Chinese Dairy Imports Update – Sep ’19

Executive Summary

Chinese dairy import figures provided by IHS Markit were recently updated with values spanning through Aug ‘19. Highlights from the updated report include:

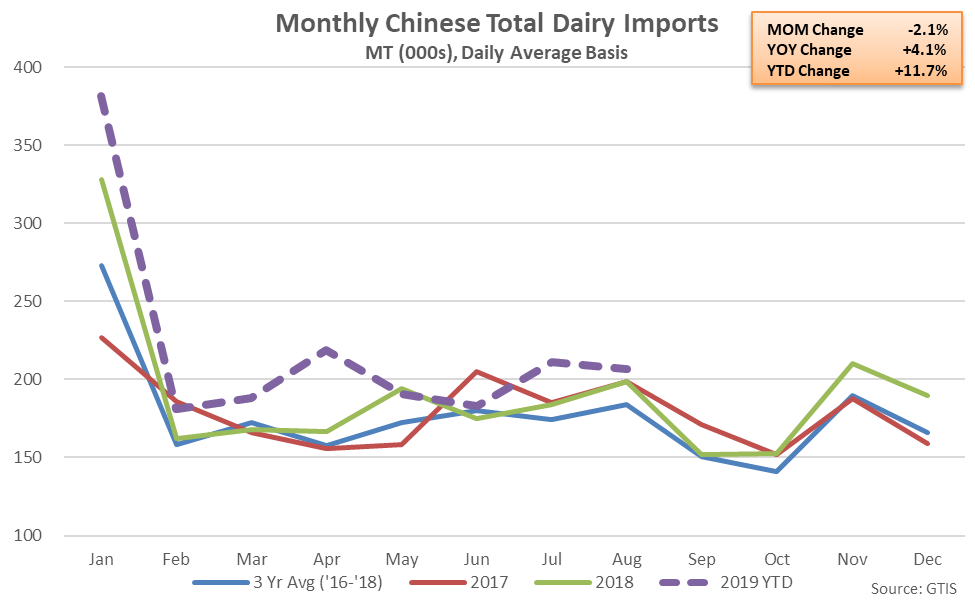

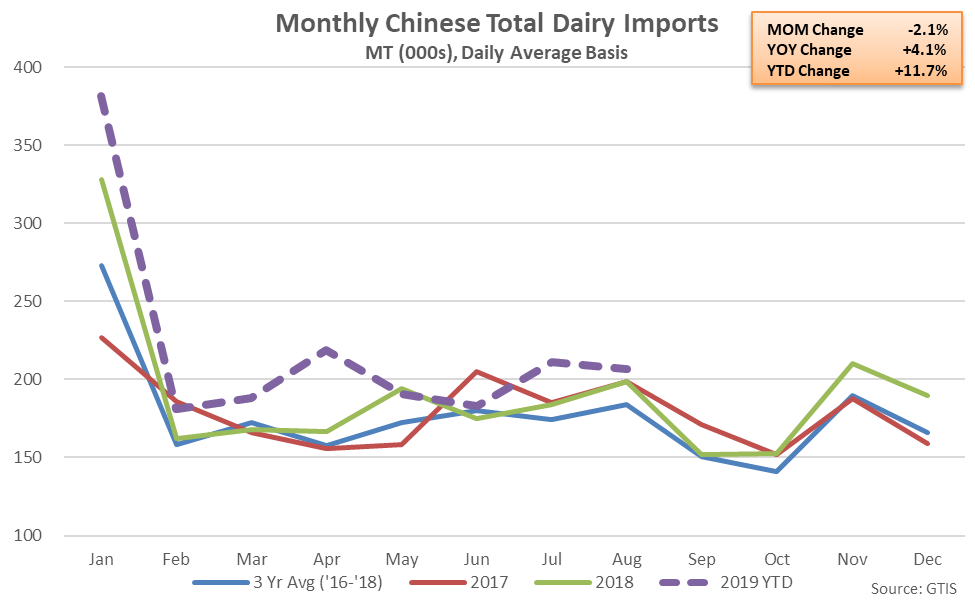

Aug ’19 Chinese Dairy Import Volumes Declined 2.1% MOM but Remained up 4.1% YOY

Aug ’19 Chinese Dairy Import Volumes Declined 2.1% MOM but Remained up 4.1% YOY

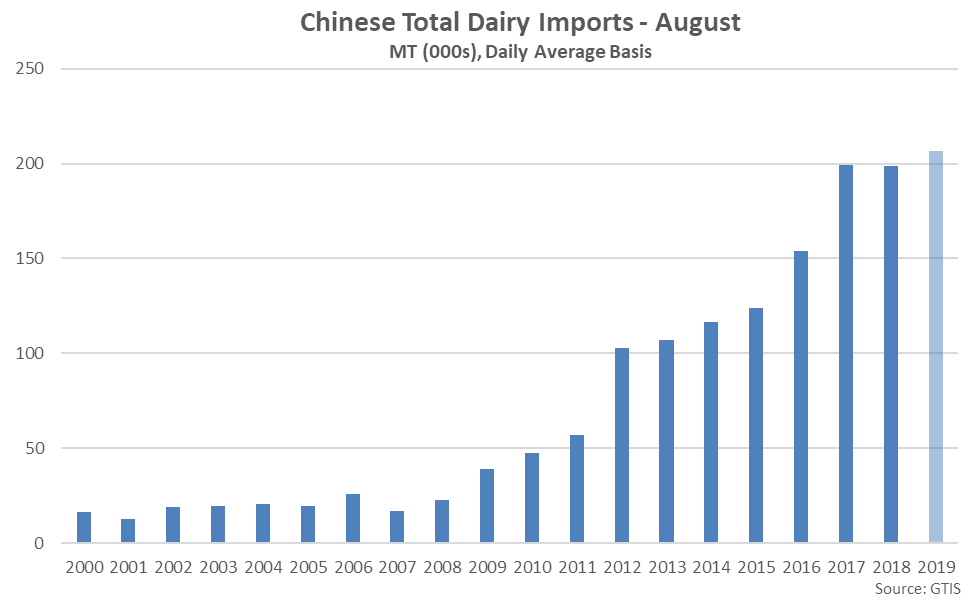

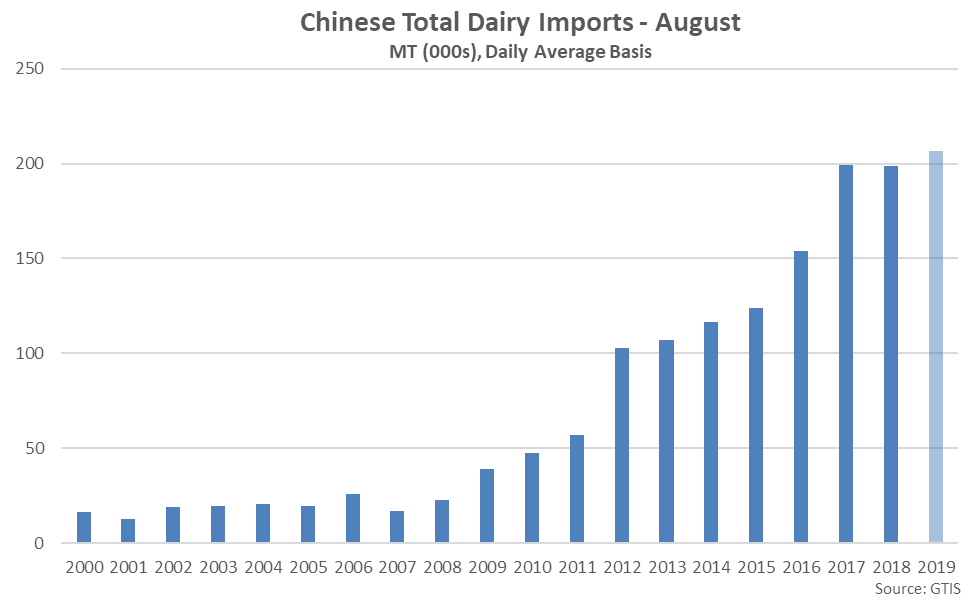

Aug ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Aug ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

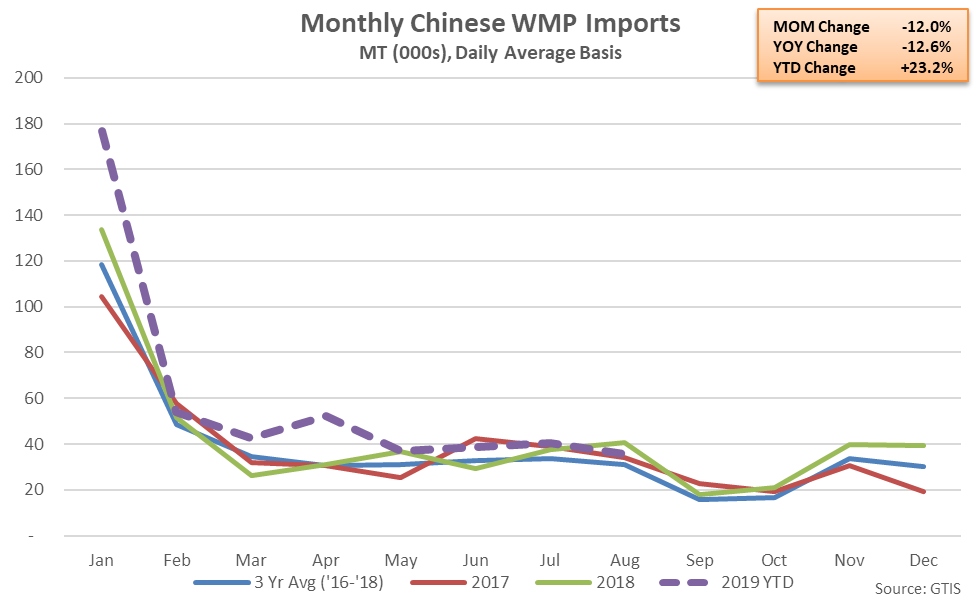

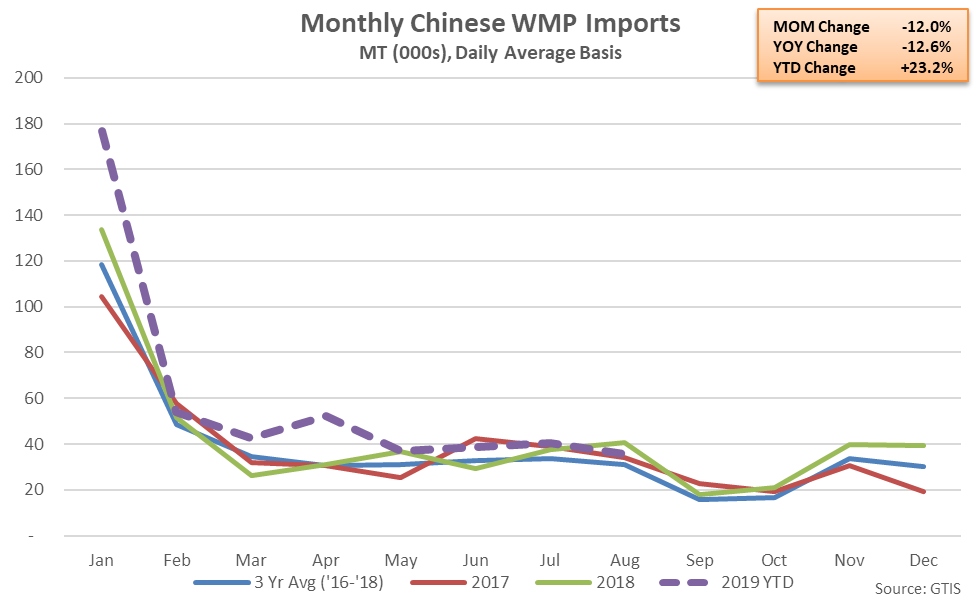

Aug ’19 Chinese WMP Import Volumes Declined 12.0% MOM and 12.6% YOY

Aug ’19 Chinese WMP Import Volumes Declined 12.0% MOM and 12.6% YOY

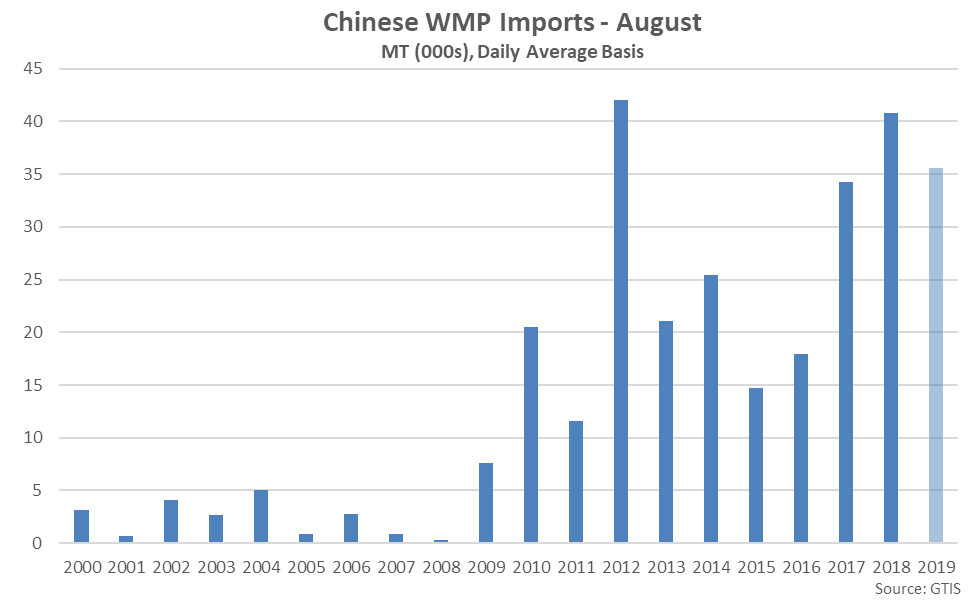

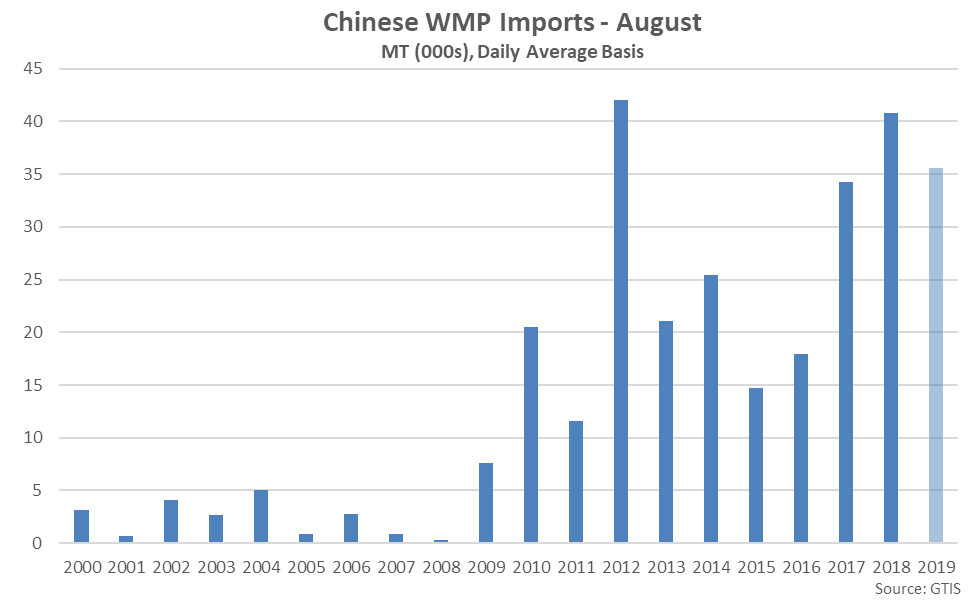

Aug ’19 Chinese WMP Imports Remained at the Third Highest Seasonal Level on Record

Aug ’19 Chinese WMP Imports Remained at the Third Highest Seasonal Level on Record

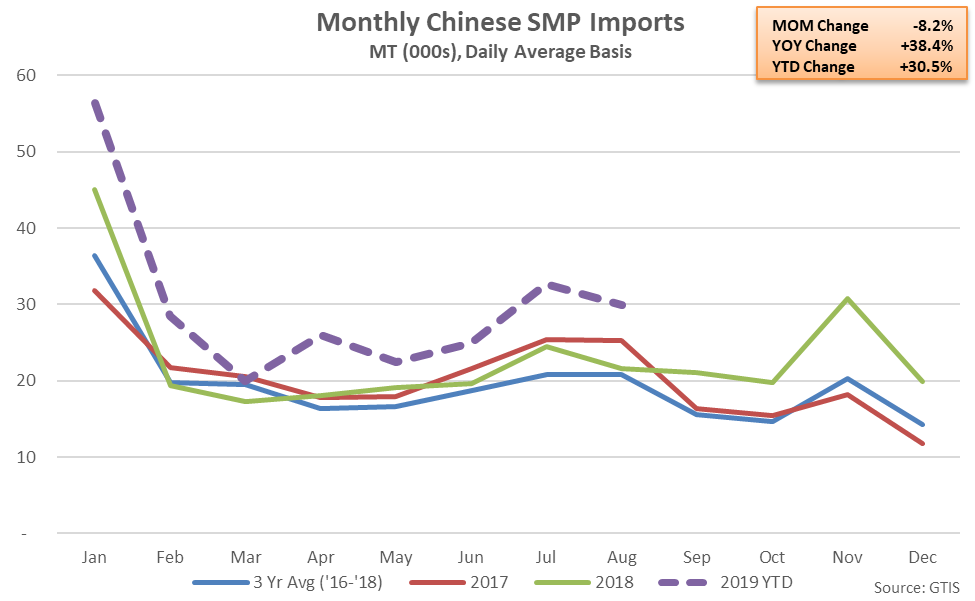

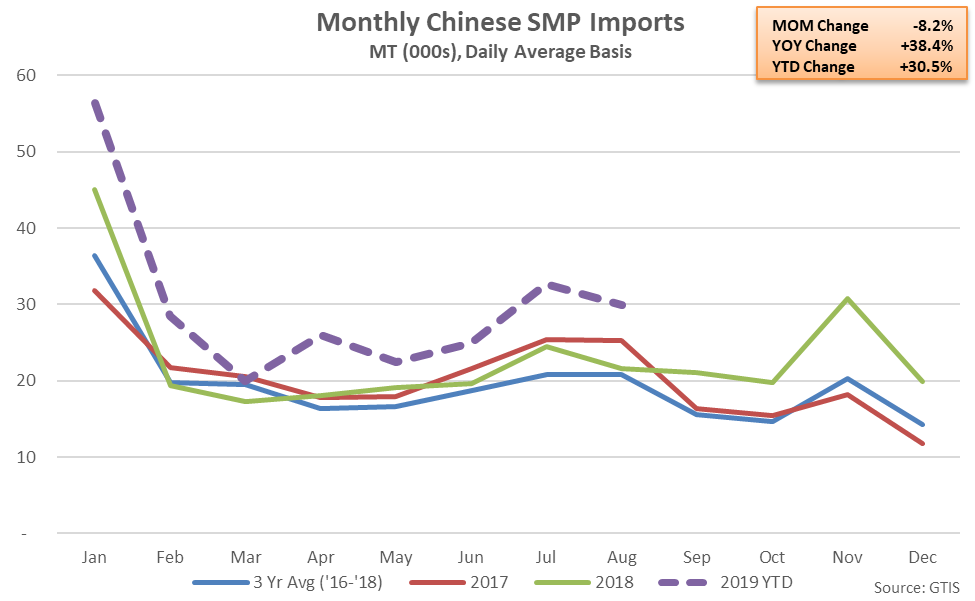

Aug ’19 Chinese SMP Import Volumes Declined 8.2% MOM but Remained up 38.4% YOY

Aug ’19 Chinese SMP Import Volumes Declined 8.2% MOM but Remained up 38.4% YOY

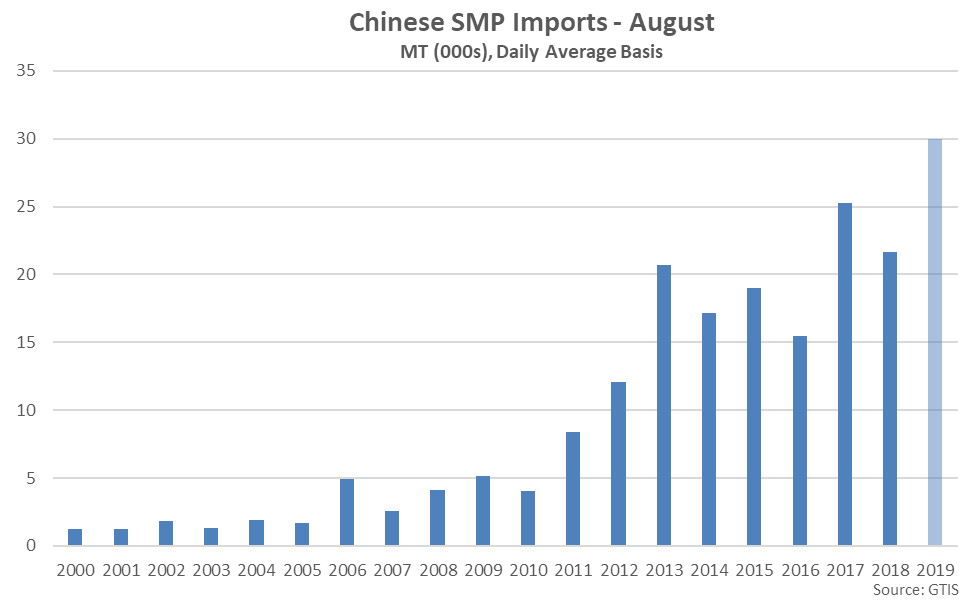

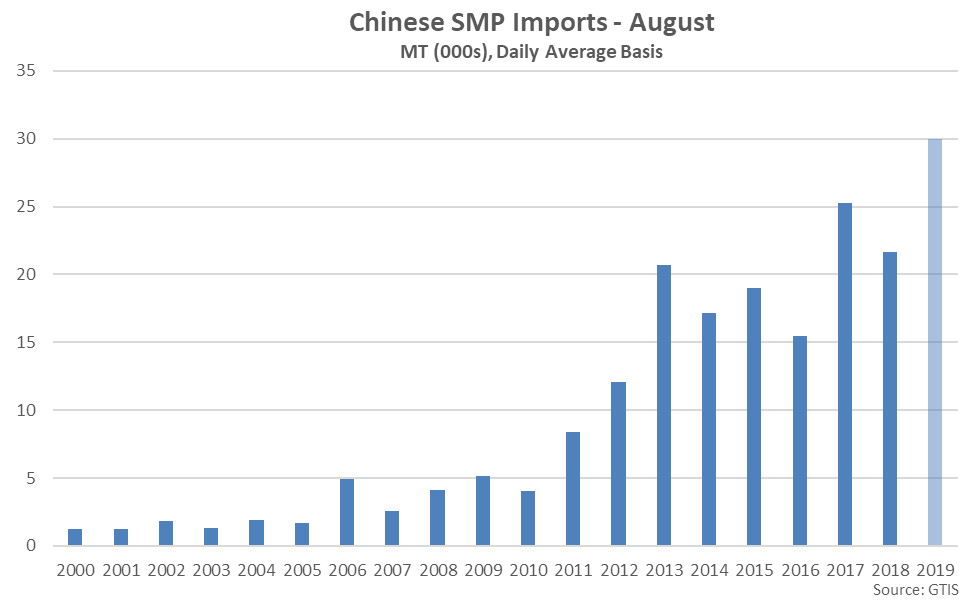

Aug ’19 Chinese SMP Imports Reached a Record High Seasonal Level

Aug ’19 Chinese SMP Imports Reached a Record High Seasonal Level

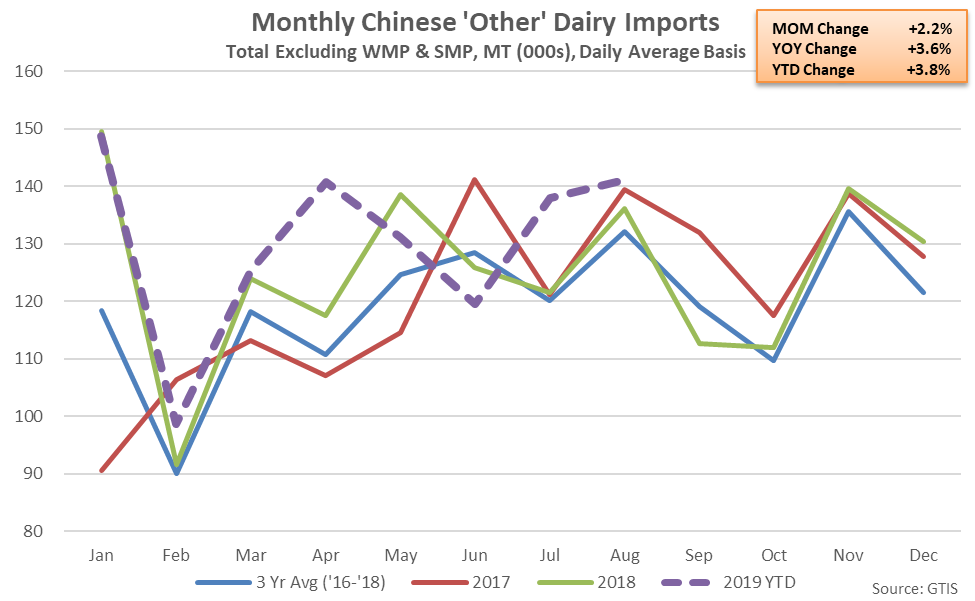

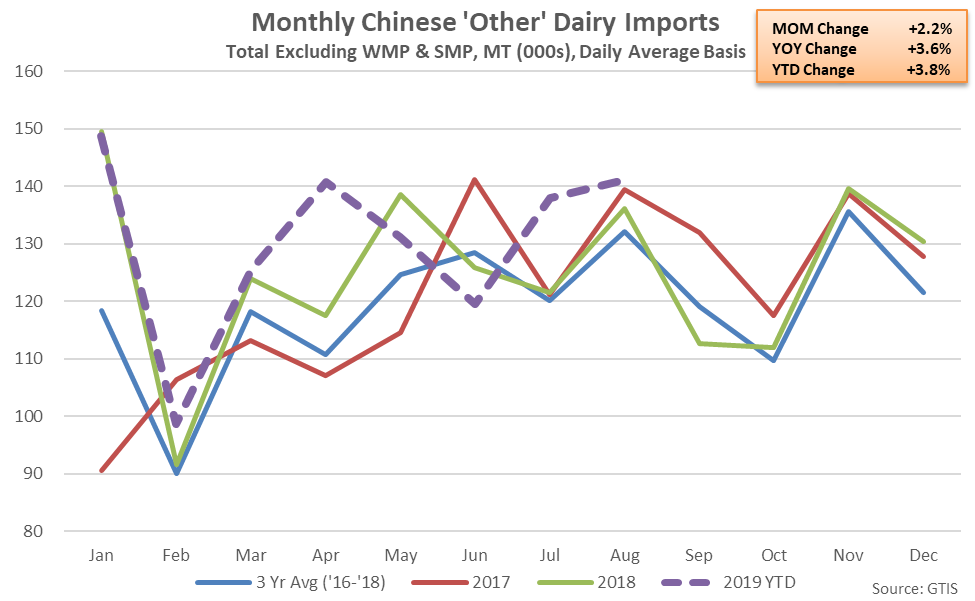

Aug ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 2.2% MOM and 3.6% YOY

Aug ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 2.2% MOM and 3.6% YOY

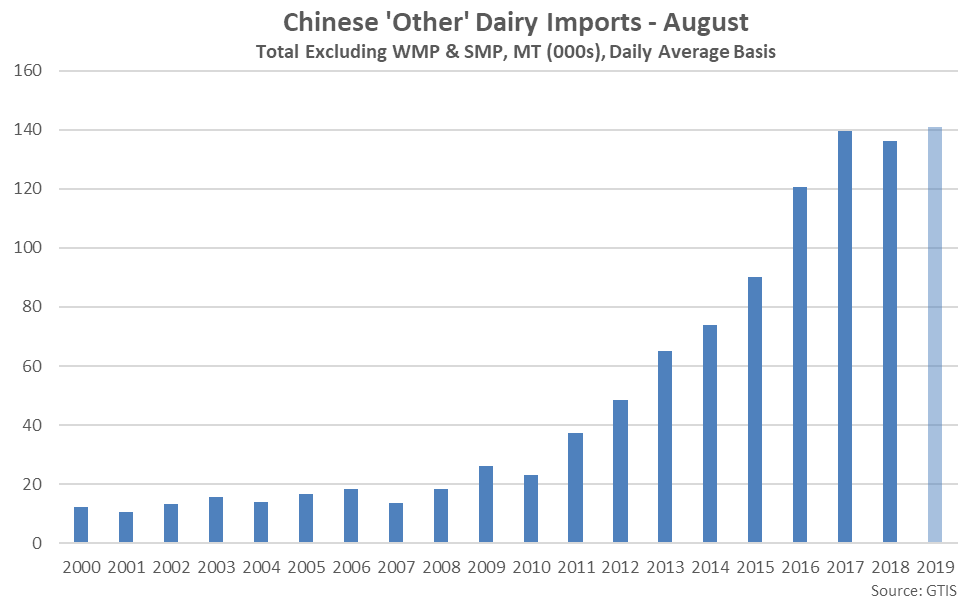

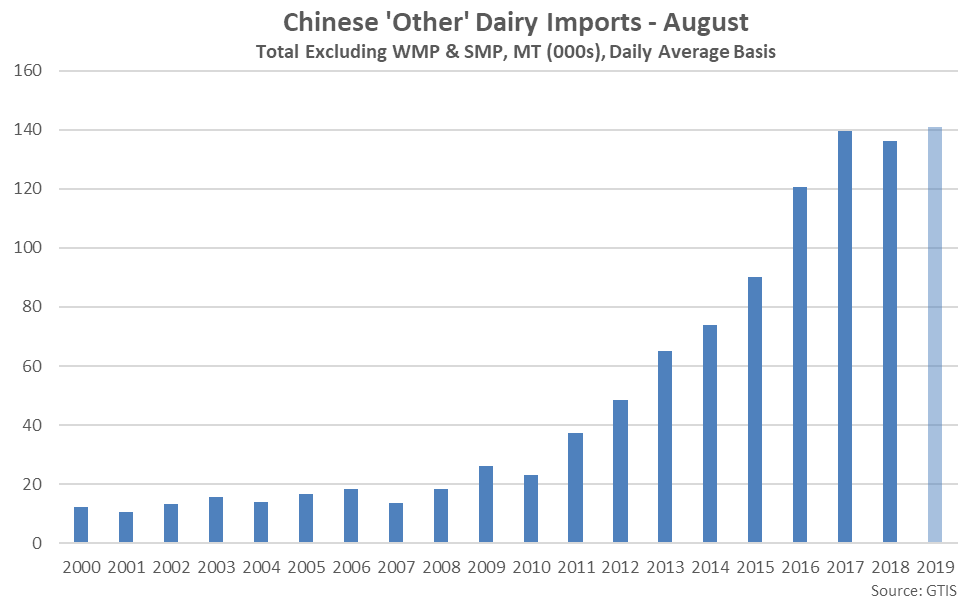

Aug ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Aug ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

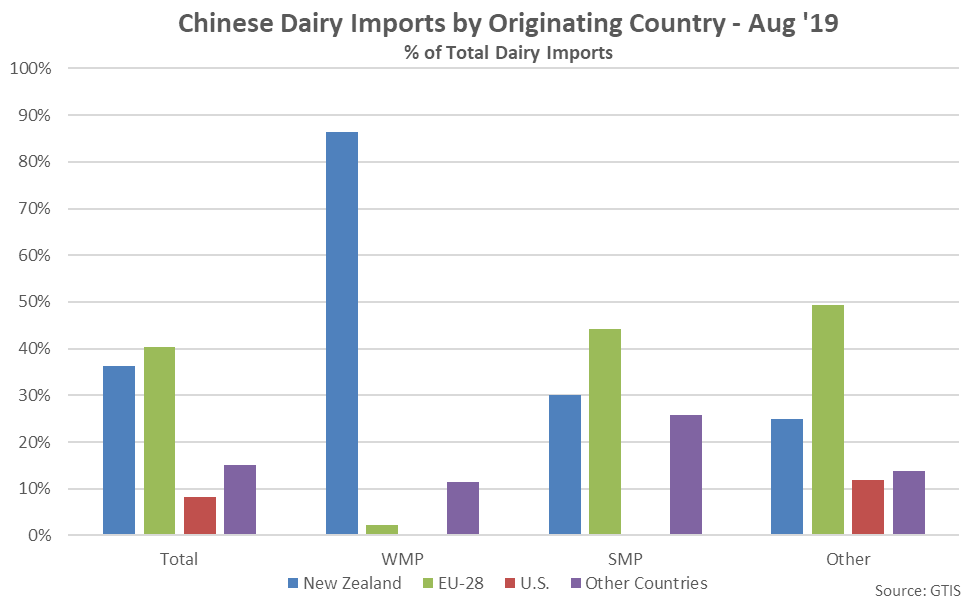

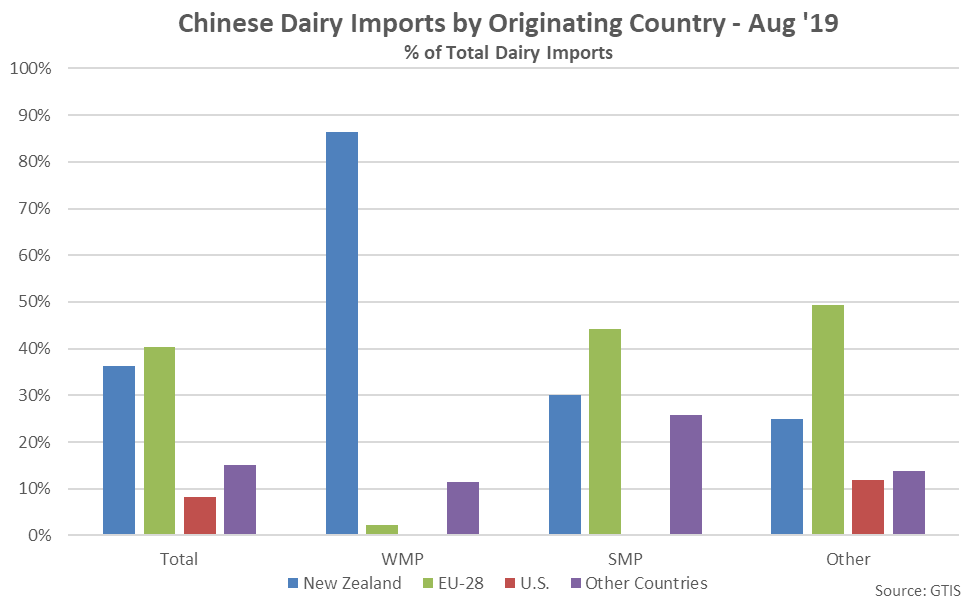

New Zealand and the EU-28 Each Accounted for Over a Third of all Aug ’19 Chinese Imports

New Zealand and the EU-28 Each Accounted for Over a Third of all Aug ’19 Chinese Imports

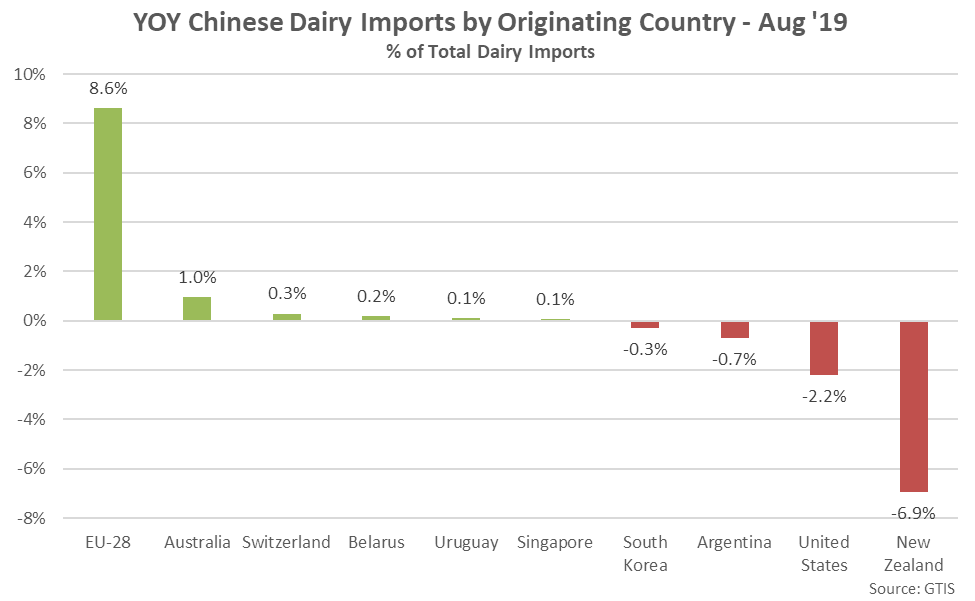

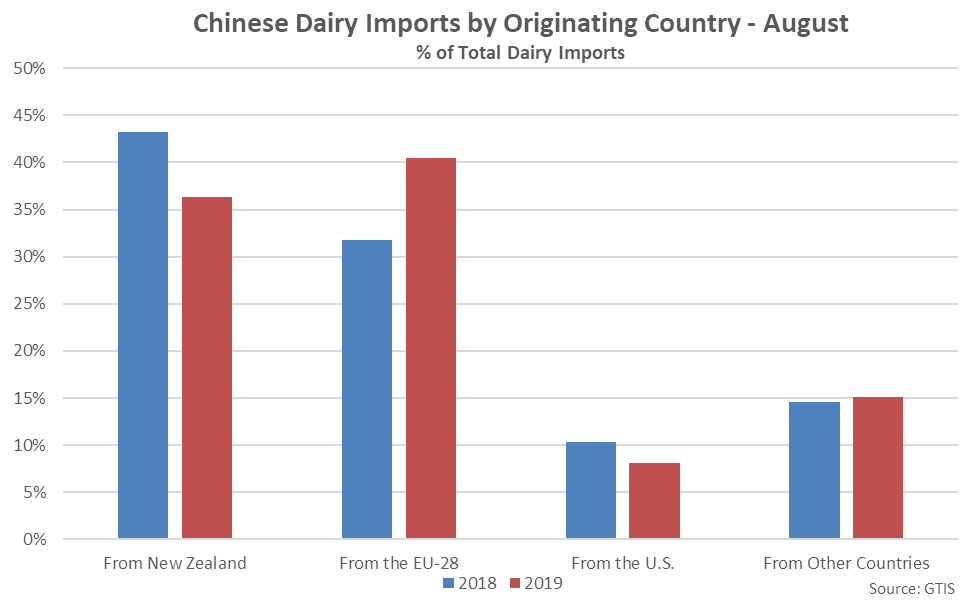

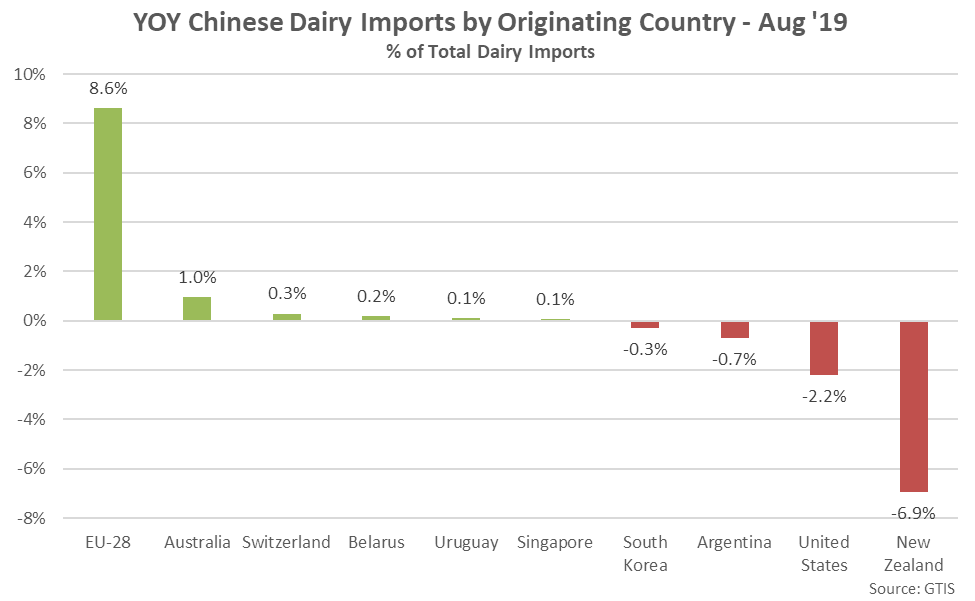

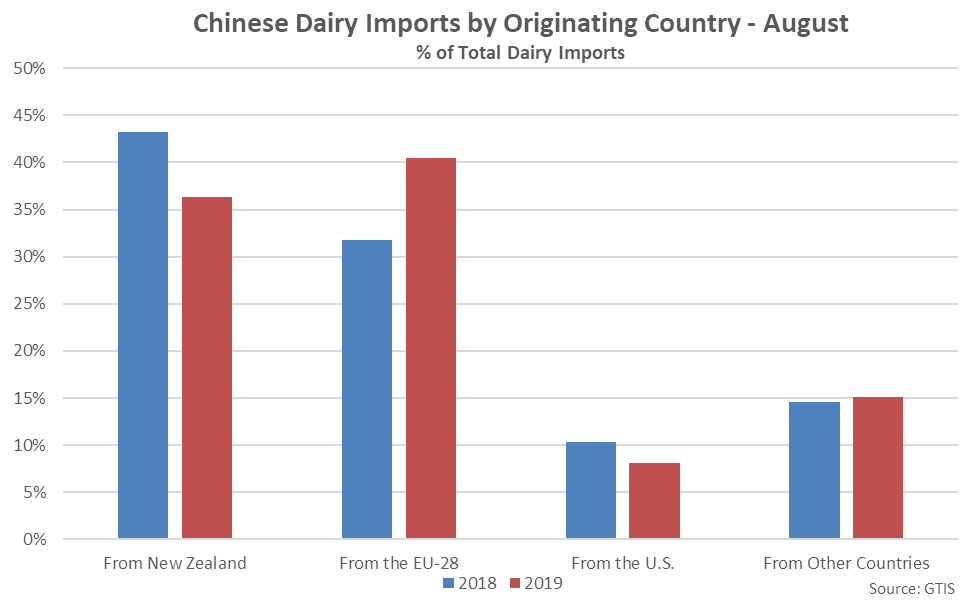

Aug ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined YOY

Aug ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined YOY

Aug ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Aug ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

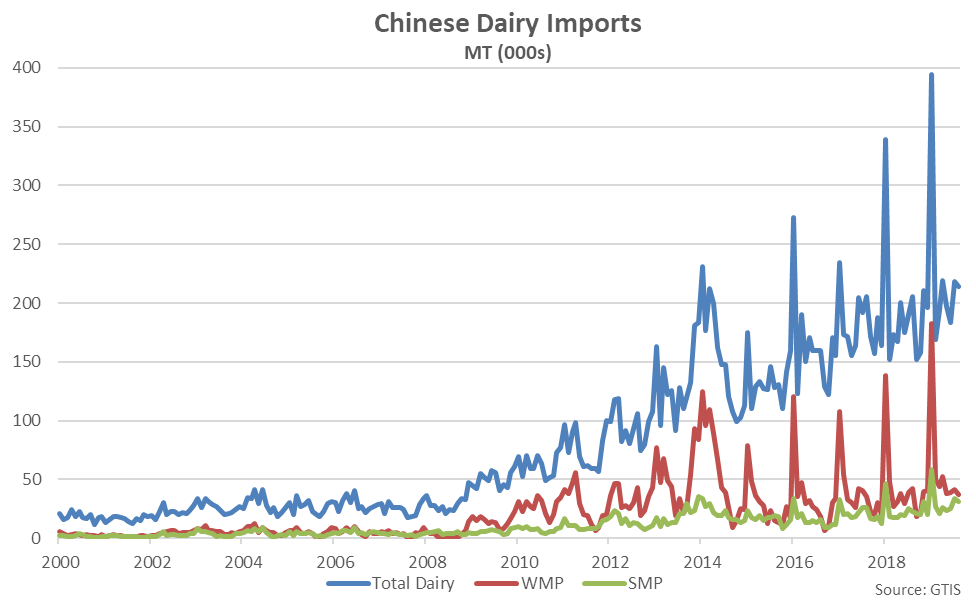

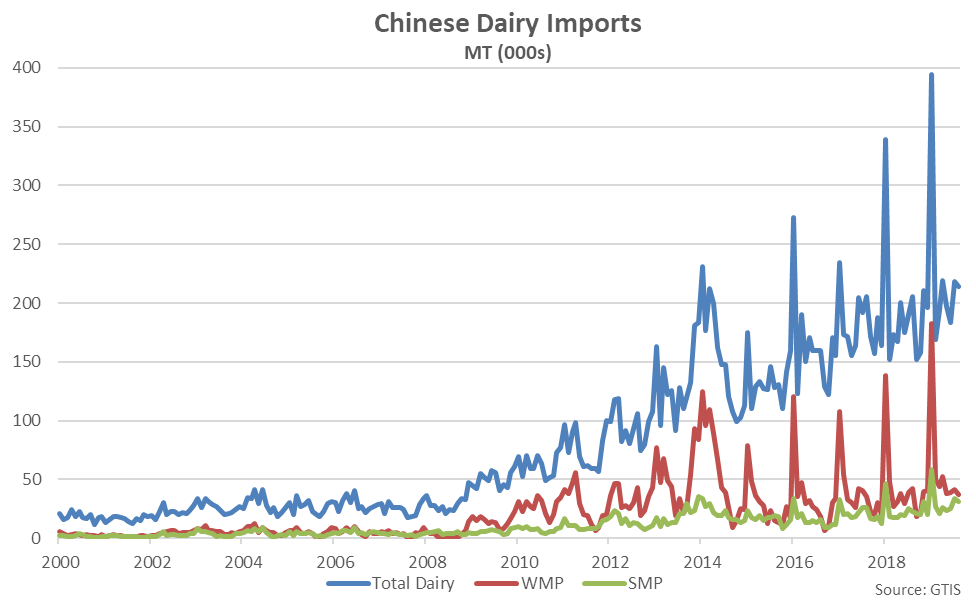

- Aug ’19 Chinese dairy import volumes increased on a YOY basis for the tenth time in the past 11 months, finishing up 4.1% to a record high seasonal level for the month of August.

- Aug ’19 Chinese whole milk powder imports declined on a YOY basis for the first time in the past 11 months, finishing down 12.6% but remaining at the third highest seasonal level on record. Aug ’19 Chinese skim milk powder imports increased 38.4% YOY to a record high seasonal level, however, while Aug ’19 Chinese dairy imports excluding whole milk powder and skim milk powder increased 3.6% YOY, also reaching a record high seasonal level.

- Aug ’19 Chinese dairy imports originating from within the EU-28 continued to gain market share from the previous year, while the New Zealand and U.S. market shares finished below previous year levels.

Aug ’19 Chinese Dairy Import Volumes Declined 2.1% MOM but Remained up 4.1% YOY

Aug ’19 Chinese Dairy Import Volumes Declined 2.1% MOM but Remained up 4.1% YOY

Aug ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Aug ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Aug ’19 Chinese WMP Import Volumes Declined 12.0% MOM and 12.6% YOY

Aug ’19 Chinese WMP Import Volumes Declined 12.0% MOM and 12.6% YOY

Aug ’19 Chinese WMP Imports Remained at the Third Highest Seasonal Level on Record

Aug ’19 Chinese WMP Imports Remained at the Third Highest Seasonal Level on Record

Aug ’19 Chinese SMP Import Volumes Declined 8.2% MOM but Remained up 38.4% YOY

Aug ’19 Chinese SMP Import Volumes Declined 8.2% MOM but Remained up 38.4% YOY

Aug ’19 Chinese SMP Imports Reached a Record High Seasonal Level

Aug ’19 Chinese SMP Imports Reached a Record High Seasonal Level

Aug ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 2.2% MOM and 3.6% YOY

Aug ’19 Chinese Dairy Imports Excluding WMP & SMP Increased 2.2% MOM and 3.6% YOY

Aug ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Aug ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

New Zealand and the EU-28 Each Accounted for Over a Third of all Aug ’19 Chinese Imports

New Zealand and the EU-28 Each Accounted for Over a Third of all Aug ’19 Chinese Imports

Aug ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined YOY

Aug ’19 New Zealand & U.S. Shares of Total Chinese Dairy Imports Declined YOY

Aug ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Aug ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY