Grain & Oilseeds WASDE Update – Mar ’20

Corn – U.S. and Global Ending Stocks Largely Consistent With Private Estimates

Corn – U.S. and Global Ending Stocks Largely Consistent With Private Estimates

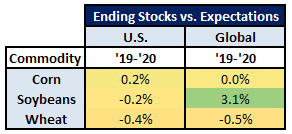

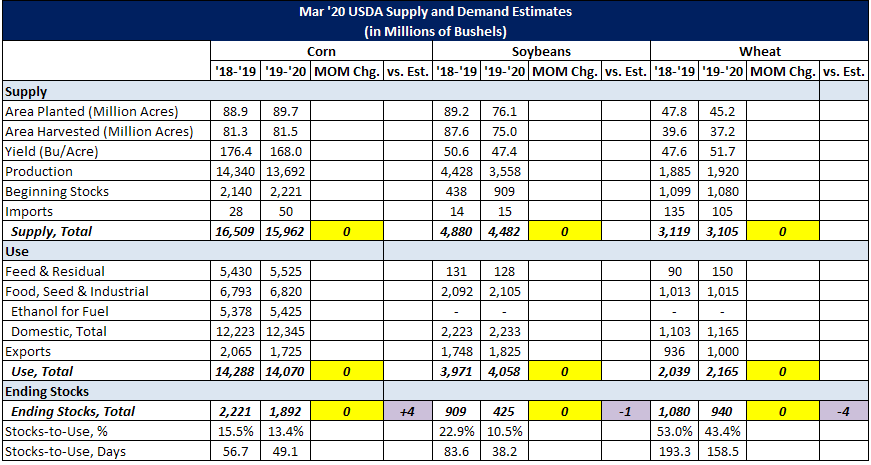

- ’19-’20 U.S. ending stocks of 1.892 billion bushels slightly above expectations

- ’19-’20 global ending stocks of 297.3 million MT consistent with expectations

- ’19-’20 U.S. ending stocks of 425 million bushels slightly below expectations

- ’19-’20 global ending stocks of 102.4 million MT above expectations

- ’19-’20 U.S. ending stocks of 940 million bushels slightly below expectations

- ’19-’20 global ending stocks of 287.1 million MT slightly below expectations