Commitments of Traders Update – Mar ’22

The Commitments of Traders report provided by the Commodity Futures Trading Commission provides breakouts of how different market participants are positioned in the futures and options markets. The following provides an update on net speculative (non-producer/merchant/processor/user/swap dealer) positions held in the corn, soybean, wheat and crude oil markets.

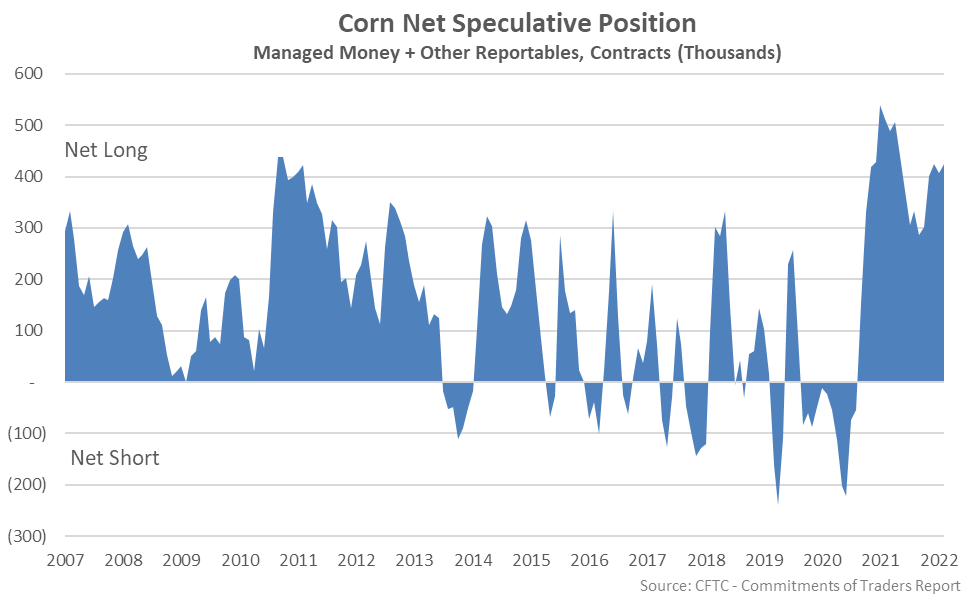

Corn

The corn net speculative position reached record high levels throughout the first quarter of 2021 and has remained elevated relative to historical levels since. Feb ’22 figures remained near recently experienced nine month high levels.

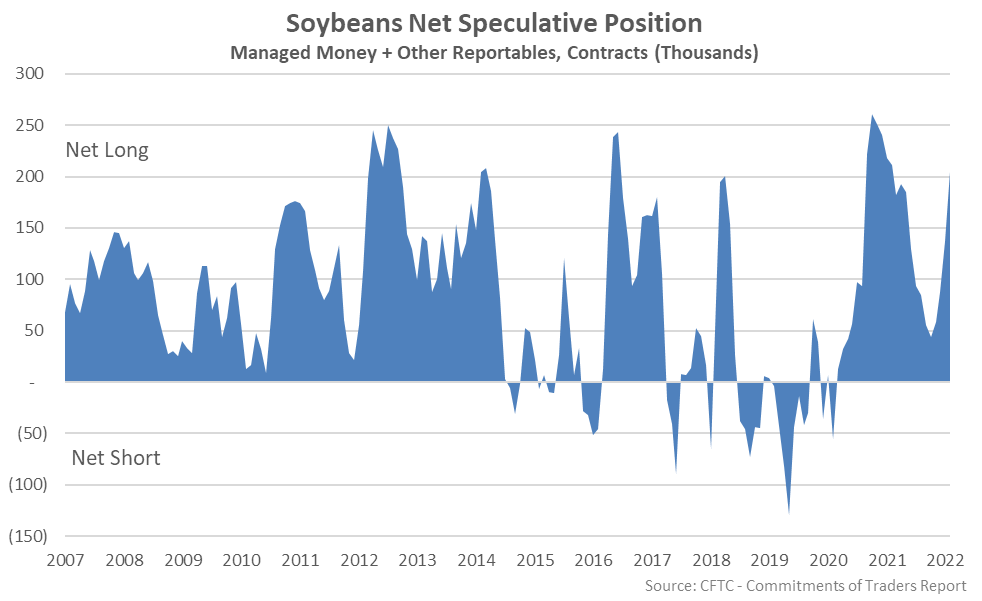

Soybeans

The soybean net speculative position reached record high levels throughout the final quarter of 2020 however positions declined significantly throughout much of 2021, returning to a 17 month low level during Oct ’21. More recently, the soybean net speculative position returned to a 12 month high level throughout Feb ’22, increasing over each of the past four months.

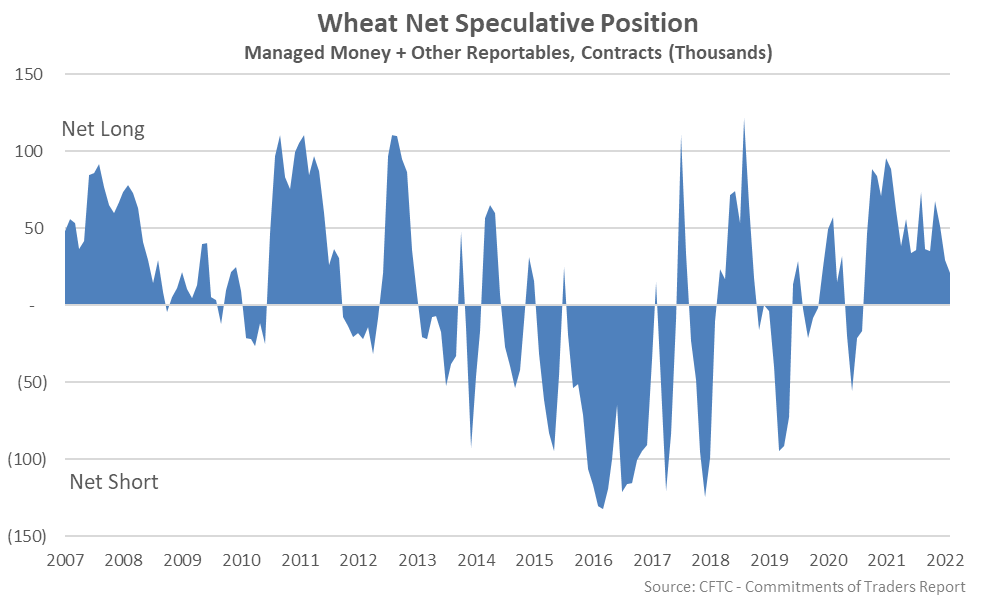

Wheat

The wheat net speculative position declined to an 18 month low level throughout Feb ’22 but remained at a positive level. The wheat net speculative position was negative over four consecutive months through Aug ’20, prior to rebounding to a positive level over the 18 most recent months of available data.

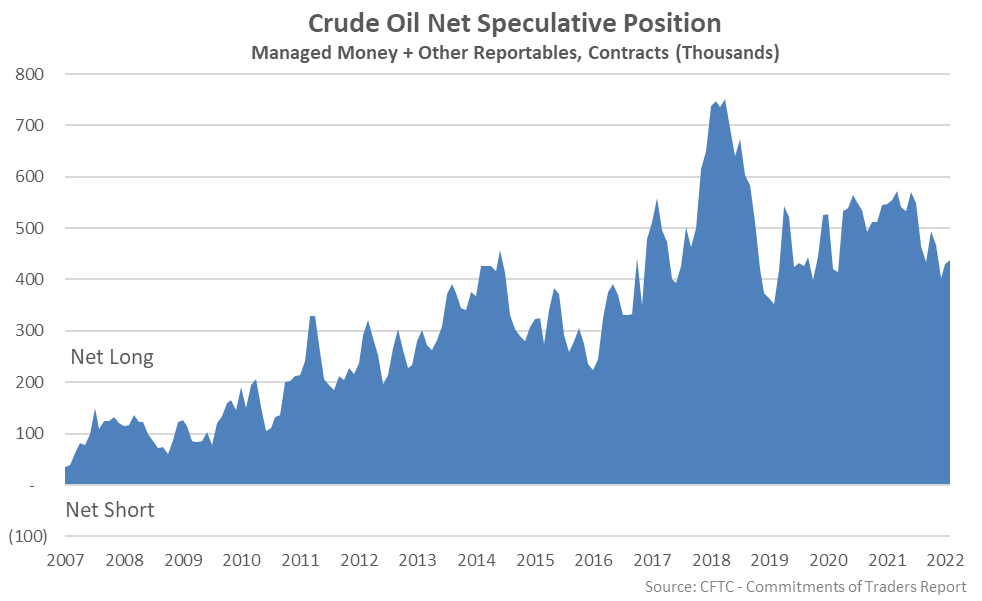

Crude Oil

The crude oil net speculative position has climbed over recent years, remaining above historical average levels since mid-2016. The crude oil net speculative position returned to a two year low level throughout Dec ’21, however, finishing 46% below the 2018 highs.