Grain & Oilseeds WASDE Update – Mar ’22

Corn – U.S. and Global Ending Stocks Mixed vs. Private Estimates

- ’21-’22 U.S. ending stocks of 1.44 billion bushels below expectations

- ’21-’22 global ending stocks of 301.0 million MT slightly above expectations

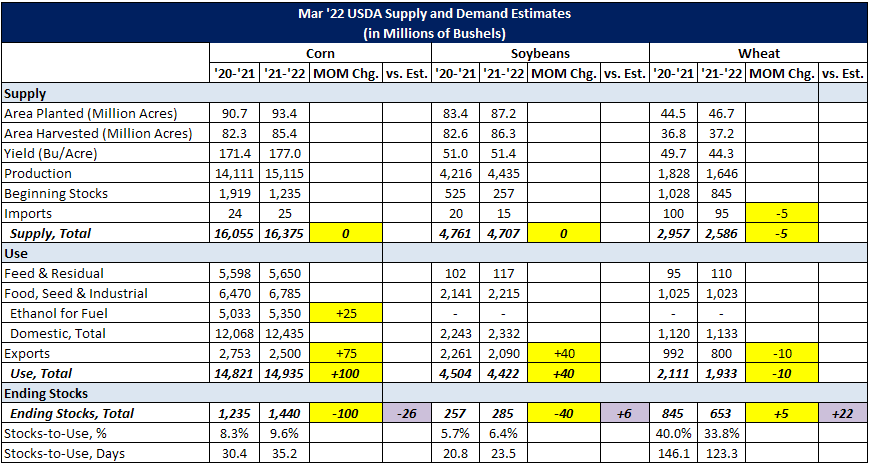

The ’21-’22 U.S. corn supply projection remained unchanged from the previous month while the demand projection was raised slightly on higher expected exports and ethanol demand. ’21-’22 projected U.S. corn ending stocks of 1.44 billion bushels, or 35.2 days of use, finished 6.5% below the previous month and 1.8% below expectations.

The ’21-’22 global corn ending stock projection finished 0.4% below the previous month but remained 0.5% above expectations. U.S. and Argentine corn stocks were revised most significantly lower, while Ukrainian stocks were projected higher as a decline in projected exports more than offset higher projected domestic feed usage. The March WASDE report represented an initial assessment of the short-term impacts of Russia’s recent military action in Ukraine. Vessel transportation throughout the Black Sea region is expected to be constrained by the Ukraine/Russia conflict and the imposition of economic sanctions.

Soybeans – U.S. and Global Ending Stocks Above Private Estimates

- ’21-’22 U.S. ending stocks of 285 million bushels above expectations

- ’21-’22 global ending stocks of 90.0 million MT above expectations

The ’21-’22 U.S. soybean supply projection remained unchanged from the previous month while the U.S. soybean demand projection was raised slightly on higher expected exports. ’21-’22 projected U.S. soybean ending stocks of 285 million bushels, or 23.5 days of use, finished 12.3% below the previous month but remained 2.2% above expectations.

The ’21-’22 global soybean ending stock projection finished 3.1% below the previous month but remained 1.4% above expectations. Brazilian soybean stocks were revised most significantly lower, as a reduction in production more than offset lower projected exports.

Soybean Complex – U.S. Oil and Meal Stocks Unchanged

The ’21-’22 U.S. soybean oil ending stock projection remained unchanged from the previous month as lower projected biofuel demand was offset by higher projected food, feed & industrial demand and export demand. Globally, the ’21-’22 soybean oil ending stock projection was raised from the previous month, led by projected increases experienced throughout European Union and India.

The ’21-’22 U.S. soybean meal ending stock projection also remained unchanged from the previous month as supply and demand projections remained consistent with previous month figures. Globally, the ’21-’22 soybean meal ending stock projection was raised from the previous month, led by increases in Southeast Asian stocks.

Wheat – U.S. and Global Ending Stocks Above Private Estimates

- ’21-’22 U.S. ending stocks of 653 million bushels above expectations

- ’21-’22 global ending stocks of 281.5 million MT above expectations

The ’21-’22 U.S. wheat supply and demand projections remained largely unchanged from the previous month. ’21-’22 projected U.S. wheat ending stocks of 653 million bushels, or 123.3 days of use, finished 0.8% above the previous month and 3.5% above expectations.

The ’21-’22 global wheat ending stock projection finished 1.2% above the previous month and 1.4% above expectations, largely on declines in projected Ukrainian and Russian exports.

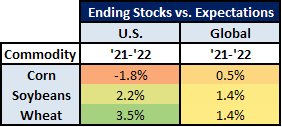

Ending Stocks vs. Expectations Summary

Overall, ’21-’22 projected domestic wheat ending stocks finished most significantly above expectations, followed by domestic soybean ending stocks, global wheat ending stocks, global soybean ending stocks and global corn ending stocks. Domestic corn ending stocks finished below expectations.