5.0% YOY while volumes shipped to all other destinations increased by 7.5% YOY. U.S. NDFM/SMP export volumes to Mexico had increased by a combined 109.5% YOY over the past two months prior to the most recent YOY decline. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY however volumes are up 13.9% YOY throughout the first two months of the ’15-’16 production season.

NFDM/SMP – Export Volumes Remain Higher on YOY Basis for Third Consecutive Month

Nov ’15 export volumes of NFDM/SMP declined 11.6% MOM on a daily average but remained higher on a YOY basis for the third consecutive month, finishing up 0.8%. U.S. NFDM/SMP exports to Mexico declined 5.0% YOY while volumes shipped to all other destinations increased by 7.5% YOY. U.S. NDFM/SMP export volumes to Mexico had increased by a combined 109.5% YOY over the past two months prior to the most recent YOY decline. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY however volumes are up 13.9% YOY throughout the first two months of the ’15-’16 production season.

Nov ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production finished higher on a YOY basis for the third consecutive month.

Nov ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production finished higher on a YOY basis for the third consecutive month.

Overall, U.S. dairy export volumes were equivalent to 12.7% of total U.S. milk solids production in Nov ’15, which was a ten month low, while dairy import volumes were equivalent to 4.0% of total U.S. milk solids production.

Overall, U.S. dairy export volumes were equivalent to 12.7% of total U.S. milk solids production in Nov ’15, which was a ten month low, while dairy import volumes were equivalent to 4.0% of total U.S. milk solids production.

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 23.2% YOY and 12.1% YOY, respectively during Nov ’15. The total value of all dairy import volumes declined 1.6% YOY throughout the month.

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 23.2% YOY and 12.1% YOY, respectively during Nov ’15. The total value of all dairy import volumes declined 1.6% YOY throughout the month.